AD code is a unique 7-digit code assigned by the Reserve bank of India to every authorized branch of banks dealing in foreign currencies. AD code stands for Authorized Dealer’s code. It is a letter from the bank mentioning the Authorized Dealer’s code provided to each bank by the Reserve Bank of India.

The primary purpose behind AD code registration is to ensure that foreign currency transactions have been made from a legitimate source. Once the bank AD code is issued, you must register it with every port from where you plan to export goods. It is also called an AD code letter by the CHA(Customs House Agent).

AD Code Certificate [Sample]

Table of Content

On India's southeast coast, Tuticorin officially known as V.O. Chidambaranar Port is a well-known maritime hub. It makes it easier to import and export a variety of products, such as chemicals, textiles, seafood, and salt. It is imperative that importers and exporters using this port register their AD (Authorized Dealer) Code with the Customs office. The AD Code facilitates the seamless processing of shipping bills and foreign exchange remittances by connecting the exporter's bank with the ICEGATE portal. Tuticorin's port code, INTUT1, needs to be specified when registering for an AD Code. Exporters are unable to obtain government benefits such as duty drawbacks, GST refunds, and other export incentives without this registration.

Additionally, it guarantees accurate tracking and transparency of foreign exchange transactions through banks that have been approved by the RBI. At Tuticorin Port, prompt AD Code registration facilitates customs clearance, expedites documentation, and encourages effective international trade operations for companies.

The benefits of an AD code registration in Tuticorin Port are as follows:

Once you receive the AD code on the bank’s authorization letter, You need to register the AD code online on the ICEGATE portal for customs clearance. The following documents are required to proceed with the application:

Our team of professionals will assist you in preparing the documents for the application.

Here is the overview of the fee structure for AD Code Registration in Tuticorin Port:

The application fee for AD code registration at Tuticorin Port is ₹2,999/-. It is a one-time fee that has to be borne by the exporter.

There is no government fee for AD code registration.

Note :The aforementioned Fees is exclusive of GST.

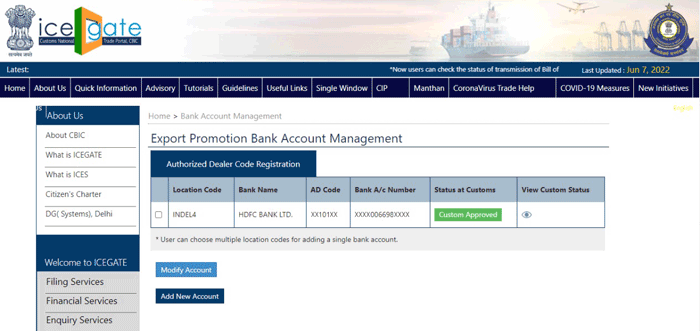

The process of AD code registration on Icegate is executed in 4 steps:

You can check if your AD code is registered on the Icegate portal or not by generating the shipping bill. Your AD code is registered with that port if the shipping bill is generated successfully.

AD code registration can be done online on the ICEGATE portal for each port separately. It is mandatory to register AD code on the port where you intend to import goods. The 13 major ports in India are listed below.

| Port Location | ICEGATE AD code Registration | Port Code |

|---|---|---|

| Mumbai | Nhava Sheva Port registration | INNSA1 |

| Tamil Nadu | Ennore Port Registration | INENR1 |

| Gujarat | Kandla Port Registration | INIXY6 |

| Chennai | Chennai Port Registration | INMAA6 |

| West Bengal | Kolkata Port Registration | INCCU1 |

| Karnataka | New Mangalore Port Registration | INNML1 |

| Kerala | Cochin Port Registration | INCOK4 |

| Orissa | Tuticorin Port Registration | INPRT1 |

| Maharashtra | Mumbai Port Registration | INBOM6 |

| Andhra Pradesh | Visakhapatnam Port Registration | INVTZ6 |

| Tamil Nadu | Tuticorin Port Registration | INTUT1 |

| Andaman & Nicobar | Port Blair Port Registration | INIXZ1 |

| Goa | Mormugao Port registration | INMRM1 |

Conclusion

AD Code Registration at Tuticorin Port is one of the most important mandatory regulatory requirements for businesses dealing with foreign exchange transactions in India. This 7-digit number serves as a unique identifier that ensures cross-border transactions are monitored in a transparent and traceable manner. Once a business submits and verifies the required documents, it can obtain the AD Code for smooth and hassle-free international operations within a regulated framework.

By obtaining an Authorized Dealer (AD) Code from an RBI-authorized bank, exporters and importers can efficiently carry out their operations at Tuticorin Port while staying fully compliant with customs and foreign exchange laws. To learn more about AD Code Registration at Tuticorin Port, consult Professional Utilities.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

The AD Code Registration connects your bank’s Authorized Dealer Code with Tuticorin Port on the ICEGATE portal. It is essential for generating shipping bills and for handling export/import shipments.

You require the AD Code letter issued by your bank, the IEC certificate, the GST certificate, the company PAN, a cancelled cheque, and identification proof of the authorized signatory.

If all documents are correct, registration usually takes 2–5 working days on the ICEGATE system.

Yes. Without AD Code registration, exporters cannot file shipping bills or complete customs clearance at Tuticorin Port.

Speak Directly to our Expert Today

Reliable

Affordable

Assured