Company closure is a notable event which signifies the end of the operation of the business concerned and marks an important stage in the company closure process. Even though company closure may be perceived as a failure or a challenge, the process of strike off company, liquidation or winding up may also indicate a new beginning that the company’s management wants to take up through voluntary company closure.

It is very essential to understand the significance of the winding up of a company or company strike off because, by understanding this, all concerned parties will be able to know what has transpired in making this decision, which will help them prepare for what is next for them. The provisions regarding the closing down of a company, company dissolution, and liquidation are provided under the Companies Act 2013, and all these provisions need to be followed very strictly.

The shutting down of a company can be a procedure to formally close down businesses for various reasons as part of company closure services. For the shutting down of a company to take place, there has to be a defined company closure process followed for the liquidation of company and company winding up.

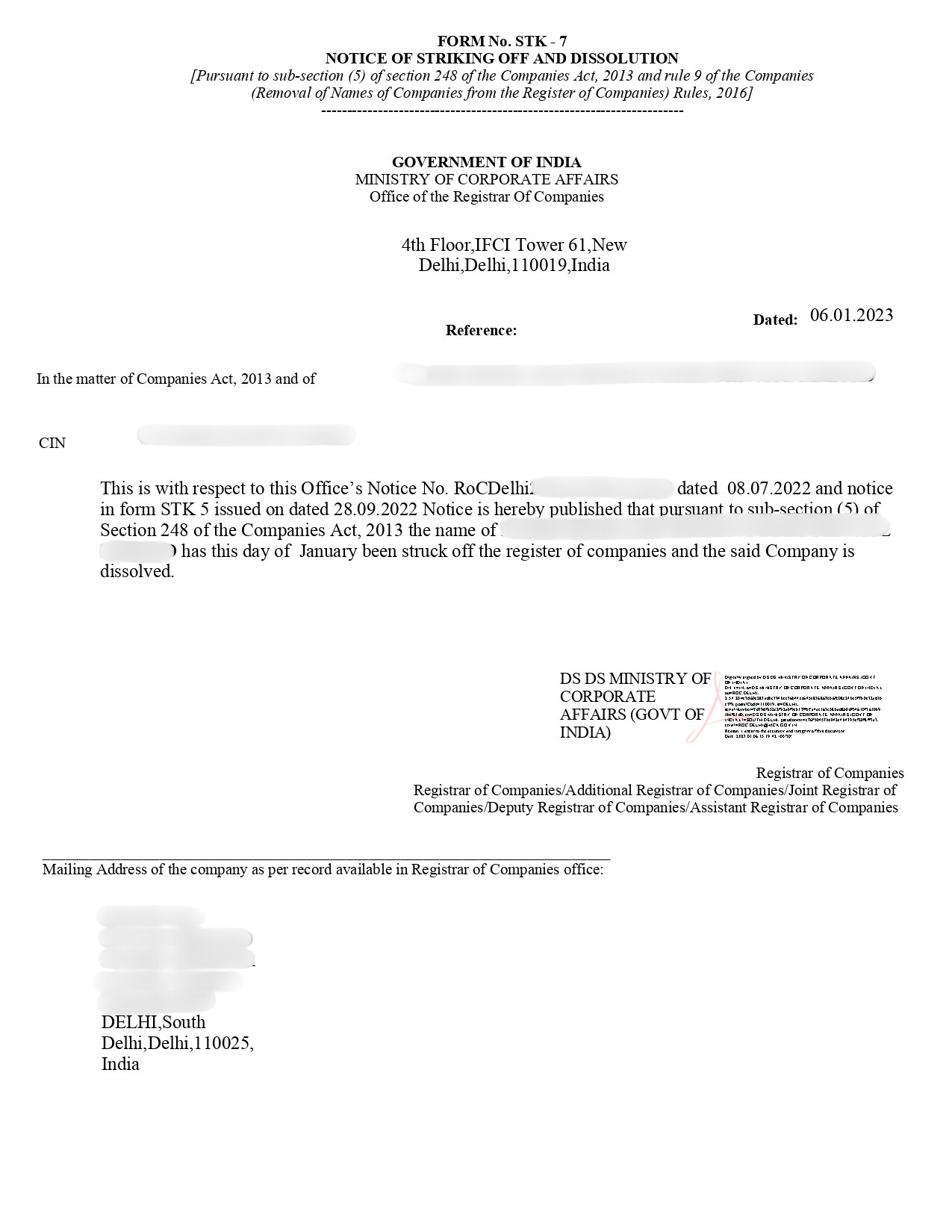

Company Closure Certificate [Sample]

Company closure refers to the shutting down of a company permanently or ceasing the operations of the company, also known as company dissolution. It may be in the form of voluntary winding up, company strike off, or voluntary company closure, depending on the circumstances and the status of the company.

When it comes to how to close a company in India, it includes the process of liquidation of assets, settling the liabilities, unwinding the contracts, and completing the overall company closure process.

Winding up or company closure indicates the end of existence of a company as a legal entity and at times may prove to be important for its employees, shareholders, and other stakeholders.

The Companies Act 2013 serves as the most recent legislation regulating the establishment, company winding up, strike off company, and liquidation in India. Enacted by Parliament on December 13, 2012, this Act officially commenced on April 1, 2013, and governs procedures relating to company closure, winding up, and company dissolution.

The procedure for winding up of a company or closing a company in India depends on whether the closure is voluntary or compulsory.

Procedure for Voluntary Company Closure or Voluntary Winding Up

Steps to be followed in case of voluntary winding up a company are as follows:

Procedure for Compulsory Winding Up of a Company

The procedure for company winding up on a compulsory basis is as follows:

The mandatory documents required for Company closure under the Companies Act 2013 include:

The Total cost of company closure in India is given in table below:

| Company Closure Items | Fees |

|---|---|

| Government Fee | ₹10,000/- |

| Professional Fee | ₹10,000 |

| Documents Processing Fee | ₹999 |

| Total fee for Company Closure | ₹20,999 |

Note: The aformentioned Fees is exclusive of GST.

Note: For the purpose of company closure a professional fee is charged by the company secretary, and an additional fee for Documents Processing and auditing (Notary and Stamp Paper)

According to the Companies Act 2013, there are two primary modes through which company winding up can be initiated:

Voluntary Company Closure

Involuntary Closure by Tribunal

There are multiple reasons which leads to closure of a company, and these reasons are as follows:

There are multiple reasons which leads to closure of a company, and these reasons are as follows:

Conclusion

Company closure is the procedure of winding up the affairs of a company, which can be through voluntary winding up, compulsory winding up, or company strike off. The company closure process involves company dissolution and appointment of a liquidator. Since winding up involve legal complexities, professional guidance is essential.

Consult with Professional Utilities for reliable company closure services and expert assistance on how to close a company in India smoothly and compliantly.

Professional utilities is a complete corporate remedy. PU offers free expert guidance for any of your queries and streamlines the procedure. Compared to other websites, PU offers the greatest costs and a full money-back guarantee. This is a fully digital procedure that gives you the certificate in 10 to 15 days. It is an easy and quick process.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Closure of the company involves passing resolutions, meeting liabilities, filing of applications to the Registrar of Companies or Tribunal and completing the winding-up or strike off liquidation, resulting in dissolution.

The total cost for the closure of an Indian company is ₹ 20,999, which is inclusive of all government, professional, and document processing charges but does not include GST.

Winding up will provide legal closure, settlement of liabilities, avoidance of future penalties, and removal of ongoing compliance obligations.

The status of closure of a company can be ascertained from the website of the Ministry of Corporate Affairs using the name of the company or Corporate Identification Number.

Strike off a company is a simplified closure procedure for inactive companies. Winding Up of a Company: It entails the liquidation of company assets and legal procedures.

The directors must make sure that the statutory compliances are fulfilled, the liabilities are paid off, the accounts are true, and the approval has been sought properly.

A company can be struck off through strike off liquidation, voluntary winding up, compulsory winding up, and the required legal formality is fulfilled.