It's critical to ascertain whether your GST registration is active or canceled if you are a business owner. If a business violates the regulations, for example, by failing to file returns for an extended period, providing false information, or ceasing to operate, the GST department may occasionally cancel a registration. If a taxpayer no longer requires GST registration, for instance, if turnover drops below the threshold, they may also request cancellation.

It's easy to check the status of your GST registration online. You can use your GSTIN (Goods and Services Tax Identification Number) to search the GST portal. The portal will display the status "Canceled" along with the cancellation date if your registration is canceled. By doing this, companies can stay current and stay out of trouble for using a canceled GST number.

Being aware of whether your GST registration has been canceled helps you stay legal and steer clear of needless tax problems. You can also request revocation within the allotted time if your registration was accidentally canceled or if you need it again. A crucial part of maintaining the legal security of your company is keeping up with your GST status.

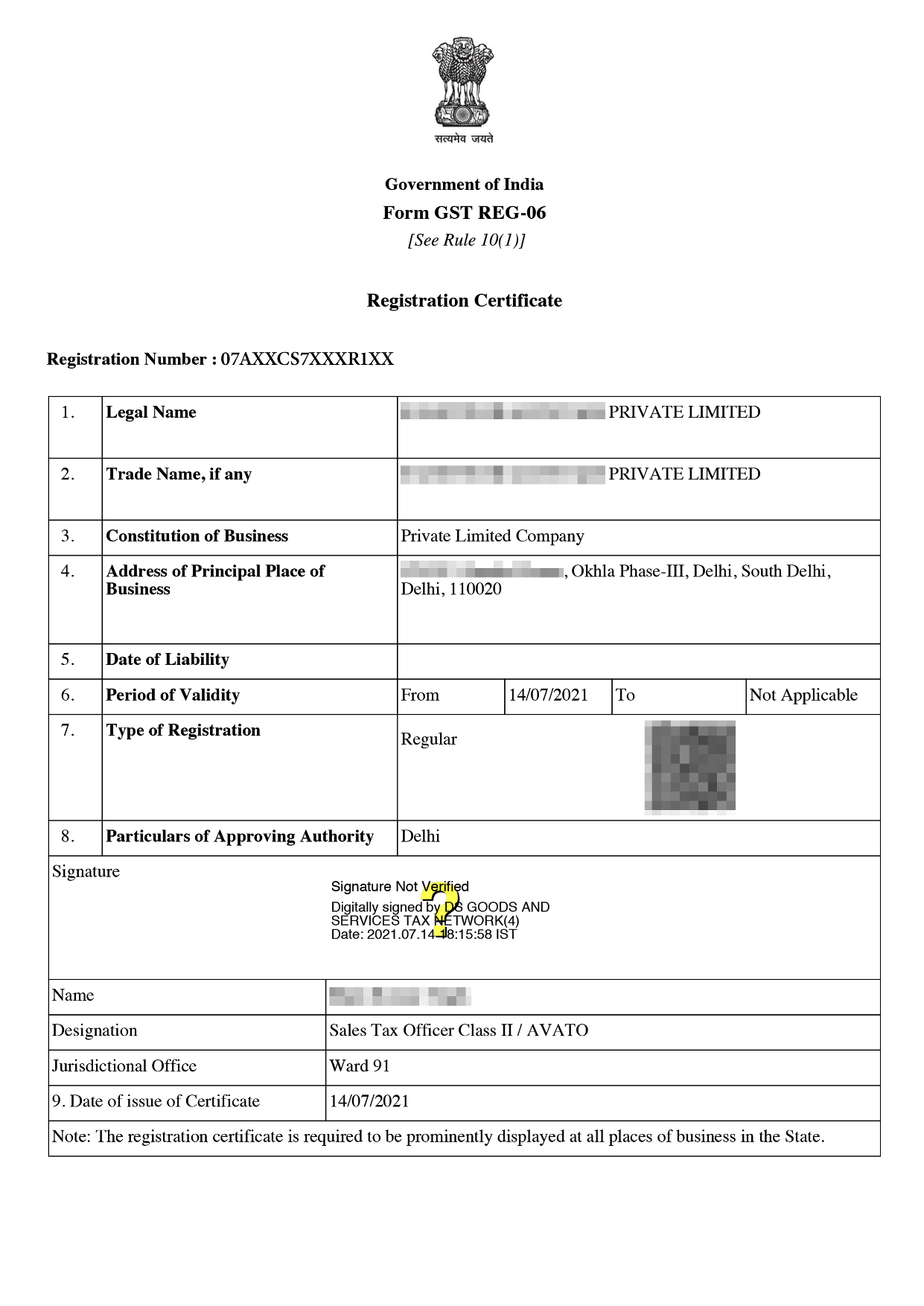

GST Registration Certificate Sample

Your GST number (GSTIN) is no longer valid upon cancellation of your GST registration, and you are no longer obligated to collect or pay GST. You are unable to claim input tax credit or charge GST on sales after it is canceled.

The cancellation may occur for a variety of reasons. A business owner may voluntarily request it in certain situations, such as when their yearly revenue drops below the GST threshold or when the company is shut down, merged, or transferred. In other situations, the GST department may cancel it because of non-compliance, such as long-term non-filing of GST returns, providing false information during registration, or breaking GST regulations.

To put it simply, your liability as a GST-registered taxpayer is formally terminated upon cancellation of your GST registration. You must, however, pay any outstanding taxes, file final returns, and settle any liabilities if your registration is canceled. Penalties may result if you carry on with business operations after cancellation without a valid GSTIN.

Depending on the circumstances, there are three primary methods to cancel a GST registration:

The GST portal may display "Pending for Processing" when you apply to cancel your GST registration. This merely indicates that although your cancellation request was successfully submitted, the GST officer is still reviewing it.

The officer may verify your application at this point, make sure all returns have been filed, and make sure there are no outstanding debts. Before granting the request, the officer may occasionally request more information or documents.

The status will change to "Approved" (registration canceled) or "Rejected" (if the application is invalid) after the review is finished. To stay informed in the interim, you should frequently check the status on the GST portal.

The GST portal provides an easy way to cancel a GST registration online. Here are the basic steps:

Open the GST Portal and log in. Enter your GSTIN, username, and password at www.gst.gov.in.

Navigate to Services and select Services > Registration > Cancellation of Registration Application.

Enter your business information, the reason for the cancellation, and the deadline for the cancellation.

If necessary, include supporting documentation, such as evidence of a business merger, transfer, or closure.

Send in your application and use an Aadhaar-based OTP, DSC (Digital Signature Certificate), or EVC (Electronic Verification Code) to confirm it.

An Application Reference Number (ARN) will be created for tracking purposes following submission.

Your request will be examined by the GST officer. Approval will be given if everything is in order.

Your GSTIN will appear on the GST portal as canceled after approval.

Conclusion

Cancelling a GST registration is a crucial procedure for companies that are no longer needed to have a GST registration. Cancellation guarantees that only active and compliant taxpayers stay in the GST system, regardless of whether it is done voluntarily or by the tax department. You can easily find out if your GSTIN is canceled, pending, or active by checking your cancellation status online.

You can prevent fines and needless compliance problems by following the right process and monitoring your application. You can also request revocation within the allotted time if your GST was accidentally canceled or if you still require it. Maintaining a clear understanding of your GST status keeps your company hassle-free and legally secure.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions

The form also states that if the taxpayer does not offer a reasonable justification, GST may be cancelled. In addition, if the officer believes the justification is insufficient or unsatisfactory, he may nonetheless order a suspension.

If your GST registration is cancelled, you cannot charge GST on sales. You must file a final return (GSTR-10) within three months, pay any pending taxes, and adjust input tax credits. Cancellation also requires surrendering your GSTIN, and you remain liable for any past GST obligations.

You can check your GST registration cancellation status on the official GST portal. Go to Services → Registration → View/Verify Canceled GSTIN, enter your GSTIN, complete the CAPTCHA, and click Search. The portal will display whether your GST registration is active or cancelled.

Yes, a business can re-apply for GST registration even after cancellation. You need to submit a fresh GST registration application on the official GST portal, providing all required business details and documents. Once approved, a new GSTIN will be issued.

There are two main types of GST registration cancellation:

1. Voluntary Cancellation:

- The taxpayer can apply for cancellation if they cease business, no longer meet GST turnover criteria, or close a branch.

- Initiated by the taxpayer through a cancellation application on the GST portal.

2. Suo Moto (Involuntary) Cancellation:

- Initiated by tax authorities if the taxpayer fails to comply with GST rules, such as non-filing of returns or providing false information.

- The taxpayer is notified and given a chance to respond before cancellation.

He must submit it through the Common Portal within 30 days of the day the cancellation order was served. If the proper official is satisfied, he may, within 30 days of the application's receipt date, order the cancellation of registration by issuing an order in form GST REG-22.

Until the authorised tax officer takes action on the application, the taxpayer may withdraw their request to terminate their registration.