To start a Retail shop it is important to get a license so that businesses can legitimize in the eye of the customer as well as the Government. Due to this three-way trust relationship is developed. Even online retail shops need to obtain licenses. The license can be obtained in three ways like GST Registration, Business Registration, and Shop and Establishment License

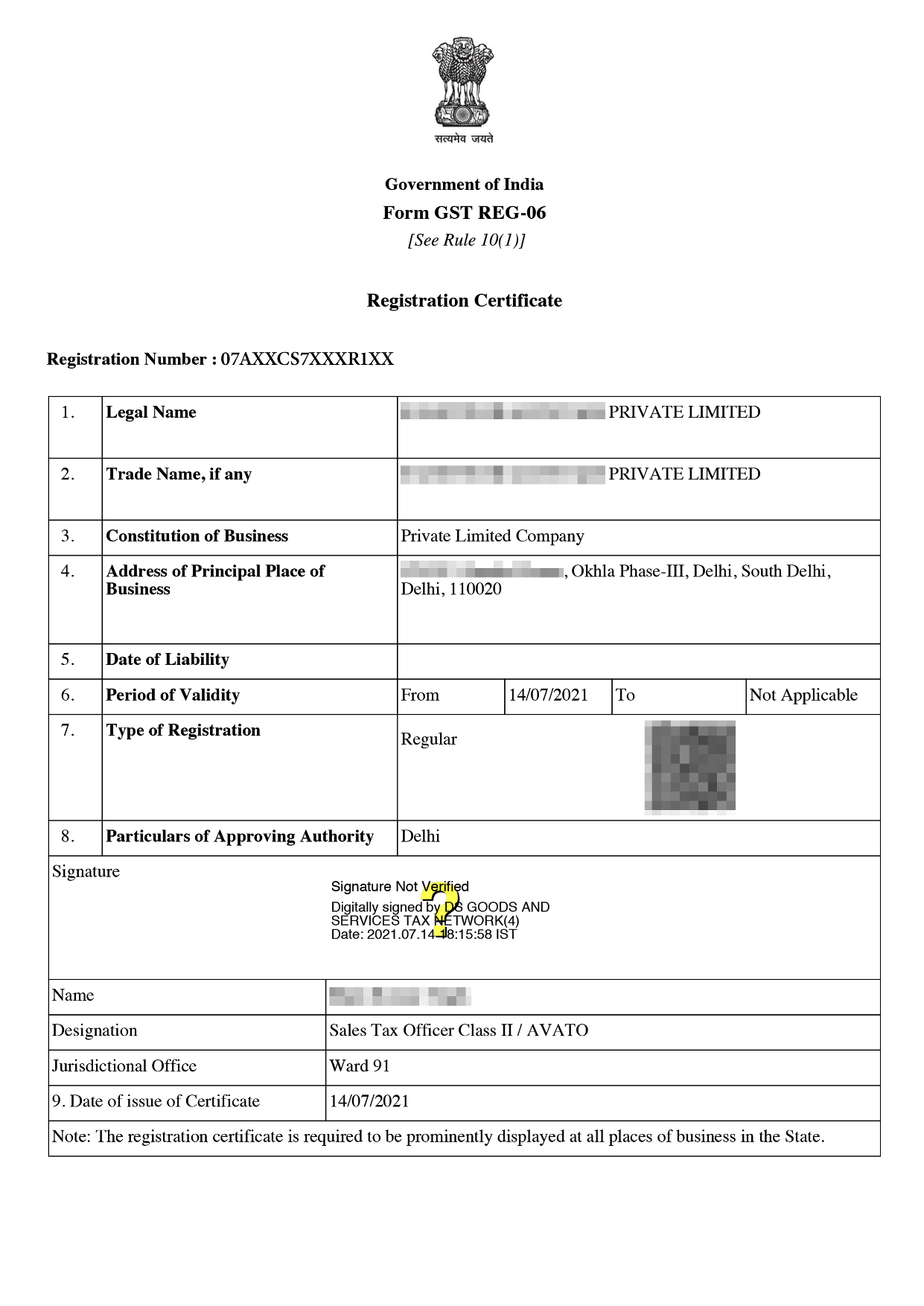

GST Registration Certificate Sample

To start the retail shop there are certain permits that need to be taken. This licensing depends on the location and nature of the business and has to be taken as required by relevant authorities or local government.

Within 30 days of the chief inspection apply for the Shop and Establishment License by filling out the application.

GST Registration should be applied when turnover exceeds 40 lakhs in supply of the goods and 20 Lakhs in supply of the services.

There are three types of licenses required by the Retail shop mentioned below -

Shop and Establishment License - This type of license is required to protect the interest and rights of the employed worker.

Business Registration - Retail shops should obtain these licenses because a larger turnover is involved.

GST Registration - If the turnover of the business exceeds the threshold limit of 40 lakhs for the supply of goods and 20 lakhs for the supply of services. Then this GST Registration is obtained.

To get the License application filling out the form, uploading the required documents, and paying the prescribed fee are required

Documents required for the GST Registration

Documents required for the shop and establishment registration certificate are-

Both parties have a lower risk - Both parties are at risk if neither possesses a business license. However, business licensing guarantees the legal protection of both the licensee and the licensor.

Legally safeguard - It is also crucial to be aware that different cities may have different legal criteria for obtaining a permit. Make sure your business satisfies all requirements before submitting an application for a business license.

Foreign market entry - It is also very important to be aware that various cities might have various legal requirements for acquiring a permit. Before you file an application for a business license, be sure your company complies with all standards.

Increase in credibility - Business licensing guarantees the legal protection of both the licensee and the licensor. The risks associated with product development, production, market testing, and distribution are minimal.

General Merchandise Stores - When a variety of products are sold through large stores.

Grocery Stores - It is a store that can be set in a physical location or Speciality Stores. It is the most popular retail.

Discount Stores - It provides an exclusive range of discounted rates for the product and services.

Departmental Stores - It is a store in which under one roof variety of products are sold.

Conclusion

A retail establishment is a store where sellers can sell products. The retail shop is in the respective state, licenses are issued by the labour department. There are many benefits of the license of the retail shop as it increases credibility, lower the risk, legal safeguard, and many others.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions

A trade license gives permission to conduct any business or trade in a specific location. This license will be issued by the local municipality. Obtaining one of these licenses has different requirements in each state.

You have 30 days to submit an application to the Chief Inspector for a Shop Act Registration if you are the owner of a store or any other commercial institution that conducts business in India. By filing an application, you can request a Shop and Establishment Act Licence in your state.

Yes, all small firms register for GST since the GST Act requires them to do so. If you are a maker of goods with an annual turnover of more than Rs. 40 Lakhs, you should definitely think about getting a GST for small businesses. Businesses in the services industry earn more than Rs.20 lakhs.

Speak Directly to our Expert Today

Reliable

Affordable

Assured