Startup India registration for Partnership Firms is an important step for businesses looking to grow and get formal recognition through government-backed programs. The Government of India launched the Startup India plan, which provides eligible Partnership Firms with a slew of incentives including as income tax deductions, reduced compliance burdens, faster patent filings, and priority access to government schemes.

To take advantage of these benefits, partnership firms must apply for DPIIT (Department for Promotion of Industry and Internal Trade) accreditation through the official Startup India portal. The procedure include providing crucial business facts, supporting documentation, and a brief write-up about the company's creativity, scalability, potential for job creation, or industry influence.

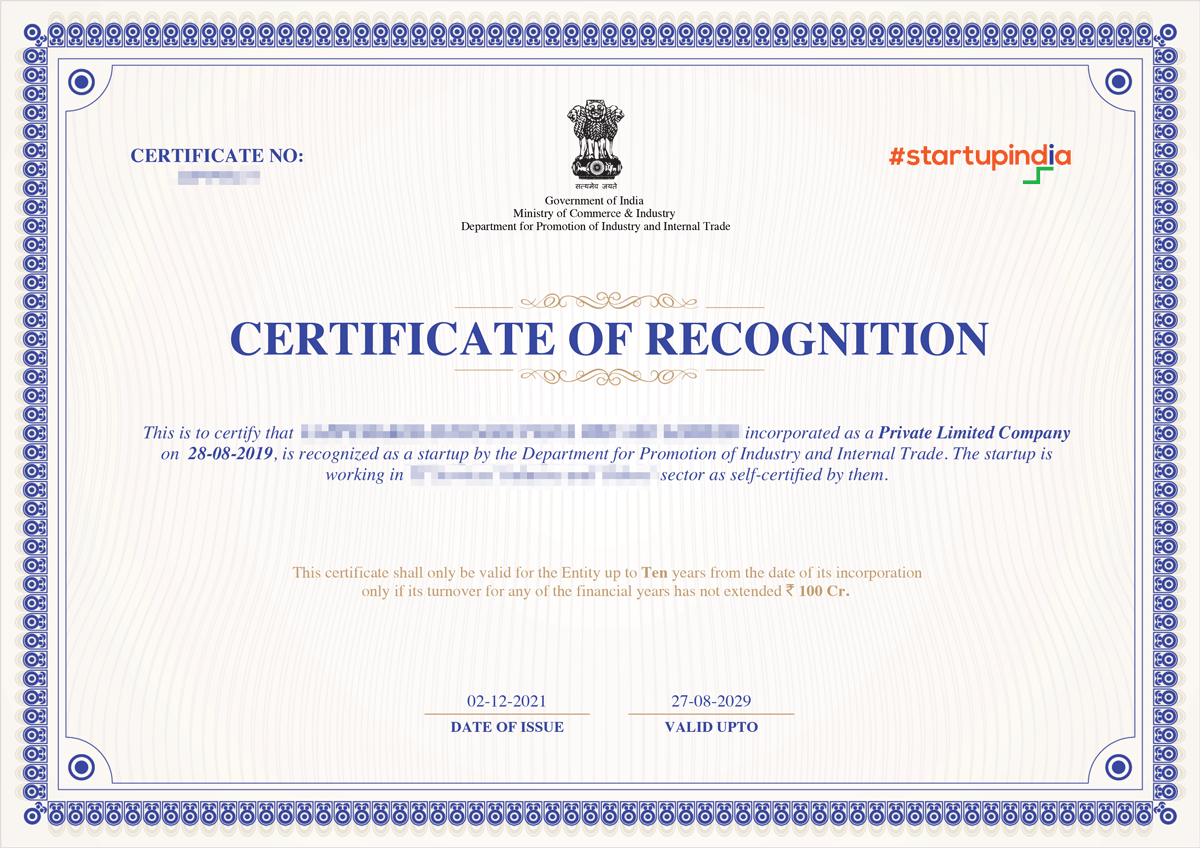

Upon approval, the company is granted a DPIIT Startup Recognition Certificate, which enables it to access government benefits such as the Startup India Seed Fund Scheme, Section 80 IAC tax exemption, and Government e-Marketplace (GeM) onboarding for public procurement. Whether you are starting a new Partnership Firm or managing one that is less than ten years old, registering with Startup India is a smart way to increase growth and credibility with the help of government incentives.

