GST Registration is a requirement for all types of businesses, including Public Limited Companies, in India. A Public Limited Company is a big business that can collect money from the public through issuing shares. Due to its size and type, it has to obey all regulations and tax laws, including GST.

Under GST regulations, if a Public Limited Company sells products or services and earns above ₹40 lakh (for products) or ₹20 lakh (for services) within a year, it is required to register under GST. For special-category states, the threshold is ₹10 lakh. Moreover, GST registration is mandatory for companies engaged in interstate trade, import/export, or e-commerce, irrespective of how much they make.

The registration is done entirely online through the official GST portal. After registering, the firm receives a GSTIN (GST Identification Number), which is applied for paying taxes, filing returns, and helping input tax credit.

Being GST-registered enables the firm to comply with the law, gain confidence, and develop smoothly. It enhances the firm's reputation as well as facilitates the expansion of business throughout India.

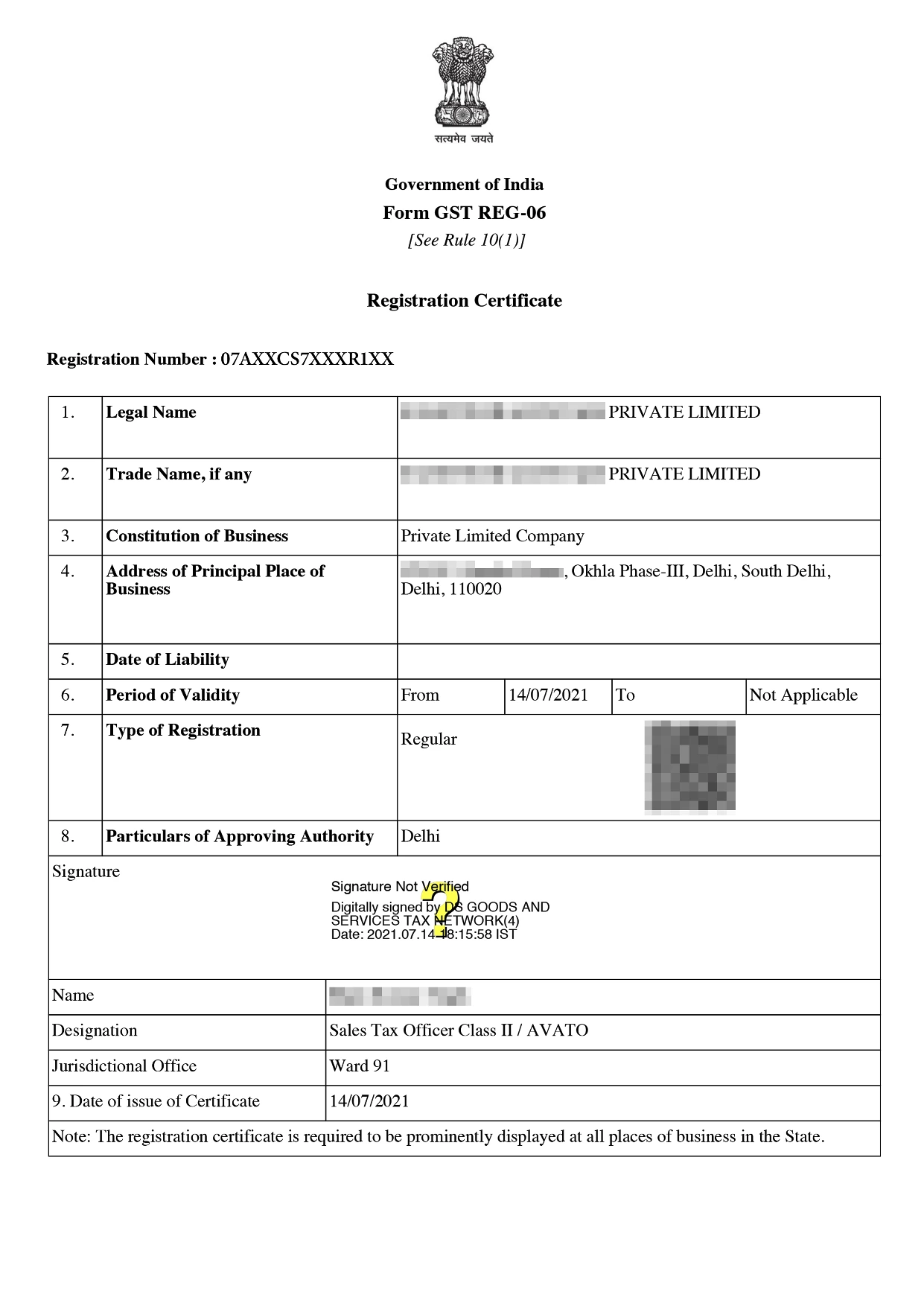

Online GST Registration Sample

Table of Content

GST registration is a procedure by which a Public Limited Company becomes officially registered under the Goods and Services Tax (GST) law in India. A Public Limited Company is a big company that can raise funds from the public by issuing shares. If this company sells goods or services and makes more than a specified amount of money each year, it needs to register for GST.

After the company registers, it receives a GSTIN (GST Identification Number). This number has to be included on every bill and utilized when paying taxes. GST registration also allows the company to claim tax benefits on its purchases.

Following are the Principal Benefits of GST registration for a Public Limited Company:

To register a Public Limited Company under GST, several documents are needed to verify the company’s identity, address, business structure, and authorized signatories.

| Document | Purpose / Details |

|---|---|

| PAN Card of the Company | Mandatory for GST registration – serves as business identity proof. |

| Certificate of Incorporation | Proof of legal formation of the company under the Companies Act. |

| MOA & AOA | To verify the company’s objectives and operational structure. |

| ID & Address Proof of Directors | PAN card, Aadhaar, Passport, or Voter ID of all directors. |

| Photographs of Directors/Signatories | Recent passport-size photographs for identification. |

| Proof of Business Address | Electricity bill, rent agreement, or NOC (if rented/shared space). |

| Bank Account Proof | Cancelled cheque, bank statement, or first page of passbook. |

