Updated on January 08, 2026 01:26:18 PM

Establishing a Non-Government Organization (NGO) helps you work for the betterment and improvement of society. To register an NGO, you need to understand what they are, how they work, and the registration requirements. There are three forms of NGO - Section 8 company, Society and Trust.

In effect from April 1, 2021, all NGOs need to file Form CSR-1 to register with Central Government to get CSR funding. Furthermore, FCRA registration is required if the NGO is seeking funds from foreign sources.

NGO stand as catalysts for addressing social issues, encompassing vital areas such as education, healthcare, environmental conservation, and human rights. If you are driven by a fervent desire to make a tangible difference and are determined to champion a cause that resonates with your values, gaining a comprehensive understanding of the intricacies surrounding NGO registration is the pivotal initial stride towards transforming your vision into a practical and impactful reality—whether you aim to form an NGO & Society.

NGO Registration [Sample]

Table of Content

A non-governmental organization (NGO) is a non-profit organization established by a group of natural persons for charitable and social purposes. The NGO's objective is to promote non-profit objectives such as commerce, art, science, sports, education, research, social welfare, religion, charity, protection of the environment and other charitable purposes. An NGO intends to apply all its profits in promoting such objectives. There are three types of NGO that we are going to cover in more detail.

There are three types of NGO registration, and each of them are governed by different laws:

Section 8 company is the most popular form of NGO registration and has more credibility among donors, government and other stakeholders. It has more benefits than traditional charitable institutions and is registered under the Companies Act, 2013. The main objective of Section 8 company is to promote arts, sports, commerce, science, religion, social welfare, charity and environmental protection. Section 8 company can be registered both as a private limited company or a public limited company.

Trust, also known as Charitable Trust, is a non-profit organization registered under the Trust Act of 1882. Trust is incorporated as a legal entity where the owner or “trustor” transfers his assets to the second party or “trustee” for the benefit of the third party or “beneficiary”. There are two types of trust - Public Trust and Private Trust. Public Trust is created to provide benefit to the general public, and Private Trust is created to benefit a particular group of individuals.

Society is a form of non-governmental organization created by a group of individuals united for a common non-profit objective of a charitable cause. It is registered under the Societies Registration Act, 1860. All the entity members come together and work towards promoting charitable activities like education, art, science, religion, sport, etc.

Note: It should be ensured that the company name does not resemble the name of any other already registered company and also does not violate the provisions of emblems and names (Prevention of Improper Use Act, 1950). You can quickly check the name availability by using our company name search tool to verify the same.

The total cost for NGO registration in India is ₹9,499, which includes all necessary charges such as the Digital Signature Certificate, Government Stamp Duty, and Professional Fees. Below is the detailed fee structure:

| NGO Registration in Delhi | Registration Fees |

|---|---|

| ✅ Digital Signature Certificate Fee | ₹3,000 |

| ✅ Government Fee(Stamp Duty) | ₹2,500 |

| ✅ Professional Fee | ₹3,999 |

| ✅ Total Cost | ₹9,499* |

*Important Note: The total cost of registering a company varies from state to state. Refer to the map for state-wise prices.

NGO registration requires specific documents related to the organization, trustees, and registered address.

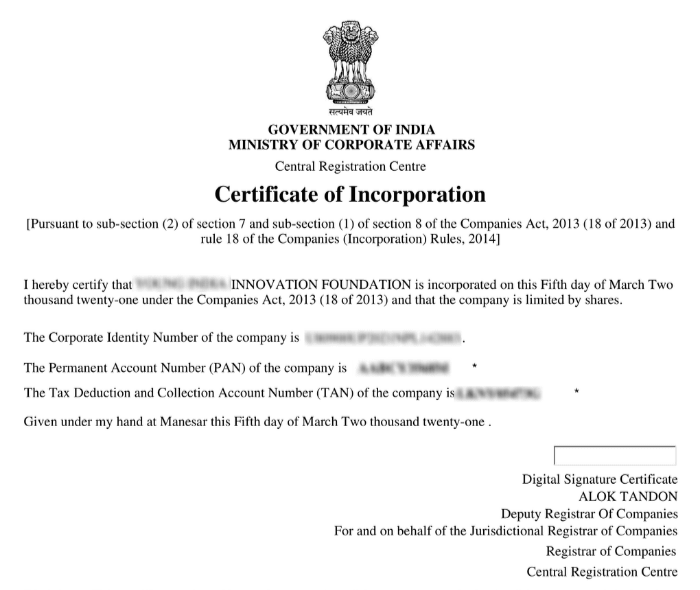

Post incorporation of Section 8 company, you’ll receive the following documents:

Post incorporation of Trust, you’ll receive the following documents:

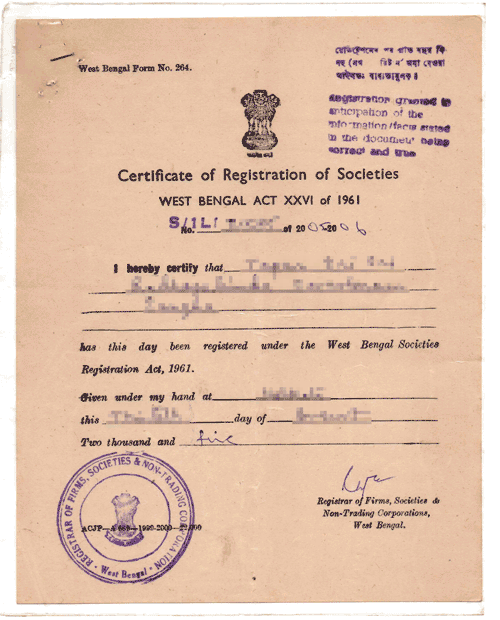

Post incorporation of Society, you’ll receive the following documents:

Conclusion

Working towards the betterment and improvement of society without any profit motive is an excellent service to the world. To do that legally, establishing an NGO is very important to get various benefits like donations from prominent foundations, tax exemptions, etc.

Choosing the suitable form of NGO is equally crucial as it is a one time work but would benefit the organization in the long-term. We at Professional Utilities offer free expert consultation to help you choose the right kind of non-profit organization as per your requirements. Get in touch with our professional team to decide which form of non-governmental organization is most suitable for your company’s goals.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

First, you need to decide which type of NGO you want to establish. Secondly, you need to arrange & provide proper identity & address proof of directors, members, and professionals' declaration (CA, CS, etc.).

It depends on the type of NGO and the number of people registered as members.

Name of a Section 8 Company (NGO) should not include the words Private Limited (Pvt. Ltd.) or Limited (Ltd.) at the end of its name. The proposed name of a Section 8 Company shall include either of the words - Foundation / Forum / Association / Federation / Chambers / Confederation / Council / Electoral Trust as per Rule 8A(1)(u) of Companies (Incorporation) Fifth Amendment Rules, 2019.

No, a single person cannot start an NGO. Minimum two people are required for Section 8 company incorporation, and at least three people are required for Trust and Society registration.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Other Company Registration by Professional Utilities