Updated on January 27, 2026 11:33:41 AM

The Ministry of Commerce and Industry has launched the Coal Import Monitoring System (CIMS), under which importers are required to provide prior information in an online system for import and obtain an automated registration number or CIMS registration for foreign trade policy measures. According to the CIMS, advance information is to be filed in an online system to import steam coal. For registration purposes, no manual document is required by the system; once you submit online data/information then it will automatically issue a registration number. On registration, the coal importers will be issued with a unique registration number referred to as the URN, which will start with COA.

CIMS seeks to guarantee that only quality coal is imported into the country, as well as regulate the market for coal imports and safeguard local coal producers from unfair competition. The system is important in helping the government make informed decisions on coal import policies by providing them with accurate and reliable information regarding the quantity, value, and quality of coal imports.

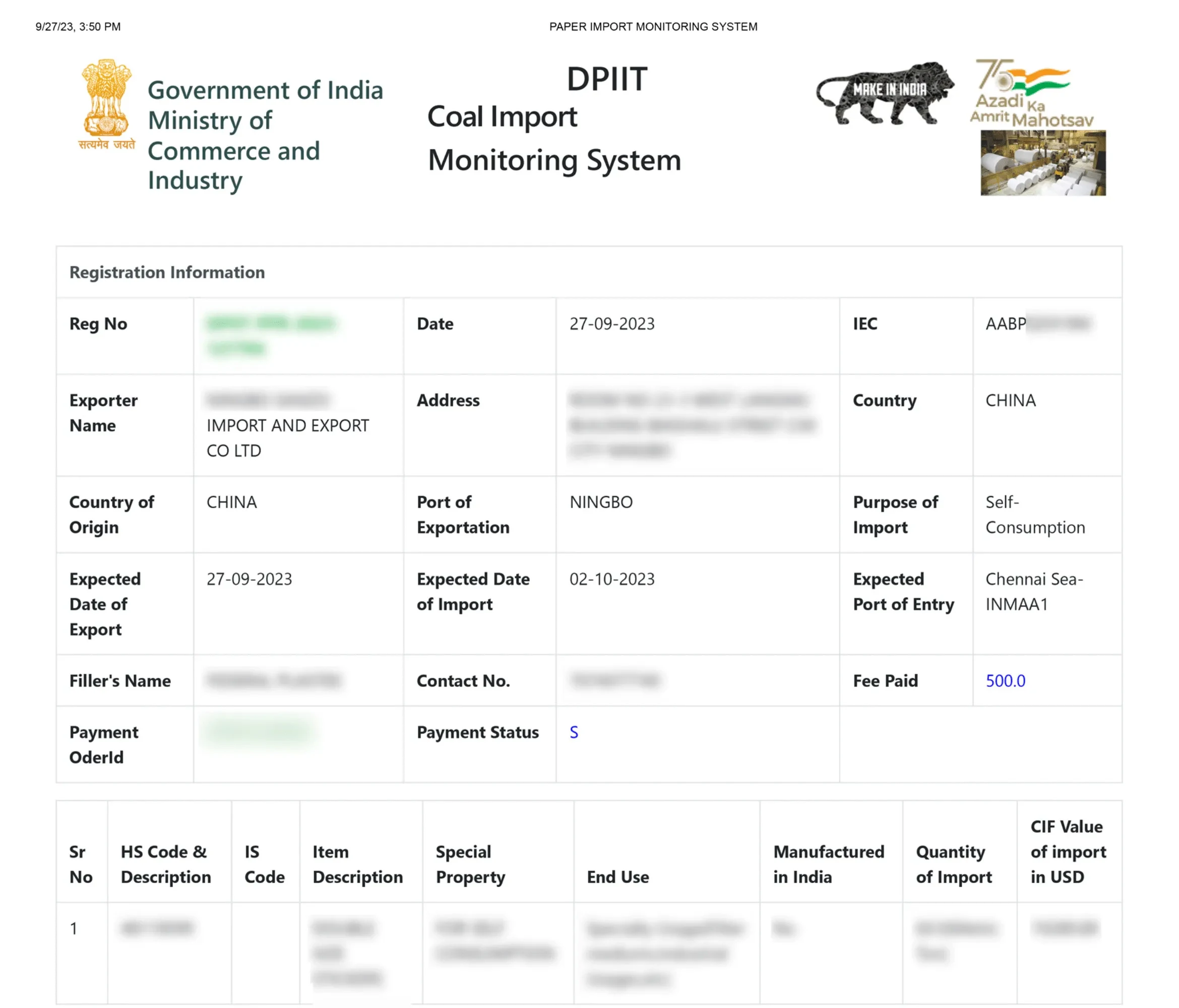

Coal Registration [Sample]

To identify the import and sale of medical devices in India, the Central Drugs Standard Control Organization (CDSCO), a division of the Central Government of India, established a mandatory procedure known as CIMS registration. Clinical Information Management System, or CIMS for short, is an online platform created to expedite medical device registration and guarantee the devices' efficacy, safety, and quality prior to their introduction into the Indian market. In order to meet regulatory requirements, manufacturers and importers of notified medical devices must complete this registration. Businesses can meet legal requirements and gain credibility, transparency, and easier access to the Indian healthcare sector by registering with CIMS.

Importers dealing with the following types of coal must obtain CIMS Registration as per the Foreign Trade Policy guidelines:

| Product Name | Usage/Application | HS Code |

|---|---|---|

| Anthracite Coal | High carbon coal used in metal smelting and industrial power plants. | 27011100 |

| Bituminous Coal | Used for electricity generation, cement production, and steel manufacturing. | 27011200 |

| Coking Coal | Essential for coke production in steel industries. | 27011910 |

| Steam Coal | Primarily used for steam generation in thermal power stations. | 27011920 |

| Other Coal | Includes miscellaneous types used in various industries. | 27011990 |

The Coal Import Monitoring System (CIMS) is a strategic initiative by the Government of India aimed at ensuring transparency, preventing unfair trade practices, and supporting informed policymaking in the coal import sector.

To successfully complete the CIMS registration process for coal imports, importers must submit the following mandatory documents and business credentials:

The total CIMS registration fee in India is ₹3,000, which includes ₹500 as the government fee prescribed by DGFT and ₹2,500 as professional service charges.

| Particular | Fee |

|---|---|

| Govt Fee | ₹500 |

| Professional Fee | ₹2,500 |

| Total Fee | ₹3,000 |

Note: The aforementioned Fees is exclusive of GST.

Registering under the Coal Import Monitoring System (CIMS) is a mandatory online process for importers in India. Follow these simple steps to get your URN and stay compliant with DGFT regulations.

To begin the registration, importers must first create an account on the CIMS portal. This requires providing essential details, including personal/company information and uploading necessary supporting documents for verification.

Importers must provide comprehensive information about the imported coal products, such as:

This data must be entered accurately to ensure compliance with import regulations.

Once registered, importers are subject to ongoing monitoring and compliance checks to confirm that all regulations are being followed. This step ensures adherence to the rules governing coal imports.

CIMS (Coal Import Monitoring System) introduced by the Government of India offers transparency, protects domestic coal industries, and supports data-driven trade policy decisions.

Conclusion

The dynamic world of international trade has seen India's CIMS registration system emerge as a vital tool for efficiently monitoring and regulating coal imports. By promoting transparency, protecting domestic industries, and aiding informed decision-making, CIMS makes a significant contribution to the growth and stability of the Indian coal sector.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions

CIMS stands for Coal Import Monitoring System. It is a registration system introduced by the Government of India to monitor and regulate coal imports through an online platform.

CIMS Registration is a mandatory online process for importers of specific types of coal in India. It requires submitting key import details to obtain a unique registration number (URN), which is needed before import clearance.

The Coal Import Monitoring System (CIMS) covers all types of coal and lignite imports into India, including non-coking coal, coking coal, and lignite. Importers must register and submit shipment details to comply with DGFT regulations.

The CIMS registration fee is calculated at Re. 1 per ₹1,000 of the CIF value, with a minimum of ₹500 and a maximum of ₹1,00,000. For example, if the CIF value of your coal import is ₹50 lakh, the registration fee would be ₹5,000.

The CIMS registration is valid for 75 days from the date of registration. Importers must complete the import process and update the Bill of Entry (BOE) number in the CIMS portal within 15 days of obtaining the ARN for customs validation.

The total fee for CIMS registration is ₹3,000, which includes:

Importers must apply for CIMS registration before placing the import order or initiating the shipment. The registration must be completed well in advance of customs clearance.

Currently, CIMS registrations cannot be canceled once issued. However, if the import does not take place within the 75-day validity, the URN will expire automatically and become invalid.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions