Startup India registration is a Government of India initiative aimed at promoting innovation, entrepreneurship, and economic growth. It provides tax exemption to startups, funding, and simplified compliance. The online portal of Startup India makes it easy for entrepreneurs to register, offering a smooth and efficient experience.

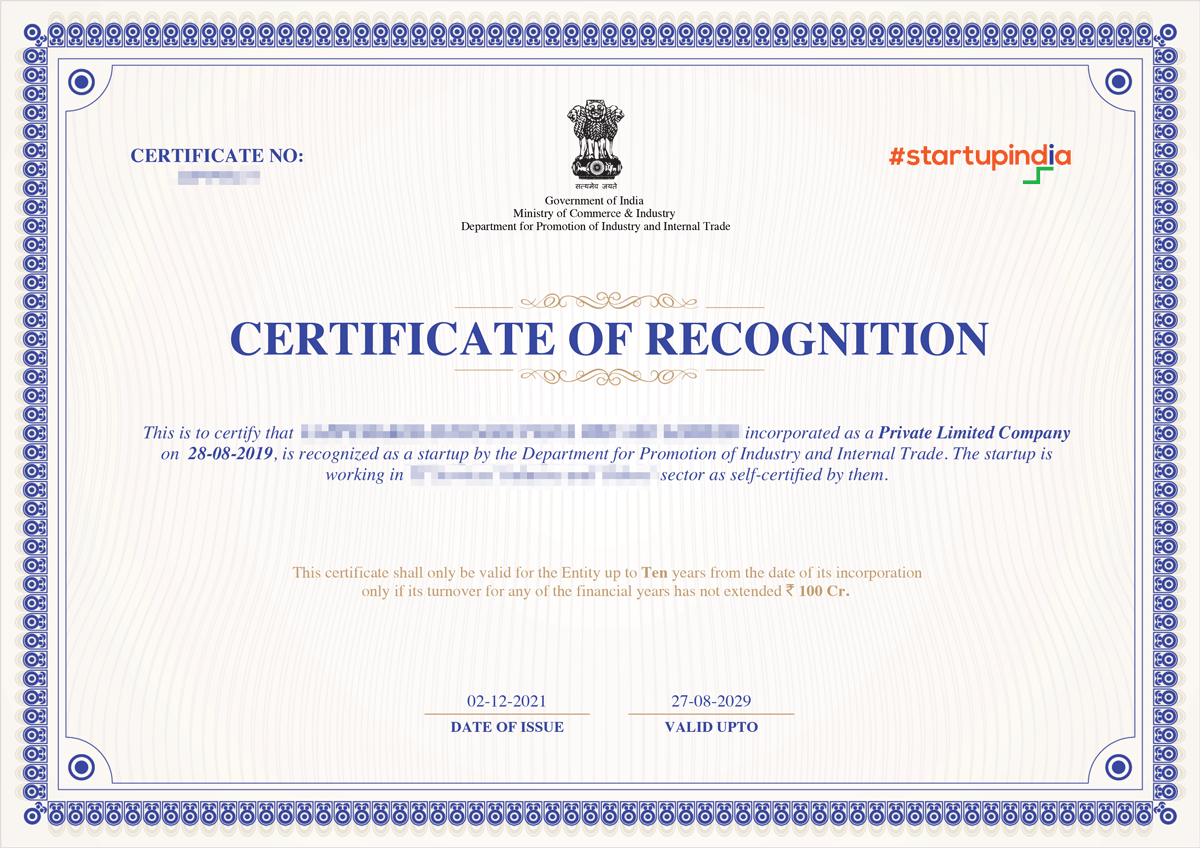

Upon approval, startups receive a Startup India registration certificate, legally establishing them as entities under the Department for Promotion of Industry and Internal Trade (DPIIT). The certification enables startups to benefit from government schemes, self-certify compliance with labor and environmental laws, apply for intellectual property facilitation, and participate in government tenders.

Through recognition, startups are able to build credibility, secure funding, and expand businesses without difficulties. The initiative plays a key role in strengthening India's startup ecosystem through financial and regulatory support given to new businesses across various industries.

Startup India Certificate [Sample]

Table of Content

The following documents are needed to be submitted by the entities for recognition of Startup India by DPIIT.

The startup India registration process with professional utilities is simple and hassle free. The are the following details you need to provide to get your business registered under the startup India certificate through DPIIT registration.

Looking to register your startup under Startup India? We make the process simple, fast, and budget-friendly. The fee for Startup India registration is ₹4,999, and the entire process takes just 7-10 days.

| Particulars | Fees |

|---|---|

| Professional Charges | Rs. 4,999 |

| Time taken in the process | 7-10 days |

Don’t let paperwork slow you down. Register your startup now!

The Startup India is a program to encourage and support the startup ecosystem in India. It aims to promote new businesses by providing them various benefits & exemptions. Such as tax holidays & access to government funding and incubator programs. The benefits of the program can be accessed by startups through DPIIT recognition.

DPIIT recognised Startups are eligible to get the following benefits under the Startup India Initiative:

1. Self-Certification:- Startups shall be allowed to self-certify compliance for 6 Labour Laws and 3 Environmental Laws through a simple online procedure to reduce the regulatory burden on Startups and keep compliance costs low.

2. Tax Exemption under 80-IAC:- Pvt Ltd Companies and LLPs are exempted from paying income tax for three consecutive financial years under Section 80-IAC out of their first ten years since incorporation.

3. Easy Winding of a Company:- As per the Insolvency and Bankruptcy Code, 2016, Startups with simple debt structures or those meeting certain income-specified criteria can be wound up within 90 days of applying for insolvency.

4. Fast-tracking of Startup Patent Applications:- Patent applications filed by Startups shall be fast-tracked for examination to realize their value sooner.

5. Rebate on filing of Patent Application:- Startups shall be provided an 80% rebate on patent filing costs to help them pare costs in the crucial formative years. The objective is to reduce the cost and time taken for a Startup to acquire a patent, making it financially viable to protect their innovations and encourage them to innovate further.

6. Easier Public Procurement Norms:- DPIIT recognized Startups can register on GeM as sellers and sell their products and services directly to Government entities. It is a great opportunity for Startups to participate in the public procurement process and access another potential market for their products.

Moreover, entities can apply for NSIC registration to act as a assessed vendor on gem

DPIIT recognised Startups are exempted from submitting Earnest Money Deposit (EMD) or bid security while filling government tenders. The Government shall also exempt Startups in the manufacturing sector from the criteria of “prior experience/ turnover” without any compromise on the stated quality standards or technical parameters.

7. Exemption under Section 56:- Investments into eligible Startups by Accredited Investors, Non-Residents, AIFs (Category I), & listed companies with a net worth more than ₹100 crores or turnover more than ₹250 crores are exempted under Section 56(2)(VIIB) of Income Tax Act. Also, consideration of shares received by eligible Startups shall be exempt up to an aggregate limit of ₹25 crores.

8. Panel of facilitators to assist in filing of IP applications:- The Central Government will bear the entire fees of the facilitators for any number of patents, trademarks, or designs that a Startup may file. The Startups have to bear the cost of the statutory fees only.

9. Gem Portal preference:- Recognized startups are given preference on GeM portal to boost startup ecosystem in India

Startup India is a flagship initiative by the Government of India to support innovation and entrepreneurship. To qualify for Startup India Registration under DPIIT (Department for Promotion of Industry and Internal Trade), a business entity must meet the following eligibility criteria:

1. Originality of the Business Entity

The startup must be a completely new entity and not a result of splitting or restructuring from an existing business.

2. Eligible Business Structures

To register under the Startup India initiative, the business must be legally incorporated under one of the following structures:

3. Annual Turnover Limit

As per DPIIT guidelines, the startup must have an annual turnover of less than ₹100 crore in any financial year since its incorporation.

4. Age of the Startup

The entity should not be older than 10 years from the date of incorporation to qualify for Startup India recognition.

5. Innovation and Scalability

The startup must be innovative and offer a scalable business model. It should have the potential to generate employment opportunities and contribute to economic growth.

Get your Startup India Certificate with Professional Utilities in three simple steps:

Step 1:

Get in touch via call or contact form

Step 2:

Provide necessary documents

Step 3:

Get your Startup India Certificate in 20-25 working days

The Startup India registration scheme provides entrepreneurs with great opportunities to grow their businesses with the help of the government. Beginning the process online enables startups to gain benefits like tax relief, funding assistance, and ease of compliance. A Startup India registration certificate enhances credibility, making it easier to attract investors and participate in government schemes. Additionally, completing all Registrations and Licenses for Startup ensures smooth operations and legal compliance.

The campaign is a significant move towards facilitating innovation and strengthening India's startup ecosystem. By registering, entrepreneurs can leverage various incentives to scale up their businesses with ease and drive the economic growth of the country.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Startup India Registration is a flagship project launched by the Government of India to develop an ideal environment for growing innovations. It will enable young entrepreneurs to obtain DPIIT recognition, which will open doors for them to benefit from tax exemptions, simplified regulations, and funding.

For registration, one needs to visit the Startup India website and create a new account with the intention of ‘DPIIT Recognition’. For registration, you would be required to provide your Certificate of Incorporation, a brief description of your innovative business model, along with your PAN information

The fees for registering a Startup India via the government website are free, according to the Government of India. It is a free process, although you may have to pay for the services of a CA or lawyer if you are getting the process done through them.

Startup Certificate provides massive benefits such as 80% reduction in fees for filing patents, income tax holiday for 3 years, and exemption from experience requirements for government tenders. It further provides ease in finalizing a company in 90 days under the Insolvency and Bankruptcy Code.

Only private limited companies, an LLP, or partnership firms incorporated in India will be eligible to apply. It should be fewer than 10 years old, with an overall turnover of less than ₹100 crore, and aim to increase innovation or enhance an existing product.

To obtain the certificate, you may apply online through the website of the Startup India initiative. After you have applied for the recognition and the DPIIT (Department for Promotion of Industry and Internal Trade) examines your application, they will mail the downloadable Recognition Certificate to your email address.

Startup certificate in India is the proof of the authenticity of your startup, which will make it easy to acquire funding from venture capital firms. This is the most important document required while claiming exemptions from taxes, which have been mentioned in Section 56, Section 80-IAC.

Startup India is the overall platform where you network as well as acquire resources, whereas DPIIT Registration is the legal recognition or certification. Think of Startup India as the community where one networks and the DPIIT as one sort of certification for government-backed tax advantages.