Updated on January 30, 2026 07:27:48 AM

A society is a non-profit organization for a specific cause, like the distribution of education, culture, sports, religion, or social welfare. Although societies are not established to earn profit, they can still be under the GST routine if they conduct certain activities that are taxable.

According to Indian GST rules, a society has to register for GST if its annual revenue is above ₹20 lakh (or ₹10 lakh in special categories of states). It also has to register if it renders services such as training, consultancy, event management, or grants tied to given deliverables. Even if the revenue falls below the threshold, a society may register voluntarily to collect advantages such as input tax credit, legal compliance, and enhanced responsibility.

After the society is registered, it is allotted a GSTIN (Goods and Services Tax Identification Number), which it will use for all tax work. GST Registration also facilitates societies to operate in multiple states, deal with the government or business houses, and maintain transparent accounts. In short, GST registration keeps societies legally on the go and facilitates their smooth functioning.

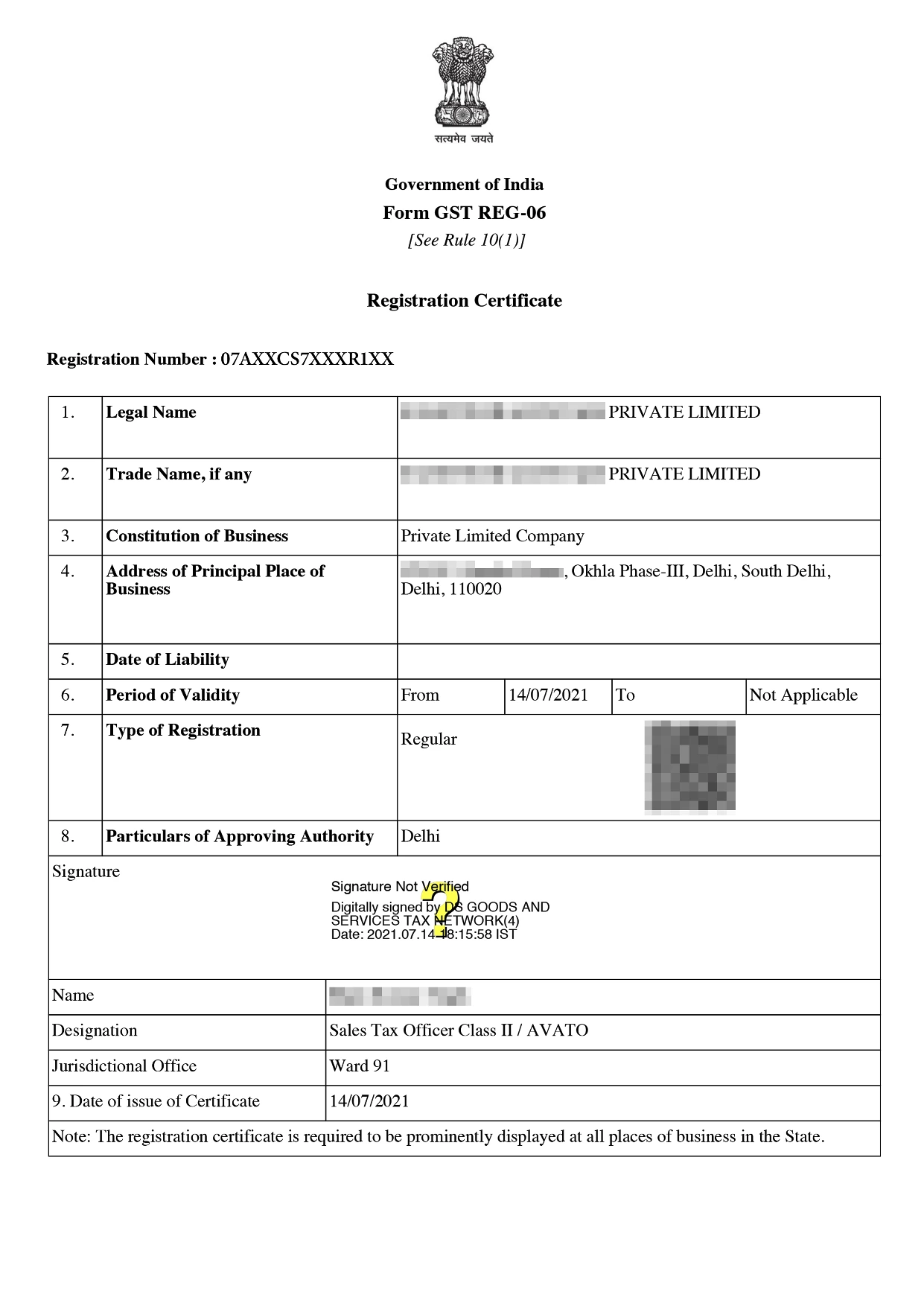

Online GST Registration Sample

The GST Registration of a Society is the process by which a registered society joins the Goods and Services Tax (GST) regime in India. Even though societies are typically established as non-profit entities with charitable or social purposes, they can still be compelled to register for GST based on their activities and income patterns.

According to GST legislation, a society is required to register if its turnover for the year is over ₹20 lakh (or ₹10 lakh in special category states) or if it deals with taxable services or supplies of goods like consultancy, training programs, or conducting paid events. Even societies that are getting grants that are tied to specific services or deliverables are within the GST purview. Voluntary registration is also possible for societies wanting to increase transparency and benefit from input tax credit.

Though Societies are incorporated for not-for-profit objectives, GST registration provides various operational and financial advantages. Below are the key benefits of obtaining GST registration for Societies:

To complete GST registration for a society, the following documents are required. These ensure legal identity, address proof, and authentication of the society and its authorized members:

| Document Type | Purpose/Details |

|---|---|

| PAN Card of the Society | Mandatory for GST registration and tax identification |

| Certificate of Registration | Proof of society’s legal formation under the Societies Registration Act |

| Memorandum of Association (MOA)/Byelaws | To outline the objectives and rules of the society |

| PAN & Aadhaar of Authorized Signatory | Identity proof of the person authorized to apply on behalf of the society |

| Photograph of Authorized Signatory | Passport-size photo of the authorized person |

| Address Proof of Registered Office | Electricity bill, rent agreement, or NOC from the owner of the premises |

| Bank Account Details | A cancelled cheque or bank statement/passbook showing the society’s name and account |

| Email ID and Mobile Number | For OTP verification and communication |

| Digital Signature Certificate (DSC) | Required especially for societies registered under state or central law |

The GST registration process for a Society is completely online and can be completed through the official GST portal. Here’s a comprehensive 8-step guide to help you through the process:

GST registration for a Society is an important but detailed process. If you choose to do it yourself on the GST portal, there are no government fees. However, if you want to save time and avoid hassle, you can go for Professional Utilities' expert service. They help you with the complete registration process for just ₹1499, making it quick and easy.

| Particulars | GST Registration Fees (INR) |

|---|---|

| Government Fees | ₹0 (No charges for self-registration under GST law) |

| Professional Fees | ₹1499 (charged by Professional Utilities for expert assistance) |

Conclusion

GST registration is important in ensuring societies remain transparent, legally compliant, and fiscally accountable. While societies are not-for-profit organizations, undertaking taxable services or obtaining connected grants subjects them to the purview of GST law.

Through GST registration, societies not only gain input tax credit but also become more credible, are eligible for government tenders, and can work in conjunction with CSR partners better. It makes operations smoother, particularly when operating between states or providing services online.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

GST registration is compulsory if a society's turnover for the year crosses ₹20 lakh (₹10 lakh in special category states) or if it provides taxable goods or services.

Yes, even though not compulsory, a society can voluntarily apply for GST registration to benefit from input tax credit and enhanced credibility.

GSTIN (Goods and Services Tax Identification Number) is a distinct 15-digit number employed to file GST returns and perform lawful business transactions.

Voluntary donations in the absence of any service or goods in exchange are not subject to tax. Yet, donations connected with particular deliverables might attract GST.

Suo Moto Cancellation of GST Registration refers to the cancellation of GST registration by the tax authorities on their own initiative due to reasons such as non-filing of returns, non-operation from the declared place of business, or violation of GST provisions. Understanding this helps taxpayers take timely corrective action and restore compliance.

The QRMP scheme under GST allows small taxpayers with a turnover up to ₹5 crore to file GSTR-1 and GSTR-3B quarterly instead of monthly, simplifying compliance and reducing the frequency of filings.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions