Updated on January 07, 2026 12:14:35 PM

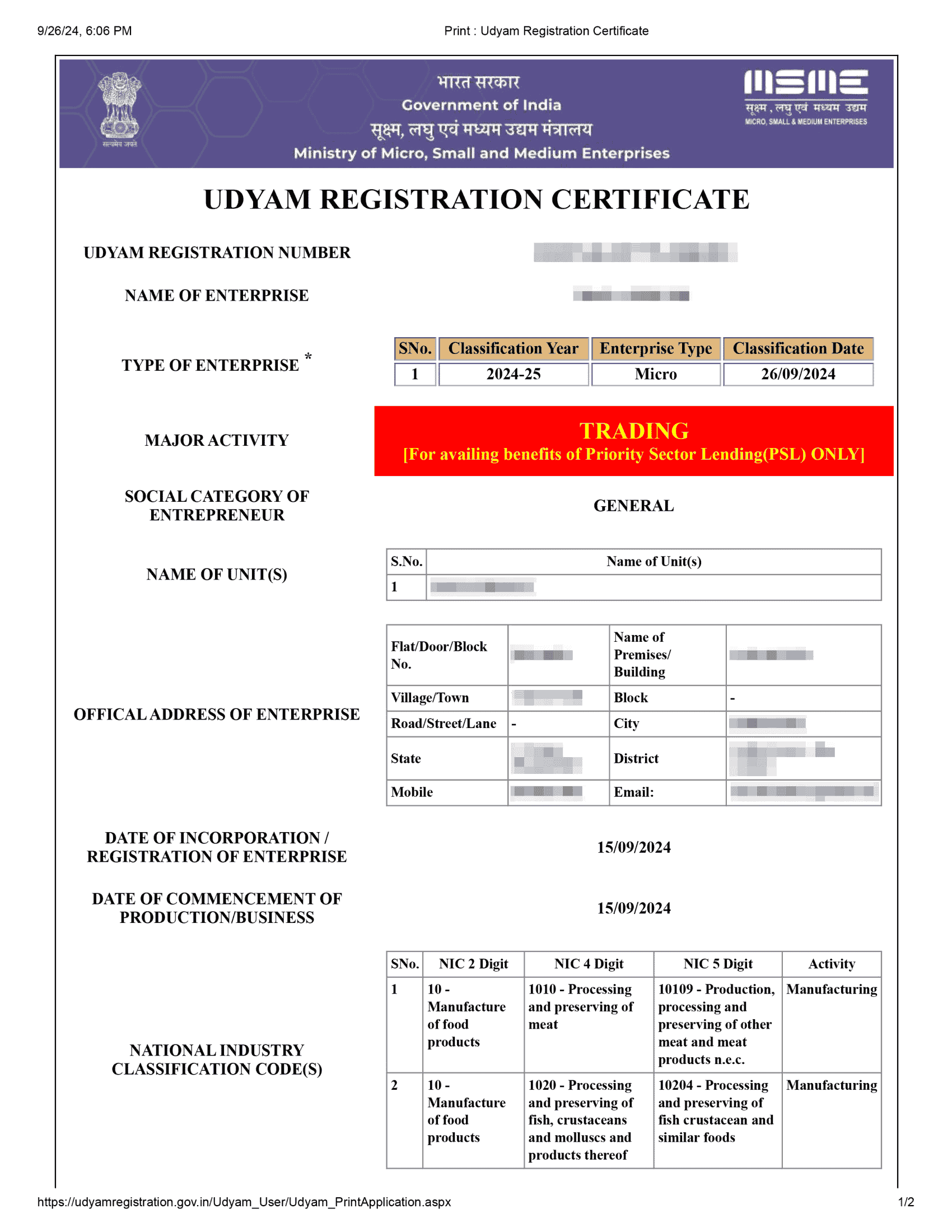

The MSME Certificate received through MSME Registration (Udyam Registration) is a formal acknowledgement that has been issued by the Ministry of Micro, Small and Medium Enterprises, which falls under the Government of India. The purpose of the Udyam Registration Certificate is to assign a distinct identity to small and medium-scale enterprises. It also enables them to have access to various benefits offered by the government.

