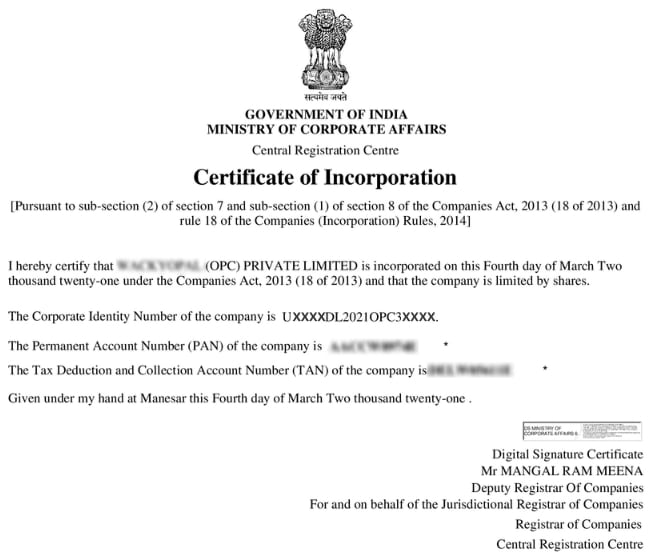

Private Limited Company

A Private limited company Registration Registration is a distinct legal entity from its owners which offers limited liabilities to stakeholders and directors. It can have a minimum of 2 members and a maximum of 200 members. Each member of a company is considered an employee of the company. Private limited company registration is India's most preferred way to incorporate an entity. Read More

.svg)

.svg)