Updated on January 30, 2026 07:28:41 AM

TDS Return Filing is one of the many services offered by a virtual CFO. TDS stands for tax deducted at Source. A deductor needs to file a TDS return apart from depositing the tax to the Income tax department. It is mandatory to file the TDS return within the due date to avoid the penalty under section 234 E of the Income Tax Act.

Filling out a TDS return may be a tedious task, but it avoids the burden of paying a huge sum of taxes collectively at a time because TDS returns are filed quarterly. Moreover, the TDS return filing provides multiple benefits to taxpayers and the government.

A growing startup has a lot going on simultaneously to keep up with the competition. There is a high chance of missing the TDS return filing within the deadline as it requires time and effort and must be done under the guidance of an experienced tax professional. It is advised to outsource the TDS return filing to a virtual CFO who will file your TDS return properly and ensure that you are not missing any due date of filing your TDS return.

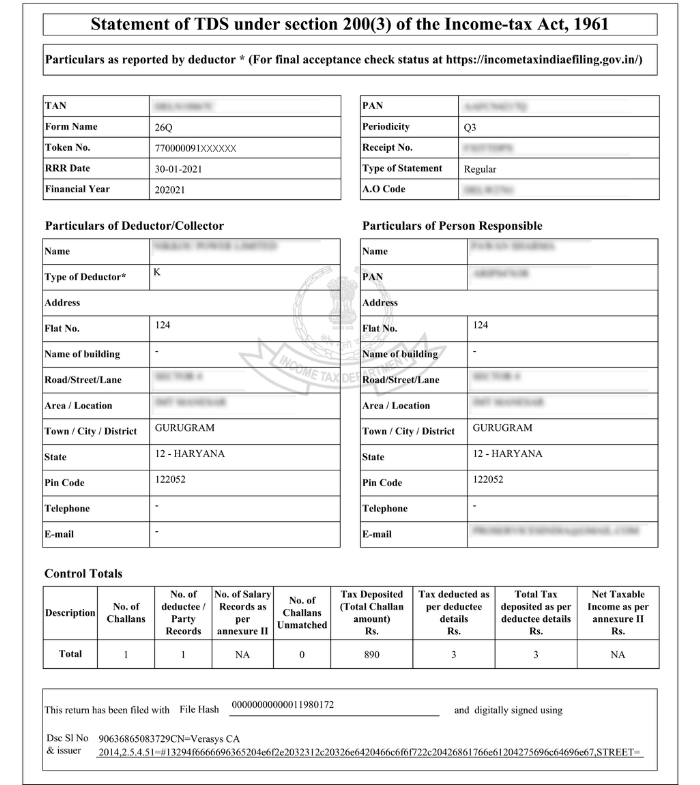

TDS Return Sample

Chief Financial Officer or CFO is the highest-ranking financial expert in an organization who is in charge of the company's financial stability. A CFO is responsible for managing the accounts and finance of a company by tracking the cash flow, analyzing the firm's financial ups and downs, and meeting the company's overall financial goals.

A full-time CFO works at a higher pay rate. That's why established brands and large-sized businesses hire a full-time Chief Financial Officer to meet their accounting and compliance goals because they have surplus resources to invest. But It's really challenging for small businesses, startups, and prosperous entrepreneurs to go for an in-house CFO. The concept of virtual CFO has been introduced to tackle this challenge.

Virtual CFO services are the external financial support provided by skilled Chief Financing Officers to startups and small businesses who can't afford to hire a highly paid in-house CFO. When a business is in a growing phase and trying to scale, It becomes quite important to track its cash flow, maintain its financial data, create a budget, and acquire capital.

But, Every startup needs more funds to afford a traditional CFO, and having a CFO in a small and medium enterprise seems too much to handle. A virtual CFO is the best alternative for getting the major financial tasks done without spending huge bucks on hiring a full-time CFO, and that too with an affordable price. A virtual CFO provides professional support in tasks like GST compliances, TDS return Filing, Bookkeeping, Legal support, and much more.

You can outsource your financial and accounting tasks to a professional virtual CFO without disturbing your budget. That's why a virtual CFO is sometimes called an outsourced CFO. Virtual CFO services are provided either remotely or through an external service provider.

In the age of fierce business competition, it has become a necessity to keep up with financial goals. Whether you are a large enterprise or a new startup, you need the services of a CFO to keep your company's finances structured and organized. An outsourced financial expert takes off a huge load from the company's stakeholders so they can focus entirely on the core business.

A CFO is necessary for every business because they provide:

Numerous transactions take place in a business daily. A CFO will record those financial transactions and provide you with the financial statement report.

There is a lot of work in the entire process of invoice management, including:

You can outsource these tasks to a CFO.

There is a lot on the plate of an entrepreneur. In a hectic schedule, it is possible to miss filing tax returns within the due date. A professional CFO makes sure that your tax returns are filed on time.

It is really important to analyze, track and report your business income. An outsourced CFO will create a formal record depicting a firm's financial performance at a given time.

A business needs a CFO to maintain a good cash flow that will help you to build your business and invest in new opportunities while covering costs.

A range of expertise: A virtual CFO has the experience of working with many different businesses. They will use their diversified expertise to help in business growth. On the other hand, a full-time CFO has experience in only a handful of industries.

Affordable CFO services: Virtual CFO services are mostly project-based or time-based. It is a cost-effective alternative to the in-house CFO, who charges a high amount. You only need to pay a virtual CFO when you need their services. It is not necessary to add it to your payroll.

Flexibility: Working with a virtual CFO is flexible because you are not bound to work with a single professional. You can always switch from one CFO to another and get insights into multiple talents. That may result in the huge growth of the company.

Less time taken in learning: Training a new employee in your company takes tons of time and effort. Sometimes, you need to give several months to get the best out of an employee. But, when it comes to a virtual CFO, know how to get familiar with a new brand and take less time to onboard at a new company.

Quickly Adaptable to your needs: A virtual CFO fits quickly in your work environment because they have already worked with multiple brands and know how to adapt to the new role. It brings a great amount of value to your business.

Professional Utilities provides affordable Virtual CFO services for TDS return filing to individuals, private limited companies, Sole proprietors, and LLPs who are liable to pay taxes. The virtual CFO team is backed by highly skilled chartered Accountants(CA) and Company Secretaries(CS) to ensure timely TDS return filing.

When you approach Professional Utilities for TDS Return virtual CFO, you can expect the following services:

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions

TDS returns are a compilation of all transactions. It is a quarterly statement that must be submitted to the Income Tax department by the payer or deductor.

A virtual CFO is hired at an affordable cost depending upon the needs. Contact us for any assistance regarding the TDS return filing. We will discuss your requirements and decide the charges.

Yes, the deductor is required to file a TDS return with the Income Tax Department each quarter. Otherwise, he will be subject to late fees under Section 234E as well as a penalty under Section 271H.

Filling out a TDS return may be time-consuming, but it saves you from having to pay a large sum of taxes all at once because TDS returns are filed quarterly. When you hire a reliable virtual CFO, You will now have more time to focus on your core business.

Speak Directly to our Expert Today

Reliable

Affordable

Assured