A GSP Registration is a legal document that is issued to an exporter of manufactured goods to verify the origin of the product. It includes important information such as the manufacturer's details, the location where the goods were produced, and the intended destination of the commodities. This registration is crucial for ensuring the compliance of the product with the regulations of the importing country, particularly regarding tariffs and trade restrictions. It is a trade agreement offered by developed countries to developing nations to promote economic growth and enhance global market access.

This document serves as proof to customs authorities and trade partners, ensuring compliance with trade agreements, import regulations, and tariff policies. It plays a vital role in verifying the authenticity and traceability of goods, promoting fair trade practices, and facilitating international trade transactions with transparency and credibility. The GSP registration also helps in reducing tariffs, thereby offering cost savings and encouraging businesses in developing nations to expand their export markets. By ensuring the proper documentation and adherence to rules, it builds trust and strengthens the overall trading.

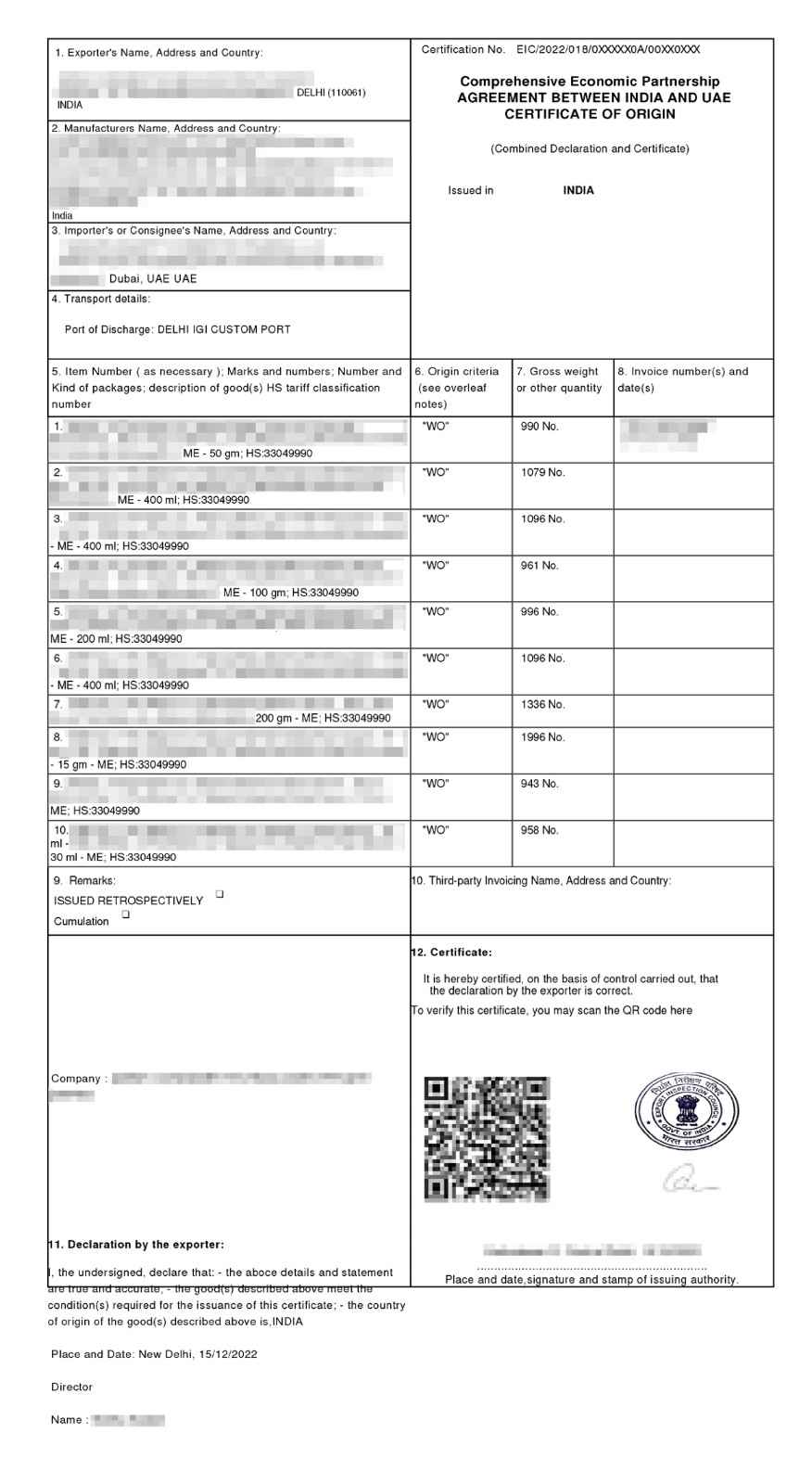

GSP Certificate [Sample]

Table of Content

The Generalised System of Preferences (GSP) is a trade program designed to promote economic growth in developing countries by allowing preferential duty-free or reduced tariff access to exports into developed countries. Beneficiary countries can export specific goods to developed countries such as the US, EU, Japan, and others at reduced or no import duties under the GSP.

The GSP's main objective is to increase developing economies' capacity to export by raising the competitiveness of their products on international markets. In those nations, this promotes economic growth, employment, and industrialization.

Exporters must obtain a Certificate of Origin (Form A) proving the goods originate from a GSP-eligible country to receive GSP benefits. Along with adhering to other trade regulations, the products must also meet certain rules of origin. In industries like textiles, chemicals, handicrafts, and agriculture, India has benefited greatly from the GSP.

The exported goods must meet the rules of origin set by the importing country to benefit from the Generalized System of Preferences (GSP). The Rules of origin are a set of requirements established by the importing country that Indian products must meet in order to be eligible for preferential tariff treatment upon importation into that country.

The three components of the rules of origin are listed as follows:

To apply for GSP Registration under respective free trade agreements, exporters must submit the following documents:

All documents must be accurate and valid to ensure smooth processing of GSP benefits. Incorrect or incomplete documentation may lead to delays or rejection of the application.

The total fee for GSP Registration is ₹2,908, which includes government charges and professional services. The registration remains valid for 12 months from the date of issue. Exporters can easily apply for a reissue once the validity period has expired:

Here’s the detailed GSP Registration fee breakdown:

| Particulars | Amount |

|---|---|

| Government Fee (per invoice) | ₹708 |

| One-Time Creation Fee | ₹500 |

| Professional Fee | ₹1,700 |

| Total | ₹2,908 |

Note: The aforementioned Fees is exclusive of GST.

The procedure for obtaining a GSP Registration involves several steps to ensure compliance with trade regulations. Here's a general outline of the process:

To apply for certification, you need to create an account on the DGFT portal using a Digital Signature Certificate (DSC) or any other authorized government portal.

An applicant must provide valid information and supporting documents with their application to prove the origin of their products.

The issuing authority will verify and confirm the product's origin by thoroughly inspecting it using a risk management system.

After the verification and inspection, the authorities will issue the GSP Registration to the respective applicants if they are approved. The GSP Registration must be in English only, as per the agreed rules under the agreement. The issued certificate must include all of the required information about the product and the exporting entity.

A product will be considered to have come from a contracting nation and be eligible for preferential treatment if it meets the following criteria:

Products with import content are goods manufactured wholly or partially from materials imported from other countries into India. Products with import content qualify for the benefit of GSP if imported or unknown origin materials are used in manufacturing such products, provided that the manufacturing process has undergone substantial transformation in India.

Note:-Exporters must provide a GSP Registration for their goods in order to confirm their authenticity, in accordance with the agreed trade agreement between the parties concerned.

The following countries are there who are giving tariff preferences to exporters of the developing countries having the certificate of Origin under GSP trade agreement:-

| Australia | Belgium | United Kingdom |

| Japan | Denmark | Czech Republic |

| New Zealand | Finland | Estonia |

| Norway | France | Cyprus |

| Switzerland | Germany | Latvia |

| United States of America | Greece | Lithuania |

| Republic of Belarus | Ireland | Hungary |

| Republic of Bulgaria | Italy | Malta |

| Russian Federation | Luxembourg | Poland |

| Turkey | Netherlands | Slovenia |

| European Union | Spain | Slovakia |

Note: To benefit from GSP tariffs, exporters must present an authorized Form A Certificate of Origin to customs in these countries.

Here is a list of documents required to obtain GSP for respective free trade agreements:

India has enhanced its market access commitments for neighbouring service providers. These commitments provide companies with an opportunity to build market expertise and grow by international expansion. Under Free or Preferential Trade Agreement there are multiple options where certificate of origin can be generated from India for import benefits to importing companies:

ICPTA - India Chile Preferential Trade Agreement

SAFTA - South Asia Free Trade Agreement

SAPTA - SAARC Preferential Trade Agreement

IKCEPA - India Korea Comprehensive Economic Partnership Agreement

IJCEPA - India Japan Comprehensive Economic Partnership Agreements

AIFTA - ASEAN India Free Trade Agreement

ISFTA - India Sri Lanka Free Trade Agreement

APTA - Asia Pacific Trade Agreement

GSTP - Global System of Trade Preferences

IMCECA - India Malaysia Comprehensive Economic Cooperation Agreement

ISCECA - India Singapore Comprehensive Economic Cooperation Agreement

Conclusion

The GSP Registration is crucial for exporters across India aiming at improving access to developed country markets. According to the set rules and regulations and producing all the documentation required, exporters are able to enjoy lowered tariffs, which can result in fair trade practices, high competitiveness and better international relations in the international market. This registration is very important in terms of extending market access and the growth of the economy. Professional Utilities has extensive experience in guiding organizations through this process and helping you to meet legal requirements and maximize efficiency where the organizations engage in import-export. From the guidelines given above, it has been seen that the exporters can avail the maximum of the advantages of the GSP program.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

it takes around 3-5 days to get GSP Registration

The govt fee for application is ₹708 per invoice and one time registration fee if ₹500.

import-export code is an essential requirement for al kind of import-export businesses in India.

The GSP Registration is issued by the DGFT

Speak Directly to our Expert Today

Reliable

Affordable

Assured