Updated on January 28, 2026 08:14:34 AM

IIP Certificate, also known as the UN certificate, is required under the common regulations for the transportation of Hazardous products either by Sea, Air, or Road for the United Nations member countries. In India, it is issued by the Indian Institute of Packaging, an autonomous body set up under the aegis of the Ministry of Commerce & Industry that has been authorized as a nodal agency to conduct the various performance tests & issue the UN Certificate. A large number of Industries across the country require the free flow of transportation of dangerous products internationally.

UN certificate is a mandatory certification for packages that fall under the Hazardous & dangerous category by Sea or Air from India. The Packaging certified for utilization of DG shall be examined by the shippers before these are used. The certified Packaging shall have a UN Mark as indicated in the certificate to ensure that only certified packages are being loaded. It is a goods category-wise certificate valid for a limited period (max 18 months), Subject to fulfillment of certain conditions.

The IIP UN Mark Certificate was issued by the Director General of Shipping and Directorate General of Civil Aviation under the Government of India. This certificate is essential for all kinds of dangerous objects transported via air or sea. Certified packaging bears a UN Mark, ensuring that only certified packages of goods are placed into the aircraft or vessel. Such Certificates are granted to package producers for the production of any number of packages following good testing of the sample packages. The validity period is the time during which packages with exact specifications, product annexure, net and gross weight, mode of shipment, and exporter can be manufactured.

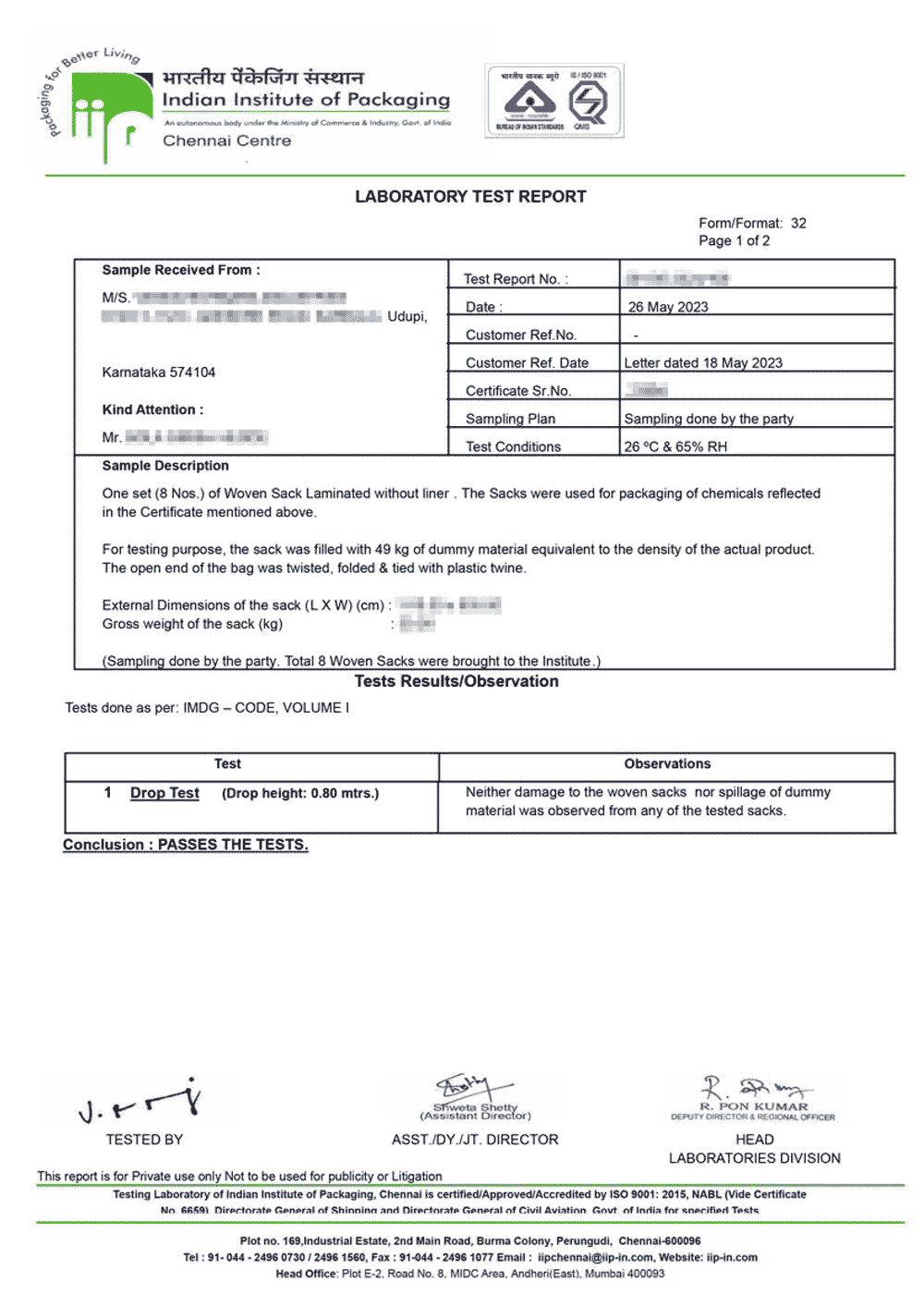

IIP Certificate Sample

Table of Content

The Indian Institute of Packaging (IIP) UN Mark Certificate, also known informally as the UN certificate , is issued by the Indian Institute of Packaging (IIP) for packages that contain dangerous substances for transport. It is granted only after analyzing the samples of packages as per UN transport standards. Packages must be fairly resistant to all types of climatic environments, as well as any potential hazards encountered during transportation. To adhere to the international standards for transport proper and efficient process is required. A UN packing code that defines the kind of packaging that is visible on transporting packaging. It indicates that the package has passed the tests set by the UN for packages that contain hazardous products.

There are 9 different classes of hazardous goods, as follows:

Learn the benefits of the IIP UN Mark Certificate for safe hazardous packaging.

Below is the complete checklist of documents required to obtain your IIP UN Mark Certification, ensuring compliance with UN packaging standards. You can also refer to the detailed guide on UN IIP certificate documents for better clarity.

The UN Mark Certification is essential for packaging materials used in the transportation of hazardous goods, ensuring compliance with international safety standards. Below is a simplified step-by-step guide to help you navigate the process of obtaining your UN Mark Certificate from the Indian Institute of Packaging (IIP):

The following table provides a detailed structure of the IIP UN Mark Certification fees for packaging materials, including Normal, Combine, and Tatkal mode charges.

| Types of Packaging Material | Normal Mode | Combine Mode | Tatkal Normal Mode |

|---|---|---|---|

| Metal Drum / Plastic Bag | ₹ 28,000 | ₹ 50,400 | ₹ 42,000 |

| Plastic Drum | ₹ 33,000 | ₹ 59,400 | ₹ 49,500 |

| Composite Drum | ₹ 38,000 | ₹ 68,400 | ₹ 57,000 |

| CFB Box / Fiber Board Drum / Paper Bag | ₹ 27,000 | ₹ 48,600 | ₹ 40,500 |

| CFB with Plastic Container | ₹ 36,000 | ₹ 64,800 | ₹ 54,000 |

| Woven Bags | ₹ 29,000 | ₹ 52,200 | ₹ 43,500 |

| Wooden Boxes | ₹ 25,000 | ₹ 45,000 | ₹ 37,500 |

| FIBC / IBC | ₹ 40,000 | ₹ 72,000 | ₹ 60,000 |

Note: The above fee structure represents the Normal Mode, Combined Mode, and Tatkal Mode charges for testing and certification of packaging materials for UN Certificates. If you obtain Combined Tatkal Mode Certification, the Government fee will be 1.5x the Normal Mode charges.

Note: Professional Fee for IIP UN Mark certification Registration Normal mode starts from ₹25,000 whereas the Combine mode (Air & Sea) Fee is ₹37,500.

The validity of IIP UN Mark Certification is structured in multiples of the standard 12-month term. A 12-month validity is charged at the standard rate, whereas a 24-month validity is calculated at twice the standard fee. Similarly, a 36-month validity is three times, and a 48-month validity is four times the standard charges.

Conclusion

An IIP certificate for the UN Mark is essential for firms involved in the transporting of hazardous goods to ensure compliance with international safety standards. This certification not onlycertifies your packaging's quality and durability, but it also helps to develop confidence with clients and regulatory organizations worldwide.

At Professional Utilities, we provide all-inclusive assistance to obtain the IIP certificate, and guide your through all steps using expertise and effectiveness. No matter if you're a producer or exporter, we makes sure that your packaging complies with UN standards and requirements of the regulatory authorities. Get your IIP certificate today to make sure you are able to ensure safe and legal transportation of your hazardous products across the globe.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Yes. Without a valid UN Mark Certificate, your hazardous goods may be rejected by customs, blocked by airlines/ports, or considered non-compliant for international shipping.

The UN Mark IIP certificate ensures that the packaging used for the transport of dangerous goods is compliant with international regulations. It helps prevent accidents, protect people, and minimize environmental hazards during transportation.

Manufacturers, packers, and distributors involved in the transportation of dangerous goods that fall under the UN classification system typically need to register for the UN Mark IIP certificate.

To Register for IIP Certificate, you need to file an application online on IIP Portal, provide necessary documents, pay the required Fees, Testing of Packaging Material, and then issuance of IIP Certificate.

Speak Directly to our Expert Today

Reliable

Affordable

Assured