| Digital Signature Certificate (DSC) | Mandatory for submission and authentication of GST application. |

| Email ID and Mobile Number | For OTP verification and further communication. |

| Board Resolution or Authorization Letter | Authorizes an individual to file the GST application on behalf of the company. |

The GST registration process for a Public Limited Company is completely online and can be completed through the official GST portal. Here's a step-by-step guide:

GST registration for a Public Limited Company is an important but detailed process. If you choose to do it yourself on the GST portal, there are no government fees. However, if you want to save time and avoid hassle, you can go for Professional Utilities' expert service. They help you with the complete registration process for just ₹1499, making it quick and easy.

| Particulars | GST Registration Fees (INR) |

|---|---|

| Government Fees | ₹0 (No charges for self-registration under GST law) |

| Professional Fees | ₹1499 (charged by Professional Utilities for expert assistance) |

Conclusion

GST registration is a fundamental requirement for any Public Limited Company to become operational legally and effectively within the tax system of India. It prevents violation of government rules, permits input tax credit by the company, and enables seamless interstate and foreign business activities. Additionally, it enhances the credibility of the firm and facilitates dealings in tenders and e-commerce platforms.

While the process entails documentation and formalities, GST registration streamlines the tax procedure and aids long-term business expansion.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Starting a data analytics company in India is a growing business opportunity due to the increasing reliance on data-driven decision making, adoption of AI and machine learning technologies, demand for insights in sectors like finance, healthcare, and e-commerce, and the expanding digital ecosystem in India.

The HSN code and GST rate for industrial machinery and mechanical products usually fall under Chapter 84 and 85, with GST generally levied at 18%, depending on the specific type and usage of the machinery.

There is no government charge for GST registration. However, if you seek professional help, there may be service charges.

After registration, the company needs to put its GSTIN on invoices, file GST returns regularly, and be in compliance to escape penalties.

Yes, if the business is located in more than one state, it will need to acquire different GST registrations for different states.

Important documents are the PAN of the company, Certificate of Incorporation, MOA & AOA, ID/address proof of directors, proof of business address, bank details, DSC, and authorization documents.