The Import Export Code (IEC) is a mandatory registration for businesses engaged in international trade. It is issued by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce and Industry, Government of India. Any enterprise in Sonipat looking to import or export goods must obtain an IEC registration to comply with Indian trade laws.

To get an IEC Code in Sonipat, applicants must submit their request to the DGFT along with the required documents. Once the application is processed, the IEC is issued within 15-20 working days. The best part? The IEC is valid for a lifetime and does not require renewal, remaining active until the business closes.

Unlike GST or PF registrations, IEC registration does not require periodic filings or ongoing compliance. However, businesses must ensure they have an IEC to legally conduct international trade. Importers need an IEC to clear shipments through customs, while exporters require it to claim benefits under DGFT schemes.

Operating an import-export business without an IEC is illegal and can lead to challenges in clearing goods from ports and handling foreign currency transactions. Secure your IEC today and trade seamlessly across borders!

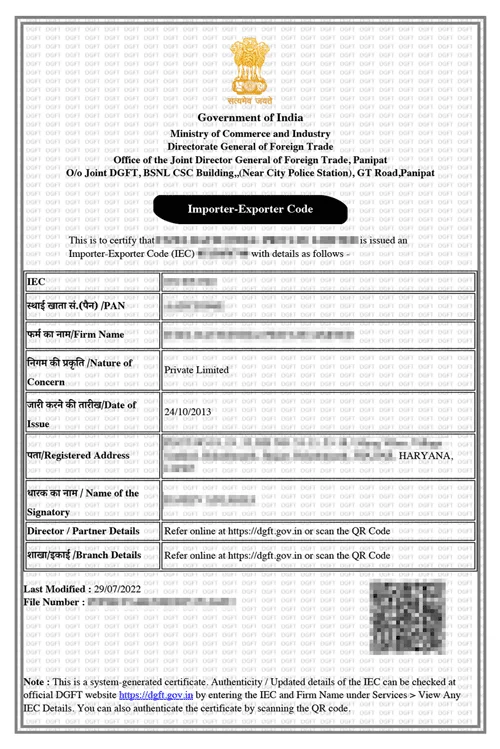

IEC Certificate [Sample]

Table of Content

IEC Code Registration in Sonipat refers to obtaining an Import Export Code (IEC) to start an import or export business from Sonipat. This is a 10-digit unique code issued by the Directorate General of Foreign Trade (DGFT). If you want to import goods from abroad or sell your products internationally, having an IEC is mandatory. Without it, customs clearance, international payments, and legal cross-border trade are not possible.

Obtaining an IEC is a crucial and useful step for Sonipat manufacturers, traders, or company owners who wish to access foreign markets. The process is simple and fully online, requiring very little paperwork. Once you have your IEC, it becomes much easier to import and export goods, work with clients abroad, and take advantage of government export incentives—making global trade straightforward and hassle-free.

Any Proprietorship firm, LLP, Company, Trust, LUF or Individual engaged in any of the following foreign trade activities is eligible for obtaining an IEC Code :

IEC Registration in Sonipat offers several advantages that help businesses carry out smooth and legally compliant import-export operations.

Following documents are required for IEC registration in Sonipat:

The step-by-step procedure of online IEC registration in Sonipat is as follows:

Register your import and export business with Professional Utilities to get your IEC Certificate . You get the free consultations and quick service at lowest Price with us.

Apply for IEC code Now

IEC registration fees in Sonipat cover basic government charges and service costs for a smooth application process.

| IEC Registration in Sonipat | Fees |

|---|---|

| Government Fees | ₹500 |

| Professional Fees | ₹999 |

| Total | ₹1,499 only |

Note: The aforementioned Fees is exclusive of GST.

The Validity of an IEC code is One year . Unlike other government licenses, The Import Export Code was valid for a lifetime. However, after the amendments in Foreign Trade Policy on 12th February 2021, the import-export code has now to be renewed every year.

This amendment made the renewal of Import Export Code details mandatory for every IEC and e-EIC holder. Even if there are no updates in IEC, the same has to be confirmed online on the DGFT portal. Failing to do so may result in the deactivation of your Import Export code.

However, it is generally recommended that any person or business that exports or imports goods must obtain an IEC license. Thus, IEC registration is useful in a variety of situations. These are:

It takes a lot of time and effort to understand the process and upload the right documents. There is a high chance of rejection of the application at each step of document uploading. There are different classes of Digital Signature certificates (DSC) that must be uploaded.

We at Professional Utilities understand completely. That’s why we come forward to help you avoid the hassle and get your Import Export Code registered at the minimum price guaranteed so that you can concentrate on running your business and leave the legal formalities to us.

You can apply for the IEC certificate in just three simple steps with us :

Step 1:

Get in touch via call or contact form

Step 2:

Provide necessary documents

Step 3:

Get your IEC registered in 2 working days

Conclusion

To summarize, the Import and Export Code (IEC) is critical for organizations involved in international trade. This will provide you access to global marketplaces and facilitate cross-border transactions. Registering with the IEC allows businesses to simply manage customs procedures, expand their reach, and capitalize on global opportunities. This period is critical for encouraging growth, ensuring compliance, and laying a solid basis in the dynamic world of international trade.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Yes, Any individual proprietor who is willing to start international trade is eligible for obtaining the Import/Export Code.

At professional Utilities, It takes less than 3 days for the complete procedure of obtaining an IEC code.

You can update the Import Export Code by following these steps :

Documents required for Import Export Code registration in Sonipat are as follows :