A private limited company is one of India's most popular and believed business entities; hence, it is ideal for budding startups, entrepreneurs, and growing businesses. Private limited company registration is done under the Companies Act, 2013, and controlled by the Ministry of Corporate Affairs (MCA). For the incorporation of a Pvt Ltd company in India, there shall be at least 2 directors and 2 shareholders. Among all the directors, at least one director shall be a resident of India. In a private limited company, the same person can hold the role of both director and shareholder.

Salient features of this business structure are that it provides limited liability protection, it has a separate legal identity, and it raises funds with easy access to investors. Limited liability is the biggest asset a Pvt Ltd Company has, wherein case of losses of the business, the personal assets of the directors and shareholders are absolutely shielded. The goodwill of a registered private limited company instills trust in clients, vendors, and financial institutions.

At Professional Utilities, we offer easy online Private Limited Company registration services in India at a very low cost. At Professional Utilities, we make sure that your Pvt Ltd Company Registration gets done completely online, as per MCA Guidelines. Whether you want to start a first business startup or want to add to your existing business, we make the legal procedure easy for you to start your business.

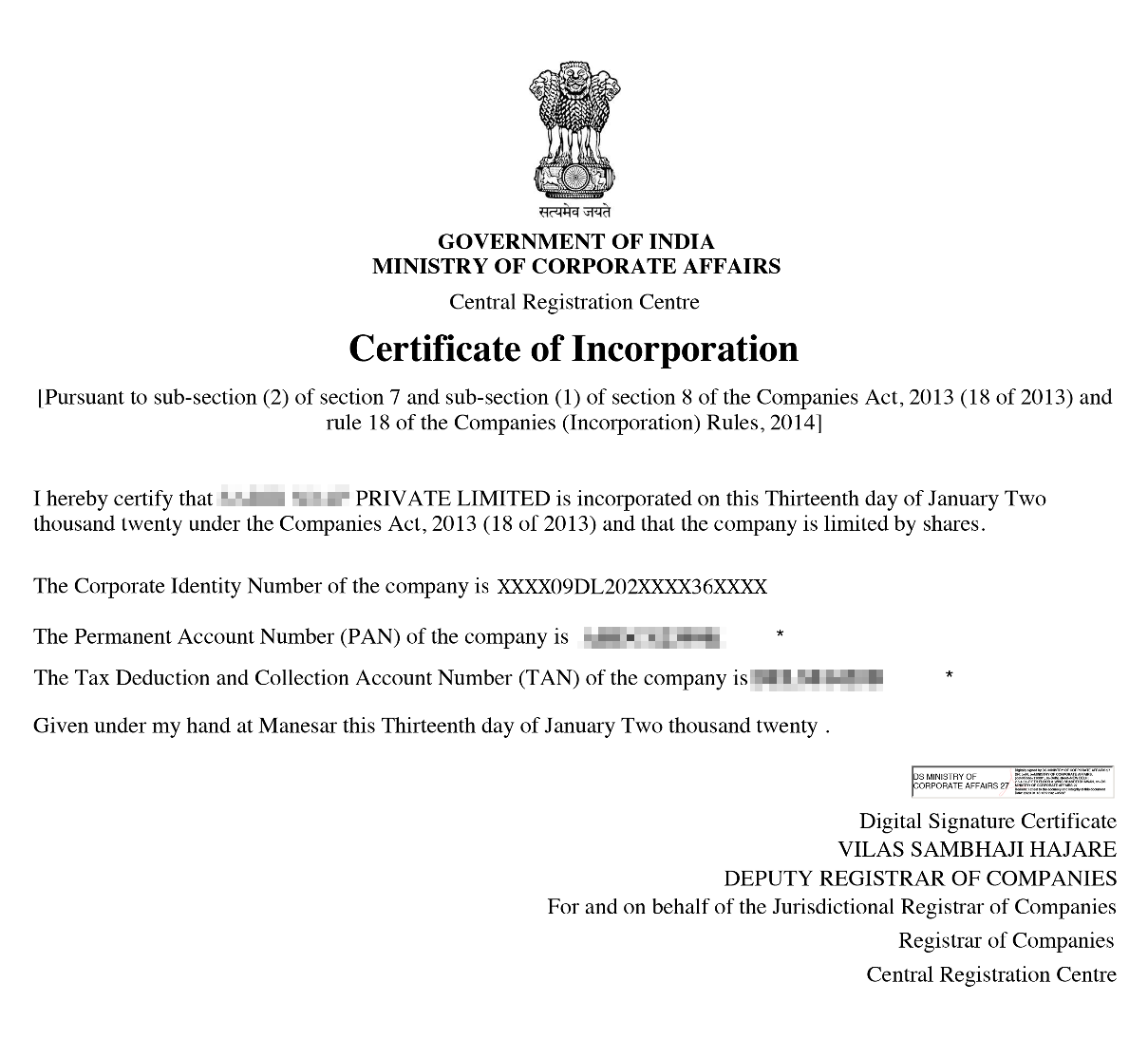

Private Limited Company - Incorporation Certificate [Sample]

Table of Content

A private limited company is the most popular form of business organization. In this, the ownership lies with the group of persons, and it offers limited liability protection. The personal rights of the shareholders are thus protected. Private limited companies are registered under the Ministry of Corporate Affairs, based on the Companies Act, 2013.

Private limited company registration requires a minimum of two members, with the maximum limit being two hundred. A Pvt Ltd company gives ownership to the shareholders, and management lies with the directors as KMPs. This is contrary to the LLP, where it has owners and managers both as partners.

Registering a private limited company offers the best option for startups or entrepreneurs because of advantages like tax benefits, increased business authenticity, easy access to funding, and simple loan approvals. It also enables the generation of capital through private funding, which is a great starting point for growth.

A Private Limited Company (Pvt. Ltd.) can also be formed in various ways, depending upon ownership and liability.

Registering a Private Limited Company provides key benefits that support business stability and expansion.

In Private Limited Company Registration in India, several legal requirements must be satisfied under the Companies Act of 2013 for proper legal registration.

As per the Companies Act, 2013, certain minimum requirements must be fulfilled to incorporate a Private Limited Company online in India.

Minimum 2 directors

Unique business name

At least one director should be the resident of India

Registered office address

The online private limited company registration in India requires the following steps:

The private limited company registration timeline in India can normally be completed in between 10-15 working days. However, this majorly depends upon the approval of the name of the company.

While the normal processing time would still be between 10-15 working days, there could be delays in case of incomplete files, resubmission of applications, or when there are large numbers of MCA applications.

In order to register your private limited company in India, you need to provide proper identity and address proof. These documents are required for directors and shareholders of the company which will be submitted to the Ministry of Corporate Affairs (MCA) portal.

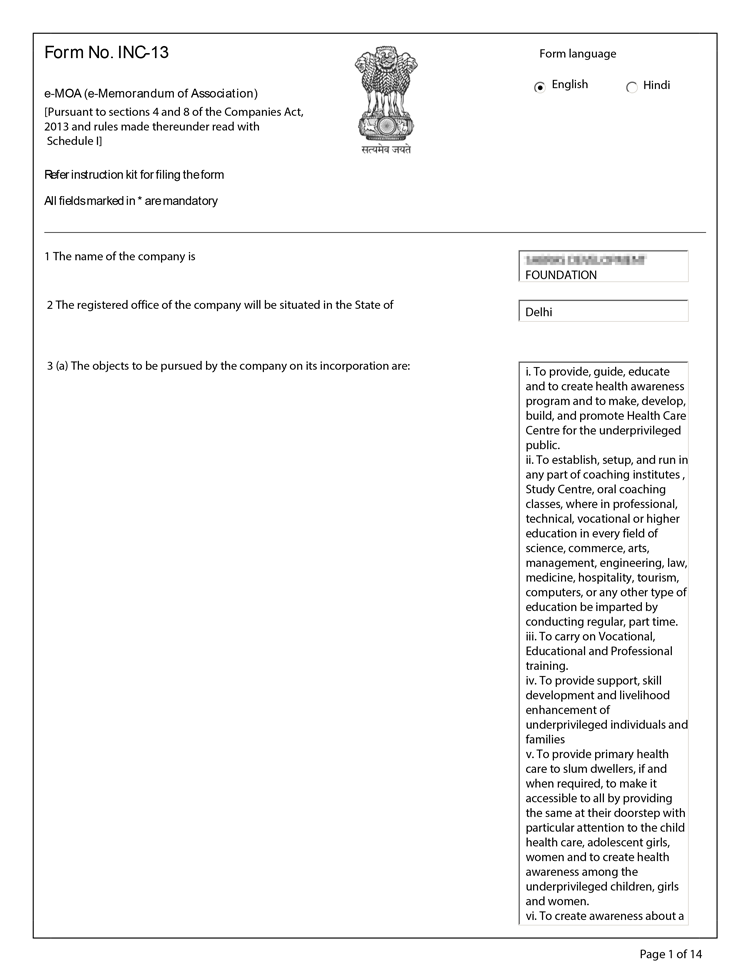

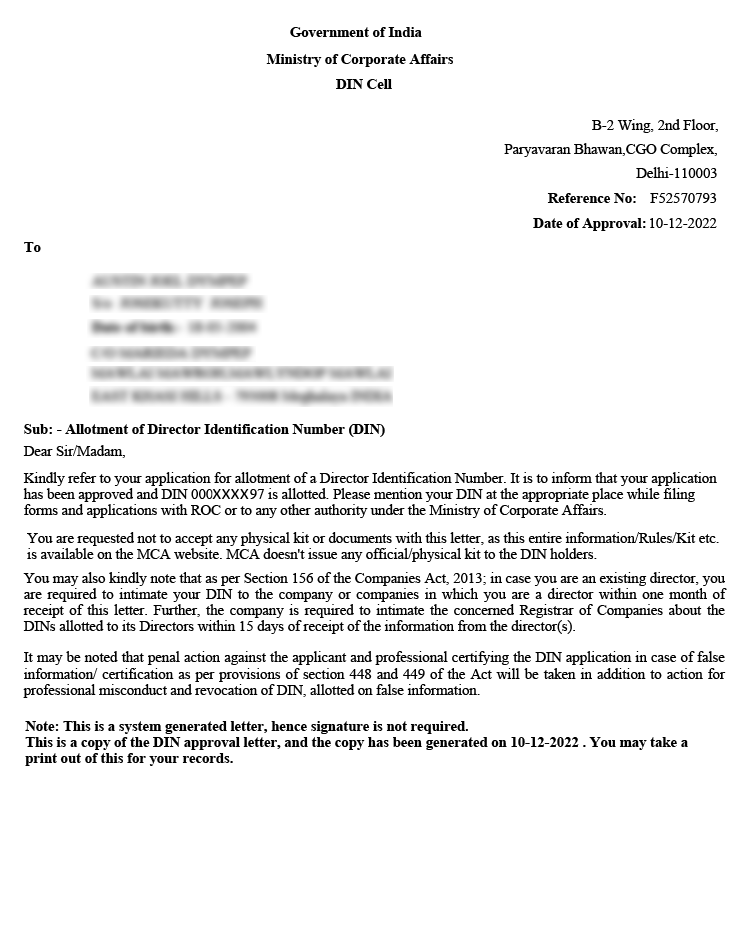

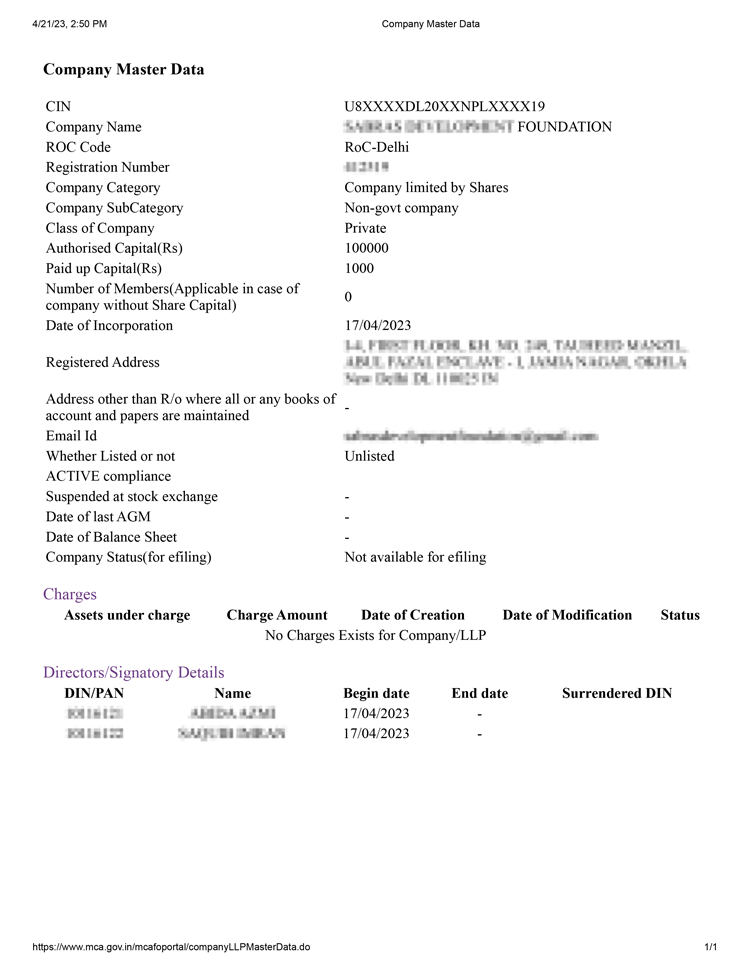

After successful registration of Private Limited Company with the Ministry of Corporate Affairs (MCA), your company receives a set of official incorporation documents that confirm its legal status and allow it to conduct business in India.

The main documents issued after it in India are:

Certificate of Incorporation Sample

Pan Card Sample Documents

Tan Sample Documents

AoA Certificate Sample Documents

.png)

MoA Certificate Sample Documents

DIN Certificate Sample Documents

DSC Sample Documents

Master data Sample Documents

The complete Pvt Ltd company registration fees in India is from ₹ 9,499. The time taken for Pvt Ltd company registration is 10–15 working days. .

| Steps | Fees (Rs.) |

|---|---|

| Digital Signature Certificate Fee | ₹3,000 |

| Government Fee(Stamp Duty) | ₹2,500 |

| Professional Fee | ₹3,999 |

| Total Cost | ₹9,499* |

Note: The aforementioned Fees is exclusive of GST.

Also Check - State wise Registration Fees of Pvt Ltd Company in India

Below are the key compliances required to remain legally active, penalty-free, and fully compliant:

The process of registering your company name as a Private Limited Company is complicated and involves various compliances. Our experts at Professional Utilities can simplify the whole registration process for you. Register your company online in 3 easy steps:

Step 1: Fill the Form

Get in

touch via call or contact form

Step 2: Submit Documents

Provide necessary

documents

Step 3: Get your IEC code

Get

your

incorporation

registered in 10-15 working days

Conclusion

The Private Limited Company (Pvt Ltd) is the most favorite form of business in India, providing limited liability, recognition, and immense growth opportunities. The registration of a private limited company can be an excellent way to increase business authenticity and personal risk security, as well as funding chances in the business setup.

