Updated on February 25 2026 06:40:05 AM

In India, every business must register itself as a legal entity. Choosing the proper company structure is the most critical business-related decision. Doing so would allow your business to operate smoothly and meet legal requirements. There are numerous benefits of registering a company which we are going to cover in more detail. The primary benefit is that a registered company is considered genuine and authentic, which increases the business's credibility.

Get to know the different business structures, importance of Company Registration , how to choose the right business structure and the requirements of entity incorporation.

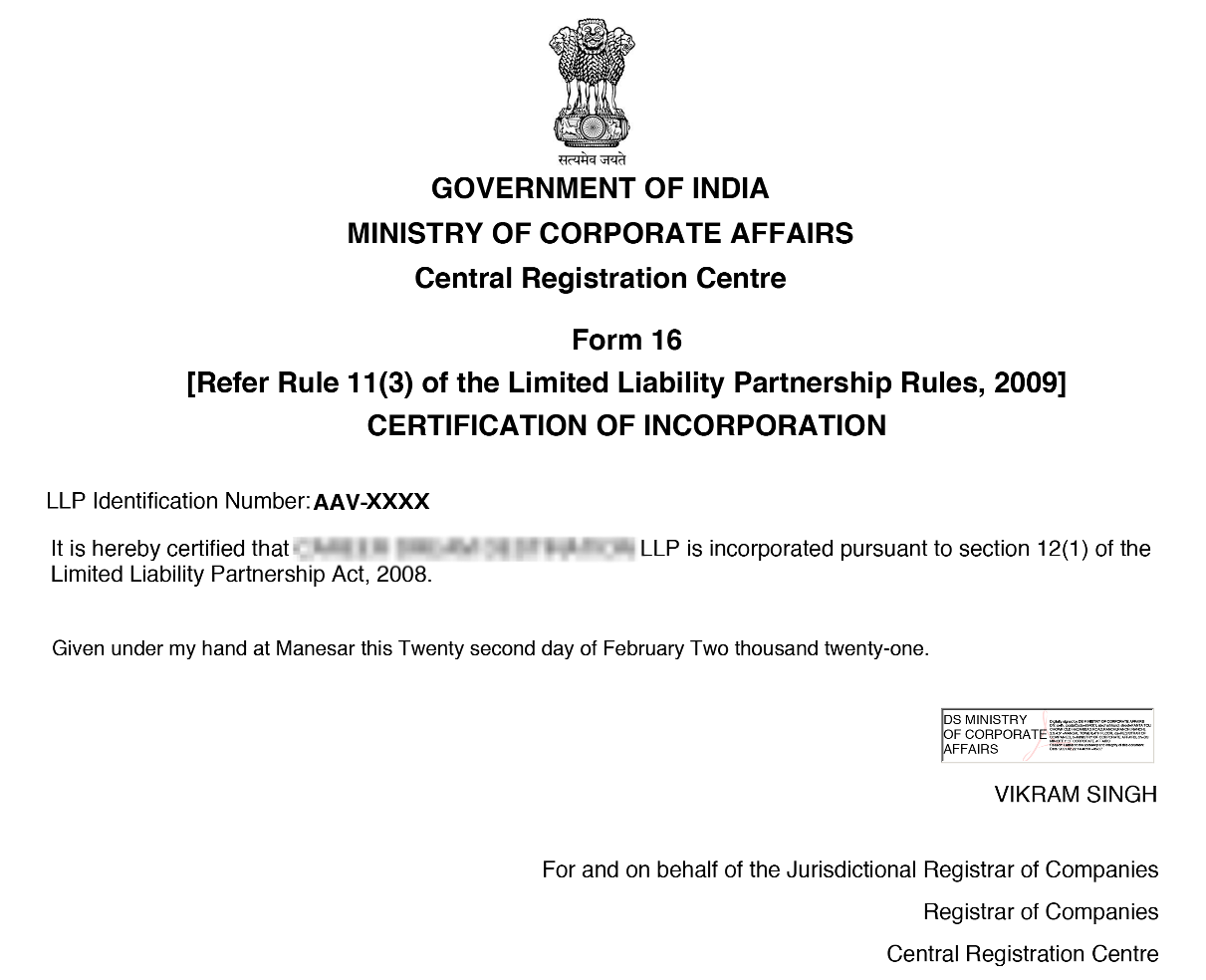

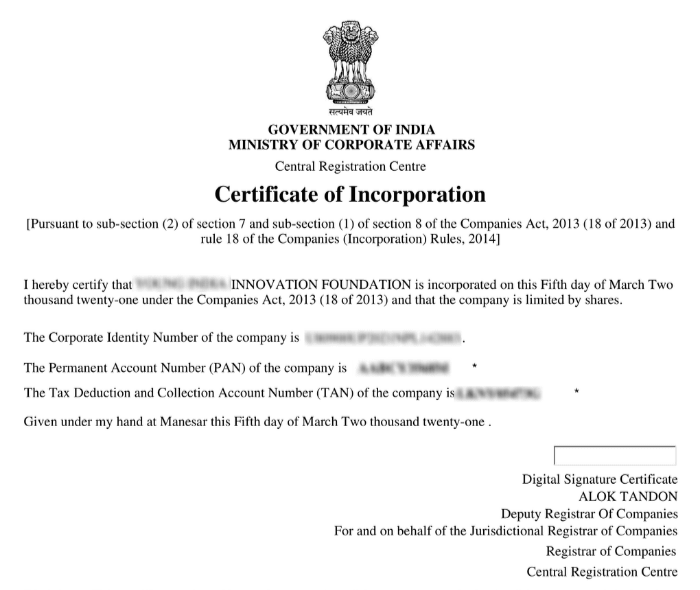

Company Registration Sample Documents

It is mandatory to register a business as part of legal compliance. Also, it is very important to register your business as it increases the credibility and authenticity of the business.

Investors always prefer a strong and legal business for investment. For example, an investor would hesitate to give money to a sole proprietor or partnership; while the investor may be more comfortable in investing in a more recognized business structure like a Private or Public Limited Company.

Let us understand the different types of company registrations in India. Here is a list of some of the most popular kinds of business structures:

A Private Limited Company is a type of business entity that is privately and collectively held by a small group of people. It offers limited liability to its shareholders and directors while also providing credibility and taxation benefits. It has a minimum of 2 members and a maximum of 200 members.

More than 90% of registered companies in India are Private Limited Companies. It is the easiest and most authentic way of company incorporation in India.

Visit our dedicated page of Private Limited company registration for more details on documents required, process, fees and benefits of Pvt Ltd company incorporation.Limited Liability Partnership (LLP) is a form of partnership that is registered under the Limited liability Partnership Act, 2008 where liabilities of all the partners are limited to the extent of contribution bought by them. It helps owners to limit their liabilities while enjoying the advantages of a limited company which is an edge over a traditional partnership firm.

