Updated on January 28, 2026 08:15:04 AM

Section 8 Company is a kind of company that is formed under the Companies Act of India 2013 with the main objective of promotion of charitable and social purposes like education, healthcare, environment, etc., charity or research, sports promotion, etc. A Section 8 Company does not issue profit share to its members; all the earnings are utilized to achieve the meant objectives only.

Being one of the most industrialized states of India with liberal policies, Gujarat is ideal for the establishment of non-profit organizations. If one intends to register a Section 8 Company in Gujarat, some of the benefits include; tax exemptions under the Income Tax Act, legal recognition, credibility among its clients, and certain privileges to secure government and private grants

To register a company, the company has to be registered with the Ministry of Corporate Affairs (MCA), prepare the Memorandum of Association (MoA) and Articles of Association (AoA), and legally conform with various rules and legislations. Legal formalities are paramount which include the issue of documents, certificates, and registration to ensure a smooth run through the process.

The NGOs and the social entrepreneurs of Gujarat need to establish a Section 8 Company to carry out their operations under legal provisions; get funds and grants; and, further ameliorate their societal contributions.

Section 8 Company Sample Documents

Section 8 Company is a private limited company that does not have a purpose to carry out any business for profit, and it is incorporated only for promoting charitable objectives such as social welfare, education, medical relief, protection of the environment, sports, etc. Section 8 Company does not disburse profits as such to its members but all the income is utilized to fulfill the objectives of the society.

This company has some incentives such as tax relief, legal status, and more credibility thus being suitable for NGOs, charitable organizations, and trusts. The registration comprises seeking permission from MCA to incorporate the company, drafting documents such as the Memorandum of Association (MoA) and the Articles of Association (AoA), and following certain prescriptions.

Section 8 companies, also known as not-for-profit companies, are registered under Section 8 of the Companies Act, 2013. These companies have the following advantages:

Overall, the Private Limited Company structure offers several advantages that make it a popular choice for small and medium-sized businesses looking for limited liability and access to capital.

Learn How to apply for Section 8 company registration? Given below is the complete registration process of Section 8 company in Gujarat, you can follow the process to register your Section 8 Company in Gujarat within a few days:

The registration process of section 8 company begins with the application of Digital Signature Certificates. A DSC or Digital Signature Certificate is a type of certificate which works as a proof of identity for signing online forms or used in the company registration process. Application process of DSC is completely online and it can be availed from the concerned authorities within 24 hours of application. Once the DSC is received, Form DIR-3 is to be filed with ROC for getting a DIN( Directors Information Number) from the ministry.

To register a section 8 company, a unique name has to be approved by the concerned authority and the process of checking the name availability is completely online through a web application called Reserve Unique Name(RUN), introduced by the Ministry of Corporate Affairs to reserve a unique name for your Section 8 Company.

You can also use our Name Search tool to check for the name availability.

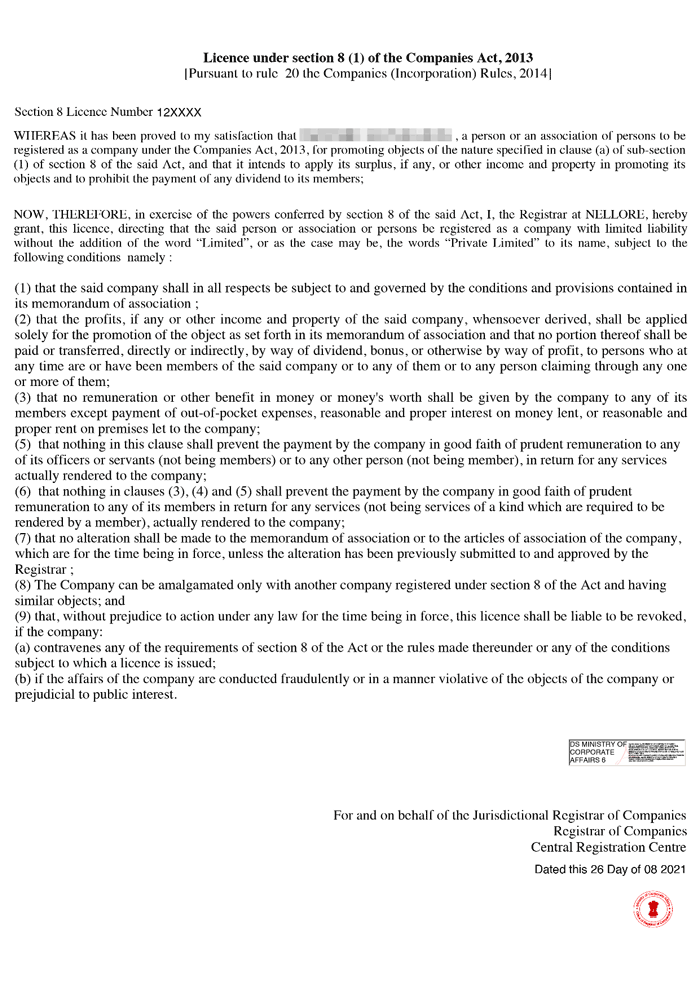

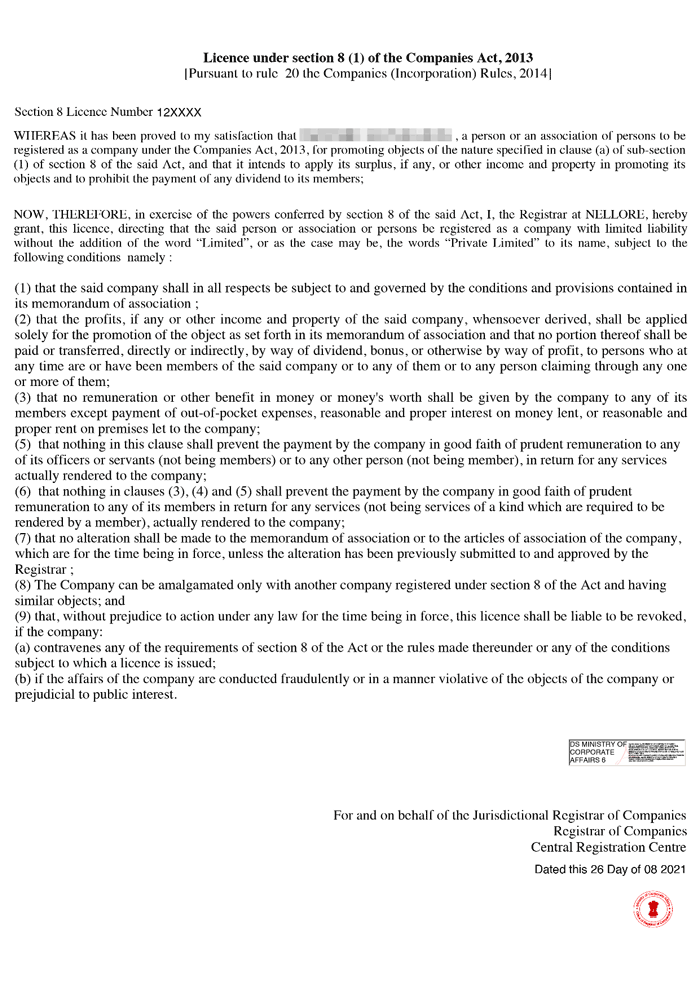

To register a Section 8 Company, you need to then fill Form INC-12 and submit it to the registrar of the company. This is a very important step as before getting a certificate of incorporation, you need to get License from the Ministry of Corporate Affairs under Section( 1 ) of the Companies Act, 2013. Post approval of the Form from the ministry, you will be issued a 6 digit Section 8 license number.

The next step after getting DSC, and Section 8 company license, is to file a SPICe form, which is a proforma for getting your Section 8 company incorporated online. The details that you need to fill in the form are given below:

The SPICe, eMoA, and eAoA are important forms which are required to be filed while applying for the Section 8 company incorporation. MoA is defined under Section 2(56) of the Companies Act, 2013 and MoA defines the powers and objectives of any company whereas AoA is defined under Section 2(5) of the Companies Act, 2013 in which internal structure and rules and regulations of the management is defined.

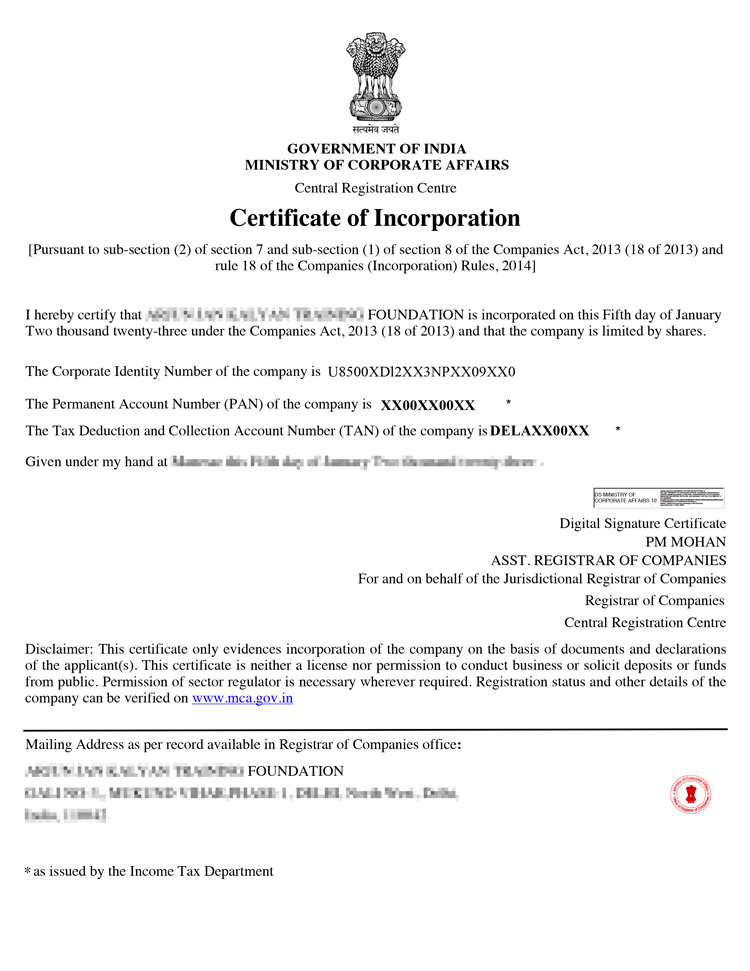

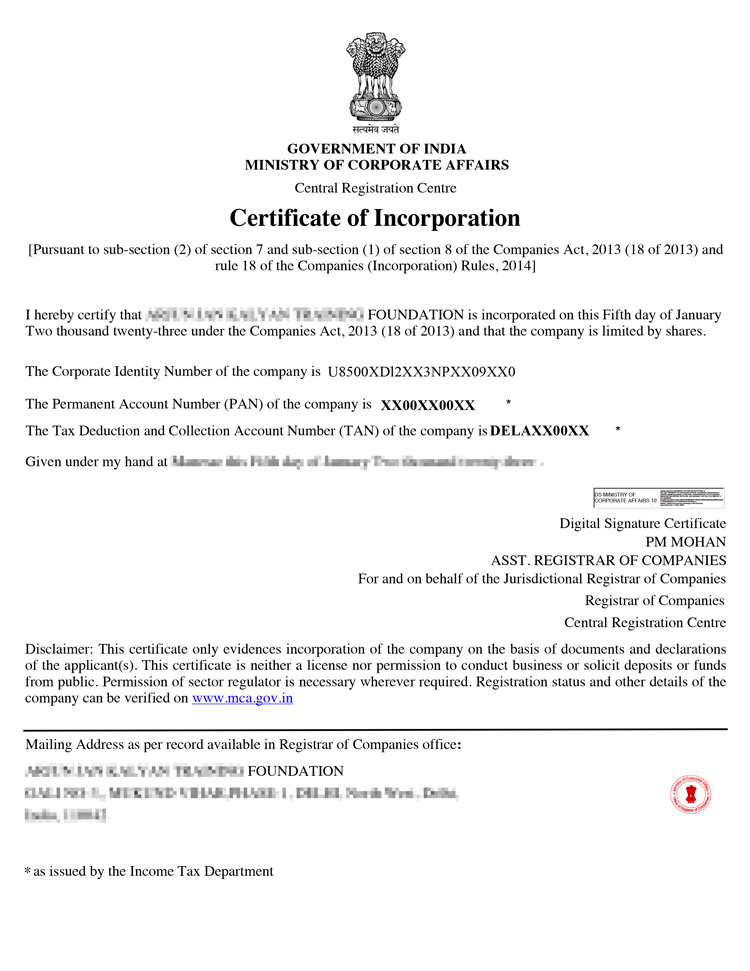

The final step after approval of the documents is issuance of the certificate of incorporation by the Ministry of Corporate Affairs. After getting the certificate, the company needs to open a current bank Account for the company within 2 months of getting the incorporation certificate.

