Updated on July 23, 2025 03:19:15 PM

Nidhi Company is a non-banking financial company (NBFC). It was established to borrow and lend money to its members. It promotes the habit of saving among its members and operates based on mutual benefit. These companies are mainly found in the south of the country. Nidhi Company does not necessarily obtain a license from the Reserve Bank of India (RBI), hence it is simple to establish. It is a public company with "Nidhi Limited" as the last word in its name.

>Nidhi Companies have a specific role in the Indian financial setting, primarily promoting savings among their members. These companies are unique in that they only take deposits from and lend to members.

If you want to register a Nidhi Company in India and need help,contact Professional Utilities. We can guide you through the Nidhi registration procedure and verify that your Nidhi Company conforms with all applicable rules. Begin your journey towards starting a Nidhi Company today!

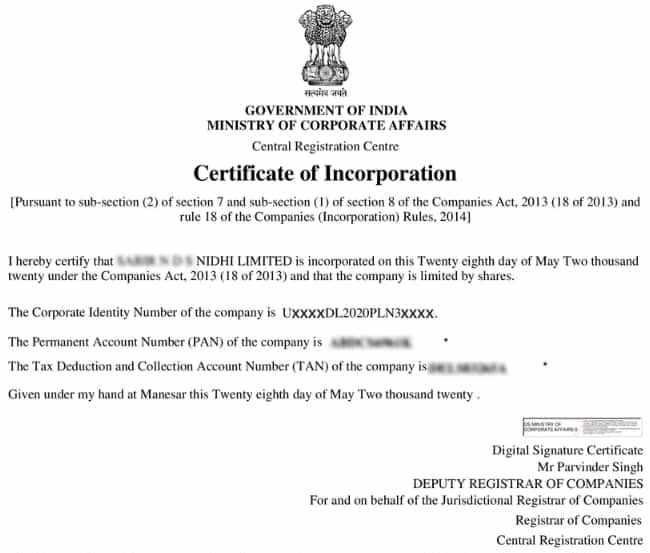

Nidhi Company - Incorporation Certificate [Sample]

Table of Content

A Nidhi Company is primarily concerned with handling deposits and offering loans to its members, who are also stockholders. The primary goal of a Nidhi Company is to encourage thrift and savings among its members while providing financial aid through lending.

Nidhi Companies in India have specific exemptions and relaxed laws regarding annual compliance obligations and tax assessments, making them an individual financial organization built to benefit all of its members. Nidhi Companies are categorized as non-banking financial companies (NBFCs). While they are not directly regulated by the Reserve Bank of India (RBI), the RBI has the authority to issue guidelines governing their deposit acceptance activities.

Law governing Nidhi Company in India

In India, NIDHI companies are controlled under Section 406 of the Companies Act, 2013, and the Companies (Nidhi Companies) Rules, 2014. These laws establish the foundation for NIDHI enterprises' formation, regulation, and management. Chapter XXVI of the Companies Rules, 2014, specifies extra restrictions for their operations

Registering a corporation as a Nidhi in India provides a number of benefits that extend beyond its primary objective of encouraging savings among members. Here are some aspects pointing out the Nidhi company benefits:

Nidhi company registration is a complete digital process and therefore requirement of Digital Signature Certificate is a mandatory criteria. Directors as well as subscribers to the memorandum of the company need to apply for a DSC from the certified agencies. Obtaining a DSC is a complete online process and it can be done within 24 hours. This process involves 3 simple verifications that are document verification, video verification and phone verification.

Name application for Nidhi Company can be done through SPICe RUN form which is a part of SPICe+ form. While making the name application of the company, industrial activity code as well as object clause of the company has to be defined.

Note: It should be ensured that business name does not resemble the name of any other already registered company and also does not violate the provisions of emblems and names (Prevention of Improper Use Act, 1950). You can easily check the name availability by using our company name search tool to verify the same.

Post name approval, details with respect to registration of the company has to be drafted in the SPICe+ form. It is a simplified proforma for incorporating a company electronically. The details in the form are as follows:

SPICe e-MoA and e-AoA are the linked forms which have to be drafted at the time of application for company registration.

Memorandum of Association (MOA) is defined under section 2(56) of the Companies Act 2013. It is the foundation on which the company is built. It defines the constitution, powers and objects of the company.

The Articles of Association (AOA) is defined under section 2(5) of the Companies Act. It details all the rules and regulations relating to the management of the company.

Post approval of the above mentioned documents from the Ministry of Corporate Affairs; PAN, TAN & Certificate of Incorporation will be issued from the concerned department. Now, the company is required to open a current bank account by using these documents. You can contact us for assistance with your current bank account opening.

.png)

The total cost of Nidhi Company registration in India, including government and professional fees, starts from ₹20,199 and takes around 14-21 working days.

| Steps | Cost (Rs.) |

|---|---|

| Digital Signature Certificate | ₹10,500 |

| DIN Allocation | ₹1,000 |

| Government Fee | ₹1,700 |

| Professional Fee | ₹6,999 |

| Total Cost | ₹20,199* |

Important Note: The total incorporation fees of a Nidhi Company varies from state to state. The DSC charges are for 7 members. Refer to the map for state-wise prices.

To register a Nidhi Company in India, certain minimum requirements must be met, ensuring compliance with legal and financial regulations.

To register a Nidhi Company in India, you must provide the following important documents:

Post incorporation of Nidhi company, you’ll receive the following documents:

To register a Nidhi Company in India, certain minimum requirements must be met, ensuring compliance with legal and financial regulations.

The process of registering a Nidhi Company is complicated and involves various compliances. Our experts at Professional Utilities can simplify the whole registration process for you. Register your Nidhi company online in 3 easy steps:

Step 1:

Get in touch via call or contact form

Step 2:

Provide necessary documents

Step 3:

Get your incorporation registered in 14-21 working days

On average, it takes around 14-21 working days to register a Nidhi company in India subject to document verification by the Ministry of Corporate Affairs (MCA).

As Nidhi companies are involved in a non-banking financial transaction, they are prohibited from performing the following activities:

Conclusion

A Nidhi company is a type of non-banking financial company (NBFC) in India that encourages savings and provides easy access to loans. Nidhi companies promote financial discipline and provide affordable financial services to their members, supporting economic growth and financial stability in their communities, based on mutual benefit principles.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

One can start a Nidhi company in India by providing necessary documents and fulfilling the requirements of a Public Limited Company registration as per the Companies Act, 2013.

The Ministry of Corporate Affairs regulates a Nidhi company.

One can start a Nidhi company in India by providing necessary documents and fulfilling the requirements of a Public Limited Company registration as per the Companies Act, 2013.

Yes, Nidhi Company is a type of Non-Banking Financial Company (NBFC). It is also known as Mutual Benefit Finance Company.

Yes, a Nidhi company can be profitable but the sole purpose is to borrow and lend money to its members only.

No, it cannot give a vehicle loan as it is restricted for Nidhi companies to lend any type of loan.

Yes, a Nidhi company can take a loan from the bank.

No, it cannot give unsecured loans. Nidhi company is strictly forbidden from giving any loans but it can give secured loans to a certain amount only.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions

Other Company Registration by Professional Utilities