Step wise process UDYAM registration for existing MSME registered before 30th June 2020

Officially, MSMEs are characterized as far as investment in plant and machinery. Be that as it may, this measure for the definition was long criticized because credible and precise details of investments were not easily available by authorities. Accordingly in February 2018, the Union Cabinet chose to change the basis to "yearly turnover", which was more in accordance with the burden of GST.

The Central Government, in the wake of acquiring the proposals of the Advisory Committee, has informed certain standards for arranging the enterprises as micro, small and medium enterprises and has determined the structure and method for recording the update (Udyam Registration), with impact from first July, 2020.

Any person who intends to establish a micro, small or medium enterprise may file Udyam Registration online in the Udyam Registration portal on self-declaration. No fees is charged for applying Udyam registration. Mandatory aadhaar of proprietor or partner or promoter or director or Karta is required in case of Udyam registration.

FOR EXISTING ENTERPRISES

- All existing enterprises registered under EM–Part-II or UAM shall register again on the Udyam Registration portal on or after the 1st day of July, 2020.

- All enterprises registered till 30th June, 2020, shall be reclassified in accordance with this notification.

- The existing enterprises registered prior to 30th June,2020, shall continue to be valid only for a period up to the 31stday of March, 2021.

- An enterprise registered with any other organisation under the Ministry of Micro, Small and Medium Enterprises shall register itself under Udyam Registration.

How can an enterprise be classified as a micro, small or medium enterprise?

An enterprise on the fulfillment of the below mentioned criteria shall be classified as a micro, small or medium enterprise:-

| Classified as | Maximum Investment in plant and machinery or equipment | Maximum Turnover |

|---|---|---|

| Micro Enterprises | Rs. 1 Crore | Rs. 5 Crore |

| Small Enterprises | Rs. 10 Crore | Rs. 50 Crore |

| Medium Enterprises | Rs. 50 Crore | Rs. 250 Crore |

Note: The aformentioned Fees is exclusive of GST.

If an enterprise crosses the ceiling limits specified for its present category in either of the two criteria of investment or turnover, it will cease to exist in that category and be placed in the next higher category.

No enterprise shall be placed in the lower category unless it goes below the ceiling limits specified for its present category in both the criteria of investment as well as turnover.

All units with GSTIN listed against the same PAN shall be collectively treated as one enterprise and the turnover and investment figures for all of such entities shall be seen together.

Only the aggregate values will be considered for deciding the category as micro, small or medium enterprise.

How to calculate investment in plant and machinery and Turnover for MSME’s?

In case of existing enterprise the investment amount is calculated considering the details mentioned in the last ITR. In case of new enterprise a self-declaration of the promoter is required to consider the investment amount.

Inclusion and exclusion in calculation of amount of Investment:

Inclusion:

- All Tangible assets

- Purchase value of first hand or second hand plant and machinery excluding GST.

Exclusion:

- Land and Building

- Furniture and Fixtures

Inclusion and exclusion in calculation of amount of Turnover:

Turnover details in case of new enterprise shall be details mentioned in the last ITR. In case of new enterprise a self-declaration of the promoter is required to consider the investment amount.

Penalty in case of misrepresentation

Penalty for misrepresents or attempts to suppress the self-declared facts and figures shall be punishable:

- In case of 1st Conviction, with fine which may extend to Rs. 1000/- and

- In case of 2nd or subsequent Conviction with fine which shall not be less than Rs. 1000/- but may extend to Rs. 10,000.

Procedure for UDYAM registration for existing enterprise:

All enterprise registered under old method till 30/06/2020 shall be reclassified. Existing enterprise registered up to 30/03/2020 – valid till 31/03/2021. Failure to update within due date – Suspension of registration. Based on the latest information – The classification will be updated. The following is the process for UDYAM registration:

Step 1: Go to Udyam Registration

Click on “For those already having registered as EM-II or UAM” option

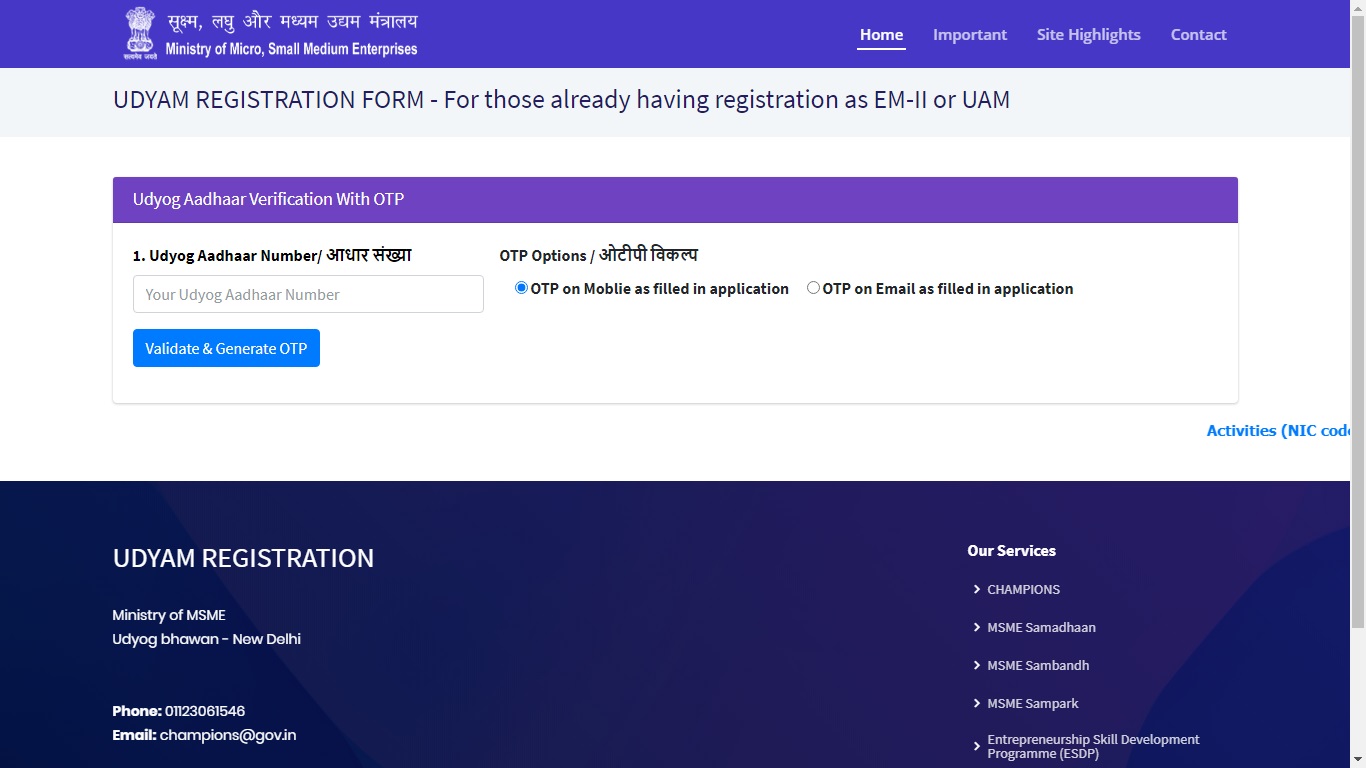

Step 2: Fill your Udyog Aadhaar details and select OTP option i.e. whether you want to receive OTP on mobile or on registered mail id.

.jpg)

Now, click on “Validate & Generate OTP” and enter the OTP number that you have received in your mobile number or E-mail and select Validate.

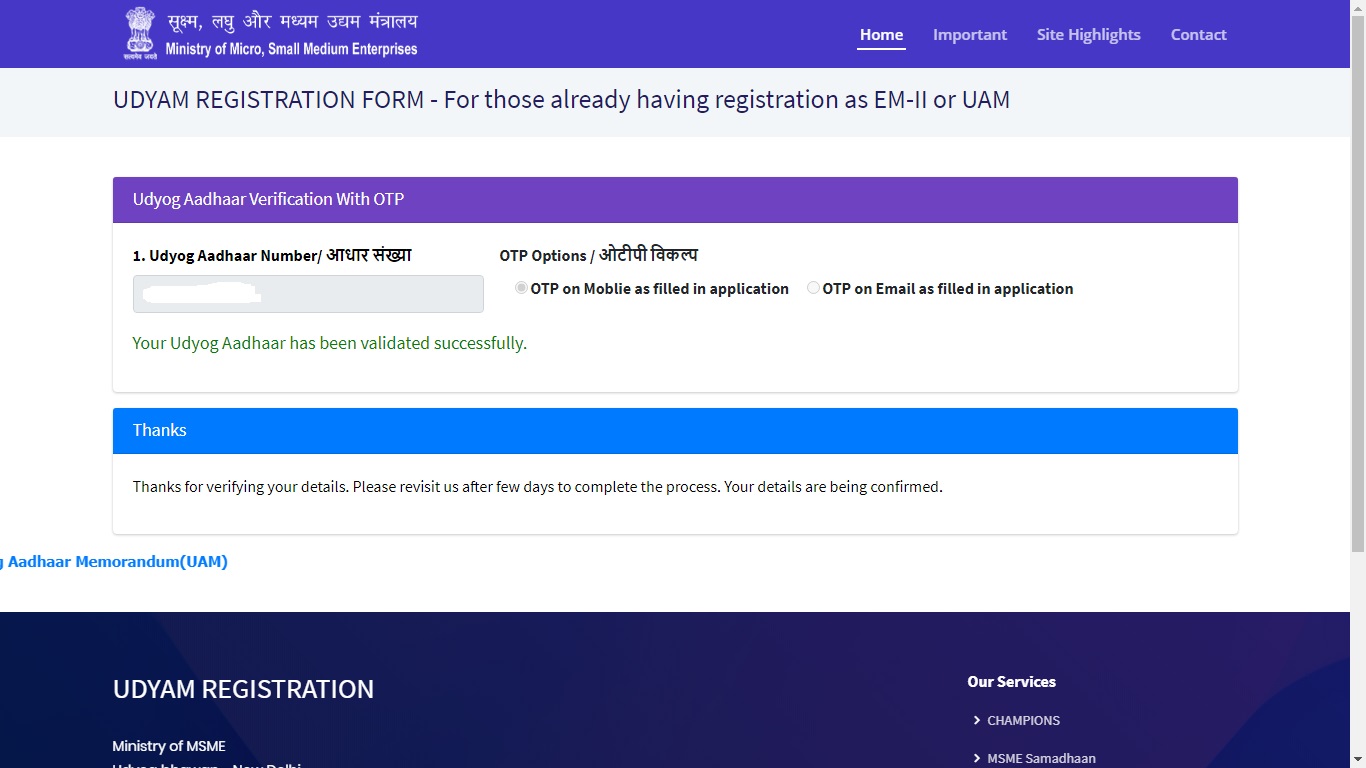

Your Udyog Aadhaar will be validated successfully.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

.svg)