Read this - NGO Registration Complete Process and Fees

Given below is the list of all the necessary documents required for Section 8 Company registration in Gujarat.

Read More - Documents Required for Section 8 company registration

After successful registration of a section 8 company, you will be provided with the following documents.

Certificate of Incorporation Sample

Section 8 Company Sample Documents

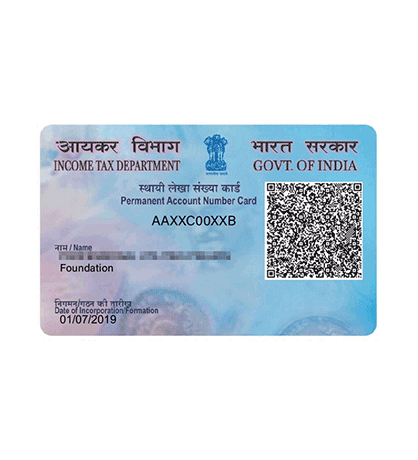

PAN Card Sample Documents

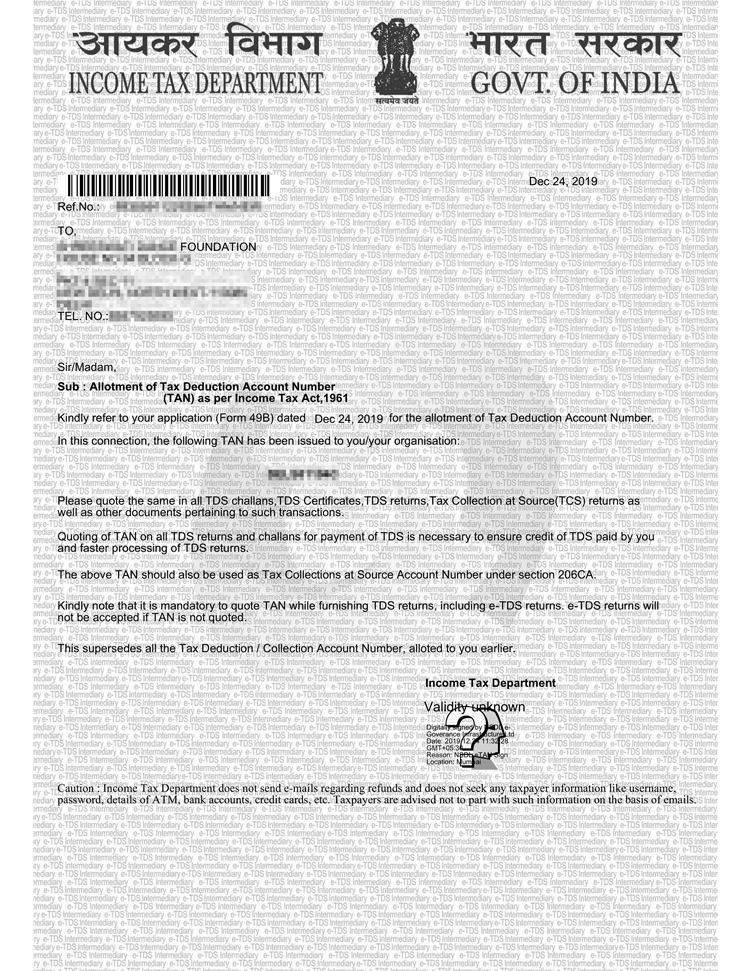

TAN Sample Documents

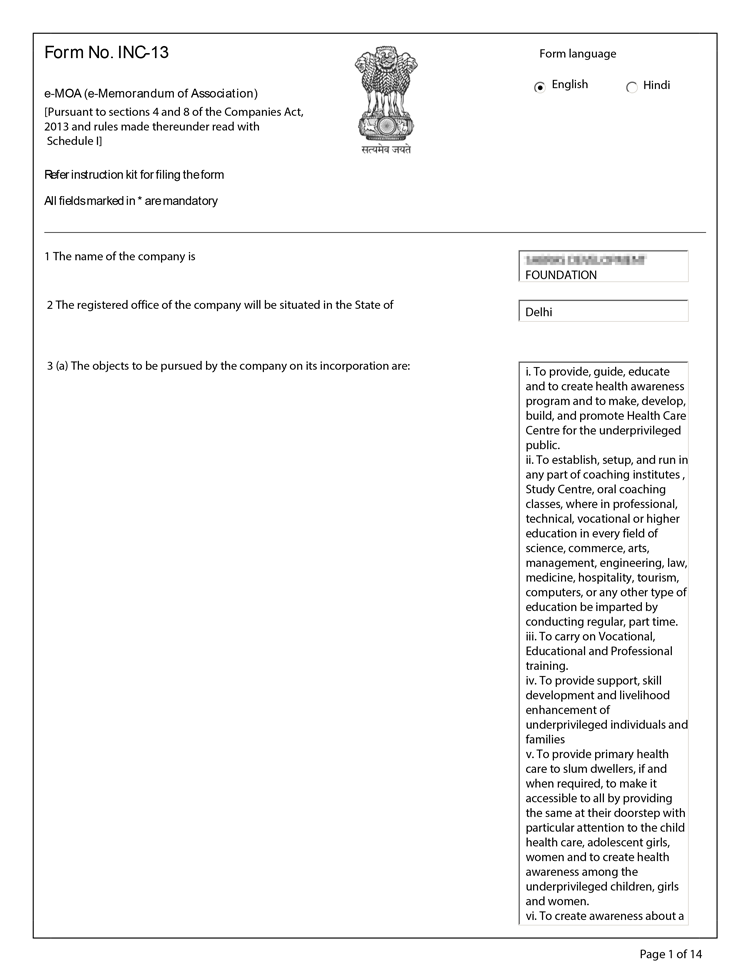

AoA Certificate Sample Documents

MoA Certificate Sample Documents

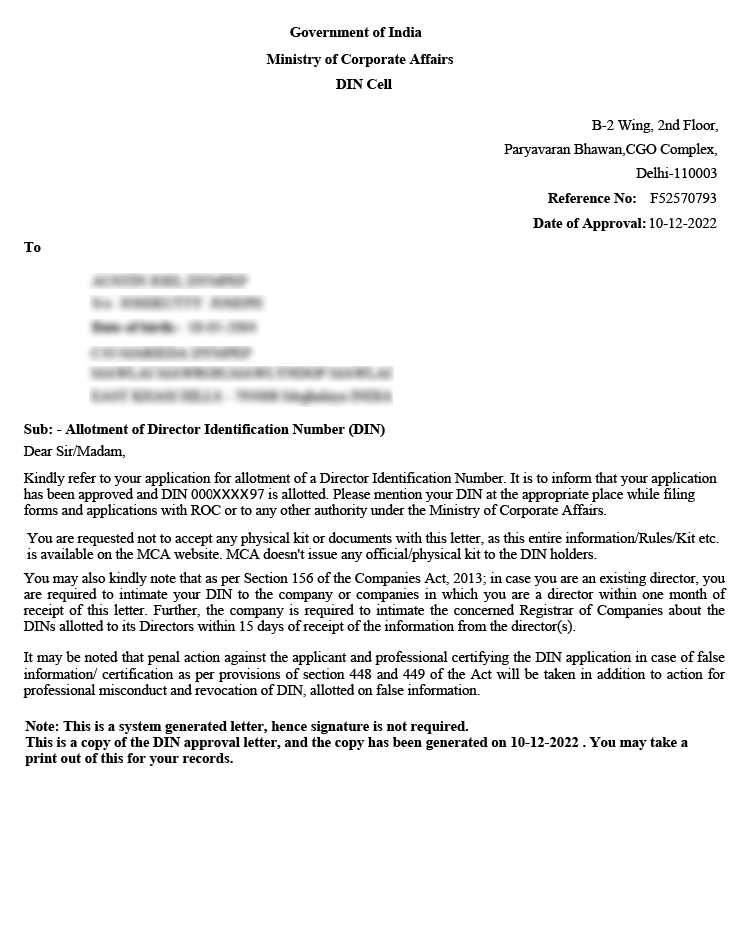

DIN Certificate Sample Documents

DSC Sample Documents

EPFO Certificate Sample Documents

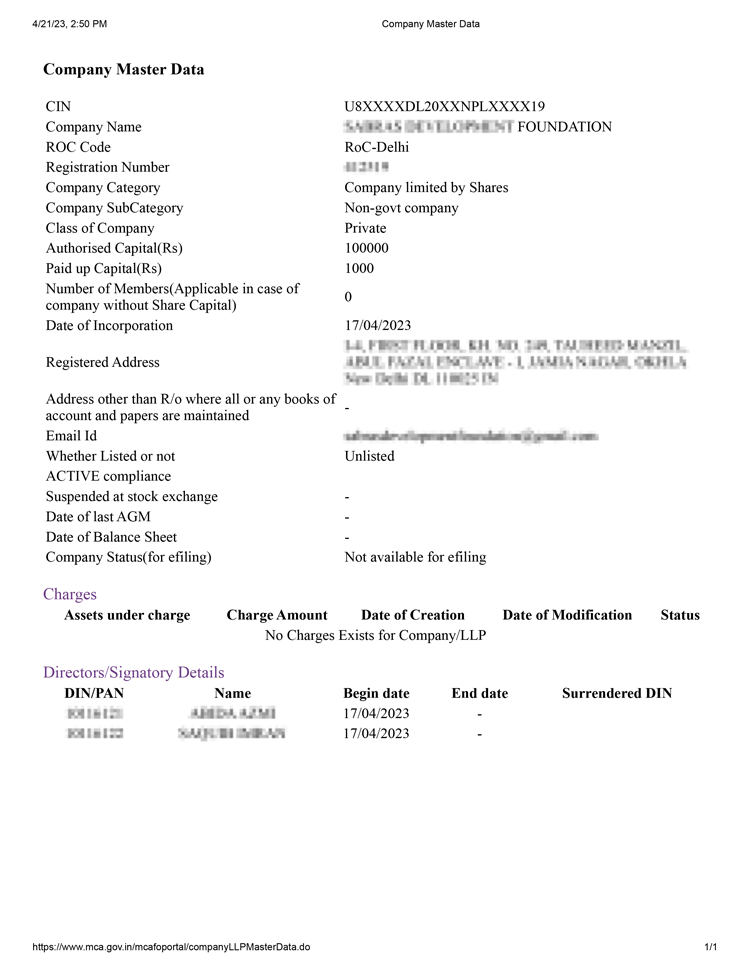

Master data Sample Documents

The total Registration fees of Section 8 company registration in Gujarat is Rs 9,499, including Govt Fees and Professional fees of Professional Utilities.

On average, it takes around 10-14 working days to register a Section 8 company in India, subject to document verification by the Ministry of Corporate Affairs (MCA).

| Section 8 Company Registration in Gujarat | Registration Fees |

|---|---|

| ✅ Digital Signature Certificate Fee | ₹3,000 |

| ✅ Government Fee(Stamp Duty) | ₹2,500 |

| ✅ Professional Fee | ₹3,999 |

| ✅ Total Cost | ₹9,499* |

Note: The aforementioned Fees is exclusive of GST.

Note - The above mentioned state wise registration fees includes registration for 2 members with minimum Authorised capital of Rs 1,00,000, DSC, Government Fees(Stamp Duty) and Professional fees.

The fees may vary if the number of members or Capital is increased or decreased.

Also Check - State wise Registration Fees of Section 8 Company in India

Conclusion

To get your Section 8 company registration in Gujarat, you need to submit all the aforementioned documents along with the required registration fees on the MCA portal and then wait for the document verification and approval. If you need any assistance in incorporating your Section 8 company in Gujarat, we can help you get your incorporation effortlessly and easily.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

The Registration fee for a Section 8 company Registration in Gujarat is Rs 9,499 which includes for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

To Register a Section 8 Company in Gujarat, you need DSC, a Unique Business Name, file Form, Section 8 License, Form SPICe INC - 32, INC-33, INC-34, and the get Incorporation Certificate. Register with Professional Utilities.

To register a Section 8 Company in Gujarat you need to provide with some of the basic documents such as Aadhar Card, PAN Card, Rent agreement, Address proof of Registered office.

Time Required for Section 8 Company Registration in Gujarat is 7-14 days.

Speak Directly to our Expert Today

Reliable

Affordable

Assured