Updated on August 23, 2025 05:25:48 PM

Getting an RCMC (Registration-Cum-Membership Certificate) is a crucial step to comply with India's export laws if you are an exporter or intend to launch an export company in Madhya Pradesh. The RCMC, which is issued by Commodity Boards or Export Promotion Councils (EPCs), is evidence that your company is registered with an approved organization, allowing you to take advantage of government programs, export incentives, and benefits.

Exporters operating in a variety of industries in Madhya Pradesh, including engineering goods, pharmaceuticals, textiles, agriculture, and more, must register with the appropriate EPC in order to receive the RCMC. In addition to confirming your exporter status, this certificate enables you to take advantage of the Foreign Trade Policy's (FTP) advantages, such as duty drawbacks, subsidies, and entry to international trade shows run by EPCs.

Businesses must provide the Import Export Code (IEC), GST registration, PAN card, and information about the goods they want to export to apply for RCMC in Madhya Pradesh. Exporters in cities like Bhopal, Indore, Jabalpur, and Gwalior can easily complete the registration process online by using the relevant EPC portal.Madhya Pradesh exporters can increase their credibility, reach a wider audience in foreign markets, and take advantage of the advantages provided by the Indian government to promote trade by using RCMC.

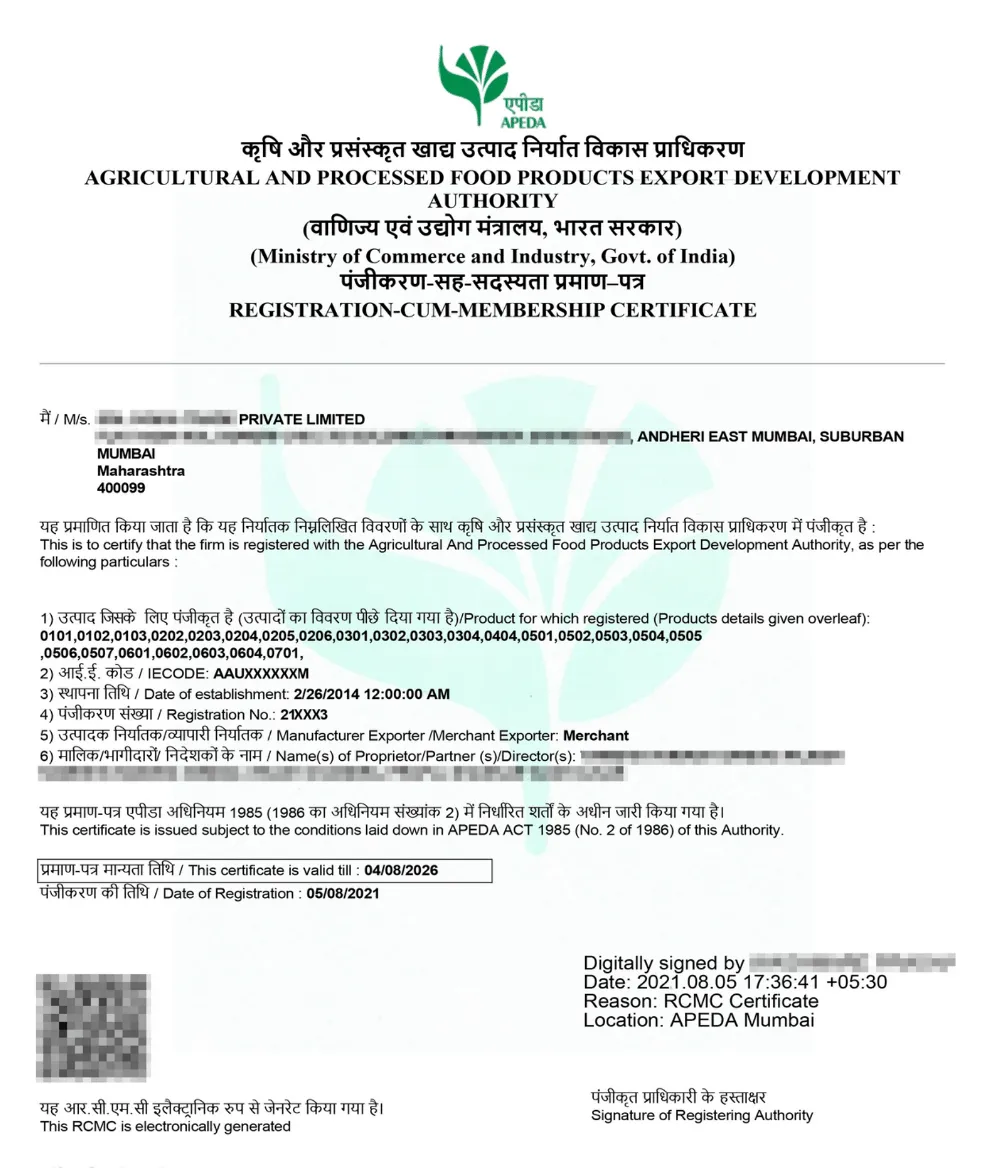

RCMC Sample Certificate

Registration Cum Membership Certificates, or RCMCs for short, are required documents that are issued by Commodity Boards or Export Promotion Councils (EPCs) in India. Businesses or individuals who export goods or services and want to benefit from the Government of India's Foreign Trade Policy (FTP) must have it.

