Updated on January 08, 2026 01:26:18 PM

Nidhi company is a kind of Non-Banking Financial Company aka NBFC. Because of the benefits Nidhi Company offers it is also called as Mutual Benefit Finance Company. Like every company, Nidhi Company also consists of few annual compliance popularly known as Nidhi Company Compliances. The statutory compliances related to Nidhi Company are disclosed in Nidhi Rules 2014 and the Companies Act 2013.

Provisions of the Section 406(1) of the Companies Act, 2013 defines the Nidhi Company as “A company which has been incorporated as a Nidhi with the object of cultivating the habit of thrift and savings amongst its members, receiving deposits from, and lending to, its members only for their mutual benefit.”

Nidhi Company is the perfect choice for those who want to indulge in lending business with minimum fund investment.

.webp)

Rs 5,00,000 is the minimum capital requirement for registration of Nidhi Company. The company also provide the opportunity to invest the capital within 2months once the registration is done.

Though Nidhi Company falls under the criteria of NBFC but they do not need any approval from RBI. Nidhi Rules, 2014 are drafted for such companies to regulate their activities and working performance.

The primary motive of Nidhi Company is to boost the habit of savings amongst its member. Hence, Nidhi Company can be counted as long term investment as its members will not stop savings anytime.

The level of risk involved in the Nidhi Company is minimal due to its nature of accepting deposit and providing loans to its members as stated in Nidhi Rules 2014. It is a trust worthy and secured way of granting loan also loans provided to members are at a very less rate.

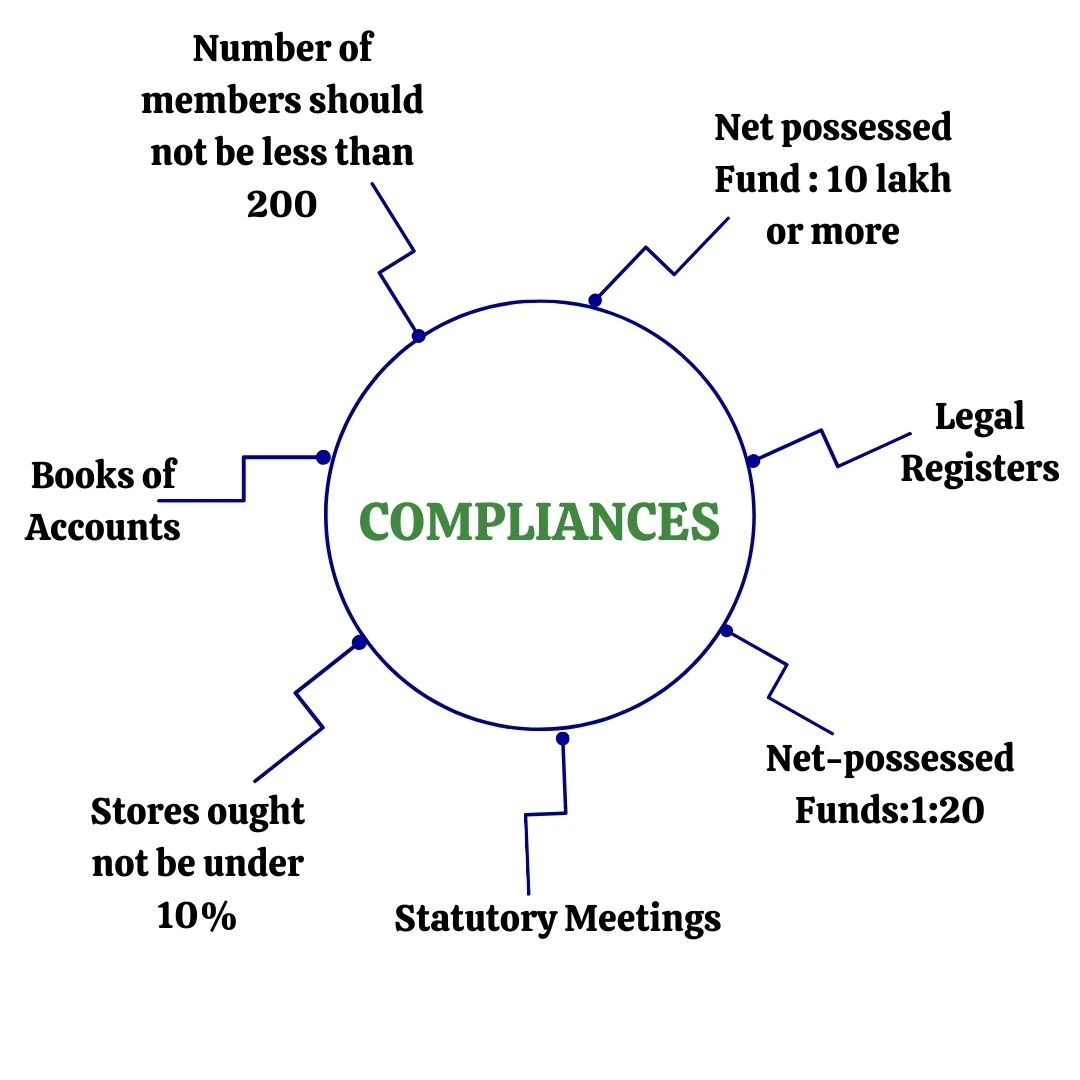

Necessary compliances to be followed are:

The nature of annual compliance is periodic in nature. Often these compliances are presented annually hence they are needed to be filed after regular intervals of time.

The purpose of these compliances is to give a clear picture of the work status and performance of Nidhi Company during a period.

It is necessary for Nidhi Company to meet all the compliance as mentioned in the Companies Act 2013 as well as in Nidhi Rules 2014.

Filing NDH-1is necessary for Nidhi Companies submit the NDH-1 along with the prescribed fees and make sure that it is duly certified by either the chartered accountant, cost accountant or by the company secretary.

File the return within 90days, begin from the end date of the first or second financial year once your incorporation is done.

The purpose of filing for form NDH-2 is to appeal for request for time extension in case following compliances are not met:

NDH-2 form is submitted to the Regional Director with the prescribed fee; the director can accept it and pass orders within 30 days from the date of receiving application.

It’s a half-yearly return form which is filed by the Nidhi Company.

Each Nidhi organization needs to guarantee that it will keep accurate books of accounts.

As per Companies Act 2013 it is essential for Nidhi Company to maintain statutory registers. It is one of the mandatory compliances for a Nidhi Company.

Conducting meeting of Board of Directors and Shareholders

Financial statements of a Company include Profit & Loss Account, Balance Sheet and Cash Flow Statement, it is compulsory for a Nidhi company to prepare financial statements.

Nidhi Company should file for annual income tax returns by 30th September of the next fiscal year.

The form AOC-4 is loaded up with subtleties of the budget reports of the Company. This form is upheld by other documents that are endorsed to transfer alongside this form.

Nidhi Company is required to file for an annual return with the Ministry of Corporate Affairs (MCA) via Form MGT-7.

| COMPLIANCE | DUE DATE |

|---|---|

| AGM (Annual General Meeting) | 30th September |

| AOC-4 | Within 30 days of AGM |

| MGT-7 | Within 60 days of AGM |

| NDH 1 | Within 90 Days of the Fiscal Year |

| NDH 3 | Half Yearly |

| Income Tax Return | 30th September |

Documenting compliances on time is required for each Nidhi organization. Not meeting the equivalent can draw in punishment for the Nidhi Bank Operators.

If the Company neglects to meet the compliance, the substance and concerned officials will be fined up to the extent of Rs 5000.

If the infringement proceeds, the further fine will be Rs 500 consistently.

Consequently, it is vital to take compliance maintenance administrations from industry master experts.

.webp)

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

As per FSS guidelines, all Food business operators need a Central FSSAI license for E-commerce businesses irrespective of their capacity.

To incorporate a Nidhi Company it is important to satisfy following rules:

The Nidhi Company utilizes the assets in loaning to investors according to Nidhi Rules. It loans such cash as little credit for business and fund.

Any individual who is over 18 years old according to the standard age verification can turn into an individual from the Nidhi Companies. The individual covetous of turning into a part ought to have legitimate ID Proof and Address Proof.