The government has taken so many steps to protect the payment of MSME enterprises, one of such step is the MSME samadhan portal. The MSME samadhan portal offers the registered MSME enterprise to file complaint regarding pending dues from the parties. Any enterprise having valid Udyog Aadhaar can apply for recovery of payment through MSME samadhan website.

The following are the other salient features of MSME Samadhan:

a.The buyer is liable to pay compound interest with the monthly rests to the supplier on the amount at the three times of the bank rate notified by RBI in case he does not make payment to the supplier for his supplies of goods or services within 45 days of the acceptance of the goods/service rendered.

b.Every reference made to Micro and Small Enterprise Facilitation Council (MSEFC) shall be decided within a period of ninety days from the date of making such a reference as per provisions laid in the Act.

c.If the Appellant (not being the supplier) wants to file an appeal, no application for setting aside any decree or award by the MSEFC shall be entertained by any court unless the appellant (not being supplier) has deposited with it, the 75% of the award amount.

Details & Document required to apply for recovery on MSME samadhan portal:

1.Udyog Aadhaar Number

2.Purchase and Sale invoices for which recovery is to be made

3.Work order for all the Sales Invocies is required

Procedure for applying for recovery on MSME samadhan portal:

The following are the steps for applying for recovery on MSME samadhan portal:

Step 1: Go to https://samadhaan.msme.gov.in/MyMsme/MSEFC/MSEFC_Welcome.aspx and click on “Case filing for Enterpreneur/ MSE units”

It will redirect you to “Enterpreneur validation” page.

Step 2: Enter your details:

After coming to Enterpreneur validation page enter the following details:

1.Udyog Aadhaar Number

2.Mobile number registered on Udyog Aadhaar

Enter the details, the verification code or captcha code and Click on “Validate Udyog Aadhaar” button

Step 3: Application for recovery

Now we will apply for payment recovery with the Micro and Small Enterprise Facilitation Council.

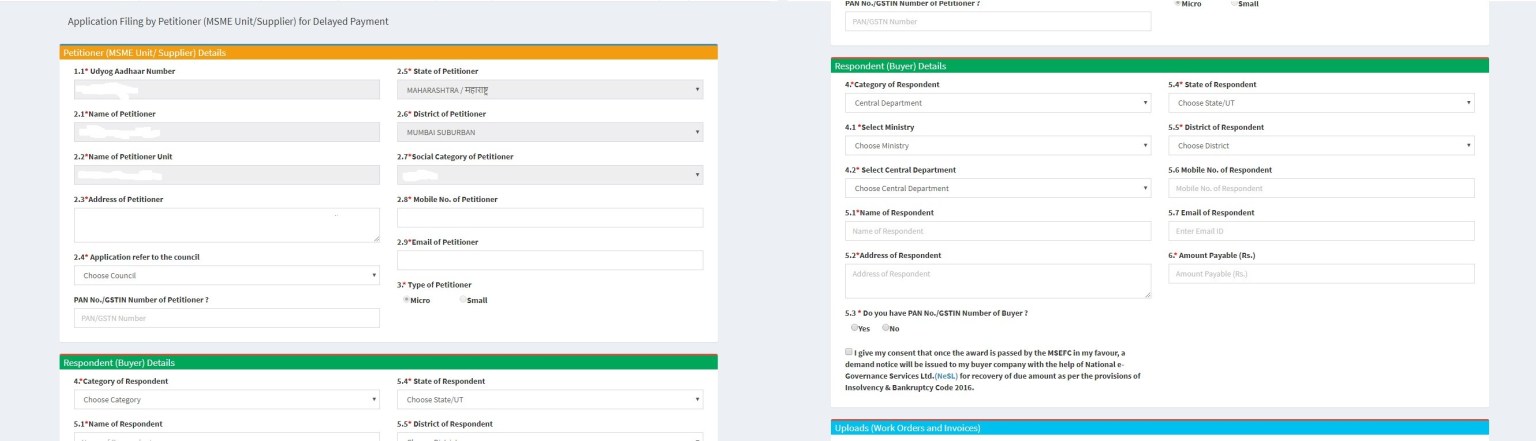

Select “ Application Entry” it will redirect you to “Application Filing by Petitioner (MSME Unit/Supplier) for Delayed Payment” page. Your address is prefilled by the website. Enter the other details as below:

1.Select the “application refer to council” it the MSEFC jurisidiction under which your application will be transferred.

2.PAN or GSTIN number of the Petitioner i.e. of your entity

3.Enter the buyers details against whom the complaint is to be filed. The details include

1.Category of buyer

2.State of the buyer

3.elect the Ministry under which the buyer comes i.e. Ministry of commerce or industry or Ministry of home affairs etc.

