Chennai Port is the second largest container port in India, which makes it a prime location for starting an import export business. The first step of an international trade business is obtaining an Import-Export code.

Running an import-export business without an IEC code is illegal and you will face a lot of hurdles while clearing your goods from the ports and also, while making transactions in foreign currency.

To get the Import Export Code in Chennai, apply to the Directorate General of Foreign Trade with the necessary documentation. Following the application, the DGFT will issue the entity's IEC code within 15-20 business days.

Thus, once issued, the IE Code Registration is valid forever and does not require renewal or filing like GST. Therefore, most businesses importing or exporting goods and services from India must get an IE code. Most importers and merchants can only import goods with an IEC code, and exporters are not eligible for the DGFT Department's export scheme, among other benefits. Importers' IE codes are required by banks when transferring or receiving money abroad, and they must be quoted while clearing customs and sending goods.

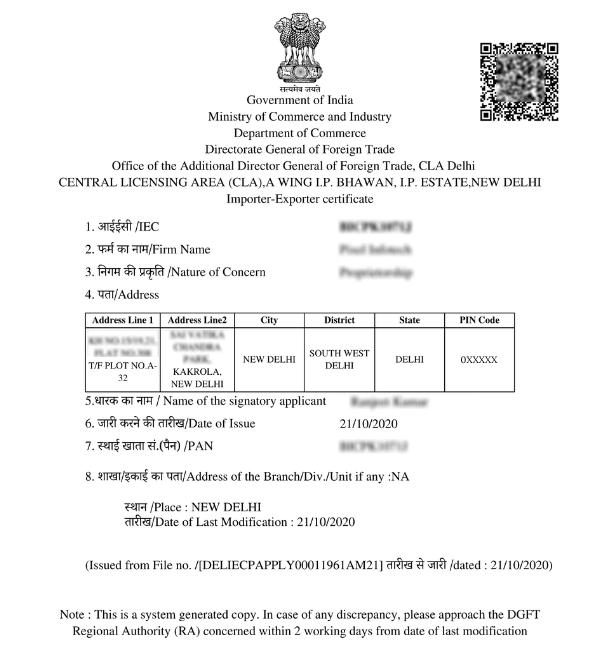

IEC Certificate [Sample]

Table of Content

IEC Registration in Chennai is an imperative procedure that needs to be followed by an individual or enterprise willing to engage in a cross-border trade activity. IEC is a 10-digit unique code issued by the Directorate General of Foreign Trade (DGFT) that permits the import or export of goods and services to and from India.

In other words, for companies operating in Chennai, an IEC is mandatory for customs clearance, receiving foreign payments, exporting services, and accessing benefits under the Foreign Trade Policy. Once the IEC is generated, traders will also be able to register their AD Code on the ICEGATE portal to activate port-based export and import operations.

IEC registration in Chennai provides key benefits that support smooth and legal import-export operations.

The following documents are required for IEC code registration in Chennai.

.png)

IEC Code Registration in Chennai follows an easy online procedure when you follow these steps.

Register your import and export business with Professional Utilities to get your IEC Certificate . You get the free consultations and quick service at lowest Price with us.

Apply for IEC code Now

IEC registration fees in Chennai cover basic government charges and service costs for a smooth application process.

| IEC Registration in Chennai | Fees |

|---|---|

| Government Fees | ₹500 |

| Professional Fees | ₹999 |

| Total | ₹1,499 only |

Note: The aforementioned Fees is exclusive of GST.

The Validity of an IEC code is 1 year. Unlike other government licenses, The Import Export Code was valid for a lifetime. However, after the amendments in Foreign Trade Policy on 12th February 2021, the import-export code has now to be renewed every year.

This amendment made the renewal of Import Export Code details mandatory for every IEC and e-EIC holder. Even if there are no updates in IEC, the same has to be confirmed online on the DGFT portal. Failing to do so may result in the deactivation of your Import Export code.

However, it is generally recommended that any person or business that engages in the export or import of goods must obtain an ICE license. Thus, IEC registration is useful in a variety of situations. These are:

The complications in understanding the process and providing appropriate documents are very much hectic. There is a high chance of rejection of the application at each step of document uploading. There are different standards of Digital Signature certificates (DSC) that must be uploaded.

We at Professional Utilities understand completely. That’s why we come forward to help you avoid the hassle and get your Import Export Code registered at the minimum price guaranteed. So that you can concentrate on running your business and leave the legal formalities to us.

You can apply for IEC registration in just three simple steps with us.

Step 1:

Get in touch via call or contact form

Step 2:

Provide necessary documents

Step 3:

Get your IEC registered in 2 working days

Conclusion

To summarize, the Import and Export Code (IEC) is critical for organizations involved in international trade. This will provide you access to global marketplaces and facilitate cross-border transactions. Registering with the IEC allows businesses to simply manage customs procedures, expand their reach, and capitalize on global opportunities. This period is critical for encouraging growth, ensuring compliance, and laying a solid basis in the dynamic world of international trade.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions

You can update the Import Export Code by following these steps :

You can get Import Export Code by following these steps :

Documents required for Import Export Code registration in Chennai are as follows :

To become a registered exporter, you need to get an IEC registration. Once you obtain the I importer Exporter code, you are allowed to export goods from India. The code is also valid for importing goods in India.