GST is one tax levied on the supply of goods and services throughout India. A Partnership Firm, registered or unregistered, is required to obtain GST Registration if it fulfills certain criteria. If the turnover of the firm exceeds ₹20 lakh (or ₹10 lakh in special category states), or if it has interstate trade, online business, or offers taxable services, GST registration is obligatory.

Even if the income crosses the threshold, most partnership firms opt to register voluntarily under GST. This enables them to avail input tax credit, grow their business, and remain compliant with vendors and government agencies. On registration, the firm is allotted a GSTIN (GST Identification Number). This should be printed on all bills and utilized for filing GST returns.

Registration under GST assists partnership businesses in streamlining their tax system, availing tax credits for purchases, and establishing trust with customers and partners. It also comes in handy when applying for loans, participating in government tenders, or listing on e-commerce websites. In general, GST registration enhances smoother business functioning and improved fiscal management.

In short, GST registration is not merely a compliance requirement for partnership firms—it's a strategic move toward professionalism, transparency, and sustainable business growth.

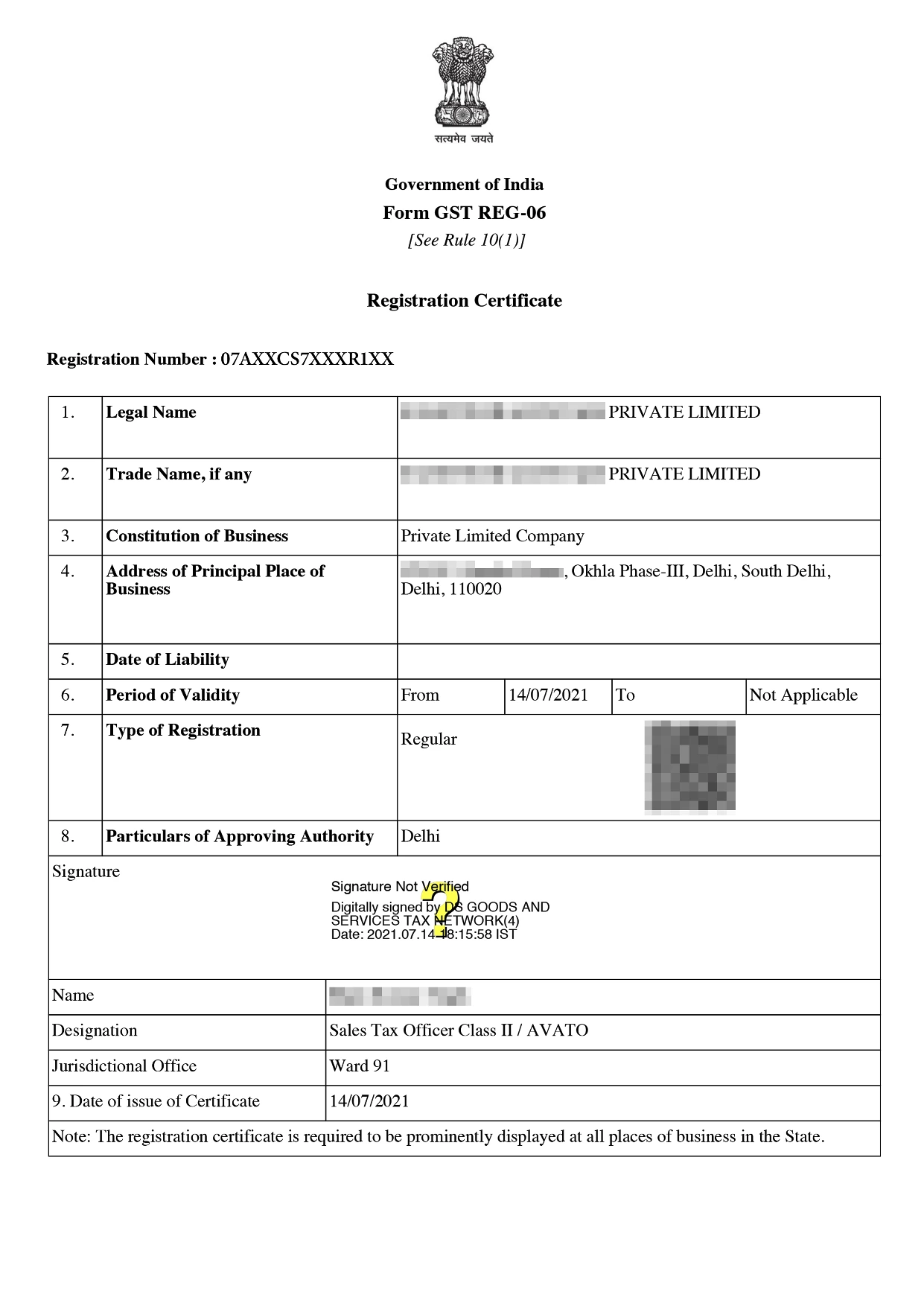

Online GST Registration Sample

GST Registration for a Partnership Firm Registration is the procedure of registering the firm under the Goods and Services Tax (GST) regime in India. A partnership firm, registered or not, is liable to get GST registration if its turnover is more than ₹20 lakh (or ₹10 lakh in special category states) in a year or if it does interstate business, offers taxable services, or sells goods online.

After getting registered, the company is allotted a GSTIN (Goods and Services Tax Identification Number), which is crucial for raising tax invoices, claiming input credit of tax, and filing periodic GST returns. Although the company's turnover doesn't exceed the limit, it can still choose voluntary registration to avail advantages such as legal recognition, input credit, and increased market access.

Following are the major advantages of registering a partnership firm under GST:

To register a Partnership Firm under GST, the following documents are required:

| Document | Purpose / Details |

|---|---|

| PAN Card of the Partnership Firm | Mandatory for GST registration and tax identification. |

| Partnership Deed | Proof of partnership and agreement between partners. |

| PAN & Aadhaar of Partners | Identity and address proof of all active partners. |

| Photograph of Partners | Passport-size photos of all partners. |

| Authorization Letter | Authorizes one partner to act as the GST applicant on behalf of the firm. |

| Address Proof of Principal Place of Business | Utility bill (electricity/water) or rent agreement/NOC from property owner. |

| Bank Account Proof | Copy of cancelled cheque or bank statement showing firm’s name and account number. |

| Email ID and Mobile Number | Required for OTP verification and communication during registration. |

| Digital Signature Certificate (DSC) (if applicable) | Required when registration is done via authorized signatory. |

The GST registration process for a Partnership is completely online and can be completed through the official GST portal. Here's a step-by-step guide:

Go to the official GST website: www.gst.gov.in

Under the ‘Taxpayers’ tab, click on ‘Register Now’ to start a new application.

Enter basic details such as PAN, mobile number, email ID, and state.

You will receive an OTP for verification.

After verification, you’ll receive a Temporary Reference Number (TRN).

Log in with your TRN and complete Part B by uploading the required documents.

Provide business details, promoter/director info, principal place of business, bank account details, and authorized signatory.

Upload the necessary documents to the GST portal to complete your application.

Ensure all documents are clear, properly scanned, and in PDF or JPEG format.

Submit the application using a Digital Signature Certificate (DSC) or EVC.

After verification, you will receive the GST Registration Certificate and a 15-digit GSTIN within 7–10 working days.

GST registration for a Partnership is an important but detailed process. If you choose to do it yourself on the GST portal, there are no government fees. However, if you want to save time and avoid hassle, you can go for Professional Utilities' expert service. They help you with the complete registration process for just ₹1499, making it quick and easy.

| Particulars | GST Registration Fees (INR) |

|---|---|

| Government Fees | ₹0 (No charges for self-registration under GST law) |

| Professional Fees | ₹1499 (charged by Professional Utilities for expert assistance) |

Conclusion

GST registration is an important step for any partnership firm that wants to expand legally and professionally. Whether compulsory because of turnover or voluntary, it offers many benefits—like input tax credit, access to interstate trade, increased credibility, and easier compliance with tax authorities. It also facilitates participation in government tenders and online marketplaces.

By registering for GST, a partnership firm acquires an exclusive GSTIN that simplifies invoicing, tax returns, and financial reporting. It develops confidence in clients and partners and allows the business to operate clearly within the framework of the law.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

Yes, if the turnover is over ₹20 lakh (₹10 lakh in special category states) or the firm has an interstate supply or e-commerce.

Yes, firms can choose voluntary GST registration to avail input tax credit, increase credibility, and operate throughout the country.

GSTIN is the 15-digit unique identification number issued to business firms upon successful GST registration.

Yes, even unregistered partnership firms (non-RoC registered partnership firms) are eligible to register for GST by producing their partnership deed.

GST registration, normally, within 7-10 working days if all paperwork is submitted as it should.

A DSC should be submitted with GST registration online in case a partner is the authorized signatory.

Non-registration where mandatory, may result in penalties, interest on tax payable, and restriction on business.

Yes, GST registration is mandatory while listing and selling on portals such as Amazon, Flipkart, etc.