4.Choose the district of the buyer

5.Name of the buyer entity

6.Address of the buyer

7.Mobile no and email id of the buyer if any

8.Total amount payable by the buyer

9.In case you are having the GSTIN or PAN number enter the same

4.After providing above details select the consent check box.

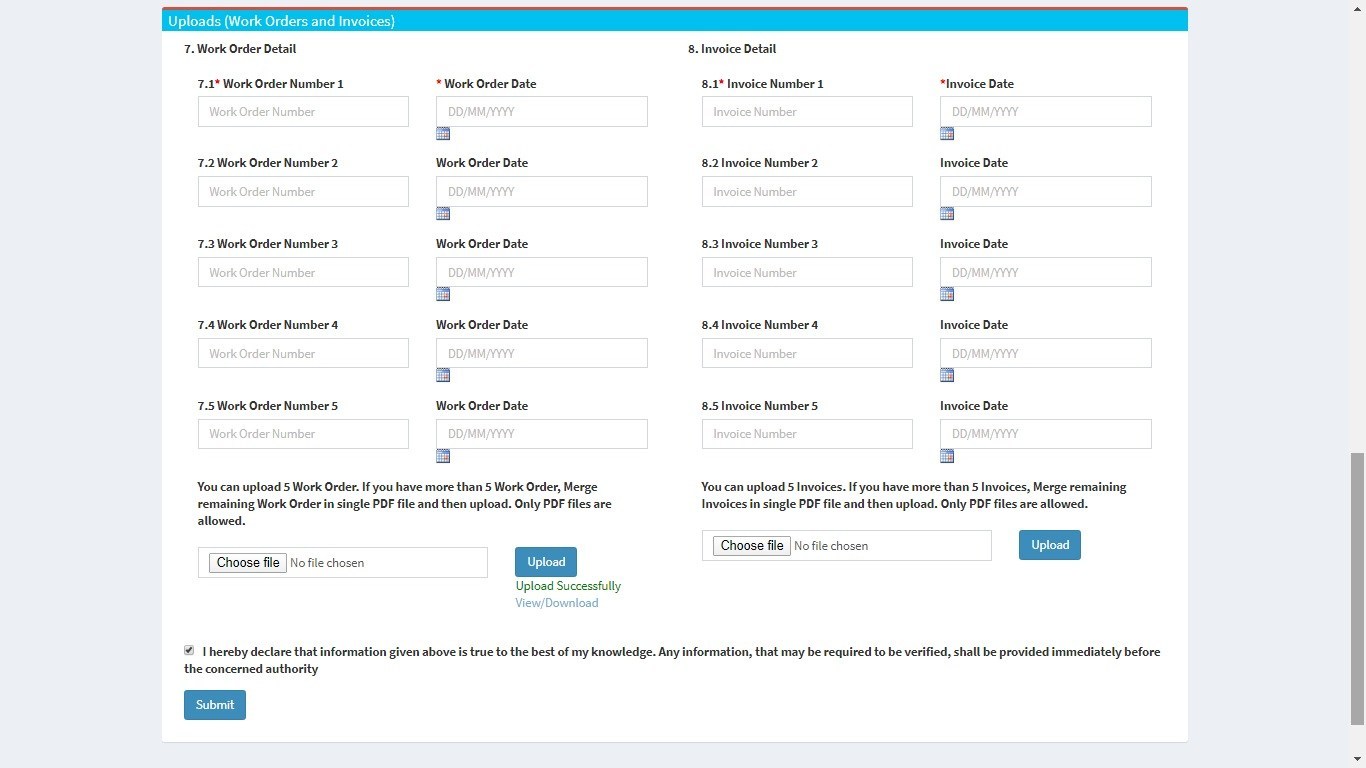

Upload work orders and Invoice details related to the buyer. You can upload a maximum 5 work orders and 5 invoices per buyer or party. You have to merge all the work order and invoice in one file as we can upload only one single file.

*After entering the details and uploading the required documents click on “Submit” button. It will redirect to final submit page.

*After redirecting to Final submit page, enter the verification code and click on “Final submit” button. Your application will get submitted on the portal and you will receive notice on your registered email id.

After you have submitted the application, you will receive communication from the MSEFC once the application is taken up by the council. Normally, it takes 2 to 3 months for the application to be reviewed by the MSEFC office. This timeline is important to keep in mind, especially when managing financial matters such as Credit Card Debt Settlement .

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

.svg)