The RCMC attests that the exporter is registered with the appropriate board or council for their product category, such as the Spices Board, APEDA, Tea Board, etc. Accessing export incentives, applying for subsidies, attending international trade shows, and guaranteeing a seamless customs clearance process all depend on it, which is normally valid for five years.

The exporter must have a valid Import Export Code (IEC) and provide the necessary paperwork, application, and fee to receive RCMC. RCMC registration encourages credibility, legal compliance, and company expansion in global marketplaces.

Exporters can align with the Foreign Trade Policy (FTP) and access several benefits that facilitate international business expansion by obtaining an RCMC (Registration Cum Membership Certificate) in Madhya Pradesh. These are the main advantages:

Businesses must prepare and submit several necessary documents to receive an RCMC (Registration Cum Membership Certificate) in Madhya Pradesh from the appropriate Export Promotion Council (EPC).

The process of obtaining an RCMC (Registration Cum Membership Certificate) in Madhya Pradesh involves a few structured steps through the relevant Export Promotion Council (EPC). Here's a step-by-step guide:

Find the Export Promotion Council (such as FIEO, APEDA, ESC, Tea Board, etc.) that is pertinent to your goods or services.

Gather all required paperwork, including the product list, GST, PAN, business proof, IEC certificate, and other documents listed on the checklist.

Visit the concerned council's official website or, if they accept offline applications, stop by their Madhya Pradesh office.

Fill out the RCMC application, which is available online or in the format specified. Only digital applications are needed for certain EPCs.

If applying online, attach scanned copies of the necessary paperwork, or if submitting offline, attach hard copies.

As directed by the EPC, pay the relevant membership and registration fee online or by demand draft.

The documents will be checked by the council. Your application will be accepted if all the information is accurate.

The RCMC certificate is issued after approval, typically in 7-10 working days. It is good for five years after it is issued.

The fees for RCMC (Registration Cum Membership Certificate) registration in Madhya Pradesh vary depending on the Export Promotion Council (EPC) you register with and your business type (e.g., manufacturer, merchant exporter, MSME).

| Export Promotion Council (EPC) | Category / Products | Government Fee ($) |

|---|---|---|

| FIEO (Federation of Indian Export Organisations) | General exporters (all products) | $8,000 – $10,000 + 18% GST (based on turnover) |

| APEDA (Agricultural & Processed Food Products Export Development Authority) | Agri & food product exporters | $5,900 (valid for 5 years, including GST) |

| EEPC India / CAPEXIL / CHEMEXCIL / PHARMEXCIL | Engineering goods, chemicals, and plazmas | $6,500 – $10,000 + GST (varies with turnover slab) |

| SEPC (Services Export Promotion Council) | IT, healthcare, logistics, and other services | $3,540 – $5,00,000 (based on export turnover) |

| CEPC (Carpet Export Promotion Council) | Carpet, rugs, and floor coverings exporters | $7,080 – $0,440 (annual + entrance fees, incl. GST) |

Note: Professional Fee for RCMC Registration in Madhya Pradesh starts from @5,000.

In order to prove their registration with the appropriate Export Promotion Council (EPC) and receive benefits under the Foreign Trade Policy (FTP), exporters in Madhya Pradesh must obtain an RCMC (Registration-Cum-Membership Certificate). RCMC assists you in claiming incentives, duty drawbacks, and trade promotion programs, regardless of your business's focus: engineering goods, textiles, chemicals, services, or agricultural products. Exporters can increase their credibility and reach in foreign markets by selecting the right EPC and registering on time.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

An RCMC is required for any exporter, whether they are selling goods or services, who wishes to take advantage of the Foreign Trade Policy's benefits or incentives.

The RCMC is valid for one fiscal year (April–March) for the majority of EPCs. APEDA does, however, provide five-year registration.

Depending on turnover and product category, most EPCs charge fees ranging from ₹5,000 to ₹10,000+GST. Depending on turnover, service exporters (SEPC) might be required to pay higher fees.

Yes, by providing the IEC, GST, PAN, and product details, RCMC applications can be submitted online through the official portal of the relevant EPC.

For registration, you must provide your PAN card, GST registration certificate, business registration paperwork, product details, IEC (Import Export Code), and identification documentation.

Yes, both manufacturer exporters (who produce goods) and merchant exporters (who trade companies) are eligible to apply; however, they must register with the appropriate EPC according to the category of their goods or services.

Following application submission and fee payment, the majority of EPCs issue the RCMC in 7–10 working days if all paperwork is in order.

If you want to take part in trade shows or claim incentives or benefits under the Foreign Trade Policy (FTP), you must have RCMC. Having RCMC increases credibility with foreign buyers, but not all exporters are required to obtain it.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions