Updated on September 04, 2025 02:57:13 PM

GST (Goods & Service Tax) Registration in Delhi is an important step for businesses to follow tax rules and operate legally. The process is completely online, requiring businesses to submit key documents like their PAN card, business registration proof, bank details, and address verification. Once registered, they receive a 15-digit GSTIN, which helps them get tax benefits and grow their business.

GST started in India on July 1, 2017, replacing older taxes like VAT, excise duty, and service tax with one simple tax system. This change made tax payments easier, increased government revenue, and helped businesses trade smoothly across different states. When businesses in Delhi register for GST, they support economic growth and follow legal rules.

Getting GST registration can be confusing, so Professional Utilities can help makes the process simple. A skilled team can assist with document submission, handling notices, and getting quick approvals. With the right support, businesses can register for GST easily and at an affordable cost. With step-by-step support, businesses can avoid delays and errors, making the GST registration process easy—whether it's filing returns or managing documents like a Delivery Challan under GST .

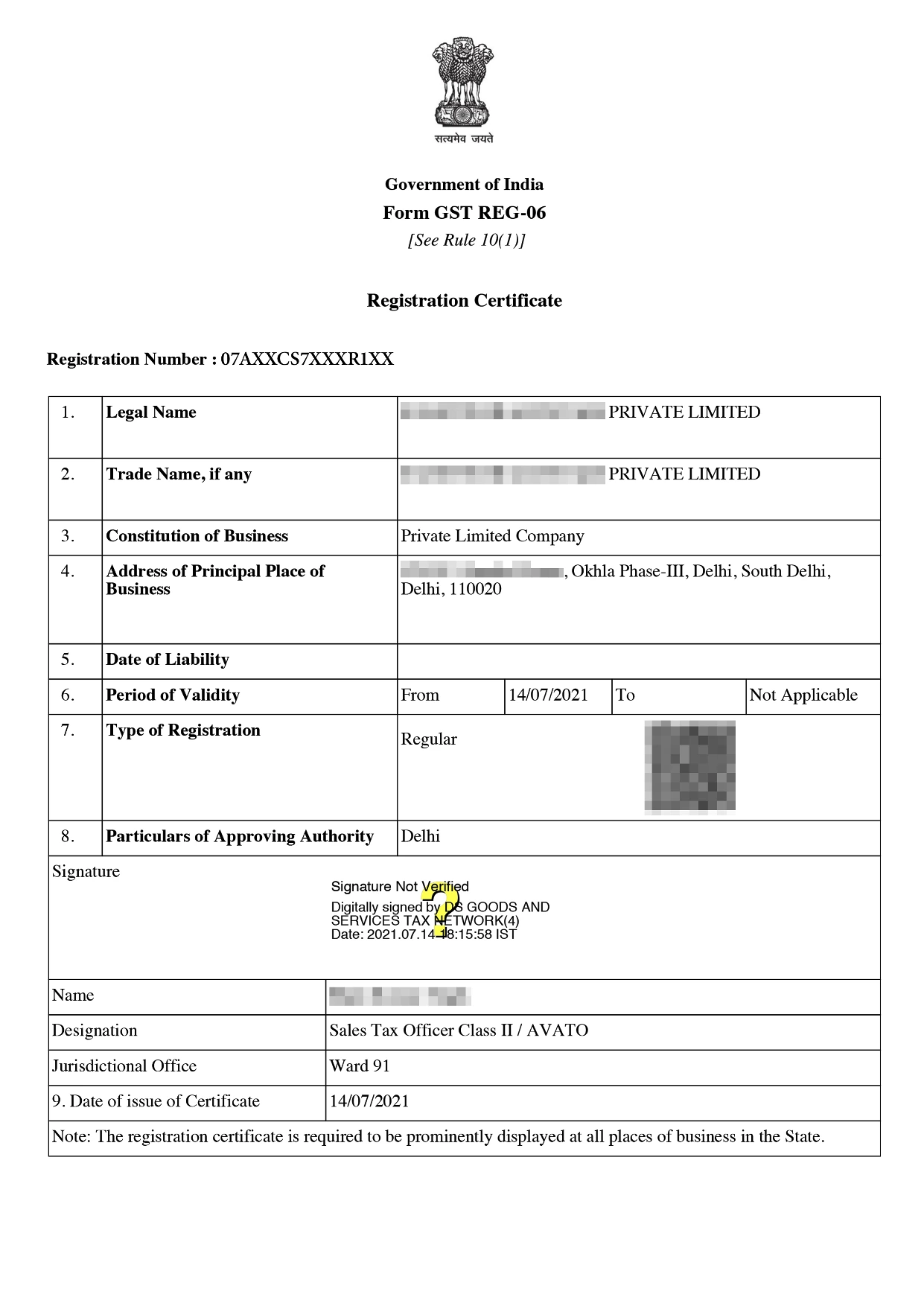

Online GST Registration Sample

Table of Content

GST registration in Delhi means the process of registering business under the GST regime in the National capital Territory of Delhi. After registration GST Number is allotted to the business in which the first two digits are state codes.

Under GST Law, where suppliers affect supply, they have to register in each and every such state. If a business entity has branches in different states, then that business has to take separate state-wise registration for those branches in different states. If a business has many branches in one state, then it has to take one registration in one state.

The GST registration process involves a few easy steps to get your business registered under the GST system. Here’s a step-by-step breakdown:

Business can be registered under different types of categories as mentioned below -

Documents required for LLP or for Partnership Firm are mentioned below -

Documents required for HUF are mentioned below -

Documents required for Company are mentioned below:

The GST registration fees in Delhi is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

Discover the top features and benefits of GST registration that every business must know to stay compliant and maximize tax advantages:

There are many benefits for getting registration in delhi as mentioned below -

Conclusion

GST Registration in Delhi helps in bringing many other taxes like service tax, entry tax. VAT, excise duty and luxury tax into one regime. It has simplified the taxation system and made day to day transactions manageable. GST Registration can be obtained with filling of the form and required documents. Contact Profesional utilities ro get GST Registration in Delhi at just Rs. 1499/-

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

The GST registration fee is just ₹1499/- only with Professional Utilities.

Input Tax Credit is Goods and Service tax which is paid on input goods and services against Output Tax Liability.

TRN or Temporary Reference Number is generated after the verification of the documents, mobile number, PAN number etc. ARN stands for Application ReferenceNumber is proof of successful submission of the application to the GST server.

A Multi-Function Product/Printer/Peripheral (MFP), also known as a multi-functional, all-in-one (AIO), or multi-function device (MFD), is an office device designed to combine the functionalities of multiple devices into one unit. This integration aims to reduce space requirements in a home or small business setting, particularly catering to the Small Office/Home Office (SOHO) market segment.

Speak Directly to our Expert Today

Reliable

Affordable

Assured