Updated on January 06, 2026 01:48:06 PM

A one-person company, as incorporated under the Companies Act 2013, has only one person as a shareholder and director. Similar to other company structures, the winding-up of an OPC requires specific procedures in order to wind up its operations, pay off its liabilities, distribute its assets, and eventually deregister with the Ministry of Corporate Affairs (MCA).

One Person Company (OPC) in India can be formed by a single individual. In many ways, OPCs are similar to PLCs, but there are some key differences. One of the key differences is that OPCs do not have any legal distinction from their owners. This essentially means that the owner of an OPC is personally liable for all the debts and liabilities of the company.

OPC closure is the winding-up procedure and dissolution of a One Person Company. An OPC may be closed by two methods: winding up, either voluntarily or compulsorily. Voluntary winding up is initiated by its sole member or director, while compulsorily winding up is initiated through a court order. The steps involved in each process vary, but both ultimately lead to the dissolution of the OPC and removal from the register of companies.

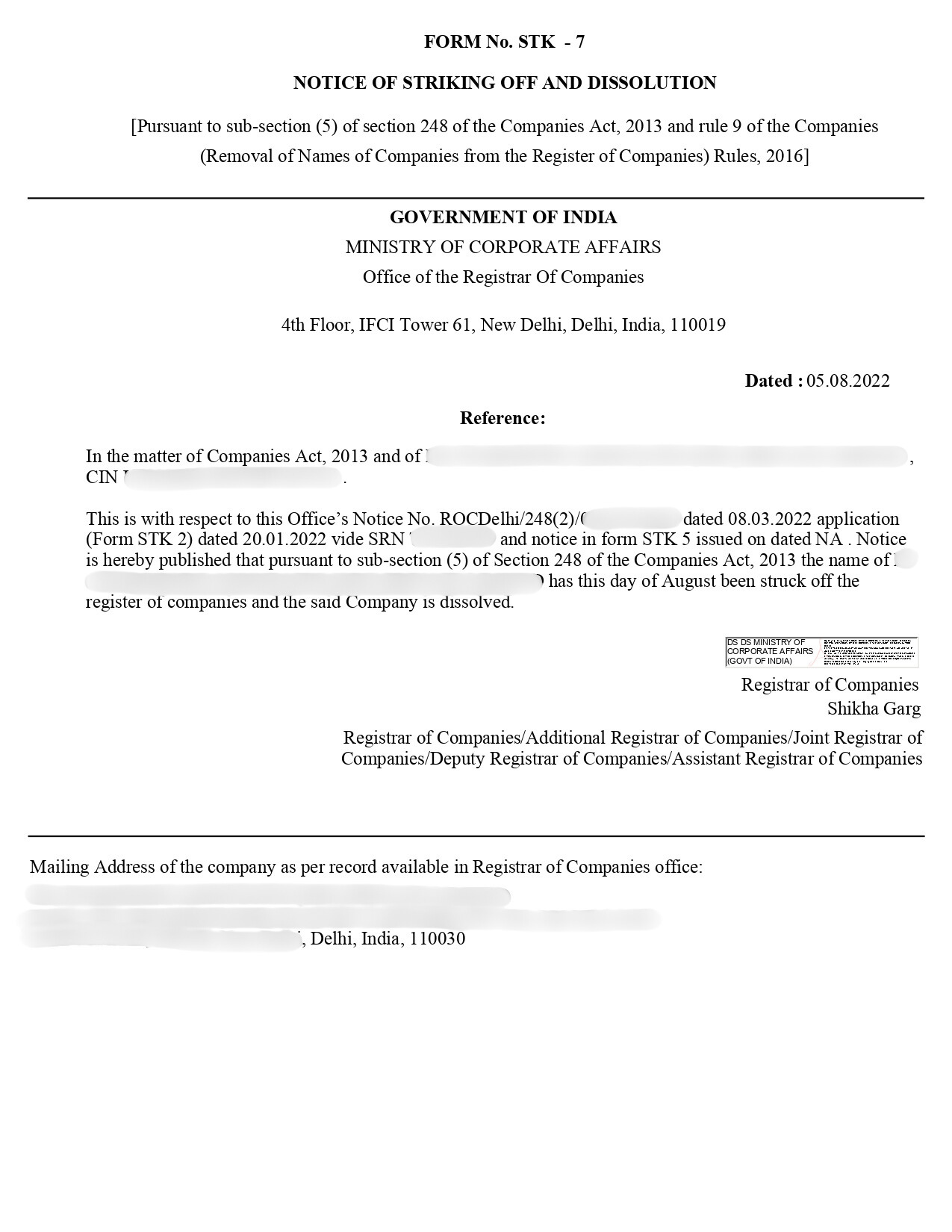

OPC Closure Certificate [Sample]

The closure of an OPC essentially means the organized end of its operations, the satisfaction of liabilities and obligations, the distribution of assets fairly, and striking it off from the records of the Ministry of Corporate Affairs. Usually, a closure of such a company is known to occur due to financial issues with the company, structural alteration, or the discretion of the sole director/ shareholder. It involves holding a general body meeting, appointing a liquidator, paying off debts, distributing assets, filing an application for closure, and obtaining a closure certificate, which are the major steps involved in the closure of a company.

The detailed process that involves the winding up or closure of One Person Company is as follows:

Following is the list of documents required for the closure of a one-person company:

The total cost of Closing a One Person Company (OPC) is ₹ 21,999, including government and professional filing fees for Professional Utilities.

| One Person Company(OPC) Closure | Fees |

|---|---|

| Government Fee | ₹10,000 |

| Professional Fee | ₹11,999 |

| Total Fee | ₹21,999 |

Note: The aformentioned Fees is exclusive of GST.

Note: For company closure, a professional fee is charged by the company secretary, and an additional fee for documents processing and auditing (Notary and Stamp Paper).

The reasons why an OPC may want to wind up or close its operations can be many. Some of the common reasons include:

Conclusion

In conclusion, the closure of a One Person Company(OPC) in India involves a structured and multifaceted process. Factors such as voluntary or compulsory winding up and compliance with regulatory requirements play a crucial role. Seeking professional advice is essential to ensure correct procedures and adherence to laws and regulations issued by the Ministry of Corporate Affairs. The closure of One Person company(OPC) is a complex procedure that involves filing various forms and following the complete winding up procedure as prescribed by the Ministry of Corporate Affairs.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Voluntary winding up is initiated by the sole shareholder/director, while compulsory winding up is initiated by a court order. Voluntary winding up is typically used when the OPC is solvent and the sole director/shareholder decides it is in the company's best interest to close down. Compulsory winding up is used when the OPC is insolvent with no prospects of paying off debts.

The duration varies based on the complexity. Voluntary winding up may take 3 to 12 months, while compulsory winding up may take 6 to 18 months.

The costs vary based on size and complexity. The cost of OPC closure is 21,999 with Professional Utilities.

GST registration for a Private Limited Company is mandatory when the company provides taxable goods or services, exceeds the turnover threshold, or engages in inter-state transactions, ensuring legal compliance, proper tax reporting, and eligibility to claim input tax credit under GST laws.

Speak Directly to our Expert Today

Reliable

Affordable

Assured