Updated on February 25, 2026 10:32:29 AM

LLP company closure or closure of limited liability partnership (LLP) firm is a complicated procedure that needs to be undertaken with due consideration and following all legal formalities strictly. Every business entity, including the limited liability partnerships (LLPs), is subject to the LLP company closure process due to reasons such as the success of the company, changes in the business policies, and the difficulties that the company may face during the operation of the business activities. Take a thorough look at this page to understand the reasons for the LLP company winding up, the legal formalities associated with the process, the procedure to close LLP company in India, and the difficulties that the owners of the LLP may face while doing so.

A limited liability partnership (LLP) company, after the successful registration with the Ministry of Corporate Affairs (MCA), functions with the purpose of accomplishing the objectives of the business. However, there exist circumstances under which the need arises to close limited liability partnership company, wind up LLP company, or liquidate LLP company due to reasons such as financial troubles, market demands, restructuring, or legal formalities. The dissolution of LLP company can also be impacted under the LLP company strike off procedure, in case the LLP is non-active. The whole LLP company closure process includes the suspension of the LLP’s operations, clearing the liabilities, distribution of the assets, and the deregistration of the LLP with the MCA.

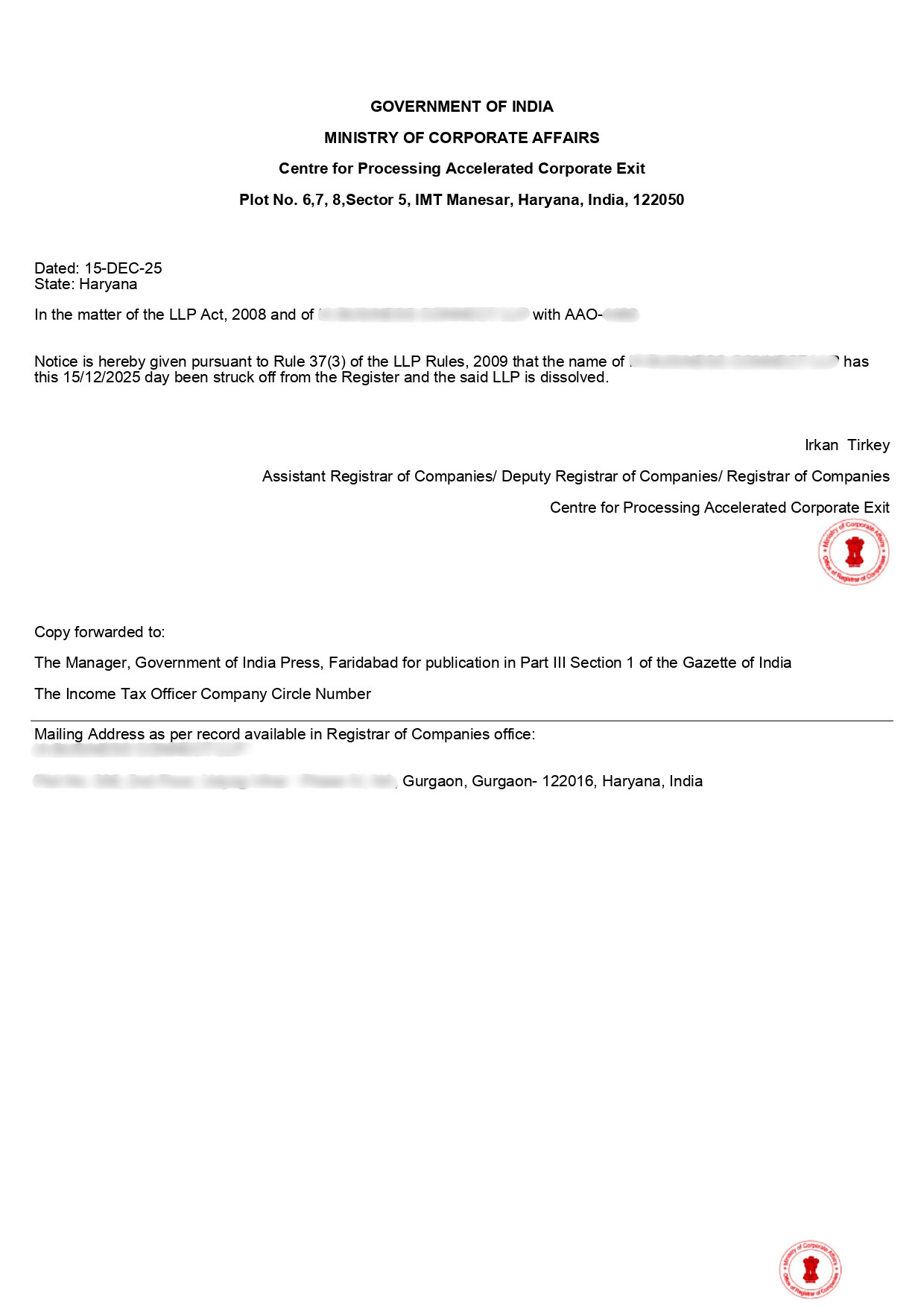

LLP Company Closure Certificate [Sample]

Closure of LLP company is the strike-off procedure prescribed by law as the manner for LLP company closure or closing down a limited liability partnership. Based on its status and liability, an LLP company can be closed through the LLP company strike off procedure, the winding-up procedure, or the liquidation of LLP company. A dormant LLP company without any assets or liability can apply for LLP company strike off, while an existing LLP company must follow the LLP company winding up procedure as outlined below.

The process of LLP company closure includes obtaining partner consent, final account preparation, payment of debt and government dues, distribution of the remaining property, and filling the required LLP company closure form with the MCA. When an LLP is insolvent or faces any kind of financial problem, the process of liquidation becomes compulsory. When the process to close LLP company in India is completed, the existence of the LLP comes to an end.

Here is a simplified step-by-step process related to the closure of LLP company for Strike Off, winding up, and liquidation of LLP company:

Below are the necessary documents that are required for the closure of the LLP company, strike-off, or liquidation:

The total cost of closure of LLP(Limited Liability Partnership) is ₹ 21,999 which includes government fee and professional filing fee of Professional Utilities.

| Limited Liability Partnership (LLP) Closure | Fees |

|---|---|

| Government Fee | ₹10,000/- |

| Professional Fee | ₹11,999 |

| Total Fee | ₹21,999 |

Note:The aformentioned Fees is exclusive of GST.

Note: For the purpose of company closure a professional fee is charged by the company secretary, and an additional fee for Documents Processing and auditing(Notary and Stamp Paper).

There may be certain reasons that may result in LLP company closure, striking-off, and winding-up of a limited liability partnership, which include:

Conclusion

Closure of an LLP Company is a complex and formally defined LLP company closure process involving LLP company strike off, winding up, or liquidation, depending upon the situation arising in this context. It is always advisable to seek proper consultation in this matter to abide by the regulations of the LLP Act and MCA while planning to close LLP company in India. Voluntary winding up of an LLP Company as well as compulsory liquidation leads to the dissolution of the LLP Company. The process to close limited liability partnership company can often be motivated by financial or regulatory factors. If anyone is in search of professional services related to LLP company strike off, liquidation of LLP Company, or LLP company winding up, they can contact Professional Utilities.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Closure of an LLP company would mean the legal dissolution of a limited liability partnership by strike-off, winding up, or liquidation and, hence, removing it from the records of MCA.

Strike off, winding up, or liquidation of LLP company, depending on its activity and liabilities, are the ways for closing an LLP in India.

No, an LLP with outstanding liabilities is not eligible to apply for strike off and will have to opt for winding up or liquidation procedure.

The key documents involved include partner resolution, statement of affairs, list of creditors, indemnity bond, financial statements, affidavits, and MCA forms.

The whole closing cost for an LLP company would be Rs. 21,999, excluding GST fees.

The LLP can make an application for strike-off in the case where it has stopped business activities and has neither assets nor liabilities.

The process to close the LLP company includes obtaining the approval of the partner, payment of the liabilities, distribution of assets, filling Form 24, and confirmation of the MCA.

There are ways to wind down an LLP, which include strike off and winding up, filling certain forms, and obtaining closing confirmation from MCA.