Updated on January 30, 2026 07:27:48 AM

The GST registration limit for restaurants in India sets the income level at which a restaurant can legally register under the Goods and Services Tax (GST) system. The restaurant industry in India is developed quickly, from small cafes to big dining chains. It is important for restaurant owners to understand and follow this limit to stay obedient with the law and build trust with customers.

GST gives restaurants a unique GST Identification Number (GSTIN), which helps them collect taxes, submit tax returns, and claim Input Tax Credit (ITC) on eligible purchases.

At Professional Utilities, we help restaurant owners in completing the GST registration process by handling all the important documents and filings with proper support.

Whether you run a dining place, food court, or cloud kitchen, knowing the current GST registration limit assure easy business operations, clear billing, and full legal compliance. This page has all the information you need about the current turnover limit, the advantages of GST registration, and the process for registering in 2025.

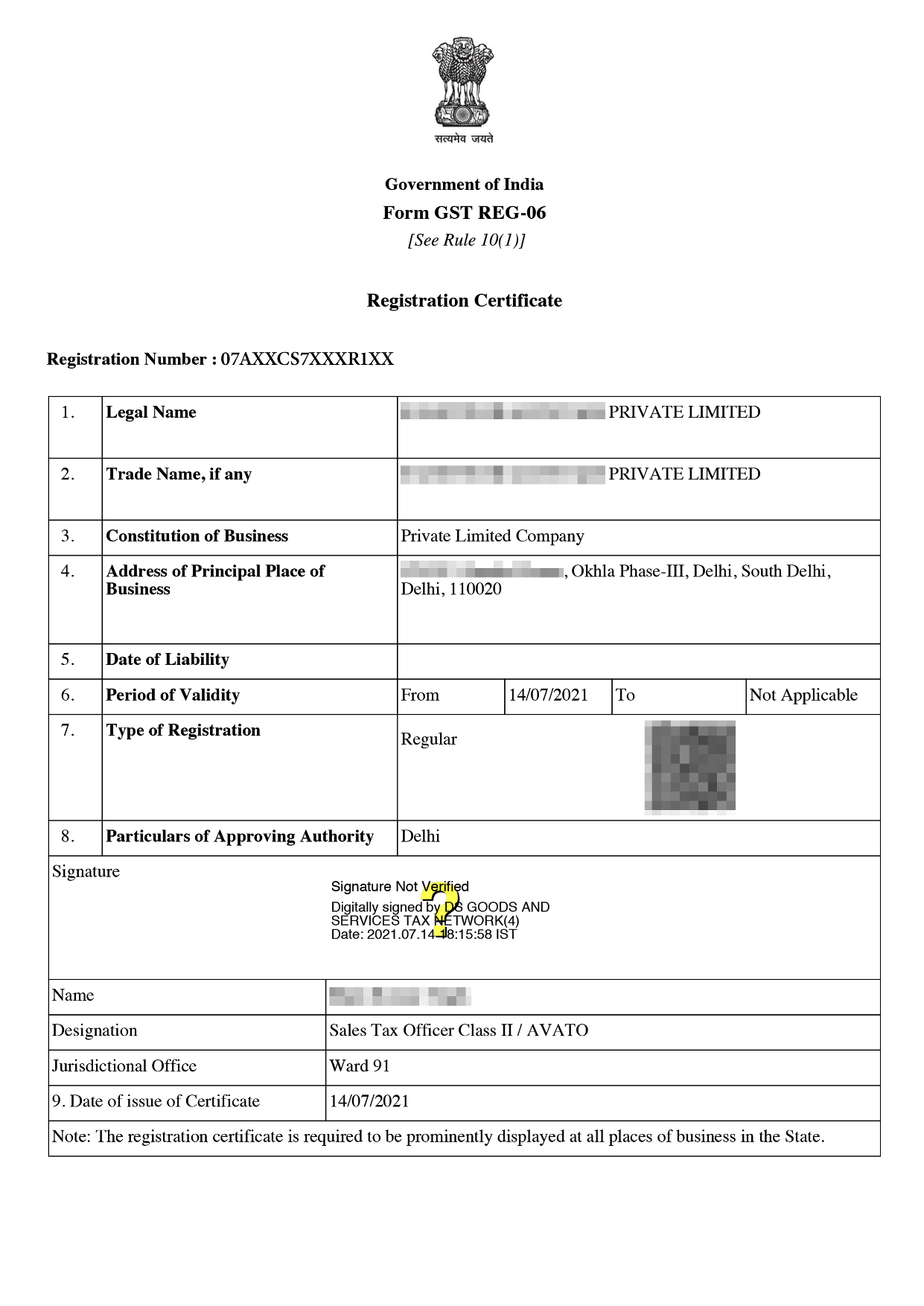

GST Registration Certificate Sample

Table of Content

The GST registration limit for restaurants is the lowest annual turnover required to register under India's Goods and Services Tax (GST) system. Restaurants and catering services must register for GST if their annual revenue exceeds ₹20 lakh in regular states or ₹10 lakh in special category states, such as North-Eastern and hilly regions.

The limit applies to the full value of both taxable and exempt supplies, but it excludes GST and inward supplies due to reverse charge. Restaurants with a turnover below the limits may still choose voluntary GST registration to benefit from increased business trust, eligibility for Input Tax Credit (if applicable), and easy functionality with platforms such as Zomato and Swiggy. Regular turnover analysis helps restaurants register on time and in full accordance with the GST Act.

| Category of the Restaurants | Rate of interest |

|---|---|

| Composite/Normal outdoor catering within the hotel (room traffic is more than 7500/-) | 18% on ITC |

| Composite/ Normal Outdoor catering within the hotel(room Trafic less than 7500/- | 5% without ITC |

| Restaurants within the hotel equal more than 7500/- | 18% on ITC |

| Restaurants within the Hotel less than 7500/- | 5% without ITC |

| Standalone Outdoor/catering services | 5% without ITC |

| Railway/ IRCTC | 5% without ITC |

| Drinks/Food without A/C | 5% without ITC |

| Drinks/Food having A/C | 5% with ITC |

| Drinks/Food with A/C in 5-star Hotel | 18% |

One Unified Tax - Multiple Taxes levied on restaurants like a luxury tax on rooms rented, Excise on the production of pastries, entertainment tax on tickets to events, VAT on dining establishments, and service tax on lodging and dining establishments are bought under compliance of one law.

Input Tax Credit - Many Taxes are paid on acquisition such as excise paid on procurement of furniture, Entry Tax paid on machinery, packaged foods, and excise paid on procurement of furniture. All these taxes are allowed to be taken as credit provided they are not paid at a concessional rate.

The following steps are followed by the Restaurant to complete the GST Registration as mentioned below -

To register your restaurant for GST, you need to have all the required documents ready in advance. These documents help verify your business and ensure the registration process is smooth and quick.

Evidence of Principal Place of Registration

If the property is neither on rent nor owned property then NOC along with the electricity bill is submitted.

The GST Certification in India fees for restaurants vary based on the type and turnover of the business. Here’s a quick overview to help you understand the costs involved.

You can get your GST Registration easily with Professional Utilities. The whole process is simple and smooth. The service is available for just Rs. 1499/-.

Note: The aformentioned Fees is exclusive of GST.

Restaurants having annual turnover of less than Rs.100 lakhs can register under the Composition Scheme. Under the GST Composition scheme GST will be paid at the rate of the 5% of the turnover divided into 2.5% as CGST and 2.5% as SGST.

Aggregate Turnover means all India basis turnover. It includes exempt supplies, taxable supplies, and export-made but excludes supplies under reverse charges central as well as state/union territory and integrated cess and taxes.

Under the composition scheme GST is levied at a lower rate. There are fewer compliances at a fixed rate of tax. This is an optional scheme subjected to certain restrictions.

Conclusion

It is mandatory to get GST Registration for the Restaurant. Failure to get GST registration can result in penalties and legal problems. By filling out the form and submission of the required documents get the GST Registration. There are many benefits of GST Registration like transparency, reduction in the cost of products, input tax claims, and many others.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions

Food items and food services in Restaurants are categorized under carious GST tax slabs, Primarily 5% and 12%. This ensures that essential food items are not subjected to high taxation, with a maximum GST Rate of 18% applicable to food services provided by restaurants.

A restaurant in a state with a specific category must register for GST if its total annual turnover reaches 10 lakhs. And in the normal category total turnover will be 20 lakhs.

A restaurant cannot impose GST while choosing the Composition Levy Scheme. The Composition Levy Scheme enables taxpayers whose total revenue in the prior fiscal year was less than Rs 50 lakh to voluntarily agree to pay the government a predetermined portion of their annual revenue in taxes.

Restaurants are subject to either a 5% GST rate under the GST with no possibility to claim input tax credits (ITCs) or an 18% GST rate with claims for ITCs. The location of the establishment will determine this rate.

Speak Directly to our Expert Today

Reliable

Affordable

Assured