The Tobacco Board of India, a significant institution operating under the umbrella of the Ministry of Commerce and Industry, holds a vital role in regulating and promoting the tobacco industry within India. Established with a clear set of objectives, the board aims to facilitate the tobacco trade by granting essential certifications to merchant traders and manufacturers.

One of the primary functions of the Tobacco Board is the issuance of certificates of origin and GSP (Generalized System of Preferences) certificates. These certifications play a crucial role in international trade, providing evidence of the tobacco's origin within India and allowing for preferential treatment in trade agreements. Merchant traders greatly benefit from these certificates as they navigate the global market, enhancing their trading opportunities and establishing trust with international partners.

The Tobacco Board is also responsible for promoting the tobacco industry within the country. This involves various initiatives aimed at encouraging growth, sustainability, and innovation within the industry. By facilitating advancements in technology, agricultural practices, and manufacturing processes, the board contributes to a more efficient and competitive tobacco sector.

This regulatory function helps maintain quality standards and compliance with relevant laws and regulations. By overseeing these aspects, the board ensures that the manufacturing of tobacco products aligns with established guidelines, promoting a safe and transparent industry.

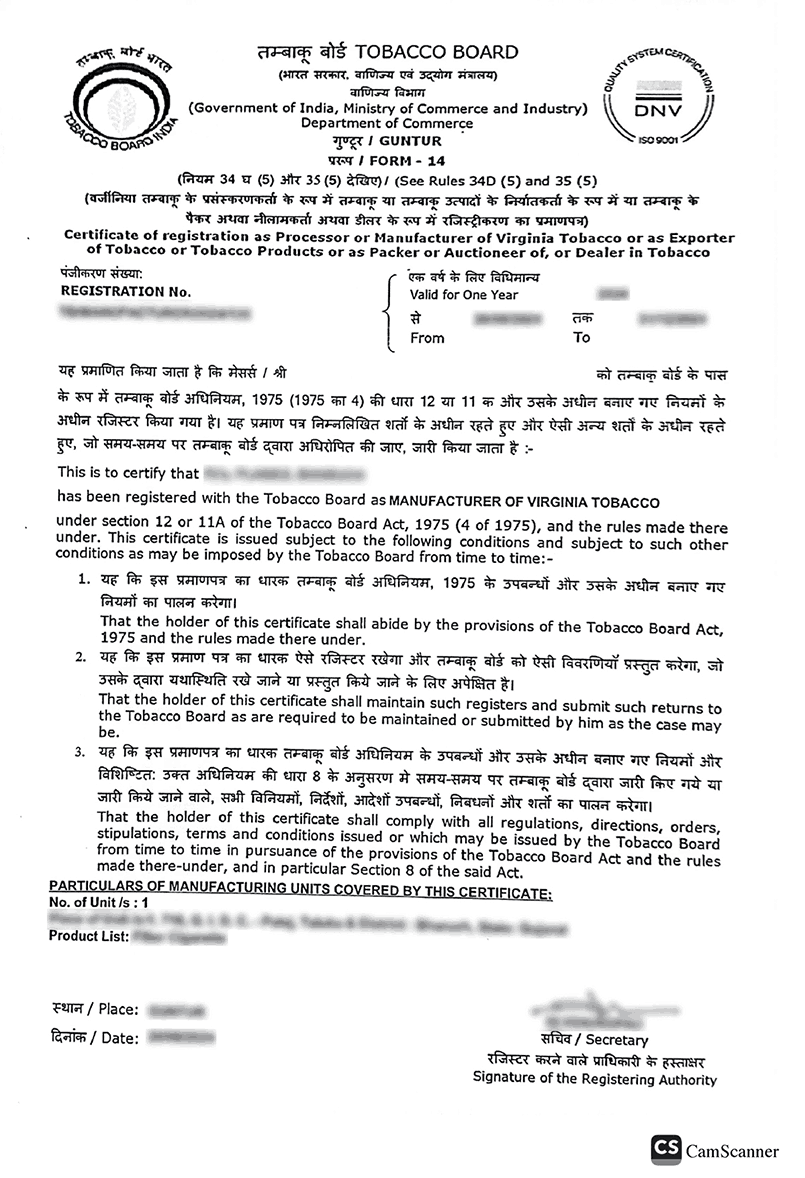

Tobacco Board Certificate [Sample]

Tobacco Board Registration is required by various industries that indulge in manufacturing, processing, packaging or trade of tobacco in India. It is an important certificate required by importers as well. The objective of certifying the tobacco industry is to control and regulate the sale, purchase and manufacturing of tobacco and its allied products in India. The Registration process can take up to 2 weeks to complete, further registered applicants are required to fulfill their annual compliances with tobacco board.

These are the following businesses that need to obtain a Tobacco Board Registration cum membership certificate (RCMC) from licensing authorities.

The Registration for tobacco board RCMC for exporters is classified into 2 main categories.

Below is the list of essential documents required to apply for Tobacco Board Registration, whether you're a manufacturer, exporter, or trader.

Here is the detailed fee structure for Tobacco Board registration based on different categories such as processors, manufacturers, exporters, traders, and packers of Virginia and unmanufactured tobacco.

| Category | Particulars | Fees |

|---|---|---|

| Processors of Virginia Tobacco | If the average quantity of tobacco processed during the preceding three financial years exceeds 10,000 Metric tons | Rs. 20,000 |

| Above 5,000 Metric tonnes and upto 10,000 Metric tonnes | Rs. 16,000 | |

| Above 1,000 Metric tonnes upto 5,000 Metric tonnes | Rs. 10,000 | |

| 1,000 Metric tonnes or below | Rs. 4,000 | |

| Manufacturers of Virginia Tobacco | If the average value of the products manufactured during the previous three financial years is above Rs.30 Crores | Rs. 30,000 |

| Above Rs.1 Crore and upto Rs.30 Crores | Rs. 20,000 | |

| Above Rs.20 Lakhs and below Rs.1 Crore | Rs. 10,000 | |

| Rs.20 Lakhs or below | Rs. 2,000 | |

| Exporter of Unmanufactured Tobacco | If the average annual value of the export of Unmanufactured Tobacco during the preceding three financial years exceeds Rs.50 Lakhs. | Rs. 6,000 |

| Export turnover above Rs.10 Lakhs and upto Rs.50 Lakhs | Rs. 4,000 | |

| Export turnover upto Rs.10 Lakhs | Rs. 1,000 | |

| Exporter of Tobacco Products | No turnover limits | Rs. 1,000 |

| Traders of Tobacco | If the average annual turnover during the preceding three financial years exceeds Rs.10 Lakhs | Rs. 1,000 |

| Turnover upto Rs.10 Lakhs | Rs. 500 | |

| Packer of Tobacco | If the average annual turnover during the preceding three financial years exceeds Rs.10 Lakhs | Rs. 1,000 |

| Turnover upto Rs.10 Lakhs | Rs. 500 | |

| Commercial Grader | No Turnover limits | Rs. 250 |

Note: The aforementioned Fees is exclusive of GST.

The tobacco board license registration is valid for the time period of 1-5 years and can be renewed accordingly as per the pre-defined criteria.

Learn How to apply for Section 8 company registration? Given below is the complete registration process of Section 8 company in Andhra Pradesh, you can follow the process to register your Section 8 Company in Andhra Pradesh within a few days:

The registration process begins accessing the official website of the relevant licensing authority. To Complete the online registration application form accurately, all necessary details & information are required to be Submitted through the online portal.

Prepare all required documentation for the registration process as specified in the application guidelines. All the documents are required to be uploaded on the online portal.

The tobacco board will review the application and the uploaded documents. Conduct thorough verification and background checks to validate the information provided.

Upon successful verification and approval, the tobacco board will issue the registration certificate. The certificate can be downloaded from the online portal or will be sent electronically to the applicant. The applicant will receive a notification confirming the issuance of the registration certificate.

Here are the key benefits of Tobacco Board Registration that help ensure legal compliance, market transparency, and industry growth for tobacco-related businesses.

Conclusion

Tobacco board Registration is an important aspect of tobacco export business in India. Exporters of virginia tobacco products and unmanufactured tobacco along with other allied products must have registration cum membership certificate (RCMC from tobacco board) to commence export oriented business. The council also helps businesses explore new business opportunities in foreign markets and helps producers and manufacturers of tobacco strategically in expansion, technology and Market research. Therefore it is professionally advisable for businesses indulging in tobacco industry to get RCMC certification as per their requirement and nature of their business.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

The RCMC registration with tobacco board is a mandatory requirement for all the businesses in the tobacco industry.

The validity for Tobacco board Registration cum membership certificate is valid up to the time period of 1-5 years.

Yes the Importer exporters code certification is required for Tobacco board membership in case of merchant exporters.

Yes, exporters must obtain a Tobacco Exporter Products License from the Tobacco Board of India to legally export tobacco products from India. Exporting without this license can result in penalties or shipment rejection. Learn more at Tobacco Exporter Products License.

Speak Directly to our Expert Today

Reliable

Affordable

Assured