Updated on October 24, 2025 11:40:27 AM

A Section 8 Company is a non-profit company under the Companies Act, 2013, to encourage charity, education, social welfare, or religion. Although such companies are not working for profit, they can still be required to be registered under GST if they provide taxable services as part of their activities or if their income exceeds a specific level.

According to GST regulations, a Section 8 Company needs to register under GST if its turnover is more than ₹20 lakh (or ₹10 lakh in special category states) per annum. Moreover, if the company has interstate business or provides services such as training, consultancy, or chargeable events, it can be mandated to obtain GST registration.

Although not mandatorily required, a Section 8 Company can even opt to register under GST voluntarily. This provides numerous advantages, such as input tax credit, greater transparency, and simplified partnerships with corporations or government organizations. Upon registration, the company receives a GSTIN (GST Identification Number), which is utilized for gst return filing and remaining law-abiding.

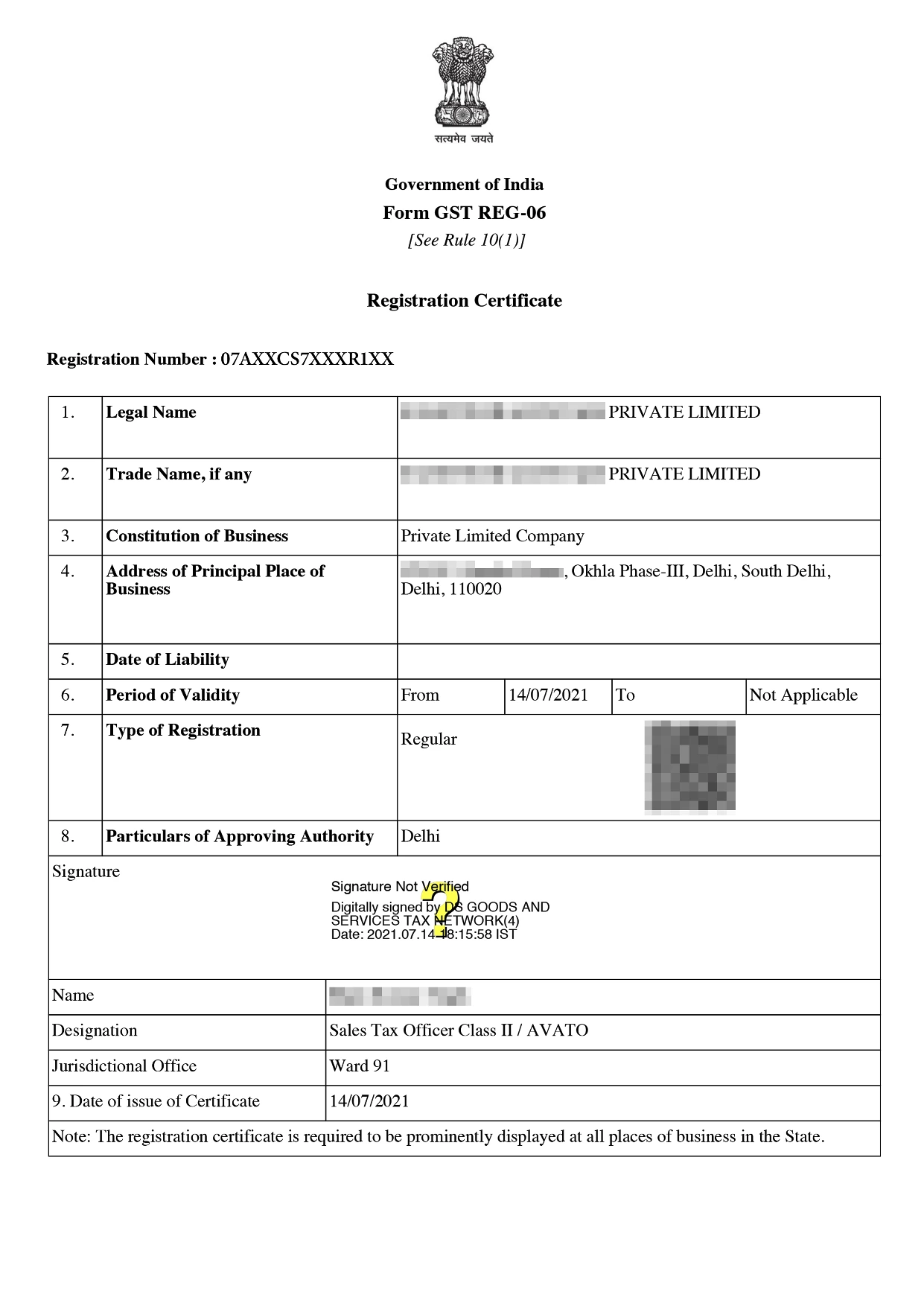

Online GST Registration Sample

Table of Content

The GST Registration of a Section 8 Company is a method of registering a nonprofit company under the Goods and Services Tax (GST) order in India. A Section 8 Company is formed under the Companies Act, 2013, to promote educational, charitable, religious, or other nonprofit objectives. While such companies are not established for profit-making, GST Registration Required for Section 8 Company still applies if their services come under taxable services or involve supplying goods.

Once registered, the company is granted a GSTIN (Goods and Services Tax Identification Number) to use in tax returns and compliance. GST registration also allows the company to recover Input Tax Credit (ITC) on goods and services consumed in its business.

Though Section 8 Companies are formed for non-profit purposes, GST registration offers several strategic and operational benefits that help them function more effectively and professionally:

To successfully register a Section 8 Company under GST, the following documents are required to validate identity, address, legal existence, and financial details:

| Document Type | Purpose/Details |

|---|---|

| PAN Card of the Company | Mandatory for GST registration and tax identification. |

| Certificate of Incorporation | Issued by the Ministry of Corporate Affairs (MCA) to confirm legal registration. |

| MOA & AOA (Memorandum and Articles of Association) | Outlines the objectives and rules of the company. |

| PAN & Aadhaar of Authorized Signatory | Identity and address proof of the person filing for GST on behalf of the company. |

| Photograph of Authorized Signatory | Recent passport-size photograph. |

| Board Resolution/Letter of Authorization | Authorization for the signatory to act on behalf of the company. |

| Registered Office Address Proof | The latest electricity bill, rent agreement, or NOC from the property owner. |

| Bank Account Proof | A cancelled cheque or bank statement/passbook showing the company’s name and details. |

| Email ID and Mobile Number | For communication and OTP verification during registration. |

| Digital Signature Certificate (DSC) | Required for applying online by a company. |

The GST registration process for a Section 8 Company is completely online and can be completed through the official GST portal. Here’s a comprehensive step-by-step guide to help you through the process:

GST registration for a Section 8 Company is an important but detailed process. If you choose to do it yourself on the GST portal, there are no government fees. However, if you want to save time and avoid hassle, you can go for Professional Utilities' expert service. They help you with the complete registration process for just ₹1499, making it quick and easy.

| Particulars | GST Registration Fees (INR) |

|---|---|

| Government Fees | ₹0 (No charges for self-registration under GST law) |

| Professional Fees | ₹1499 (charged by Professional Utilities for expert assistance) |

Conclusion

GST registration is a must for Section 8 Companies dealing in taxable business or operating across states. Though such companies are incorporated for non-profit or charitable activities, adherence to tax rules makes the entity legally transparent, enhances credibility, and provides access to funding and collaboration.

With GST registration, Section 8 Companies get the benefit of input tax credit, free movement across states without any hindrances and are eligible to apply for government tenders and CSR initiatives. It also adds to professionalism in their financial dealings and instills faith among stakeholders.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

Yes, if turnover is more than ₹20 lakh (or ₹10 lakh in special category states) or if there is interstate supply.

Yes, voluntary registration can be availed and assists with compliance, input tax credit, and credibility.

Companies established under the Companies Act for non-profit or charitable purposes with the intention of advancing social or philanthropic endeavors are referred to in Section 8.

Yes, a Section 8 company can obtain GST registration if it carries out taxable goods or services, even while operating as a non-profit.

The Section 8 companies are usually not subject to income tax on donation and charity activities, but the GST is obligatory on the taxable business activities.

PAN, certificate of incorporation, MOA/AOA, DSC, proof of address, and bank statements are required.

A tax audit is required only if the company’s turnover exceeds the threshold limit set under the Income Tax Act.

GST registration provides legal compliance, the ability to claim input tax credit, enhanced credibility, and easier business transactions for the organization.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions