A closure of Section 8 company in India can be made by surrendering the license issued by the MCA to run the nonprofit organization. The section 8 company closure process involves striking off or surrendering the license granted to operate as a non-profit entity. The license to run the Section 8 company can be struck off by converting the company into other types of companies, such as private and public companies. However, there exist complexities in the section 8 company winding up, liquidation, or closure process. These types of companies cannot wind down their operations directly. A Section 8 company generally requires converting the company into a normal company before proceeding with the section 8 company strike off. Then the license is to be surrendered to the concerned government authority. Several complexities exist that need to be taken care of at the time of closure of Section 8 company.

Section 8 companies that have been formed under the Companies Act of 2013 are deemed to be non-profitmaking in nature and are social and charitable in their objectives. Although such companies have immense use in dealing with social issues and in protecting public welfare, in certain instances it may be required that such companies wind up or liquidate their affairs through section 8 company winding up in India.

Check out this page to learn more about how to close Section 8 company, including the procedure, documents, costs, and formalities associated with section 8 company strike off, liquidation, or section 8 company closure online.

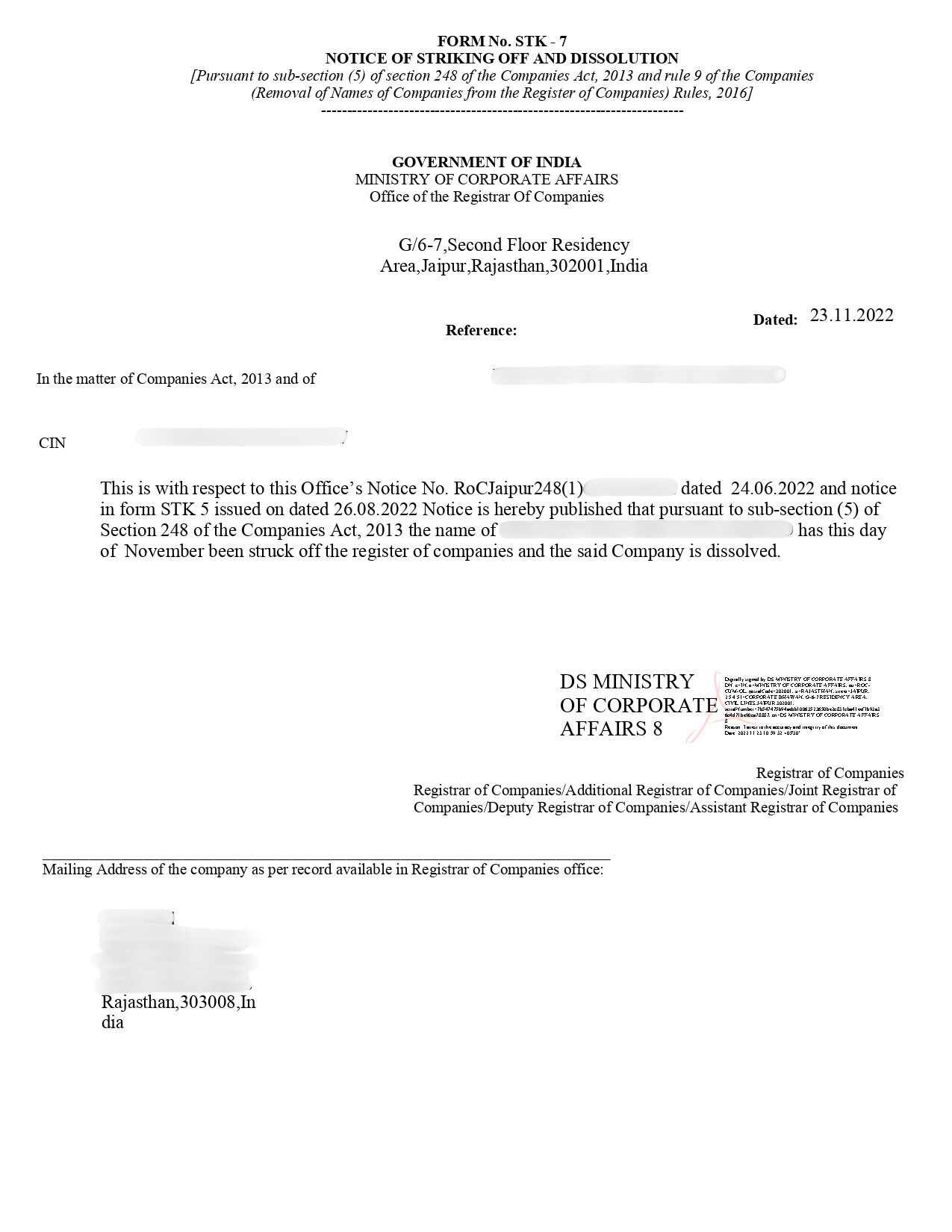

Section 8 Company Closure Certificate [Sample]

The closure of Section 8 company involves the legal process of striking off, liquidation, and subsequently the section 8 company winding up. It entails stopping all functions, settling the liabilities and debts, and realizing the assets, as well as the eventual surrender of the registration and the license provided by the MCA. The liquidation of the Section 8 Company might be necessary because the organization faces limitations of finances and fails to offer the charitable aim, as well as due to restructuring and merger of the organization with another one, ultimately leading to section 8 company closure in India.

The section 8 company winding up is done following an official procedure, which involves holding a general meeting, appointment of a liquidator, liquidation of creditors’ claims, disposal of remaining properties, as well as submission of the section 8 company closure online application to the MCA. Once the verification is done, the closure certificate is received, which completes the section 8 company strike off process from the register.

The main advantages of striking off, liquidation, and winding up of Section 8 Companies are:

