Updated on February 24, 2026 06:57:04 AM

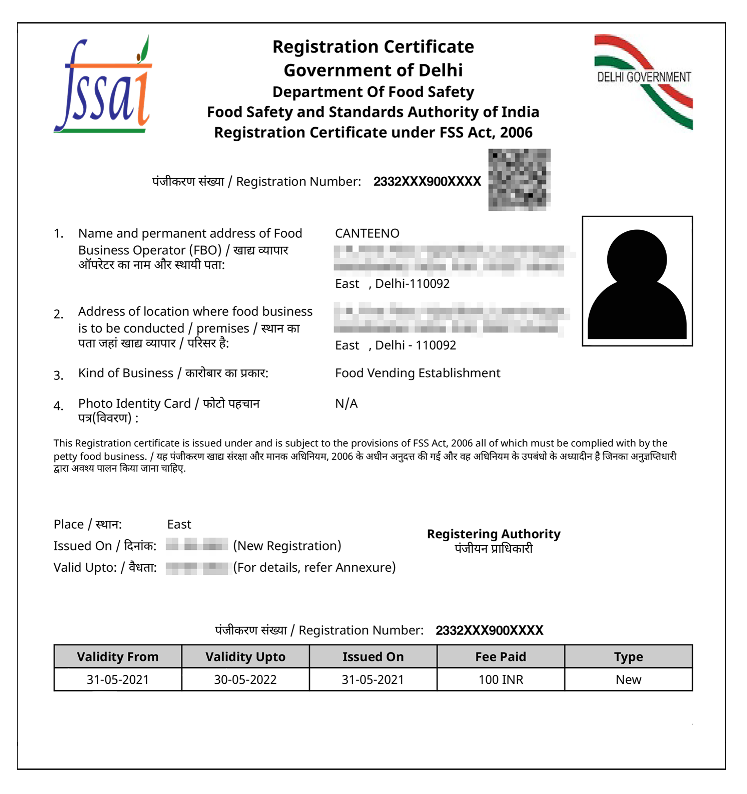

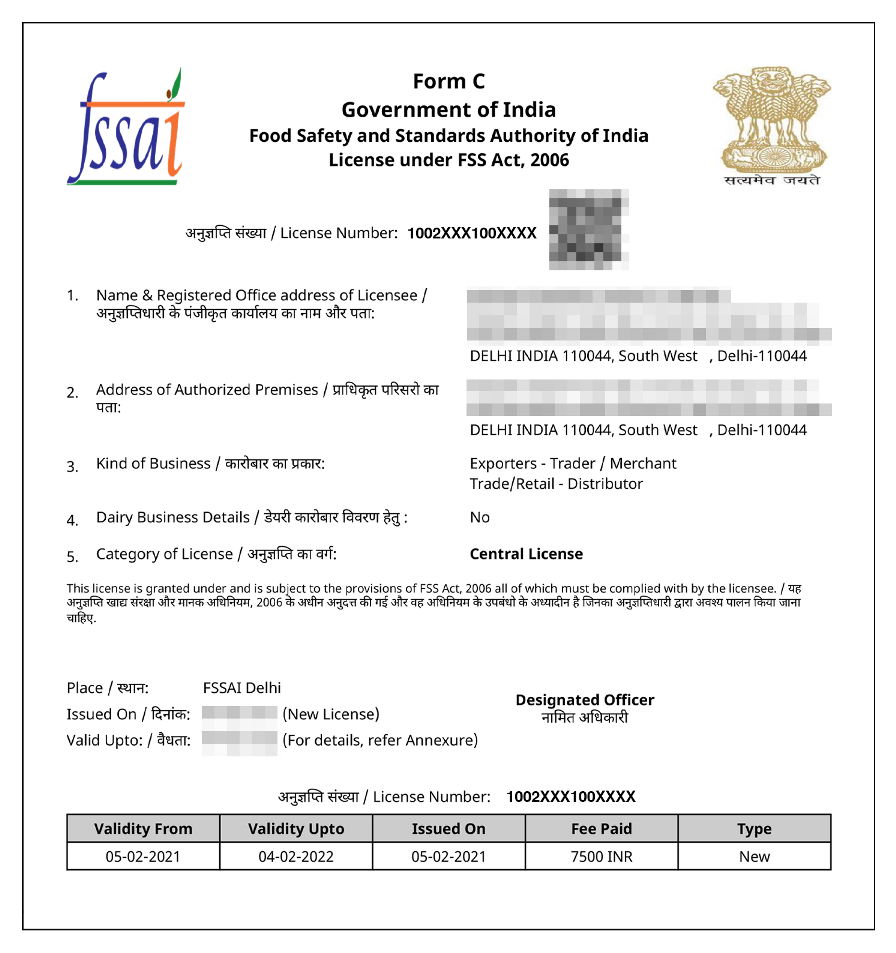

Every Food Business Operator must file periodic FSSAI returns depending on its type of business and the license category. Filing FSSAI returns is regulatory compliance according to clause 2.1.13 (1) of Food Safety and Standards Regulations.

You’ll get to know about FSSAI returns that are required to be filed depending on business activity and license category. It is important to note that if an FBO holds more than one FSSAI License, he must file separate returns for each license.

.png)

There are three types of FSSAI returns for food business operators:

Annual return is to be filed by food business operators involved in manufacturing, processing, relabellers, repackers and importers. It is filed within two months from the end of the previous financial year (1st April - 31st March). The due date for filing annual returns is 31st May.

A half-yearly return is filed by food business operators involved in manufacturing/ processing milk and milk products. It is filed for the periods - 1st April to 30th September and 1st October to 31st March. Half-yearly returns are required to be filed within one month from the end of the periods.

Quarterly return is to be filed by food business operators involved in exporting food products. It is filed quarterly during a financial year.

All FBOs holding State and Central Food License are eligible for filing FSSAI returns. Every business operator selling, importing, exporting, manufacturing, distributing, storing, handling/transporting any food product has to file an annual return. The food business involved in the distribution and manufacturing of milk has to file half yearly returns.

| Return Type | Eligibility | Due Date |

| Annual Return | FBOs involved in Manufacturing, Processing, Relabellers, Repackers and Importers | By 31st May (For Financial Year of the preceding year) |

| Half Yearly Return | FBOs involved in Manufacturing and Processing of Milk & Milk Products | To be filed within one month from the end of the periods - 1st April to 30th September and 1st October to 31st March |

| Quarterly Return | For Exporters | To be filed Quarterly |

FBOs which are not mentioned in the Eligibility Column of Annual Return are exempted from filing FSSAI Return.

Filing of periodic FSSAI returns by FBOs is regulatory compliance. Also, FBOs are required to maintain the record of submission of returns. An inadvertent lapse of non-submission or loss of submission proof renders FBOs liable for hefty penalties.

The provision of mandatory online submission of returns would facilitate the food business operators, ensure ease of doing business, and help create national-level databases.

As per clause 2.1.13 (1) of Food Safety and Standards (Licensing and Registration of Food Businesses) Regulations, 2011:

“Every manufacturer and importer who has been issued a license shall on or before 31st May of each year, submit a return electronically or in physical form as may be prescribed by the concerned Food Safety Commissioner, in ‘Form D-1’ provided in Schedule-2 of these Regulations to the Licensing Authority in respect of each class of food products handled by him during the previous financial year.

Provided however that every licensee engaged in manufacturing of milk and/or milk products shall file half yearly returns for the periods 1st April to 30th September and 1st October to 31st March of every financial year in the ‘Form D-2’ as provided in Schedule-2 of these regulations. Such returns will be filed within a month from the end of the period.”

FSSAI returns should be filed in the proper prescribed format within the due time.

These returns are required to be sent physically or by Email to Food Licensing Authorities. Annual FSSAI return must be filed in Form D-1 and Half Yearly FSSAI return must be filed in Form D-2.

This return can be filed online on FoSCos website. Eligible FBOs are required to fill proper details and file the returns online.

The fees for filing FSSAI return would be Rs. 1,999 Only per Return.

If the return is filed in the due time then Rs. 100/- per day shall be leviable on the food business operator from the expiry date of due time.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam