Updated on January 28, 2026 08:15:04 AM

A Section 8 Company is a registered non-profit entity under the Companies Act, 2013, in India. It is incorporated to undertake social welfare and charitable activities like education, healthcare, poverty alleviation, conservation of the environment, rural development, and women's empowerment. Contrary to usual businesses, a Section 8 Company does not share profits among its members. All income and funds are, instead, ploughed back to achieve the social goals of the organization.

Tripura, which emphasizes social development and government-supported programs for welfare, is a good location to form a Section 8 Company. Registration in Tripura provides several advantages such as legal acceptance, tax exemptions, credibility, and access to government and overseas funding. It is a perfect form for NGOs, charitable trusts, and social enterprises that look to make a positive contribution to society.

The process of registration requires approval from the Ministry of Corporate Affairs (MCA), preparation of required documents such as the Memorandum of Association (MoA) and Articles of Association (AoA), and government regulation compliance. Documentation is very important for smooth registration.

By establishing a Section 8 Company in Tripura, organizations are able to function under an organized legal structure, earn public trust, attract investments, and make meaningful contributions towards social causes while enjoying tax benefits and government assistance.

Section 8 Company Sample Documents

A Section 8 Company is a non-profit company registered under the Companies Act, 2013, in India. It is established to encourage charitable and social welfare activities like education, healthcare, poverty alleviation, protection of the environment, women empowerment, and rural development. Unlike other businesses, a Section 8 Company does not share its profits with its members. All profits and donations are utilized for the social purposes of the organization.

Such a company is best for NGOs, charitable organizations, and social enterprises that need legal status and legitimacy. A Section 8 Company has several advantages, such as tax-free status, support from the government, and easy access to money from different sources.

To incorporate a Section 8 Company, sanction from the Ministry of Corporate Affairs (MCA) must be obtained. The procedure involves filing significant documents such as the Memorandum of Association (MoA) and Articles of Association (AoA) and fulfilling legal formalities.

Section 8 companies, also known as not-for-profit companies, are registered under Section 8 of the Companies Act, 2013. These companies have the following advantages:

Overall, the Private Limited Company structure offers several advantages that make it a popular choice for small and medium-sized businesses looking for limited liability and access to capital.

Learn How to apply for Section 8 company registration? Given below is the complete registration process of Section 8 company in Tripura, you can follow the process to register your Section 8 Company in Tripura within a few days:

The registration process of section 8 company begins with the application of Digital Signature Certificates. A DSC or Digital Signature Certificate is a type of certificate which works as a proof of identity for signing online forms or used in the company registration process. Application process of DSC is completely online and it can be availed from the concerned authorities within 24 hours of application. Once the DSC is received, Form DIR-3 is to be filed with ROC for getting a DIN( Directors Information Number) from the ministry.

To register a section 8 company, a unique name has to be approved by the concerned authority and the process of checking the name availability is completely online through a web application called Reserve Unique Name(RUN), introduced by the Ministry of Corporate Affairs to reserve a unique name for your Section 8 Company.

You can also use our Name Search tool to check for the name availability.

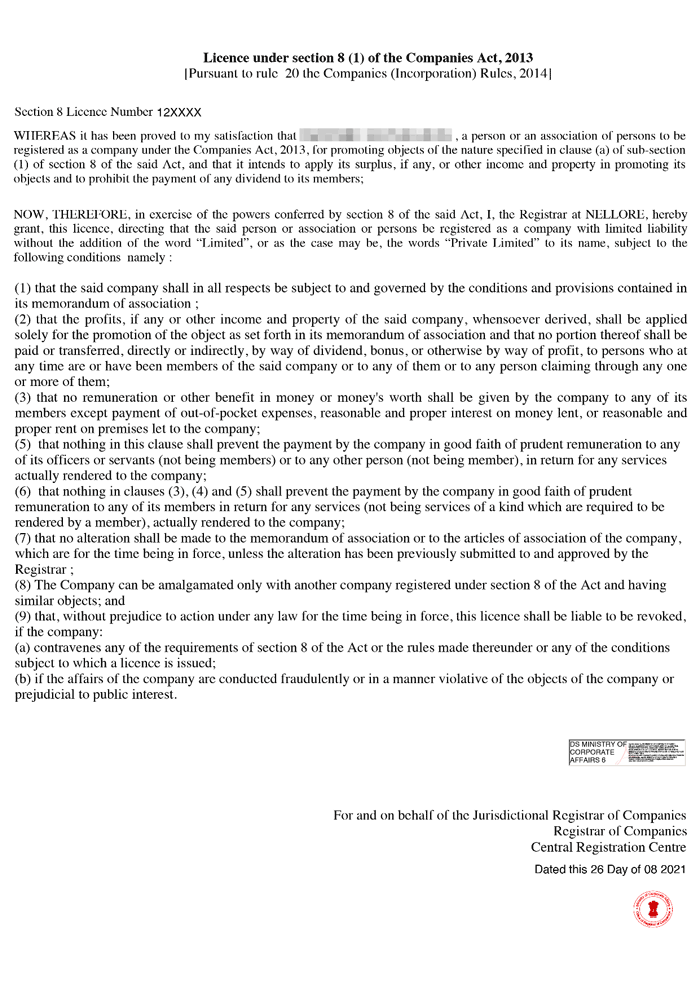

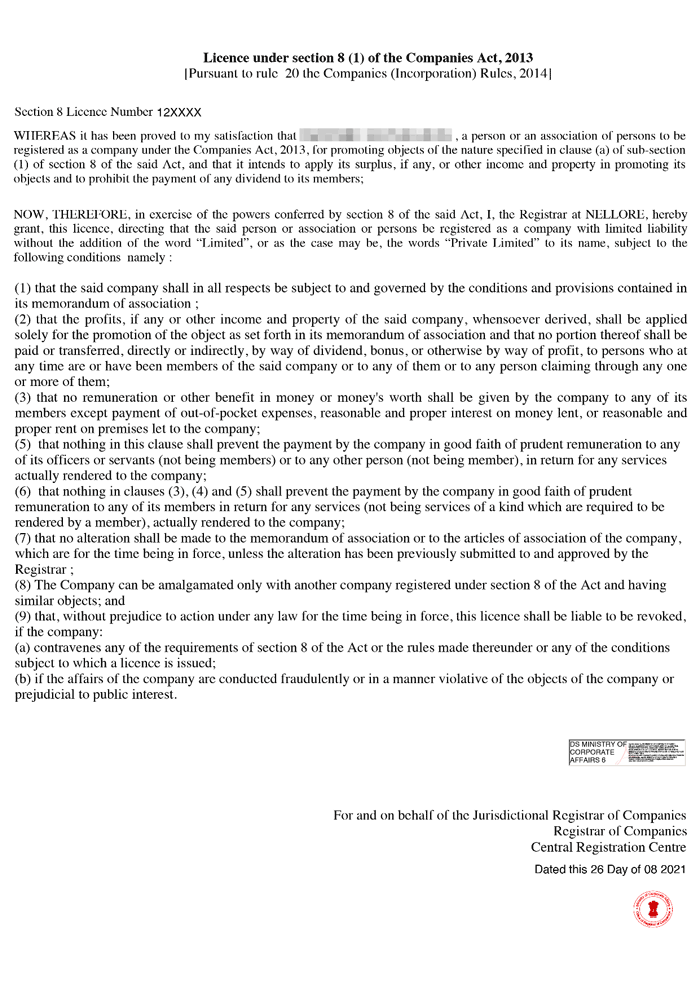

To register a Section 8 Company, you need to then fill Form INC-12 and submit it to the registrar of the company. This is a very important step as before getting a certificate of incorporation, you need to get License from the Ministry of Corporate Affairs under Section( 1 ) of the Companies Act, 2013. Post approval of the Form from the ministry, you will be issued a 6 digit Section 8 license number.

The next step after getting DSC, and Section 8 company license, is to file a SPICe form, which is a proforma for getting your Section 8 company incorporated online. The details that you need to fill in the form are given below:

The SPICe, eMoA, and eAoA are important forms which are required to be filed while applying for the Section 8 company incorporation. MoA is defined under Section 2(56) of the Companies Act, 2013 and MoA defines the powers and objectives of any company whereas AoA is defined under Section 2(5) of the Companies Act, 2013 in which internal structure and rules and regulations of the management is defined.

