Updated on January 08, 2026 01:26:18 PM

A sole proprietorship business is a general form of business in India. A sole proprietorship business is formed and owned by a single person. It is most suitable for those who want to begin a business with minimal investment. It usually does not need any registration as such.

A sole proprietorship firm may be established at home or in a premise with a minimum amount of money. Business control lies entirely in the hands of the single proprietor/owner who invests in the business. He undertakes all losses of the business and receives all profits. He may appoint people to carry on the business, but the ownership will lie solely with him.

Most local establishments like grocery stores, parlours, boutiques, retail shops, etc., may be set up as a sole proprietorship firm. Even small manufacturers and traders may set up a sole proprietorship firm.

Professional Utilities can help you register a proprietorship firm online, an easy and effective business structure suitable for individual entrepreneurs. You can register your proprietorship firm online quickly and easily with our professional assistance and smooth procedure. Begin your Sole Proprietorship registration online with us and realize the potential of your business concepts.

Table of Content

Sole Proprietorship is a type of business entity which is owned and managed by a single person only. It is not governed by any law and hence it is the easiest form of business in India. All the decisions and management of the business is in the hands of one person.

Let’s take a closer look at the benefits of Private Limited Company registration in India:

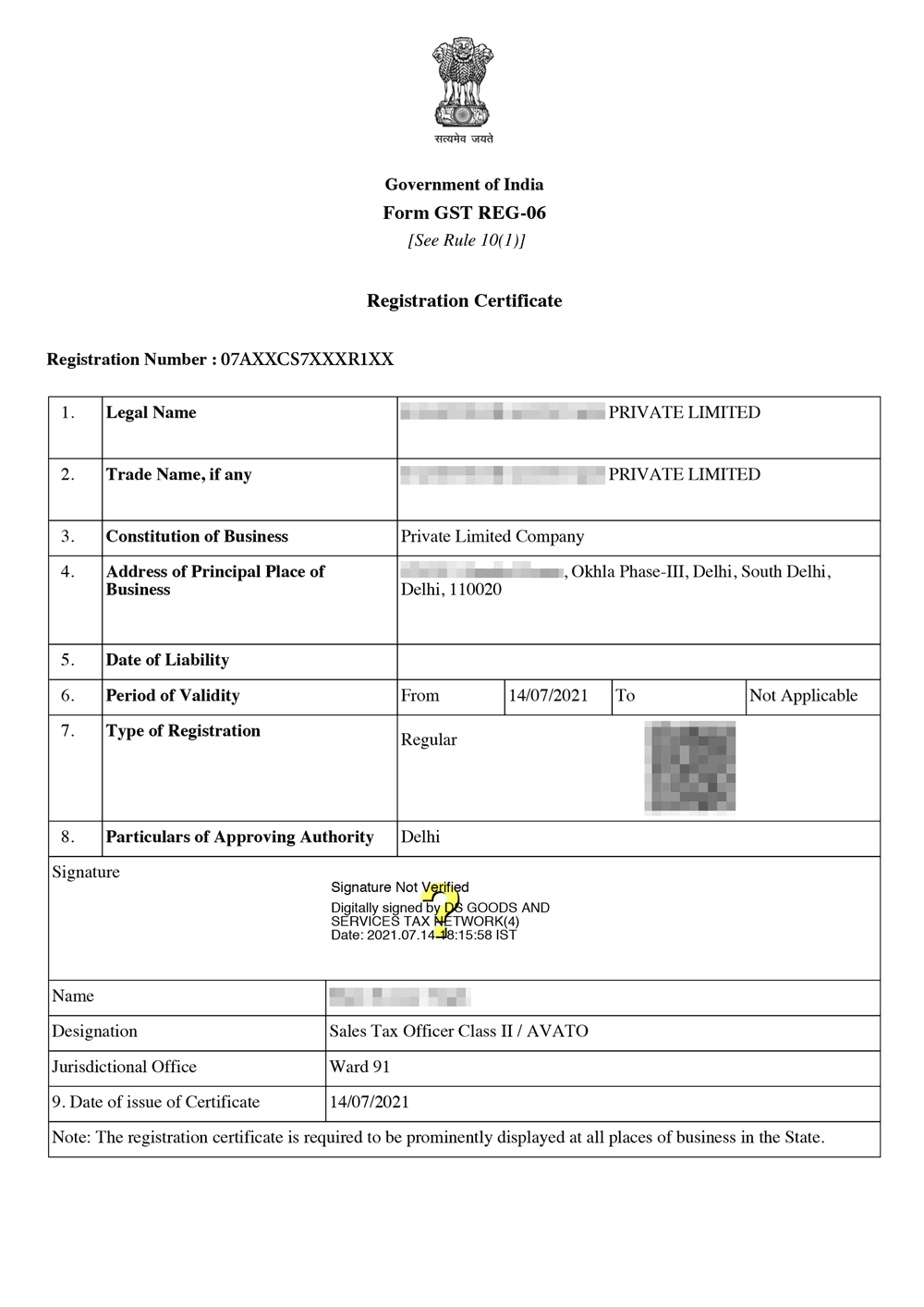

1. GST Registration

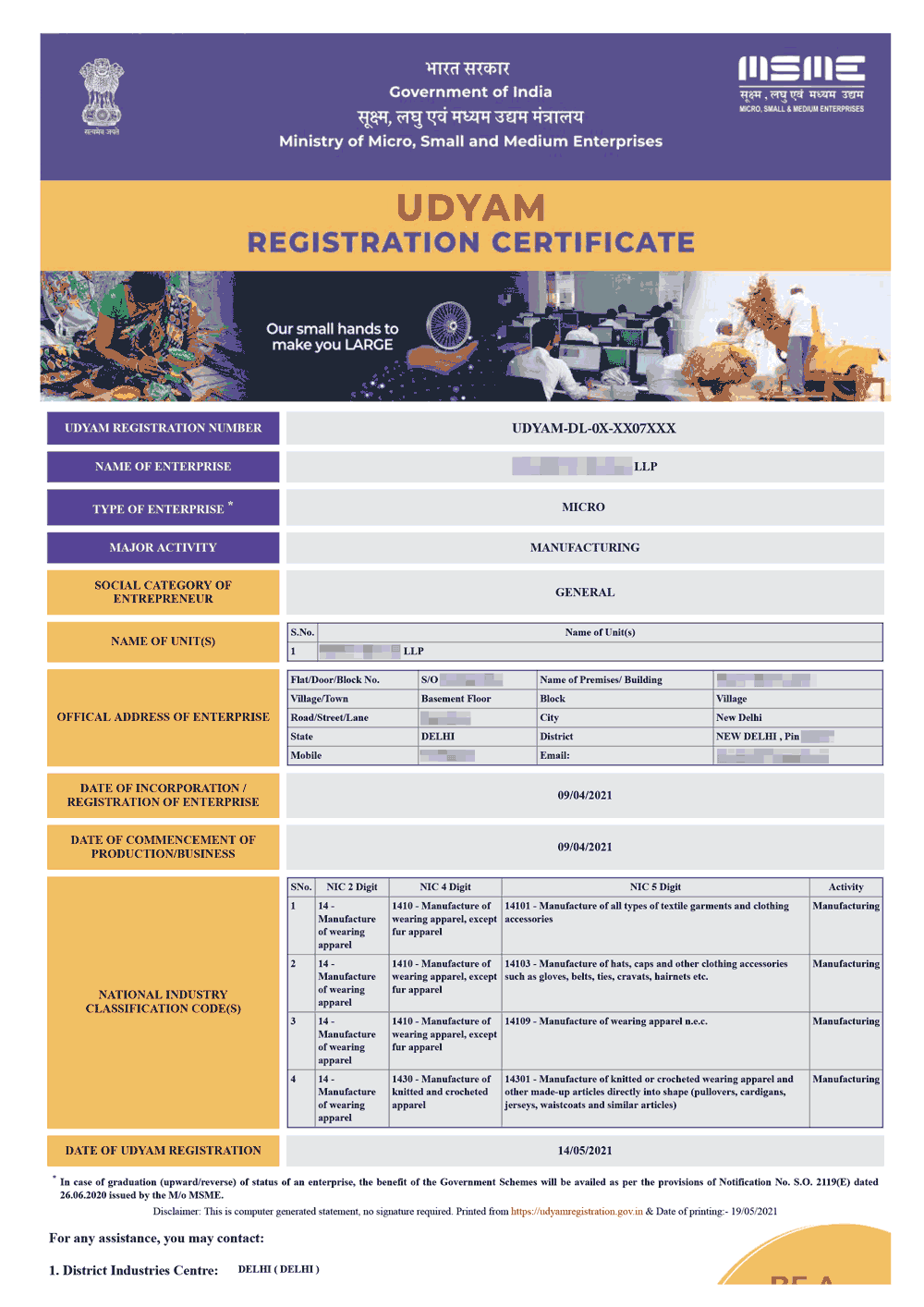

2. MSME Registration

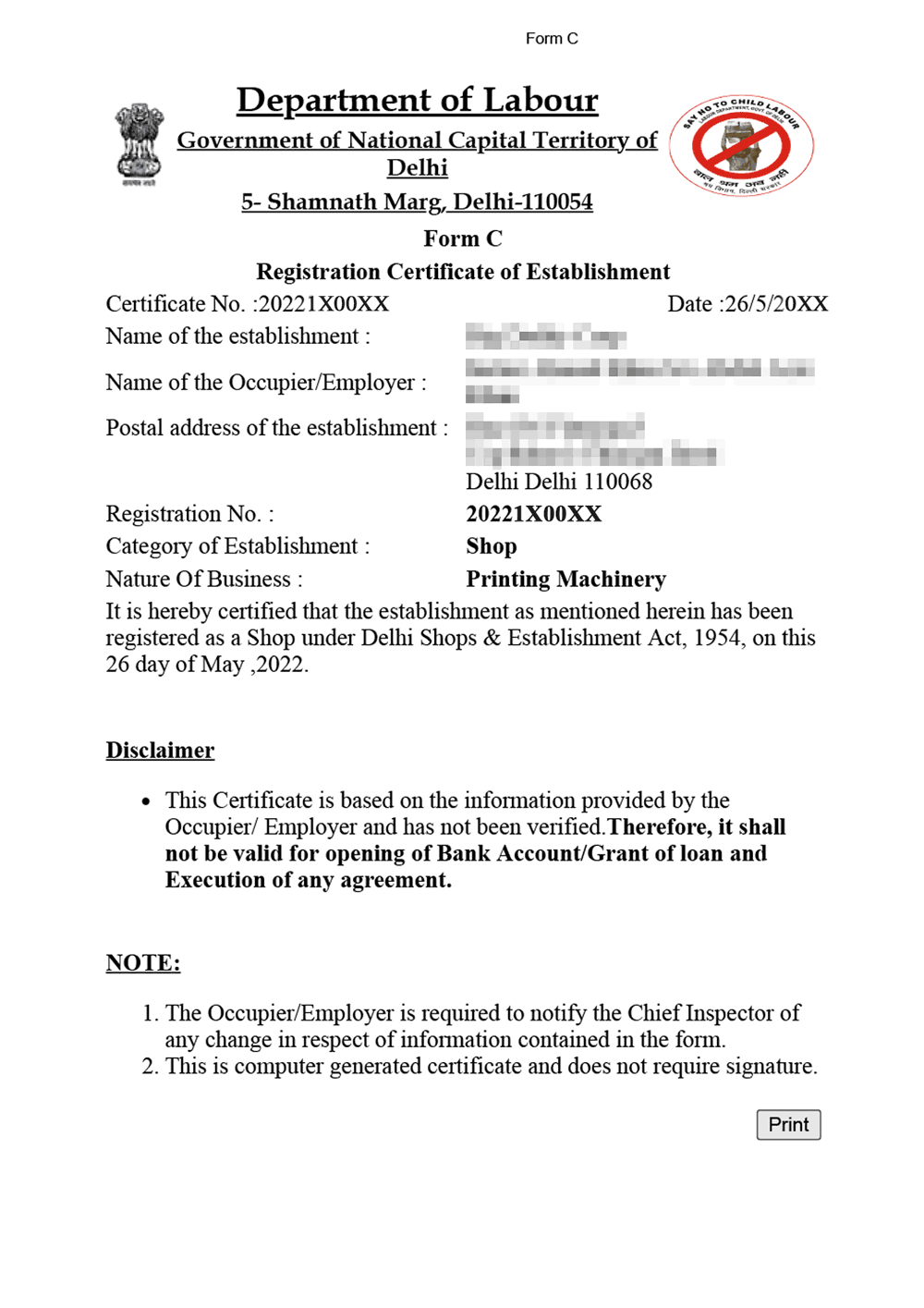

3. Shop and Establishment Act License

Depending upon the requirement of the business and GST Law, application for GST registration has to be made with the department. GST registration usually takes around 5-10 working days.

To establish the existence of your proprietorship firm and avail various benefits, you’ll have to file an application for registering your firm as Small and Medium Enterprise (SME) under the MSME Act. It is beneficial for the business at the time of taking out a loan. The government runs various schemes for SMEs to provide loans at low-interest rates.

You are required to obtain a shop and establishment license according to the local laws. It is issued by the municipal corporation on the basis of the number of employees or workers in the firm.

Once all the steps are completed, the current bank account should be opened by the proprietorship firm. You can contact us for assistance with your current bank account opening.

The process of registering your business as a sole proprietorship firm is not much complicated. Our experts at Professional Utilities can make the whole registration process hassle-free for you. Register your firm online in 3 easy steps:

Get your business registered quickly and hassle-free

Get in touch via Call or Contact Form

Submit the necessary documents for verification

Get your incorporation registered within 7–10 working days

Here’s the updated list of documents required for Sole Proprietorship Registration 2025:

Note: These are official registrations applied for using your core documents. Once approved, the respective authorities issue certificates that legally recognize your business.

Post incorporation of your sole proprietorship firm, you’ll receive the following documents:

A Sole Proprietorship Firm in India offers an easy and affordable way to start a business. The total cost varies based on required registrations, licenses, and the operating state. Professional assistance of Sole Proprietorship Firm Registration starts at just ₹2,999, while government fees depend on registrations such as GST, MSME, and Shop & Establishment License.

| Category | Approx. Fees (₹) |

|---|---|

| Professional Service Fees | 2,999 onwards |

| GST Registration | Included |

| MSME (Udyam Registration) | Included |

| Shop and Establishment License | 500 – 5,000 |

| Other Licenses (FSSAI, Trade, etc.) | 100 – 10,000 |

Note: Fees are indicative and can vary based on state regulations and business size.

The Sole Proprietorship involves obtaining a PAN card for a proprietor, a business bank account, a Certificate of Registration under the Shop and Establishment Act of the concerned state, and GST Registration. Sole Proprietorship Registration takes about 10 days, depending on departmental approval and reverts from the concerned department.

A Sole Proprietorship is the easiest and least expensive business form for entrepreneurs who desire complete control of their business with few compliance needs. It is best suited for small businesses, freelancers, and self-employed professionals seeking simple setup, tax advantages, and flexibility. However, it has unlimited liability, which means the owner is personally liable for all business obligations.

With Professional Utilities, Sole Proprietorship Registration process will be simple and easy. Start your business today with a legally recognized structure and establish your market presence with ease!

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

A sole proprietorship is a type of business owned and operated by one individual, where there is no legal distinction between the owner and the business.

To convert sole proprietorship into private limited company , you need to register the new company under the Ministry of Corporate Affairs (MCA) and transfer all assets, licenses, and business contracts from the proprietorship to the new entity. The owner of the proprietorship becomes a director and shareholder in the new company. This conversion offers better credibility, limited liability, and easier access to funding for business growth.

The fee for GST registration for a sole proprietorship is ₹1,499, including professional assistance, document preparation, application filing, and expert guidance to ensure accurate and hassle-free registration.

You can register your business as a sole proprietorship by GST registration. There are additional and beneficial registrations too like MSME, Shop & License License, etc.

The three advantages of a sole proprietorship are:

Yes, one needs to obtain GST registration in order to establish the existence of the proprietorship firm.

On average, it takes around 7-10 working days for registration of sole proprietorship firm in India subject to document verification by the concerned authorities.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions

Other Company Registration by Professional Utilities

Sole Proprietorship Registration in Other States