Startup India DPIIT Sample Report

Table of Content

DPIIT Startup India Registration for Partnership Firms is a legal recognition issued by the Department for Promotion of Industry and Internal Trade as part of the Startup India program. Eligible Partnership Firms can apply online by uploading the required documents and company information to the Startup India portal. Once authorized, the company obtains a Startup India Registration Certificate, which formally identifies it as a DPIIT-recognized startup. The certificate grants access to a variety of government incentives, including tax exemptions, financing possibilities, simpler compliance processes, and participation in public procurement schemes and innovation-driven programs backed by the Indian government.

Listed below are the benefits that Partnership Firms recognized under Startup India registration get:

Note: Businesses with DPIIT recognition are exempted from deposition of EMD (Earnest money deposit) in tender participation on public procurement platforms.

Under the Startup India Action Plan, Partnership Firms that meet the definition prescribed under G.S.R. notification 127 (E) can apply for recognition under the program. The program aims to create a robust ecosystem and pick up new-age enterprises.

The following are the eligibility criteria for Startup India registration for Partnership Firms set up by DPIIT.

Note: Businesses with DPIIT recognition are exempted from deposition of EMD (Earnest money deposit) in tender participation on public procurement platforms.

The following documents are needed to be submitted by the Partnership Firms for recognition of Startup India by DPIIT.

Other Certificates, if available:

Individuals seeking Steps for Startup India Registration for Partnership Firm can follow the steps below to complete the application process:

Incorporate your business as one of the following:

Visit startupindia.gov.in to register and verify your email to access the dashboard.

Apply for DPIIT Recognition” and fill in details such as:

In case any issues are being raised fom DPIIT, respond with corrections or clarifications appropriately.

Upon successful examination of application from department, DPIIT will issue the Startup India Recognition Certificate.

The professional charge for getting DPIIT recognition for Partnership Firms under Startup India initiatives is Rs 4,999 only and the total time it would take in the process would be 20-25 business days. The professional fees are exclusive of GST. There is no government fee for DPIIT recognition.

| Particulars | Fees |

|---|---|

| Our Professional Charges | ₹4,999 |

| Time Taken in Process | 20–25 Days |

Conclusion

Startup India registration for Partnership Firms provides access to a variety of government-backed incentives aimed at promoting innovation, economic development, and operational efficiency. DPIIT-recognized businesses can take benefit of tax reductions, simpler compliance, and investment options such as the Startup India Seed Fund. The registration process is completely online and simplified through the official Startup India platform. Securing Startup India recognition is a critical move for entrepreneurs looking to establish scalable, future-ready enterprises. Begin your journey today to realize the full potential of government-led assistance for your Partnership Firm's growth.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

DPIIT recognition is a formal approval given by the Department for Promotion of Industry and Internal Trade under the Startup India scheme. Once a Partnership Firm is recognized, it becomes eligible for various government incentives, including tax exemptions, funding opportunities, and simplified compliance.

Yes, if your firm is less than 10 years old, has an annual turnover below ₹100 crores, and is focused on innovation or scalable business models, it is eligible to apply for Startup India registration through DPIIT.

Recognized firms can enjoy income tax benefits, self-certification under labour and environmental laws, fast-tracked patent filing, access to public procurement via GeM, and eligibility for funds like the Startup India Seed Fund.

The entire DPIIT recognition process for a Partnership Firm typically takes around 20 to 25 business days, assuming all required documents are properly submitted.

You’ll need your Certificate of Incorporation, PAN card, identity proofs of partners, business write-up, and optional registrations like GST, MSME, or trademark if available.

No, the DPIIT does not charge any fee for Startup India registration. However, a professional service fee of ₹4,999 (exclusive of GST) is applicable for processing and documentation support.

Yes, existing firms can apply if they are less than 10 years old and meet the other eligibility requirements like turnover limit and innovation-driven goals.

It offers government-backed credibility and unlocks access to a host of support systems such as tax relief, public procurement access, and investor-friendly schemes—helping your business scale faster with reduced operational hurdles.