Updated on August 21, 2025 11:51:15 AM

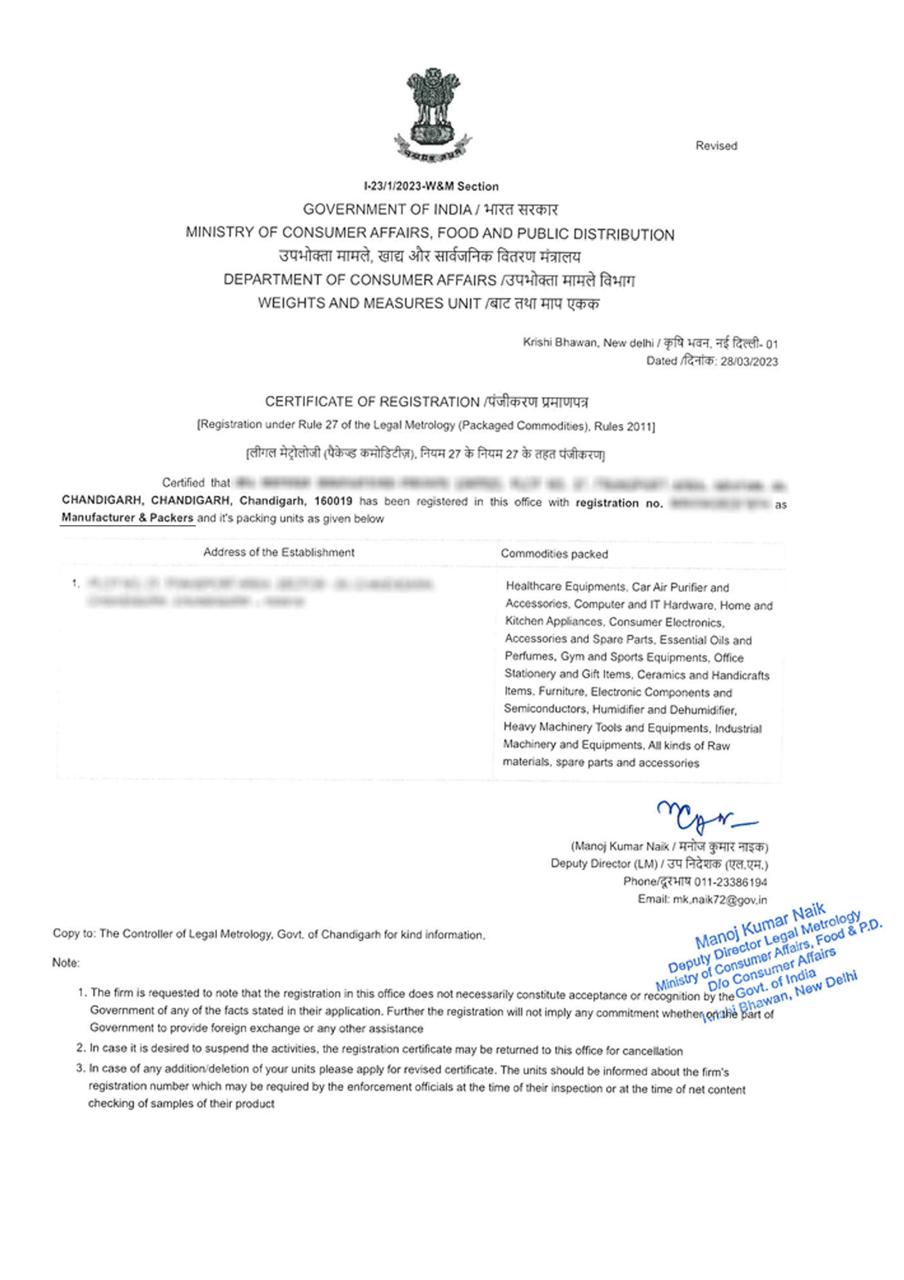

LMPC Certificate stands for Legal Metrology Packaged Commodity Certificate, is mandatory requirement for all pre-packaged goods, whether you are a manufacturer, repacker, or importer. It ensures that all packaged goods meet the LMPC rules under the Legal Metrology law. There are several mandatory labelling requirements that should be followed for pre-packaged goods in India like Products must have honest, readable labels in English or Hindi. Additional guidelines may apply for certain categories like food or electronics under FSSAI, BIS, or CDSCO.

LMPC Certificate for importer is a mandatory requirement for importing any pre-packaged goods in India. It ensures that labels have correct details like weight, price, importer & manufacturers details. It helps custom department to identify whether the product meets the Indian LMPC rules or not, non-compliance of above rules may lead to demurrages at custom ports as the shipment can be withheld by the custom officials.

LMPC registration certificate also acts as a trust among customer & helps in brand building to the company. To apply an LMPC Certificate online certain documents & details are required, such as Name & Date of Manufacture / Packing / Import, Weight of the goods, Maximum Retails Price (MRP), Generic Name of the Product, Country of Origin. (these details may vary depending upon industry type).

With experience in securing over 1,000 + LMPC Certificates, Professional Utilities ensures fast, reliable, and hassle-free registration for importers, Manufacturer & re-packers across PAN India.

Table of Content

The LMPC certificate for import is a certification that identifies commodities that have been packaged by a third party before they become commercially available. The packaging process can include everything from vacuum sealing and shrink wrapping to product development and shelf-life testing.

| Full form: | Legal Metrology Packaged Commodity |

|---|---|

| Mandatory For: | Importers of Prepackaged Goods. |

| Registration Fees: | ₹500 + Professional Fees |

| Validity: | 5 years |

The Department of Consumer Affairs grants an LMPC import license. When an importer applies for the LMPC registration, the Director of Legal Metrology will register the name and address of the importer in the legal metrology Database and grant the LMPC certificate for import.

A “pre-packaged commodity” is defined as any product that is placed in a package, whether sealed or not, before being bought, with assurance that the contents of the package will meet certain quality standards at the time of packaging with the buyer not required to oversee this process.

Pre-packaged Commodities that are covered under the Legal Metrology Packaged Commodities are:

| Tea and Coffee | Cooking oils |

| Milk and Detergent powders | Soft drinks and other non-alcoholic Beverages | Rice Flour, Wheat Flour, Suji, Rawa | Soaps |

| Paint, Varnish, Enamels | Cement in Bags |

| Biscuits, Bread, Baby food | Mineral Water and Drinking water |

Here is the complete list of documents required for LMPC certificate registration:

Know about how to apply for the lmpc certificate online in India.

To apply online for an LMPC import license, you must first submit an application form. The application form must be submitted to the Director of Metrology at your local government unit. You can find the Director of Metrology's contact information on the Metrology Council website.

If you are applying for an LMPC certificate, you will need to submit a copy of your business permit and a copy of your current license to operate as a merchant or store owner. You will also need to submit documents verifying that you have paid all city and provincial taxes in the past two years (if applicable), along with any other documents that the Director of Metrology may request.

Once you've submitted all required documents and paid the applicable fees, you can expect your LMPC certificate within 7-10 working days (depending on when your application is received).

Once you have submitted your application, it will be forwarded to the Director of Metrology for review. The director will then contact you via email to let you know if your application has been accepted or not. If accepted, you will be sent an approval call which will include more details about the course and how much it costs.

Note: In case of incomplete/incorrect details, the application will be returned to the applicant entity within 7 days of receiving it.

According to the Department of Consumer Affairs, you are not permitted to manufacture, market, sell, import, pack, or distribute pre-packaged goods without mentioning certain information on the outer package.

Following declarations must be made by the importers while registering for a Legal Metrology certificate. Importers who fail to declare the following are ineligible to apply for LMPC registration.

The total cost of LMPC Registration is ₹5,499, including a ₹500 government fee and ₹4,999 as professional fee. LMPC Certificate is granted after inspection by the registration authorities. It takes 7-10 days to complete the process.

Below mentioned LMPC Certificate fee for the Manufacturer, Importer, Packer

| Particulars | LMPC Certificate Fee |

|---|---|

| Government Fees | ₹500 |

| Professional fees | ₹4,999 |

| Total Cost | ₹5,499 |

| On Urgent Basis | ₹9,999 |

Note: The aforementioned Fees is exclusive of GST.

The benefits of obtaining an LMPC certificate for import are as follow:

The LMPC certificate is a document that certifies that you have completed the legal metrology course. It has been designed to enhance India's trade, finance, and export sectors. It makes it easier to import goods to India.

Proper accuracy in weights and measurements is crucial in promoting the welfare of customers. That way, the consumers are protected from the illegal practices of selling underweight products, and they actually get the same amount of product at that price as mentioned on the package.

The Legal Metrology Act is accountable for controlling any illegal or unethical trade practices. This act aims to ensure that all commercial transactions of packaged commodities are genuine.

Importer's license or LMPC license consists of all the information about the weights and properties of packaged goods. It saves tons of time during the customs clearance of packaged commodities. The LMPC certificate for import accelerates the customs process, avoids unnecessary delays, and saves from penalties. Thus saving importing time and expense.

Customers always seek to purchase products that meet the specifications mentioned on the package. Properly checking the weight and measurements of goods by a trusted authority creates a sense of customer satisfaction. That's why LMPC-certified vendors are trusted by their customers.

The validity period for an LMPC Certificate is a minimum of 1 year (12 months) to a maximum of 5 years (60 months). LMPC Renewal is required after every five years. The LMPC import license must be renewed before the expiry period to avoid hassle during customs clearance.

The following are not considered to be a legal compulsion for having an LMPC certificate for import:

The Legal Metrology Act, 2009, imposes strict penalties for non-compliance with measurement and weight regulations, as follows:

The LMPC registration process involves a tonne of statements and information to be included. It is advised to seek an expert to apply for an LMPC certificate to avoid the cancellation of registration.

Professional Utilities will help you get the LMPC certificate at a minimal cost and help you avoid the hassle during customs clearance. Follow the steps below:

Step 1:

Get in touch via call or contact form

Step 2:

Provide necessary documents

Step 3:

Get your LMPC certificate within 7 working days

Conclusion

To comply with the Legal Metrology Act, an LMPC Certificate must be obtained before importing pre-packaged products for distribution or sale. Importers have to submit their application within 90 days after commencing their import business. The process to get an LMPC Certificate include submitting an application form and the required documentation to the registering authorities. After verification, the LMPC Certificate is granted within 20 days. Failure to comply with the LMPC Certificate rules may lead to penalties like detention of imported products, fines, and legal actions, emphasizing its importance in ensuring smooth import operations.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Frequently Asked Questions

The government fee for an LMPC certificate is ₹500, and our professional fee for applying is ₹4,999, and the total cost will be ₹5,499. Upon filling the application and making the payment, the authorities will then conduct a physical examination of the business premises.

Essentially there are two types of LMPC Certificate:

he Department of Consumers Affairs is the governing body that issues the LMPC import license to the importers of pre-packaged commodities.

To obtain an LMPC (Legal Metrology Packaged Commodities) import certificate, importers must approach the concerned state or central authority, provide the necessary documents, pay a fee, and undergo inspection of their premises. The application must be made within 90 days of the start of the import.

The LMPC certificate is valid for 5 years. It is important to renew it before its expiration to prevent complications in customs clearance.

Importers of the pre-packaged goods mostly need the LMPC certificate at the customs.

Yes, an LMPC certificate is mandatory for importing pre-packaged goods into India. Without it, customs officials could detain or decline the consignment.

Legal Metrology Packaged Commodities Certificate (LMPC) signifies the packaging obligation of the pre-packaged commodity sold or distributed in India, also it is an obligatory requirement if you are ready to import pre-packaged products.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions