Updated on November 04, 2025 12:42:27 PM

The Companies Act 2013 enables Indian organizations to register as non-profit Section 8 Companies. Section 8 Companies exist specifically for social benefit projects including education delivery and healthcare services alongside environmental conservation and poverty reduction work as well as women empowerment and sports and scientific research support. A Section 8 Company diverts its income away from distributing profits to its members such as traditional business structures. The organization dedicates its complete income stream toward accomplishing its charitable objectives.

Section 8 companies obtain multiple advantages because they receive tax incentives and official authorization from the government and gain credibility among donors when they obtain domestic and international financial resources. A Section 8 Company operates with greater reliability than trusts and societies because it supports strict regulatory guidelines.

The MCA must approve the registration process while organizations need to submit their Memorandum of Association (MoA) and Articles of Association (AoA) as important documents. The organization becomes legally bound after registration and it needs to maintain proper funds usage for charitable causes.

Section 8 Companies provide NGOs as well as social enterprises together with charitable institutions with a framework they need for structured legal management so they can achieve their societal impact goals successfully. A Section 8 Company provides organizations with the capability to establish public trust while obtaining funding and achieving efficient operations toward social welfare.

Section 8 Company Incorporation Documents

Section 8 company is an upgraded form of Society and Trust. It has many benefits over traditional forms of charitable institution registration. Section 8 company is the most popular form of NGO registration in India. It is easy to register, run and manage.

The main purpose of Section 8 company is to promote non-profit objectives such as commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment and other charitable purposes.

In effect from April 1, 2021, all NGOs need to file Form CSR-1 on MCA portal to register with Central Government. MCA has made this Form available on its website and made it mandatory for all the social organisations seeking CSR funds or CSR implementing agencies to file it. The aim of the CSR-1 Form is efficient monitoring of CSR spendings in the country.

The minimum requirements for Section 8 Company registration assure compliance with the legislative provisions for creating a non-profit organization in India.

Section 8 Company incorporation is a complete digital process and therefore requirement of Digital Signature Certificate is a mandatory criteria. Directors as well as subscribers to the memorandum of the company need to apply for a DSC from the certified agencies. Obtaining a DSC is a complete online process and it can be done within 24 hours. This process involves 3 simple verifications that are document verification, video verification and phone verification.

Name application for Section 8 Company can be done through SPICe RUN form which is a part of SPICe+ form. While making the name application of the company, industrial activity code as well as object clause of the company has to be defined.

Note: It should be ensured that company name does not resemble the name of any other already registered company and also does not violate the provisions of emblems and names (Prevention of Improper Use Act, 1950). You can easily check the name availability by using our company name search tool to verify the same.

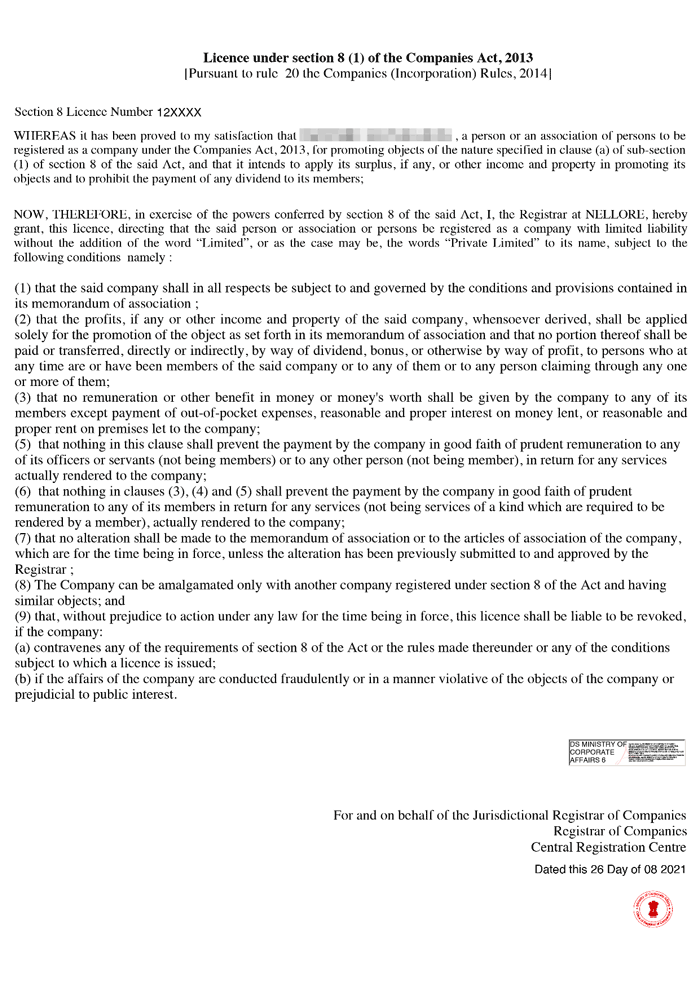

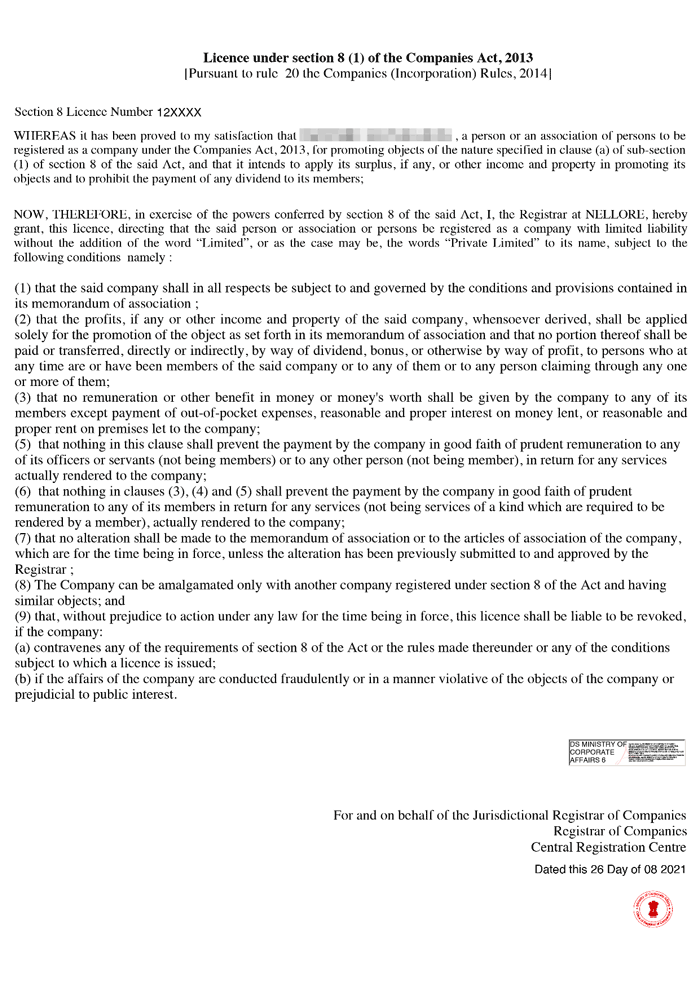

For obtaining the license under Section 8 Company, Form INC-12 is required to be filed with the Registrar of Companies. Prior to issuance of Certificate of Incorporation for Section 8 company, approval letter under Section 8 of Part 1 i.e, License under Section(1) of the Companies Act, 2013 is issued from the Ministry of Corporate Affairs. Once the form is approved by the Central Government, ROC will issue a 6-digit Section 8 license number.

Post name approval, details with respect to registration of the company has to be drafted in the SPICe+ form. It is a simplified proforma for incorporating a company electronically. The details in the form are as follows:

