Updated on June 19, 2025 02:53:21 PM

Startup India registration for a Section 8 Company is an important step for companies looking to expand and get recognition through government-sponsored initiatives. The Startup India scheme, launched by the Indian government, provides qualifying Section 8 companies with a variety of incentives, including income tax deductions, eased compliance rules, speedier processing of IPR applications, and preferential access to different government schemes.

To take advantage of these benefits, a Section 8 company must apply for DPIIT (Department for Promotion of Industry and Internal Trade) accreditation through the official Startup India portal. The application procedure entails providing critical business information, needed documentation, and a brief write-up emphasizing the company's innovation, scalability, job creation, or sectoral effect.

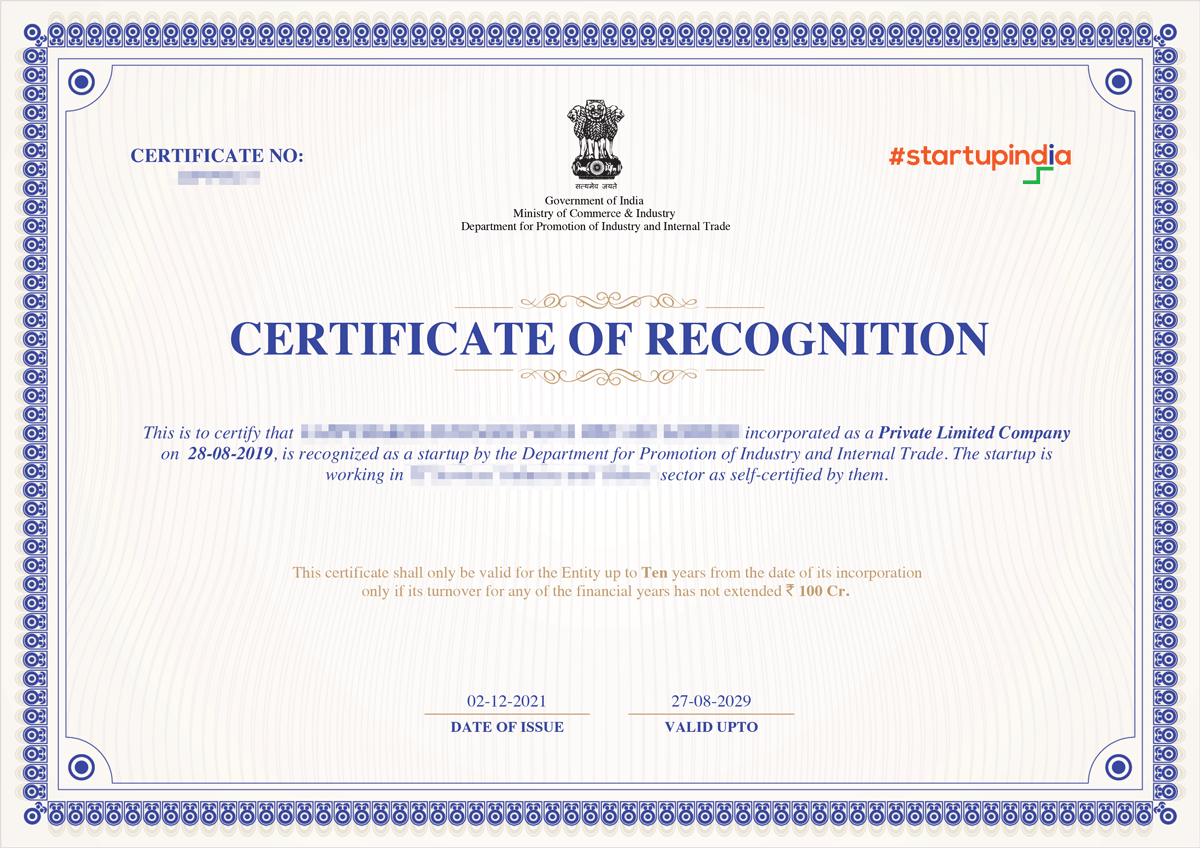

Once authorized, the firm receives a DPIIT Startup Recognition Certificate. This certificate provides access to important benefits such as the Startup India Seed Fund Scheme, a tax exemption under Section 80 IAC, and registration on the Government e-Marketplace (GeM) platform for public procurement.

Whether you're starting a new Section 8 company or currently run one that's less than 10 years old, acquiring Startup India designation is a critical step toward building up with government backing and legitimacy.

Startup India DPIIT Sample Report

Table of Content

DPIIT Startup India Registration as a Section 8 Company is an official recognition conferred by the Department for Promotion of Industry and Internal Trade via the Startup India program. Eligible Section 8 companies can apply online by uploading the necessary documents and company information via the Startup India portal.

Once authorized, the entity obtains a Startup India Recognition Certificate, which officially identifies it as a DPIIT-recognized startup. This certificate allows the firm to take benefit of a variety of government-backed benefits, including tax breaks, financing possibilities, easier compliance processes, and eligibility for public procurement schemes and innovation-driven programs developed by the Government of India.

Listed below are the benefits that Section 8 Companys recognized under Startup India registration get:

Note: Businesses with DPIIT recognition are exempted from deposition of EMD (Earnest money deposit) in tender participation on public procurement platforms.

Under the Startup India Action Plan, Section 8 Companys that meet the definition prescribed under G.S.R. notification 127 (E) can apply for recognition under the program. The program aims to create a robust ecosystem and pick up new-age enterprises.

The following are the eligibility criteria for Startup India registration for Section 8 Companys set up by DPIIT.

Note: Businesses with DPIIT recognition are exempted from deposition of EMD (Earnest money deposit) in tender participation on public procurement platforms.

The following documents are needed to be submitted by the Section 8 Companys for recognition of Startup India by DPIIT.

Other Certificates, if available:

Individuals seeking Steps for Startup India Registration for Section 8 Company can follow the steps below to complete the application process:

Incorporate your business as one of the following:

Visit startupindia.gov.in to register and verify your email to access the dashboard.

Apply for DPIIT Recognition” and fill in details such as:

In case any issues are being raised fom DPIIT, respond with corrections or clarifications appropriately.

Upon successful examination of application from department, DPIIT will issue the Startup India Recognition Certificate.

The professional charge for getting DPIIT recognition for Section 8 Company under Startup India initiatives is Rs 4,999 only and the total time it would take in the process would be 20-25 business days. The professional fees are exclusive of GST. There is no government fee for DPIIT recognition.

| Particulars | Fees |

|---|---|

| Our Professional Charges | ₹4,999 |

| Time Taken in Process | 20–25 Days |

Conclusion

Startup India registration for Section 8 Companies provides access to a variety of government-sponsored benefits aimed at encouraging innovation, economic growth, and ease of doing business. DPIIT-recognized firms benefit from tax breaks, simpler regulatory compliance, and access to funding opportunities such as the Startup India Seed Fund.

The application procedure is fully online and managed through the official Startup India portal, making it both accessible and efficient. Obtaining DPIIT recognition is a key step for mission-driven entrepreneurs looking to create scalable, impact-oriented businesses. Begin your registration process immediately and take advantage of government assistance to help your Section 8 company flourish.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Frequently Asked Questions (FAQs)

Startup India Registration for a Section 8 Company is an official recognition granted by the Department for Promotion of Industry and Internal Trade (DPIIT). This recognition helps Section 8 Companies gain access to various government benefits designed to support innovation, entrepreneurship, and ease of doing business in India.

Yes, a Section 8 Company is eligible to apply for DPIIT recognition under the Startup India scheme. As long as it fulfills the required conditions such as age, turnover, and innovation potential, it can register through the Startup India portal.

To be eligible, the Section 8 Company must be less than 10 years old from the date of incorporation and have an annual turnover of less than ₹100 crores. It must also be engaged in innovation or development of products or services and must not be created by splitting or reconstructing an existing business.

The required documents include the Certificate of Incorporation, PAN card of the company, directors’ Aadhaar and PAN cards, and passport-size photographs. Additionally, a brief write-up about the company’s innovation, scalability, and job creation potential is required, along with any available supporting certificates such as GST, MSME, or trademark registrations.

Recognized Section 8 Companies enjoy numerous benefits such as tax exemptions under Section 56 and 80 IAC, easier compliance with labour and environmental laws, and fast-tracked IP and patent applications. They also gain preference on government procurement platforms like GeM and are exempt from submitting EMD while applying for tenders.

Yes, DPIIT recognition is essential to access the full range of benefits offered under the Startup India initiative. Without this recognition, startups cannot avail of tax exemptions, funding schemes, or simplified regulatory processes.

Yes, NGOs registered as Section 8 Companies can apply for Startup India recognition if they meet the eligibility conditions. They must also demonstrate innovation, scalability, and their potential impact on society or the economy.

You can apply directly through the official Startup India portal by creating a profile and submitting your application online. Alternatively, you can seek professional assistance to ensure a smooth and error-free registration process.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions