The private limited company obtains the certificate of incorporation from the Ministry of Corporate Affairs after the successful registration process with the government, as part of the broader framework of private limited company registration requirements. Once the company name is registered with the government, the name can only be removed after the private limited company closure process of strike off, winding up, or liquidation is initiated as applicable to the company. The voluntary process to remove the name of the company from the register can also be automatically triggered if the company does not carry on the business or cannot submit the annual returns or statutory compliance. In these situations, the registrar of the companies can suo moto remove the name of the company through the official notice, resulting in private limited company dissolution.

The striking off of the names of the companies from the Register of Companies is provided under Sections 248 to 252 of the Companies Act, 2013, and the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016. These sections altogether describe the private limited company winding up, and liquidation process in India, explaining how to close private limited company in India legally.

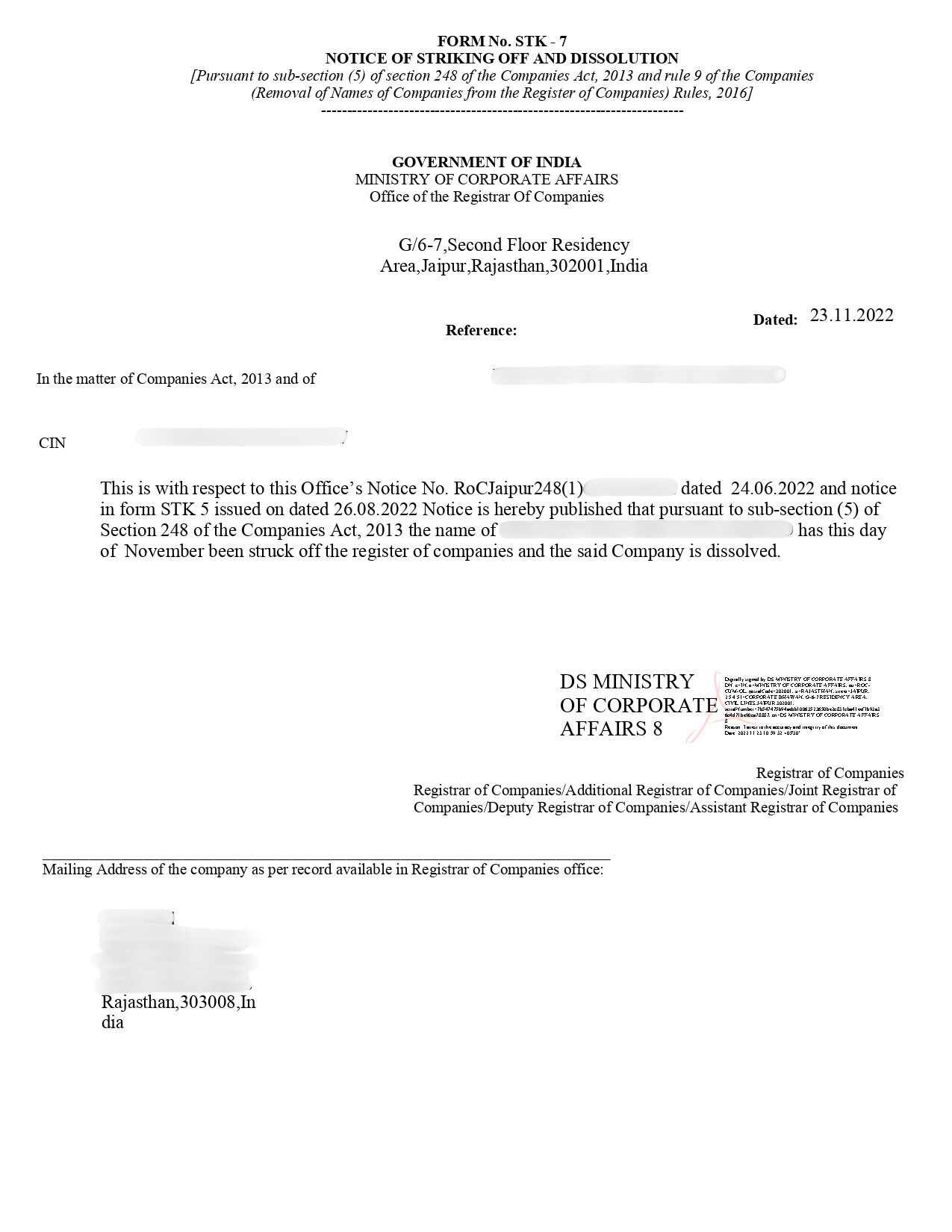

PVT LTD Company Closure Certificate [Sample]

Closure of a private limited company means the legal shutting down of its business operations involving satisfaction of liabilities and debts, distribution of remaining assets, and removal of the company's name from the registry with the MCA. This private limited company closure may be carried out under conditions of the firm's financial position, compliance level, and business goals, either by way of voluntary private limited company strike off, formal winding up, or liquidation. Normally, companies undertake strike-off when operations cannot be continued, are suffering from protracted inability to generate surpluses, strategic restructuring of the organization, or merger with another organization.

A private limited company's closure follows a structured legal course of action in which every step is defined to ascertain the statutory compliances for its closure. It mainly involves conducting meetings of the shareholders, if necessary, followed by an appointment of a liquidator, identification and settlement of outstanding liabilities, distribution of surplus assets amongst the shareholders, and filing of the closure forms defined under the said rules with the MCA. The verification of the same by the MCA issues a certificate of closure, which officially completes the private limited company dissolution and removes its name from the register.

In private limited companies, there are three established ways of closing down the business under the Company’s Act of 2013 as part of the pvt ltd company closure process. They include private limited company strike off, voluntary winding-up, and compulsory winding-up methods of closure based on the operations of the firm.

Strike off is applicable in the case of a solvent company that decides to close down the business on the basis of restructuring, decision-oriented reasons, or reasonable grounds. Shareholders give their approval to the private limited company winding up and appoint the liquidator.

Voluntary winding up is applicable in the case of a solvent company that decides to close down the business on the basis of restructuring, decision-oriented reasons, or reasonable grounds. Shareholders give their approval to the winding up of the company and appoint the liquidator.

The process of compulsorily winding up a company is ordered by the National Company Law Tribunal (NCLT) on grounds of insolvency, fraud, and serious non-compliance, leading to final private limited company dissolution.

The key advantages for dissolving a private limited company through a proper private limited company closure are:

Organizations with multi-state operations may also review procedural aspects similar to those applicable to private limited company in Maharashtra where relevant.

The private limited company closure process for winding up or liquidation is formalized in such a manner that everything is followed in compliance with the requirements.

The papers needed for closure, strike-off, or winding up a private limited company are:

The total cost of private limited company closure is ₹ 24999 which includes government fee and professional filing fee of Professional Utilities.

| Private limited company closure | Fees |

|---|---|

| Government Fee | ₹10500 |

| Professional Fee | ₹14499 |

| Total Fee | ₹24999 |

Note: The aformentioned Fees is exclusive of GST.

Note: For the purpose of company closure a professional fee is charged by the company secretary, and an additional fee for Documents Processing and auditing(Notary and Stamp Paper).

There are several possible reasons due to which a private limited company might decide to close, strike off, wind up, or liquidate. These are classified as follows:

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Conclusion

In conclusion, private limited company closure in India, whether through private limited company strike off, liquidation, or the private limited company winding up process, is a formal and compliance-oriented procedure. Each process has different legal effects, comparable in complexity to an LLP company closure or liquidation of an LLP company, and clearly explains how to close private limited company in India.

The two major ways of closure are voluntary and compulsory winding-up. While in voluntary winding-up, it is carried out by shareholders or by the company's directors, in compulsory winding-up, it is ordered by a court. In both cases, it leads to private limited company dissolution and deletion of the company's name from the registry.

Consult Professional Utilities for expert private limited company closure services, liquidation, or striking off, and get professional advice on closing your company smoothly and penalty-free.

For proper guidance and advice on pvt ltd company closure, consult experts at Professional Utilities.

Frequently Asked Questions

To register a Private Limited Company in Meghalaya, applicants need ID proof, address proof, PAN, photographs, utility bills, NOC from the property owner, and draft of MoA & AoA. In the middle of this process, Private Limited Company Registration in Meghalaya ensures proper documentation and smooth submission for faster approval.

Starting an agritech company in India offers significant opportunities due to the large agricultural sector, increasing use of digital technologies in farming, government support for agri-innovations, and rising demand for smart solutions in crop management, supply chain, and agribusiness.

The costs of closing down a private limited company will vary depending on the company's size and complexity. However, the cost of private limited company closure is ₹21,999 with Professional Utilities.

Speak Directly to our Expert Today

Reliable

Affordable

Assured