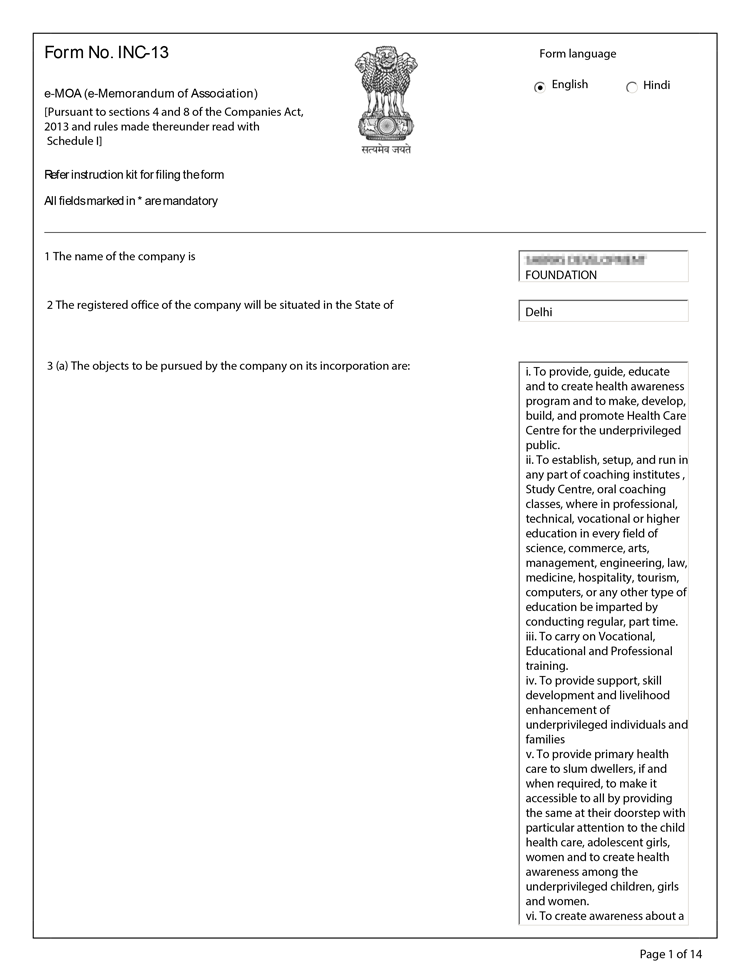

SPICe e-MoA and e-AoA are the linked forms which have to be drafted at the time of application for company registration.

Memorandum of Association (MOA) is defined under section 2(56) of the Companies Act 2013. It is the foundation on which the company is built. It defines the constitution, powers and objects of the company.

The Articles of Association (AOA) is defined under section 2(5) of the Companies Act. It details all the rules and regulations relating to the management of the company.

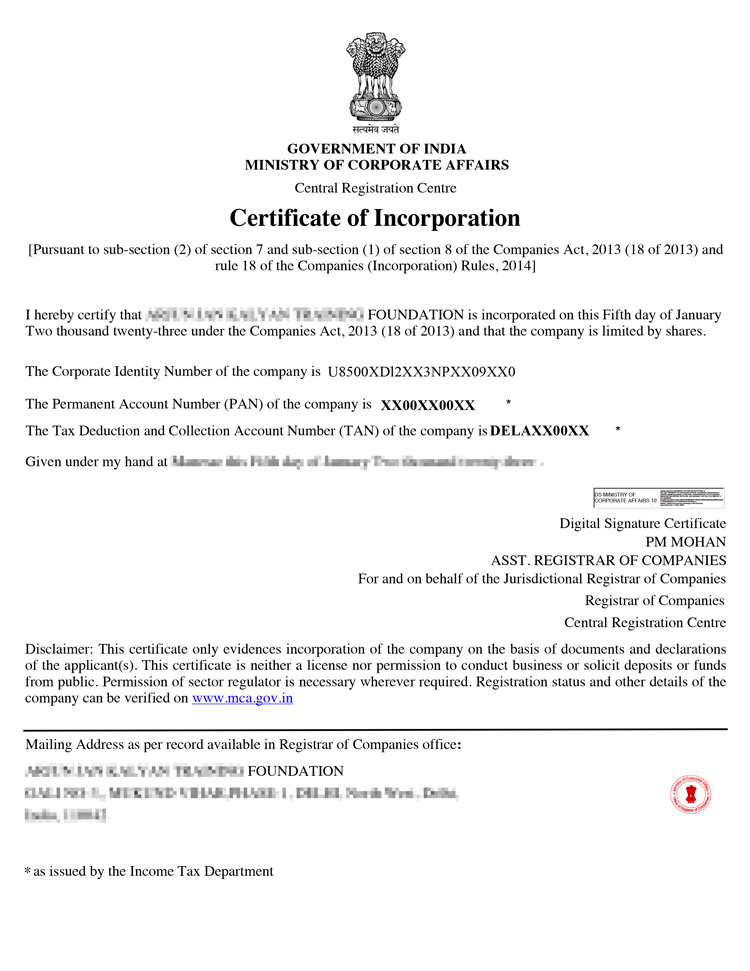

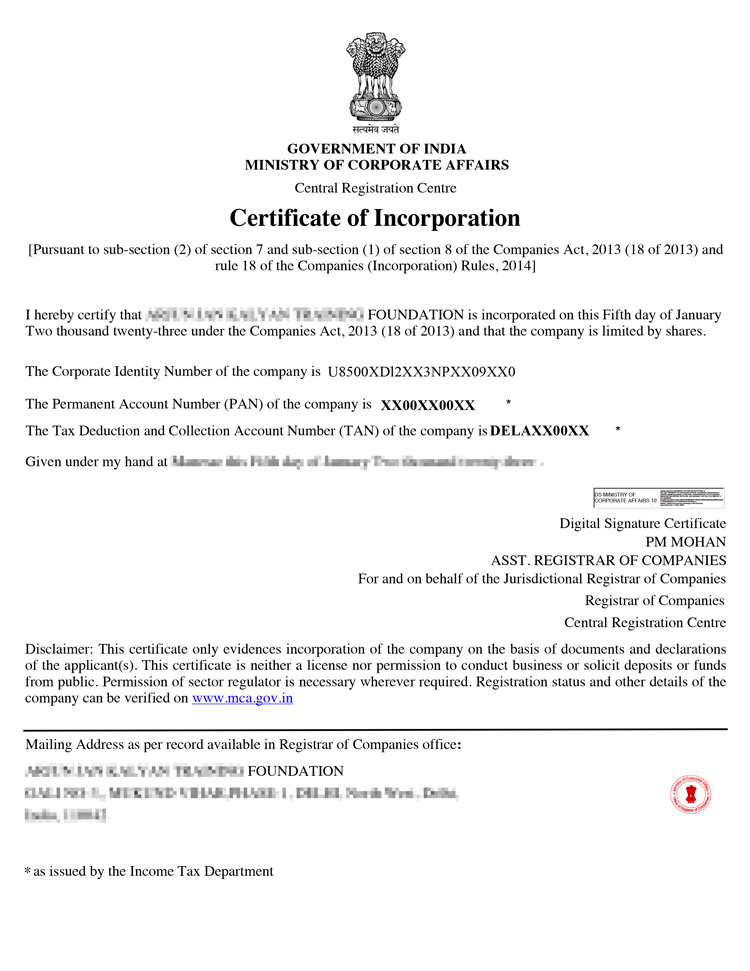

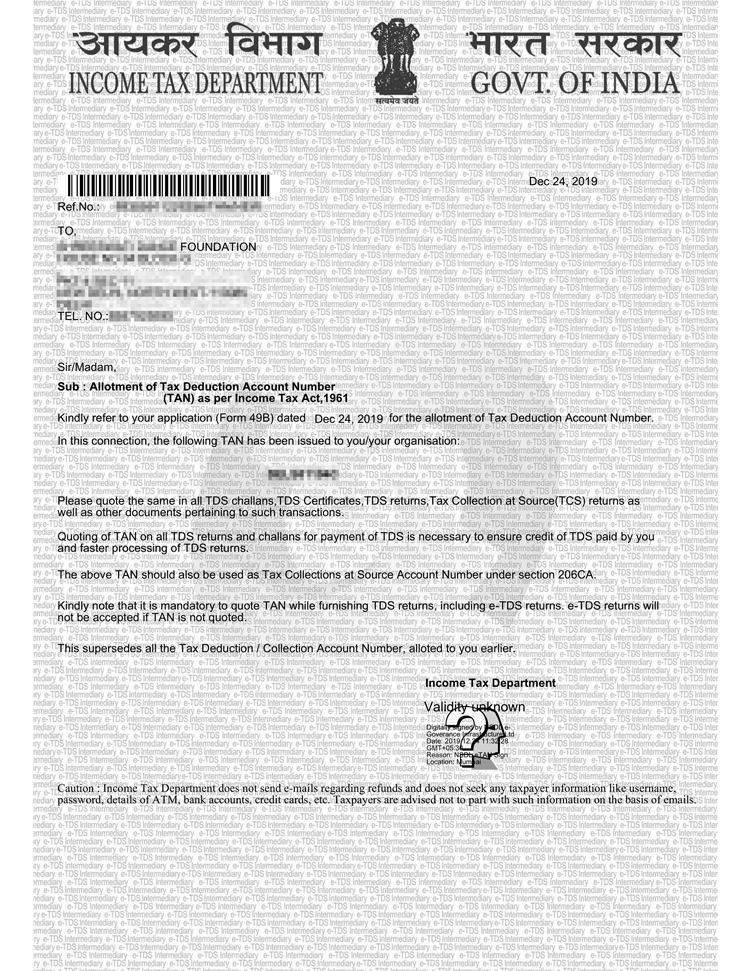

Post approval of the above mentioned documents from the Ministry of Corporate Affairs; PAN, TAN & Certificate of Incorporation will be issued from the concerned department. Now, the company is required to open a current bank account by using these documents. You can contact us for assistance with your current bank account opening.

The total Registration fees of Section 8 Company is ₹9,499 including government Fees and professional fees.

On average, it takes around 10-14 working days to register a Section 8 company in India, subject to document verification by the Ministry of Corporate Affairs (MCA).

| Section-8 Company Registration | Registration Fees |

|---|---|

| ✅ Digital Signature Certificate Fee | ₹3,000 |

| ✅ Government Fees(Stamp Duty) | ₹2,500 |

| ✅ Professional Fees | ₹3,999 |

| ✅ Total Cost | ₹9,499 |

Note - The above mentioned registration fees includes registration for 2 members with minimum Authorised capital of Rs 1,00,000, creation of DSC, Government Fees(Stamp Duty) and Professional fees.The Registration cost may vary if the number of members or the value of Authorised Capital is changed.

After successful registration of a section 8 company, you will be provided with the following documents.

Certificate of Incorporation Sample

Section 8 Company Incorporation Documents

PAN Card Sample Documents

TAN Sample Documents

AoA Certificate Sample Documents

MoA Certificate Sample Documents

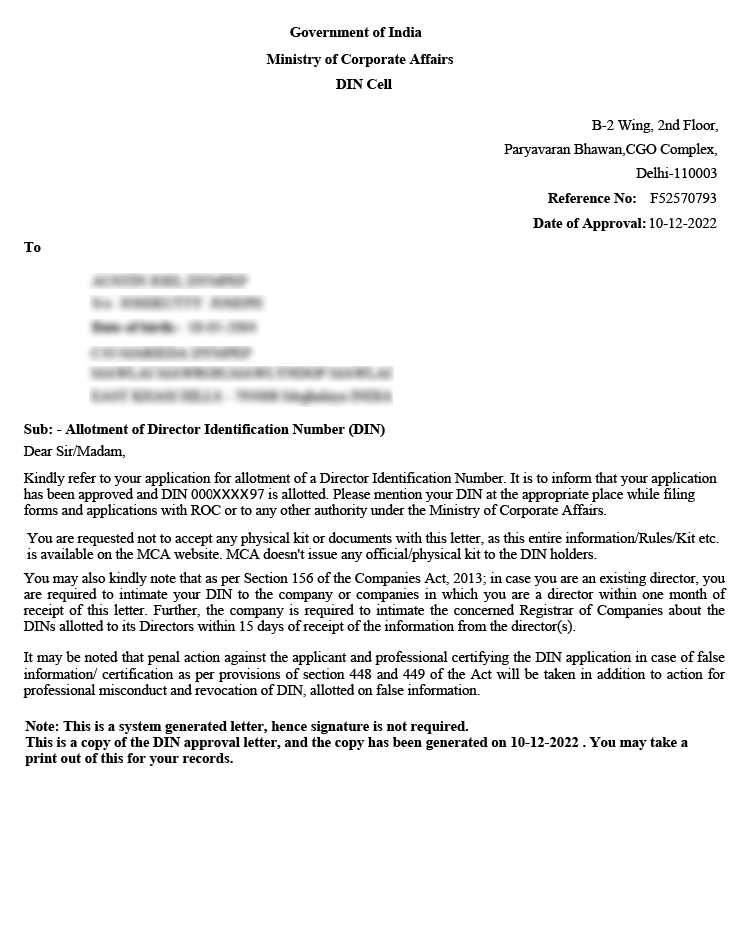

DIN Certificate Sample Documents

DSC Sample Documents

EPFO Certificate Sample Documents

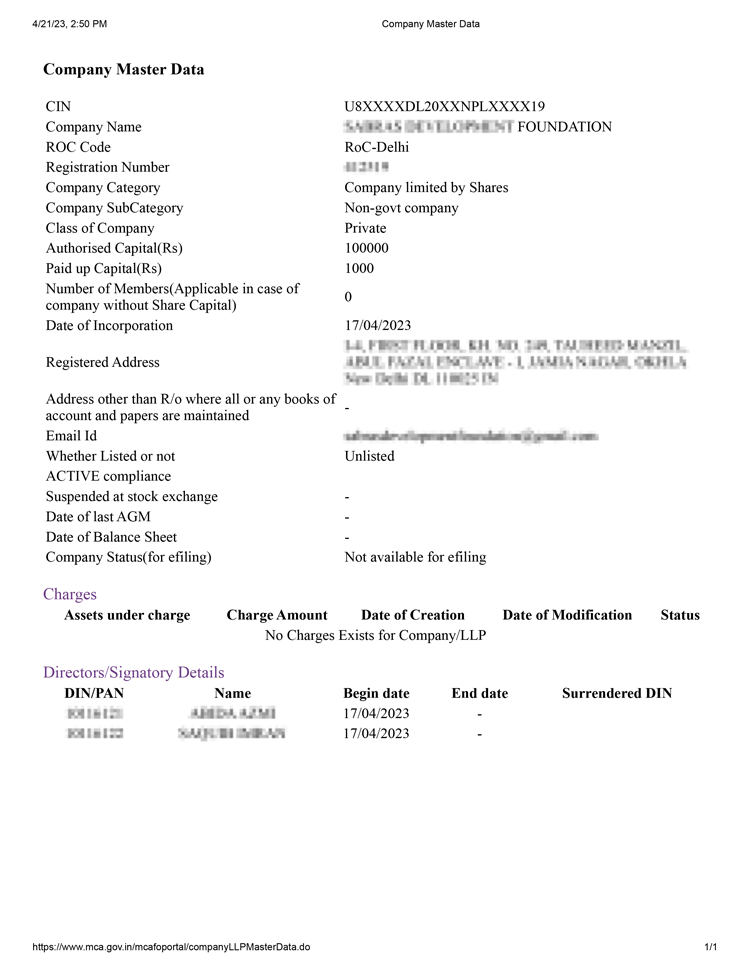

Master data Sample Documents

As per the Companies Act 2013, you need to provide proper identity and address proof to be submitted on the Ministry of Corporate Affairs (MCA) portal for Section 8 company registration.

The benefits of Section 8 Company registration include the ability to operate an NGO with legal and financial rights in India.

The companies registered under section 8 becomes eligible for various grants offered by the Government of India. Further, Section 8 Companies are also entitled to receive donations from the general public.

Those donating to a Section 8 Company are eligible for tax exemptions under 80G of the Income Tax Act.

There are many tax benefits for Section 8 companies in India.

The identity of the Section 8 Company and its directors are separate which means the entity will continue to survive, even if all the directors of the company become incompetent to carry on the business.

There is no requirement of minimum paid-up capital for the Section 8 Company registration.

.png)

Section 8 Company creates their own credibility in the market by holding the License issued by the ROC and the various kinds of activity undertaken by them.

The Registrar of Companies provides License to Section 8 Companies in Form INC-16.

A Section 8 Company must comply with the Companies Act, 2013. Failure to follow the law or act within its objectives can put a Section 8 Company’s license at risk.

Non-compliance attracts financial penalties: the company may be fined ₹10 lakh to ₹1 crore, while directors or officers responsible may face ₹25,000 to ₹25 lakh, or both fines and imprisonment for up to three years.

Strict compliance not only protects the company’s license but also strengthens its credibility with donors, stakeholders, and regulatory authorities.

Therefore, maintaining full legal compliance guarantees the company’s continued goodwill, functioning stability, and long-term success.

Conclusion

Registration of a Section 8 Company is a good option for groups or individuals looking to create a non-profit entity with educational, charitable, or social purposes. With its legal recognition as well as tax exemptions and increased credibility, it offers an ideal structure for promoting social welfare projects. The simple registration process assures that the organizations can focus on their goals while ensuring compliance with regulations. When you sign up as a Section 8 Company, you can make Section 8 Company, you can make a significant contribution to society, that will provide long-term benefits as well as legal security.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Section 8 company is a type of company which is established for Non-profit motive. To start a company that is engaged in social welfare objectives, section 8 company registration is required.

The required fee for closure of section 8 company in India is ₹20,999 including govt fee as well as professional fee of professional utilities.

To register a company in India, you need to hire a professional to get your section 8 company registered. Contact Professional Utilities for Section 8 company registration consultancy in India.

To register a section 8 company in India, it usually takes 7-15 working days subject to approval from the Ministry of Corporate Affairs.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Other Company Registration by Professional Utilities