It is possible to ensure compliance, tax advantages, and an organized business by registering an online private limited company. But it is always necessary to make timely filings with the ROC, returns, and taxes.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

The Tax rate for Private Limited Company with a turnover of less than ₹400 crore is as follows: companies with a turnover up to ₹1 crore are taxed at 25%, those with a turnover between ₹1 crore and ₹10 crore are taxed at 25% on profits exceeding ₹25 lakh plus an additional ₹25 lakh, and companies with a turnover above ₹10 crore are taxed at 30%. These tax rates are applicable to both domestic Private Limited and Public Limited Companies as per the Income Tax Act.

You can easily register your private limited company by arranging all the required documents and fulfilling the requirements as per the Companies Act, 2013.

No, GST is not mandatory for private limited companies.

There is no minimum capital requirement for private limited company registration. One can start a company with a share capital of as low as ₹10.

No, it is not compulsory to furnish a business plan for company registration; however, it can aid in planning, fund acquisition, and pitching the business to investors or partners.

The Certificate of Incorporation (COI) issued by the ROC is a valid document for a lifetime, which does not require a renewal, but yearly compliance is mandatory to keep the company alive.

Yes, a salaried person can become a director as long as he/she confirms with his/her employment document that there are no conflicts or ban.

Yes, you can change your company’s name by passing a board resolution and applying for name change approval through the MCA.