What is GSTR-2?

Every registered taxable person is required to give details of Inward Supply, i.e., purchases for a tax period in GSTR-2.

Why is GSTR-2 important?

GSTR-2 contains details of all the purchases transactions of a registered dealer for a month. It will also include purchases on which reverse charge applies.

The GSTR-2 filed by a registered dealer is used by the government to check with the sellers’ GSTR-1 for buyer-seller reconciliation

What is buyer-seller reconciliation??

Buyer-seller reconciliation or invoice matching or is a process of matching taxable sales by the seller with the taxable purchases of the buyer.

It is vital because ITC on purchases will only be available if the details of purchases filed in GSTR-2 return of buyer matches with the details of sales filed in GSTR-1 of the seller.

For example, Ajay buys 100 pens worth Rs. 500 from Vijay Stationery. Vijay Stationery must show Rs. 500 sales in his GSTR-1. Ajay must show the same Rs. 500 purchase in GSTR-2 to claim ITC. Unless the amounts match, Ajay will not be able to claim ITC..

What happens if GSTR-2 is not filed??

If GSTR-2 return is not filed then the next return GSTR-3 cannot be filed. Hence, late filing of GST return will have a cascading effect leading to heavy fines and penalty.

Who should file GSTR-2?

Every registered person is required to file GSTR-2 irrespective of whether there are any transactions during the month or not.

However, these registered persons do not have to file GSTR 2 –

- Input Service Distributors

- Composition Dealers.

- Non-resident taxable person.

- Persons liable to collect TCS.

- Persons liable to deduct TDS.

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves (as per Section 14 of the IGST Act).

What happens if GSTR-2 is filed late?

If you delay in filing, you will be liable to pay interest and a late fee.

Interest is 18% per annum. It has to be calculated by the taxpayer on the amount of outstanding tax to be paid. The time period will be from the next day of filing (16th of the month) to the date of payment.

The late fee is Rs. 100 per day per Act. So it is 100 under CGST & 100 under SGST. Total will be Rs. 200/day. The maximum is Rs. 5,000.There is no late fee on IGST.

How to revise GSTR 2?

GSTR 2 once filed cannot be revised. Any mistake made in the return can be revised in the next month’s return. It means that if a mistake is made in September GSTR 2, rectification for the same can be made in October’s GSTR 2..

How to file GSTR 2 on ClearTax GST software?

- Make sure all your purchase invoices are in the software – by using Excel Import or importing through other software

- While uploading purchase bills, you can select bills on which reverse charge will apply..

- Our software will read your day’s invoices. If you cross the threshold of Rs. 5,000, it shows an alert message saying that your aggregate purchases from URDs have exceeded Rs. 5,000. “Please verify: There are one or more unregistered purchase invoices under reverse charge without any tax (no or 0 tax) in your data. As per GST rules you should add appropriate tax amount against such invoices before filing..

- Our software will track invoices and remember their treatment. If an invoice from same GSTIN is already marked as under reverse charge, system will alert the user that a similar invoice from same GSTIN had already marked under reverse charge and hence the new invoice may also be under reverse charge.

- Download your seller’s return from GST Portal through our software. The software will automatically highlight any mismatches between you purchases and your vendor’s sales..

- Finally, validate data and upload to the government GST portal..

Details to be provided in GSTR-2?

There are 13 headings in GSTR-2 format prescribed by the government.

We have explained each heading along with the details required to be reported under GSTR-2.

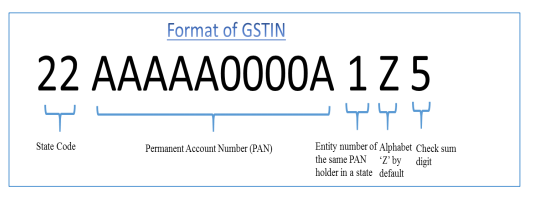

- GSTIN – Each taxpayer will be allotted a state-wise PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN). A format of proposed GSTIN has been shown in the image below. GSTIN of the taxpayer will be auto-populated at the time of return filing.

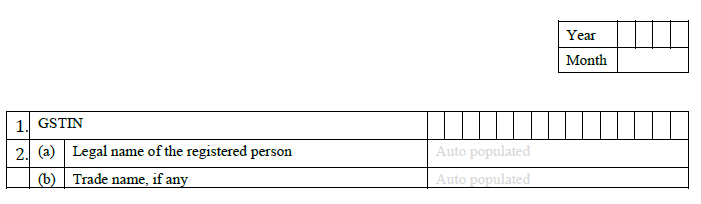

- Name of the Taxpayer – Name of the taxpayer including legal and trade name (will be auto-populated .Month, Year – Mention the relevant month and year for which GSTR-2 is being filed.

Inward Supplies from Registered Taxable Person

Most of the purchases from a registered person will be auto-populated here from GSTR-1 filed by the seller. It will have all details of type, rate and amount of GST, whether ITC is eligible, amount of ITC.

However, it will not contain purchases under reverse charge.

Certain transactions may not be auto-populated because-

- Seller did not file GSTR-1.

- Seller filed GSTR-1 but he missed the transaction

- n either case, the buyer can manually add these transactions. The seller will get a notification to accept this addition/modification in his GSTR-1A return.

- If the supply is received in more than one lots, the invoice must be reported in the return of the month in which the last lot is received and recorded in books of accounts..

image

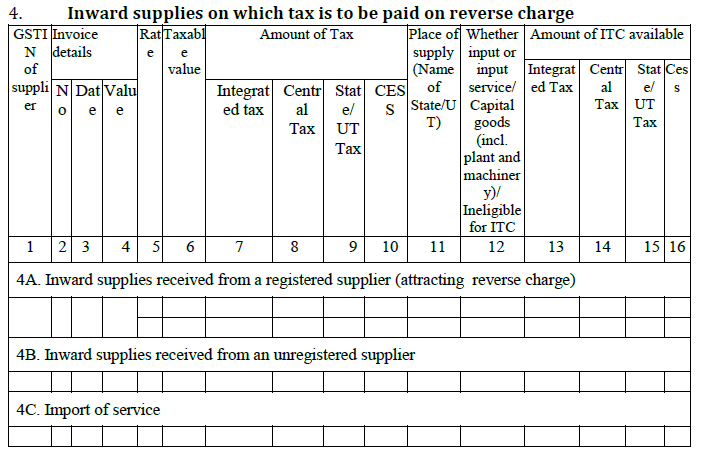

Inward supplies on which tax is to be paid on reverse charge

Certain goods and services attract reverse charge, i.e., the buyer is liable to pay GST. A registered dealer purchasing more than Rs. 5,000 per day from an unregistered dealer is liable to pay reverse charge..

All purchases on which reverse charge applies, will be reported in this part..

.- Under this head, all purchases on which reverse charge specifically applies by law must be mentioned. For example, purchasing cashew nuts from an agriculturist..

- This head will list the purchases from unregistered dealer which exceed Rs. 5,000 per day from an unregistered dealer

- Under this head, reverse charge GST paid on import of service will be reported..

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

.svg)