The Central Board of Indirect Taxes and Customs (CBIC) created the official online portal known as the Indian Customs Electronic Gateway (ICEGATE) to promote trade, electronic filing, and communication among importers, exporters, customs officials, and other interested parties. By providing services like online shipping bill filing, bill of entry submission, electronic customs duty payment, cargo tracking, refund status updates, and more, ICEGATE plays a crucial part in India's digital customs ecosystem.

Businesses engaged in import and export operations must complete ICEGATE registration in order to use these services. Through this registration, shipping lines, airlines, importers, exporters, and customs brokers can safely file paperwork and monitor clearances without physically visiting customs offices. To ensure seamless adherence to trade laws, ICEGATE also integrates with the Directorate General of Foreign Trade (DGFT) and several other government agencies.

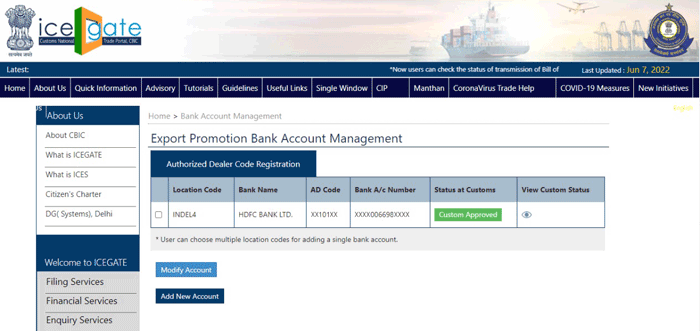

For smaller exporters and importers, there is Simplified Registration; for larger transaction volumes, there is Partnership Registration. After registering, users can enable duty payments and cargo clearance by linking their AD Code to particular ports.

AD Code Certificate [Sample]

Table of Content

Importers, exporters, customs brokers, and other stakeholders can conduct customs-related transactions online through the Indian Customs Electronic Gateway (ICEGATE), the Central Board of Indirect Taxes and Customs' (CBIC) official e-filing portal. Without physically visiting customs offices, users can use ICEGATE to track consignments, pay customs duties, file shipping bills, bills of entry, and access other trade-related services.

Businesses must complete ICEGATE registration to use these services. Secure login, document submission, and smooth communication with Indian Customs and related government agencies are all made possible by it. ICEGATE Portal is an essential component of India's digital trade facilitation system since it integrates with banks, DGFT, and other departments.

Explore the two primary types of ICEGATE registration, tailored for both small and large businesses, which streamline customs e-filing, simplify regulatory compliance, and facilitate smooth and efficient trade operations across import and export channels.

With the growing digitization of India’s customs system, ICEGATE registration offers multiple advantages to importers, exporters, and customs brokers by simplifying trade processes, reducing delays, and ensuring faster, more secure transactions.

Allows shipping bills, bills of entry, and e-Sanchit documents to be submitted online without going to customs offices.

Expedites import-export clearance by reducing paperwork and digitizing procedures.

Offers integrated banking channels for the safe and simple online payment of customs duties.

Enables users to monitor document approvals, challans, duty refunds, and consignment status.

For seamless trade compliance, it integrates with banks, SEZs, the RBI, DGFT, and other government organizations.

Uses electronic procedures to replace manual filing, saving time and money.

To complete ICEGATE registration, applicants must keep the following documents ready:

| Applicant Entity | Documents Required | Scanned Copy Format |

|---|---|---|

| Custom Broker/CHA(Individual) |

|

|

| Custom Broker/CHA(Firm) |

|

|

| Custom Broker/CHA(Individual(Employee) |

|

|

| IEC Authorized person |

|

|

| IEC holders |

|

|

| Airlines/Air Agents |

|

|

| Shipping Lines/Shipping Agents |

|

|

| Console Agents |

|

Note: One of the following Address proofs of the applicant Entity are considered valid for ICEGATE Registration.

The ICEGATE registration process is simple and fully online. Follow the steps below to complete your registration:

Visit www.icegate.gov.in, the official website.

Depending on the nature of your company, select between Partnership Registration and Simplified Registration.

Provide your IEC code, GSTIN, PAN, email address, and mobile number for validation.

Use the OTPs sent by ICEGATE to confirm your email address and mobile number.

Submit required documents including DSC (if applicable), PAN, GSTIN, and AD code letter.

Create a username and password for future logins.

ICEGATE verifies the information and supporting documents submitted.

Once approved, your ICEGATE account will be activated and confirmation sent via email or SMS.

The application fee for ICEGATE registration is ₹2,999/-, which is a one-time service charge paid by the exporter for completing the registration process. This fee is generally charged by service providers or consultants assisting with the registration. It is important to note that there is no government fee for ICEGATE registration.

Note: The aforementioned Fees is exclusive of GST

The Directorate General of Foreign Trade (DGFT) has issued guidelines for businesses to ensure a smooth ICEGATE registration process and compliance with trade regulations.

Each port's AD code registration can be completed online via the ICEGATE site. You must register your AD code at the port where you wish to import your goods. The thirteen major Indian ports are listed below.

| Port Location | ICEGATE AD code Registration | Port Code |

|---|---|---|

| Mumbai | Nhava Sheva Port registration | INNSA1 |

| Tamil Nadu | Ennore Port Registration | INENR1 |

| Gujarat | Kandla Port Registration | INIXY6 |

| Chennai | Chennai Port Registration | INMAA6 |

| West Bengal | Kolkata Port Registration | INCCU1 |

| Karnataka | New Mangalore Port Registration | INNML1 |

| Kerala | Cochin Port Registration | INCOK4 |

| Orissa | Paradip Port Registration | INPRT1 | Maharashtra | Mumbai Port Registration | INBOM6 |

| Andhra Pradesh | Visakhapatnam Port Registration | INVTZ6 |

| Tamil Nadu | Tuticorin Port Registration | INTNC6 |

| Andaman & Nicobar | Port Blair Port Registration | INIXZ1 |

| Goa | Mormugao Port registration | INMRM1 |

ICEGATE registration is an essential step for enterprises conducting import-export activity in India. It streamlines customs processes, improves compliance, and gives users access to the Indian Customs Department's extensive digital offerings. Businesses that register on ICEGATE benefit from faster documentation, less delays, and more smooth transactions. Whether you are a regular exporter or someone who is planning to start exporting, ICEGATE registration help in eliminating several steps and brings your organization in-line with the digital interface of India’s trade system. By working through this system, not only does productivity improve, but also the position on the global trading map becomes more powerful.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

ICEGATE (Indian Customs Electronic Gateway) is CBIC’s e-customs portal.

You can register in two ways:

ICEGATE stands for Indian Customs Electronic Gateway.

ICEGATE is registered in 2 ways.

CEGATE (Indian Customs Electronic Gateway) is the official online platform of the Central Board of Indirect Taxes and Customs (CBIC) for facilitating import-export customs clearance, duty payments, and document submission.