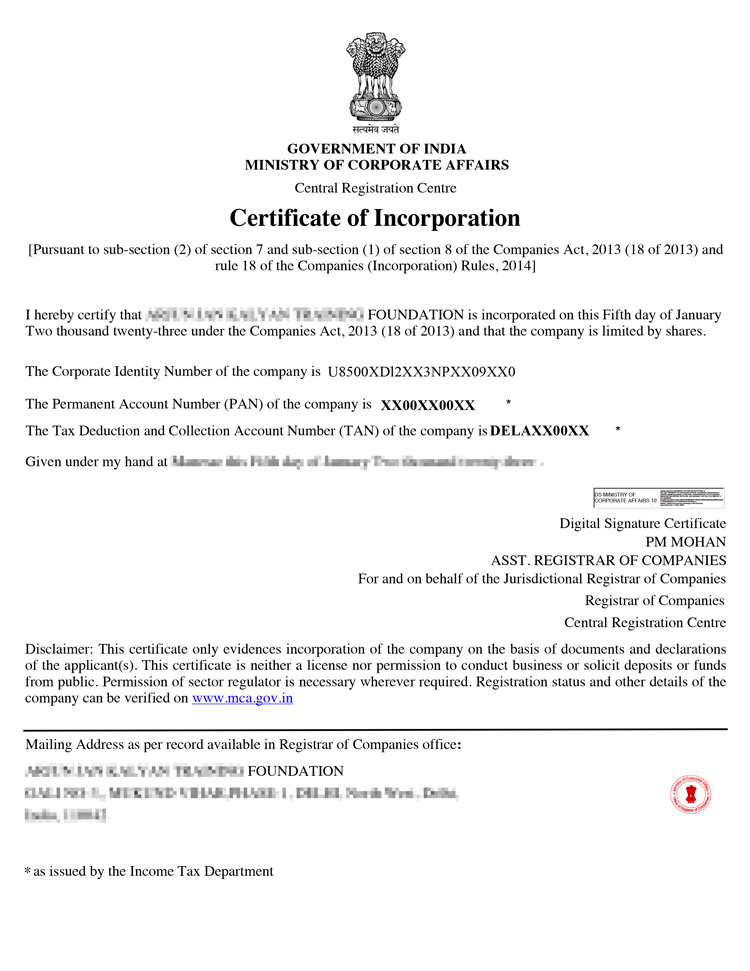

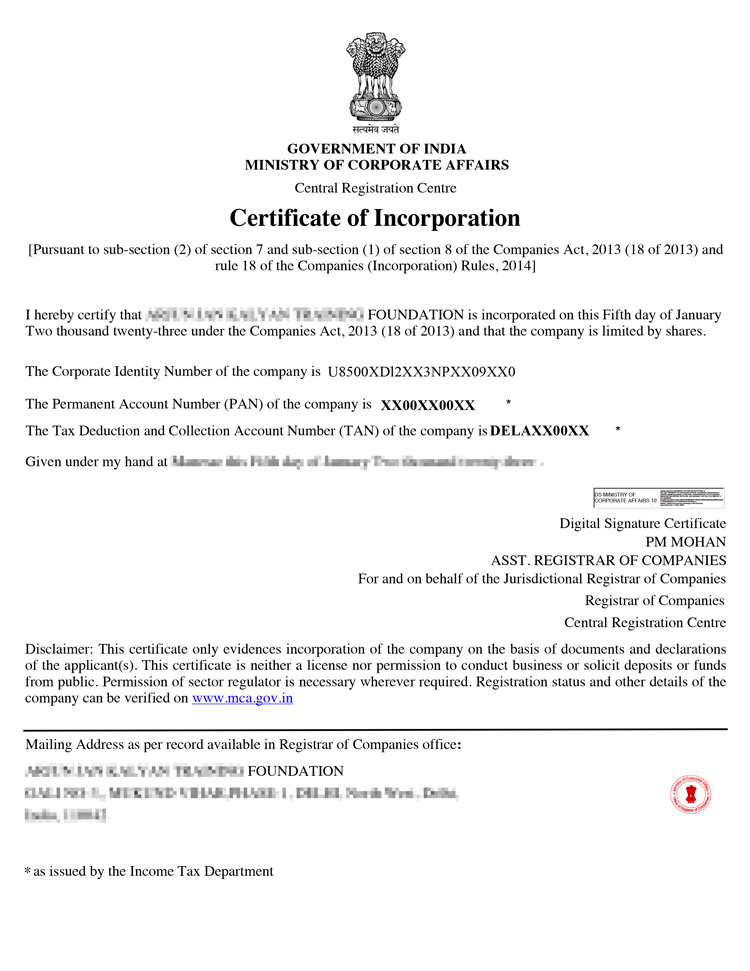

The final step after approval of the documents is issuance of the certificate of incorporation by the Ministry of Corporate Affairs. After getting the certificate, the company needs to open a current bank Account for the company within 2 months of getting the incorporation certificate.

Read this - NGO Registration Complete Process and Fees

Given below is the list of all the necessary documents required for Section 8 Company registration in Tripura.

After successful registration of a section 8 company, you will be provided with the following documents.

Certificate of Incorporation Sample

Section 8 Company Sample Documents

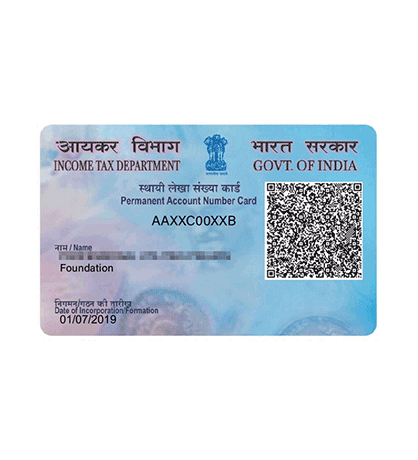

PAN Card Sample Documents

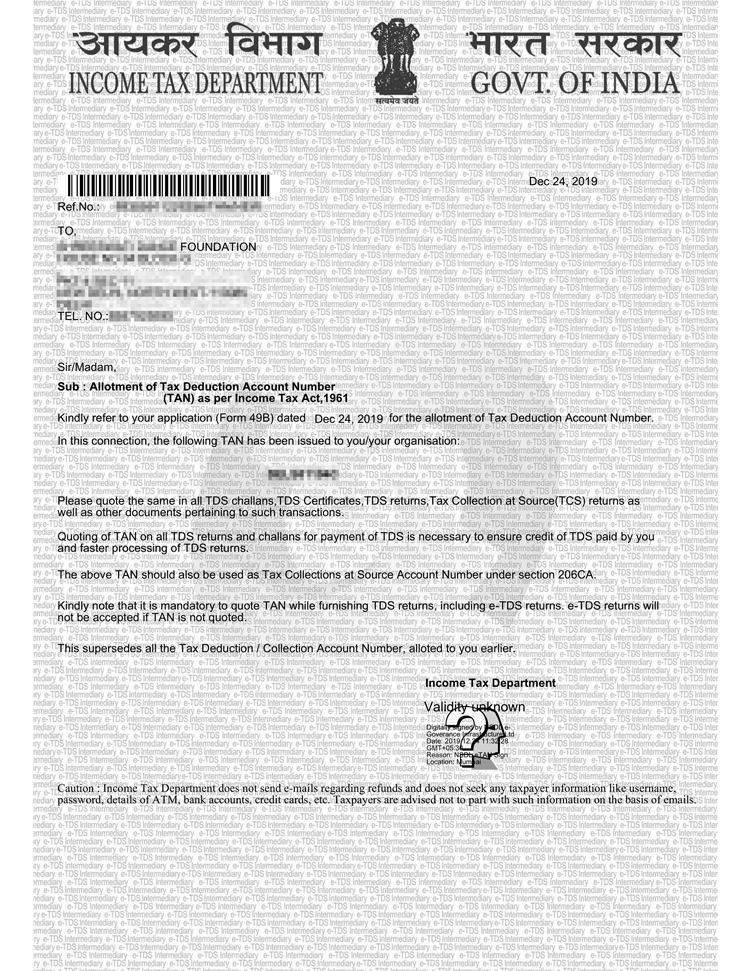

TAN Sample Documents

AoA Certificate Sample Documents

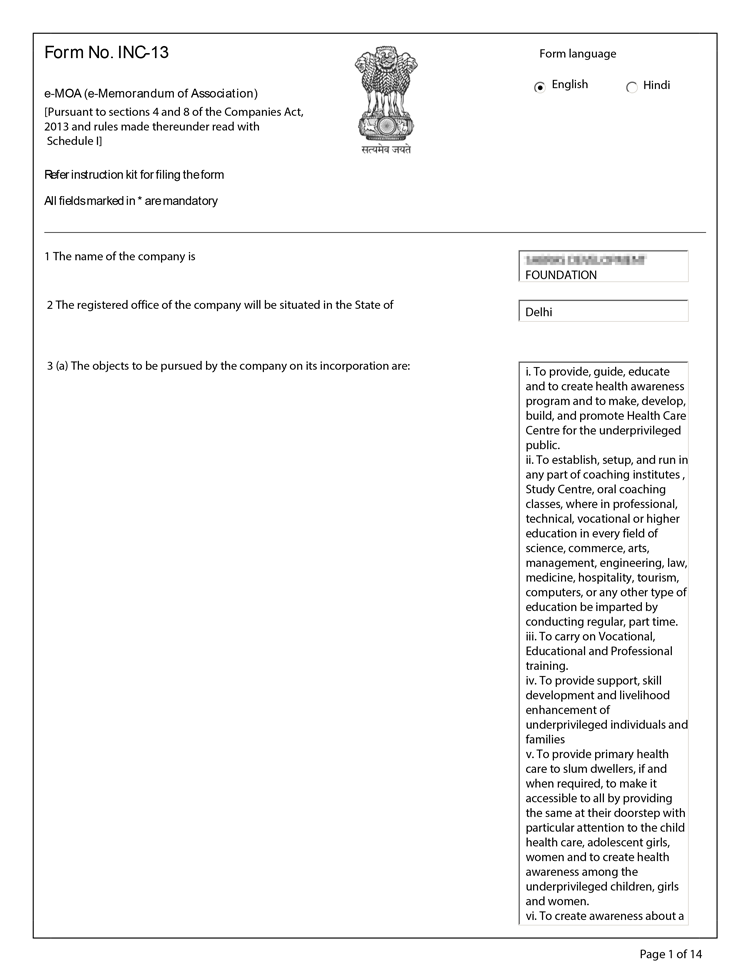

MoA Certificate Sample Documents

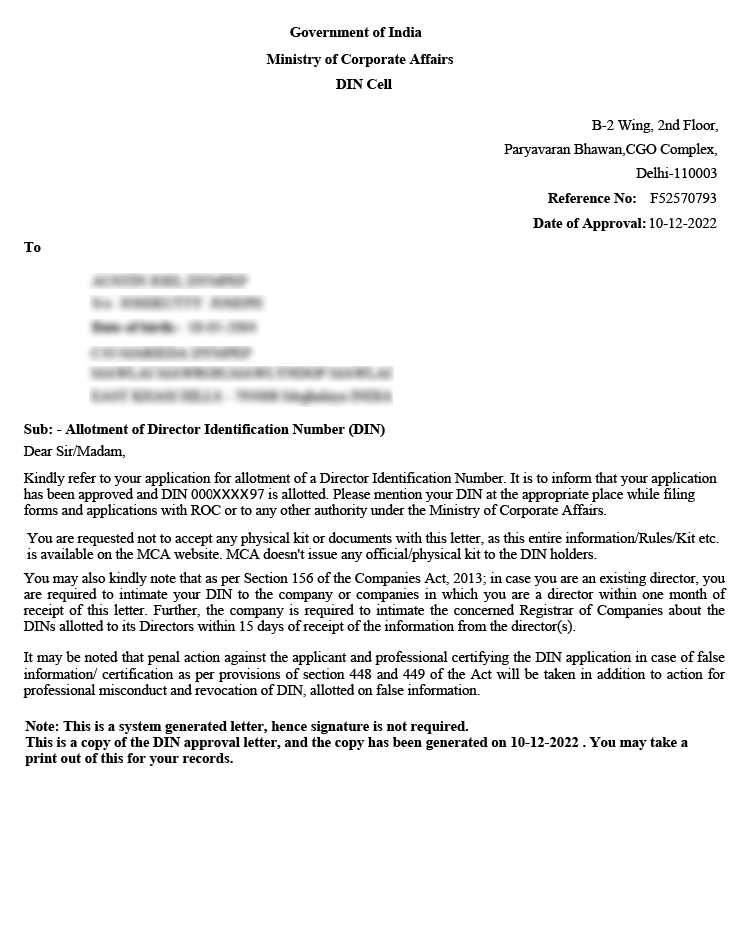

DIN Certificate Sample Documents

DSC Sample Documents

EPFO Certificate Sample Documents

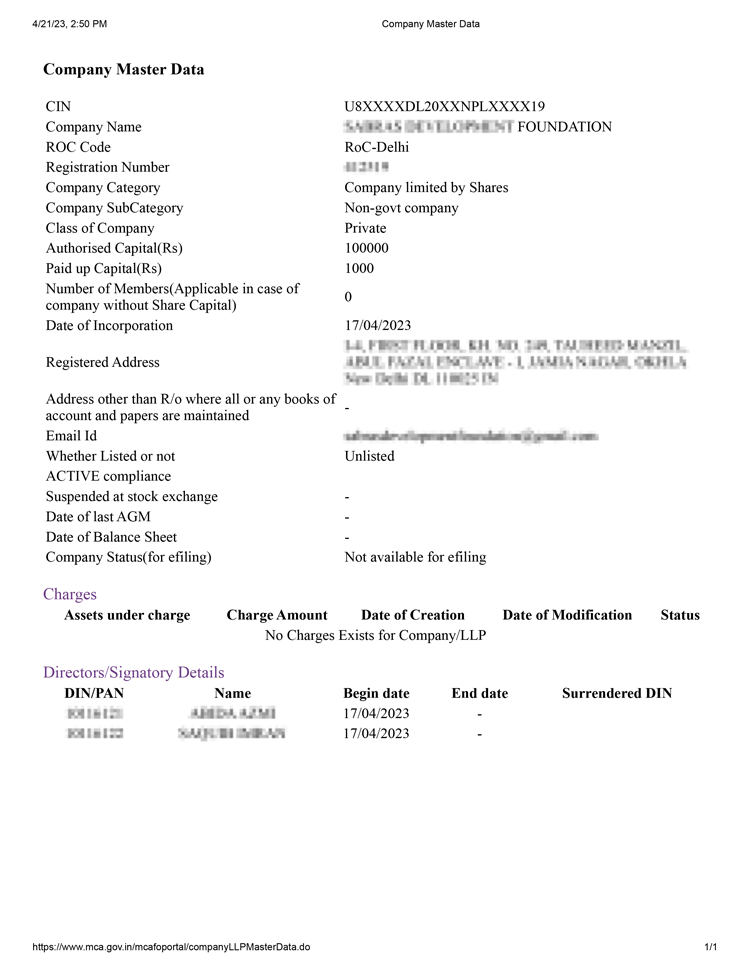

Master data Sample Documents

The total Registration fees of Section 8 company registration in Tripura is Rs 9,499, including Govt Fees and Professional fees of Professional Utilities.

On average, it takes around 10-14 working days to register a Section 8 company in India, subject to document verification by the Ministry of Corporate Affairs (MCA).

| Section 8 Company Registration in Tripura | Registration Fees |

|---|---|

| ✅ Digital Signature Certificate Fee | ₹3,000 |

| ✅ Government Fee(Stamp Duty) | ₹2,500 |

| ✅ Professional Fee | ₹3,999 |

| ✅ Total Cost | ₹9,499* |

Note - The above mentioned state wise registration fees includes registration for 2 members with minimum Authorised capital of Rs 1,00,000, DSC, Government Fees(Stamp Duty) and Professional fees.

The fees may vary if the number of members or Capital is increased or decreased.

Also Check - State wise Registration Fees of Section 8 Company in India

Conclusion

Section 8 company in Tripura is transparent, accountable, and dedicated to promoting social welfare and community service, section 8 company registration is the perfect choice for you. By registering your non-profit venture as a section 8 company, you can access funding and grants, enjoy tax exemptions, and build a strong reputation for your organization. Get your Section 8 Company registered in Tripura today.

To complete your Section 8 company registration in Tripura, you need to submit all the aforementioned documents along with the required registration fees on the MCA portal and then wait for the document verification and approval.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

The Registration fee for a Section 8 company Registration in Tripura is Rs 9,499 which includes for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

To register a Section 8 company in Tripura, you need DSC, a Unique Business Name, file Form, Section 8 License, Form SPICe INC - 32, INC-33, INC-34, and the get Incorporation Certificate. Register with Professional Utilities.

To register a Section 8 Company in Tripura you need to provide with some of the basic documents such as Aadhar Card, PAN Card, Rent agreement, Address proof of Registered office.

Time Required for Section 8 Company Registration in Tripura is 7-14 days.

Speak Directly to our Expert Today

Reliable

Affordable

Assured