The steps that are followed in the closing, strike-off, or section 8 company winding up process are as follows:

Here is the list of documents required for closure of section 8 Company are:

The total cost of Section 8 company closure is ₹ 21,999 which includes government fee and professional filing fee of Professional Utilities.

| Section 8 Company Closure | Fees |

|---|---|

| Government Fee | ₹10,000 |

| Professional Fee | ₹11,999 |

| Total Fee | ₹21,999 |

The company secretary charges a professional fee for the purpose of closure of the company, with additional charges for documents processing and auditing (Notary and Stamp Paper).

The following are the results of the section 8 company strike off, liquidation, or winding up as per the Companies Act, 2013:

A Section 8 company may close or strike off for any one of several reasons. The various reasons can be grouped into three broad categories:

Conclusion

The closure of Section 8 company is a momentous legal issue that entails compliance law, financial laws, as well as societal values. This might occur through Section 8 Company winding up, liquidations, or Section 8 company strike off. When considering a step-by-step procedure for how to close Section 8 company, it is always prudent to seek professionals. To do Section 8 company closure online, please contact Professional Utilities.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

The detailed procedure of closure of a section 8 company involves various steps such as Convening a general meeting, Appointing a liquidator, Settle debts and liabilities, Distribute assets, File closure application, Obtain section 8 company closure certificate.

The documents required for closure of section 8 company are Certificate of Incorporation, Memorandum of Association (MOA), Articles of Association (AOA), Last audited Balance sheet and profit & loss account, Audit report, Copy of newspaper advertisement, Digital Signature Certificate (DSC) of existing directors, Copy of notice sent to the members for calling an extraordinary general meeting (EGM), Copy of special resolution (SR) approving winding up, Copy of list of creditors, Copy of an explanatory statement, Copy of advertisement in the format of INC-19.

Starting an electric bike manufacturing company in India is important to meet rising demand for eco-friendly mobility, benefit from government incentives, and support sustainable transportation while building a future-ready business.

Closing a Section 8 Company involves settling liabilities, filing necessary forms with the MCA, and obtaining official approval for dissolution. For detailed step-by-step guidance, visit Closure of Section 8 Company.

Speak Directly to our Expert Today

Reliable

Affordable

Assured