The Udyam Registration is applicable to both the manufacturing sector and the services sector, provided they fulfil the necessary investment and turnovers. The whole process for the registration is online, paperless, and cost-free on the Udyam portal, where the entrepreneur needs to fill in details about Aadhaar and PAN. The MSME Certificate is then valid for the whole lifetime of the business, with no need for renewal.

An MSME business with an MSME Certificate will get greater credibility and may be entitled to priority sector lending, easier borrowing from banks and NBFCs, favourable interest rates, subsidies from the government, government tenders, and protection from late payments as per the MSME Development Act. This registration plays a significant part in being compliant, identified, and sustainable over time as a business entity in India.

MSME Registration Certificate [Sample]

Table of Content

MSME Registration is also known as Udyam Registration. The Government of India issues MSME certificate to Micro, Small, and Medium Enterprises (MSMEs). The MSME udyam registration assists MSMEs in redeeming several benefits from government schemes for their establishment and growth. The MSME Udyam registration has replaced the old Udyog Aadhaar memorandum (UAM) registration process. Enterprises can apply for MSME registration online through self-declaration and obtain a unique MSME registration number. The Udyam Registration certificate is issued digitally to allow access to subsidies, loans at lower interest rates, and priority sector lending. Enterprises can check their status through the MSME registration check or by PAN number.

The MSMEs are classified based on their investment in plant and machinery and annual turnover. The current revised MSME classification is structured below in which the annual investment and annual turnover determine whether a business should considered as an MSME or not:

| Enterprise Category | Investment Limit | Turnover Limit |

|---|---|---|

| Micro Enterprise | Up to ₹2.5 crore | Up to ₹10 crore |

| Small Enterprise | Up to ₹25 crore | Up to ₹100 crore |

| Medium Enterprise | Up to ₹125 crore | Up to ₹500 crore |

Key benefits of MSME Registration include financial support, legal recognition, government benefits, and business growth opportunities.

To apply for an MSME certificate, Businesses must submit the following documents on the Udyam registration portal:

Follow the below-listed process to apply for and obtain the MSME certificate through the Udyam registration portal:

The government does not charge any fee for MSME registration. Businesses that wish to obtain the MSME certificate can apply through the Udyam registration portal for free

Note: Professional Fee for MSME Registration is ₹1,000 (exclusive of GST).

The Udyam/ MSME Certificate does not have an expiry date and it remains valid for as long as a business is ethical and profitable. The MSME registration remains valid for the lifetime of a business.

Businesses do not need to apply for MSME renewal process since it does not expire and has a lifetime validity. However, the MSME certificate must be renewed with updated Income Tax Returns (ITR) and Goods and Services Tax Returns (GSTR) details for the last fiscal year annually to ensure appropriate MSME classification based on the latest exportation, investment and turnover details. The renewal for MSME registration can be online done through Udyam registration portal. Businesses need to provide their Udyam Registration Number, PAN, GSTIN, ITR filed in the previous year, and registered mobile number to apply for MSME Registration renewal. The businesses do not need to pay any processing fee for MSME certificate renewal since it is free of cost by the government.

Conclusion

MSME registration, also known as Udyam registration, is very important for Micro, Small, and Medium Enterprises to get government benefits, subsidies, and financial assistance. The process for MSME registration online is easy, with minimum documents and no government fees. Registered businesses can benefit from priority sector lending, tax exemptions, quick loan approvals, lower interest rates, and protection against delayed payments. MSMEs do not need to renew the Udyam certificate as its validity remains for lifetime but it needs to be updated every fiscal year with updated investment or turnover information. By getting an MSME registration certificate, businesses can assure long-term growth and eligibility for various government schemes and incentives aimed to support small businesses in India.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions

MSME registration is a government certificate for Micro, Small, and Medium Enterprises in India and it helps to avail government benefits, financial support, and tax exemptions. The MSME registration can be done online via the Udyam Registration Portal.

Businesses that meet the criteria for MSME classification based on their investment and annual turnover are eligible for an MSME certificate.

Any business that fulfills the MSME registration criteria can apply for Udyam registration, including.

A: Registered MSMEs can access government schemes, low-interest loans, and tax benefits. Businesses in Tripura can also avail these advantages after registration. Learn more at MSME registration in Tripura.

Speak Directly to our Expert Today

Reliable

Affordable

Assured