The LLP full form is a Limited Liability Partnership. LLP is a newer form of business in India with limited liability benefits of a private limited company and the flexibility of a partnership firm. The concept of the LLP was introduced in India in 2008 and is regulated by the Limited Liability Partnership Act, 2008.

The maintenance cost and compliances are less in LLP; hence, it has become a preferred form of business organization among entrepreneurs. This form of business structure is ideal for small and medium-sized businesses.

It is easy to start and manage a Limited Liability Partnership in India. A minimum of two partners are required to register an LLP, and there is no upper limit. The LLP Agreement governs the rights and duties of the designated partners. They are directly responsible for the compliances and all the provisions specified in the LLP agreement.

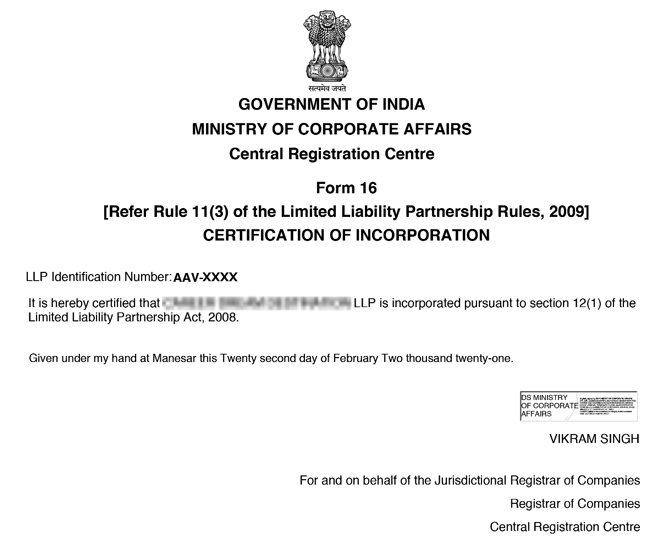

LLP Registration Certificate [Sample]

Table of Content

Limited Liability Partnership Registration, or LLP Registration, is a company type that merges the characteristics of corporations and partnerships. The core idea behind LLP is that the partners enjoy limited liability. Business partners in LLP have nonabsolute liability. The partners are not personally liable for business losses or indebtedness that is more than their investments within the partnership enterprise.

Although LLP registration offers the flexibility and tax advantage of a partnership, it also provides protection from liabilities such as a corporation. LLP registration is favored by professional service providers such as accountants, lawyers, and consultants. They are also employed by firms operating in various industry segments. LLPs are regulated by the laws and rules of the relevant jurisdictions for incorporation and business.

The LLP Act of 2008 governs the formation and operation of LLPs in the Indian territory. It is a versatile legal framework that provides a structure suitable to the entities of both partnerships and companies.

The LLP Act of 2008 allows businesses functioning in India to enjoy limited liability status with ease of compliance and smooth operation.

Registering a Limited Liability Partnership (LLP) in India offers several advantages, making it a popular choice for businesses seeking flexibility, legal protection, and cost-efficiency. Here are the key benefits of LLP registration in India:

Here’s a comprehensive checklist of requirements to successfully register an LLP in India:

The following documents of partners and the LLP are mandatory for the Documents for LLP Registration.

Following are the documents you’ll receive after registering an LLP in India:

The step-by-step procedure of LLP registration in India is as follows:

The first step of LLP registration in India is applying for the digital signature of all the designated partners of the proposed LLP. The incorporation of LLP is entirely digital; all the documents are filed online and must be digitally signed.

Designated partners whose signatures are to be affixed on the e-forms must obtain Class-3 Digital Signature Certificates from government-recognized certifying agencies.

You have to apply for the “Designated Partner Identification Number (DPIN)” of all the designated partners or those intending to be designated partners of the proposed LLP.

LLP-RUN (Limited Liability Partnership-Reserve Unique Name) form is filed for reservation of the name of the proposed LLP. While making the name application, it is recommended that the name should not be similar, identical or phonetically similar to existing LLPs, companies, firms, and trademarks.

You can easily check for name availability using our free LLP name search tool or company name search tool. The system will provide a list of similar or closely resembling names of existing companies or LLPs based on the search criteria.

If it fulfils all the prerequisites, the proposed name of LLP is approved by the Central Registration Centre of the Ministry of Corporate Affairs if found in the ordinance.

The FiLLip form has to be filed for incorporation of Limited Liability Partnership with the Registrar having jurisdiction over the state in which the registered office of the LLP is located. Details which has to be filed in the FiLLip form are:

The Registrar will register the LLP if the documents comply with the LLP Act's relevant provisions. Post-approval of the FiLLip form, Certificate of Incorporation is issued within 14 days in Form-16 from the Central Registration Centre of MCA under the letterhead of the Government of India.

LLP Agreement is the most important document of an LLP that governs the mutual rights and duties of the partners; also between the LLP & its partners.

The total cost of LLP registration in India starts at just ₹8,499, including government and professional fees, with Professional Utilities.

| Steps | Cost (Rs.) |

|---|---|

| Digital Signature Certificate | ₹3,000 |

| Government Fee | ₹1,500 |

| Professional Fee | ₹3,999 |

| Total Fee | ₹8,499 |

Note: The aforementioned Fees is exclusive of GST.

Depending on the application submission, document verification, and approval, the registration of LLP company name is done in 15 to 30 working days. Thus, the Limited Liability Partnership Registration in India is completed approximately in about 20 days. You can prevent unnecessary delays in registration by availing services from LLP registration consultants such as Professional Utilities.

Conclusion

Registering a Limited Liability Partnership (LLP) in India offers businesses a flexible and legally recognized framework that merges the benefits of limited liability with ease of operation. It is especially ideal for startups, professionals, and small enterprises looking for an affordable substitute for a private limited company.

The registration of an LLP allows for smoother compliance, tax advantages, and legal protection, thus ensuring smooth business operations while protecting the interests of the partners. With Professional Utilities, you can make the registration process easier with expert support, ensuring seamless documentation and government approvals.

Start your LLP registration today and take the first step toward building a legally compliant and scalable business!

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

A Limited Liability Partnership (LLP) in India is a form of business that incorporates the advantage of limited liability with the flexible nature of a partnership.

In India, an LLP can be registered through the process of acquiring a DSC and DPIN, approval for the LLP’s name, filing incorporation forms, and submitting the LLP Agreement to the MCA.

Any person or a corporate can register an LLP in India, if there are a minimum of two partners, including the designated partner.

The LLP in India requires no capital to be registered.

The LLP registration procedure in India consists of obtaining DSC, applying for DPIN, name approval, filing for incorporation, and submission of the LLP agreement.

A minimum of two partners is required to form an LLP in India, with no maximum limit.

Yes, LLP registration is compulsorily required for carrying on any business with a legal entity as a Limited Liability Partnership in India.

These are the following documents required for LLP