Updated on October 14, 2025 05:27:40 PM

Establishing a Noida import-export company, getting your Import Export Code registration is the first crucial step. The Directorate General of Foreign Trade (DGFT) issues this special 10-digit code, which is commonly known as IEC registration in Noida. It is required for people and companies engaged in international trade in goods and services.

A valid IEC code in Noida is your legal authorization to conduct international trade operations, regardless of your plans to import electronics, textiles, machinery, or export software services, handicrafts, or agricultural products. You cannot open a foreign exchange account, clear customs, or take advantage of government incentives and benefits without an IEC.

The process of IEC registration in Noida is completely online and user-friendly. It requires minimal documentation, just a PAN card, address proof, bank details, and a passport-sized photo. Once issued, the Import Export Code remains valid for a lifetime and doesn’t require renewal.

Getting your Import Export Code registered in Noida is the best course of action if you're a trader, manufacturer, or service provider looking to grow internationally. It not only guarantees adherence to the law but also provides access to fresh global business prospects.

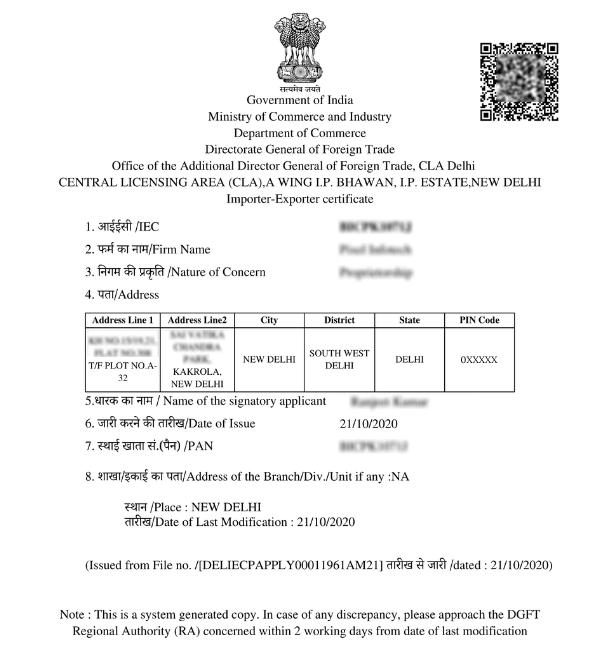

IEC Certificate [Sample]

Table of Content

IEC code is a 10-digit code issued by the Directorate General of Foreign Trade (DGFT) to ease foreign trade in India.

You cannot import or export goods in Noida without IEC license or IEC code registration. Once the IEC code is issued, an exporter can apply for port registration on the Icegate portal with the help of AD Code Registration.

For IEC code registration, the following documents are required :

Importer Exporter code is the primary requirement to enter the international market and expand your business. While an IEC code allows you to operate an import-export business in Noida, it has many additional benefits. Some of them are listed below :

Register your import and export business with Professional Utilities to get your IEC Certificate . You get the free consultations and quick service at lowest Price with us.

Apply for IEC code Now

Any Proprietorship firm, LLP, Company, Trust, HUF or Individual engaged in any of the following foreign trade activities is eligible for obtaining an IEC Code :

You can register for the Importer Exporter code offline as well as online. The online registration process is effortless, and you don’t need to go anywhere. The process is carried out in 5 steps :

The Directorate General of Foreign Trade(DGFT) is an online government portal where you can register for an import-export license. Therefore, your first step is to register on this portal.

The second step is the application phase, where all your documents are arranged and prepared for application. Refer to the documents required for better understanding.

An importer/exporter must file an online application in ANF 2A(i) and submit the required documents for verification. You also need to pay the government fees to complete the application process.

Once your application is submitted, it is sent to DGFT for verification. In case there is wrong or incomplete information, Your license will be canceled. So, make sure you provide the correct information.

Your IEC code will be issued after the approval by DGFT. In the case of the online application, you will get an e-IEC. Once approved by the competent authority, DGFT will notify you through email or SMS that your e-EIC is available on the DGFT website.

IEC Registration cost in Noida :

| IEC Registration | Fees |

|---|---|

| Government Fees | ₹500 |

| Professional Fees | ₹999 |

| Total | ₹1,499 only |

Note: The aforementioned Fees is exclusive of GST.

The Validity of an IEC code is One year. Unlike other government licenses, The Import Export Code was valid for a lifetime. However, after the amendments in Foreign Trade Policy on 12th February 2021, the import-export code has now to be renewed every year.

This amendment made the update of Import Export Code details mandatory for every IEC and e-EIC holder. Even if there are no updates in IEC, the same has to be confirmed online on the DGFT portal. Failing to do so may result in your Import Export code deactivation.

The complications in understanding the process and uploading appropriate documents are very hectic. It takes a lot of time and effort. There is a high chance of rejection at each step of document uploading.

We at Professional Utilities understand that completely. That’s why we come forward to help you avoid the hassle and get your Import Export Code registered at the minimum price guaranteed so that you can concentrate on running your business and leave the legal formalities to us.

You can apply for the IEC registration with us in just three simple steps.

Step 1: Fill the Form

Please fill out our simple form and receive a callback from our team of experts.

Step 2: Submit Documents

Provide all the required documents for the Import Export code registration of the company and make a 50% payment in advance.

Step 3: Get your IEC code

Your Import export code will be delivered to you, and you will have to make the remaining payment.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

Documents required for Import Export Code registration in Noida are as follows :

No, You can not do any import/export without the IEC code. Your goods will not be allowed to pass the ports without an IEC code. However, it is not required to import or export goods for personal use.

DSC is not mandatory for an IEC certificate. DSC has been introduced in IEC registration to strengthen the application process. You can sign the application with Aadhaar authentication.

DGFT(Directorate General of Foreign Trade) issues and updates the Import Export code.

To become a registered exporter, you need to get an IEC registration. Once you obtain the I importer Exporter code, you are allowed to export goods from India. The code is also valid for importing goods in India.

Talk to us. Get in touch with our team to find all import-export-related answers. Our expert will guide you throughout the entire process. Call us at @9716711090 or write to us at support@professionalutilities.com.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions