Startup India registration for a Private Limited Company is an effective strategy for companies seeking to grow and get recognition through different government-sponsored initiatives. The Government of India's Startup India initiative provides eligible Private Limited Companies with various benefits, including tax breaks, reduced compliance, speedier IPR processing, and easier access to government programs.

To take advantage of these benefits, a Private Limited Company Registration must seek DPIIT (Department for Promotion of Industry and Internal Trade) recognition via the official Startup India portal. The procedure includes providing crucial business information, relevant documents, and a brief write-up emphasizing the company's creativity, scalability, and potential for employment or industry influence.

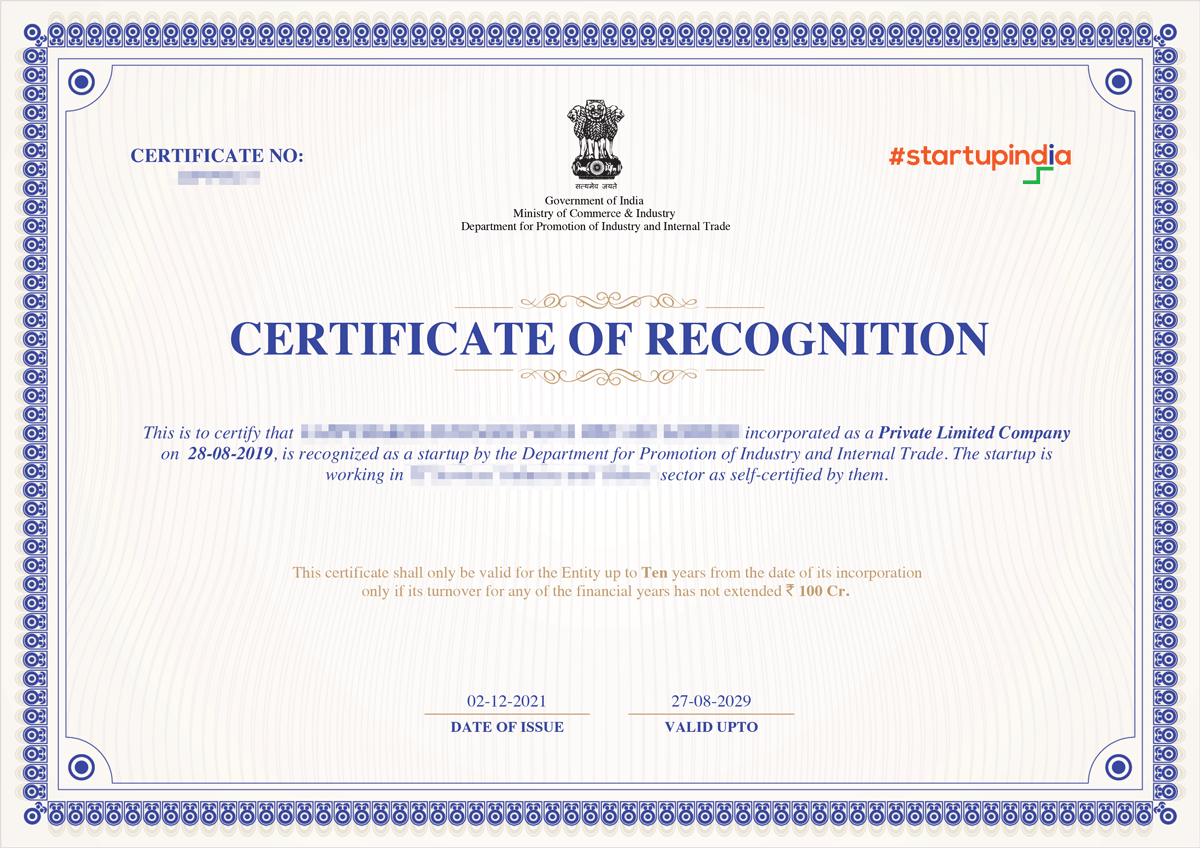

Upon approval, the company receives a DPIIT Startup Recognition Certificate, which grants access to the Startup India Seed Fund Scheme, a tax exemption under Section 80 IAC, and the right to register on the Government e-Marketplace (GeM) for public procurement. Whether you're starting a new Private Limited Company or running one that's less than 10 years old, gaining Startup India recognition is an important step toward growth, visibility, and government support.

Startup India DPIIT Sample Report

Table of Content

DPIIT Startup India Registration for Private Limited Company is an official recognition issued by the Department for Promotion of Industry and Internal Trade (DPIIT) via the Startup India scheme. Eligible Private Limited Companies can apply online by uploading basic company information and supporting papers via the Startup India portal.

Once accepted, the company is issued a Startup India Recognition Certificate, which formally recognizes it as a DPIIT-recognized startup. This certificate allows the company to take advantage of a variety of government-backed benefits, including tax breaks, financing possibilities, eased compliance standards, and participation in public procurement and innovation-driven projects sponsored by the Government of India.

Listed below are the benefits that Private Limited Companys recognized under Startup India registration get:

Note: Businesses with DPIIT recognition are exempted from deposition of EMD (Earnest money deposit) in tender participation on public procurement platforms.

Under the Startup India Action Plan, Private Limited Companys that meet the definition prescribed under G.S.R. notification 127 (E) can apply for recognition under the program. The program aims to create a robust ecosystem and pick up new-age enterprises.

The following are the eligibility criteria for Startup India registration for Private Limited Companys set up by DPIIT.

Note: Businesses with DPIIT recognition are exempted from deposition of EMD (Earnest money deposit) in tender participation on public procurement platforms.

The following documents are needed to be submitted by the Private Limited Companys for recognition of Startup India by DPIIT.

Other Certificates, if available:

Individuals seeking Steps for Startup India Registration for Private Limited Company can follow the steps below to complete the application process:

Incorporate your business as one of the following:

Visit startupindia.gov.in to register and verify your email to access the dashboard.

Apply for DPIIT Recognition” and fill in details such as:

In case any issues are being raised fom DPIIT, respond with corrections or clarifications appropriately.

Upon successful examination of application from department, DPIIT will issue the Startup India Recognition Certificate.

The professional charge for getting DPIIT recognition for Private Limited Companys under Startup India initiatives is Rs 4,999 only and the total time it would take in the process would be 20-25 business days. The professional fees are exclusive of GST. There is no government fee for DPIIT recognition.

| Particulars | Fees |

|---|---|

| Our Professional Charges | ₹4,999 |

| Time Taken in Process | 20–25 Days |

Conclusion

Startup India registration for a Private Limited Company offers a number of government-backed incentives aimed at encouraging innovation, driving economic development, and simplifying business operations. DPIIT-recognized firms benefit from tax breaks, reduced compliance obligations, and access to investment sources such as the Startup India Seed Fund.

The registration procedure is fully online, via the official Startup India portal, offering a smooth and time-saving experience for candidates. Securing DPIIT recognition is a critical step for entrepreneurs that want to establish successful and effective businesses. Begin your registration today to take full benefit of government support for the growth of your Private Limited Company.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

Starting a logistics and transportation company is advantageous due to increasing demand for efficient supply chain services, growth of e-commerce, and the opportunity to build scalable, profitable operations in India’s transport sector.

Any Private Limited Company that is less than 10 years old, has an annual turnover of less than ₹100 crores, and is focused on innovation or scalable business models can apply. The company must also not be formed by splitting or reconstructing an existing entity.

A DPIIT-recognized Private Limited Company receives benefits such as tax exemptions under Section 80 IAC, self-certification under various labour and environmental laws, and access to the Startup India Seed Fund. It also enjoys faster IPR processing, easier public procurement, and exemption from EMD deposits in government tenders.

To apply, the company must submit its Certificate of Incorporation, PAN, director ID proofs, photographs, and an authorization letter. It should also provide a business write-up outlining its innovation, potential for job creation, and any relevant product media or additional certifications like GST or MSME, if available.

The registration process generally takes about 20 to 25 business days to complete. This includes creating a profile on the Startup India portal, submitting the application for DPIIT recognition, and undergoing the document review process.

Yes, DPIIT recognition is a mandatory requirement for startups to access the tax exemptions, funding schemes, and procurement benefits offered under the Startup India initiative. Without it, a startup cannot claim the full range of benefits.

The write-up serves to highlight the company's innovation, potential for job creation, and overall impact on the industry. It helps DPIIT assess whether the business aligns with the Startup India mission of promoting innovation and entrepreneurship.