No partner is liable on account of unauthorized actions of other partners, thus individual partners can safeguard them from joint liability arising from misconduct of other partners. LLP as an organization is mostly preferred by professionals, micro and small businesses.

Visit our dedicated page of Limited Liability Partnership (LLP) registration for more details on documents required, process, fees and benefits of LLP incorporation.One Person Company is a kind of private limited company which is registered with a single person who acts both as the director as well as shareholder of the company. Earlier in a private limited company, a minimum of 2 directors and 2 members were required. A single person could not form a private company. But a new concept of OPC was introduced as per Section 2(62) in the Company’s Act 2013 where a single person can form a private limited company.

The need for OPC (One Person Company) arose due to the limitations of sole proprietorship firms which is the most popular form of business registration of small businesses in India.

Visit our dedicated page of One Person Company (OPC) registration for more details on documents required, process, fees and benefits of OPC incorporation.One Person Company is a kind of private limited company which is registered with a single person who acts both as the director as well as shareholder of the company. Earlier in a private limited company, a minimum of 2 directors and 2 members were required. A single person could not form a private company. But a new concept of OPC was introduced as per Section 2(62) in the Company’s Act 2013 where a single person can form a private limited company.

The need for OPC (One Person Company) arose due to the limitations of sole proprietorship firms which is the most popular form of business registration of small businesses in India.

Visit our dedicated page of One Person Company (OPC) registration for more details on documents required, process, fees and benefits of OPC incorporation.Section 8 Company is a type of NGO that works for non-profit and charitable purposes. The income and profit earned from the company are used to promote the objectives of the company and not to be distributed as dividends to its shareholders.

Section 8 company is the most popular form of NGO registration in India as it is easy to register, run and manage. The main purpose of Section 8 company is to promote non-profit objectives such as commerce, art, science, sports, education, research, social welfare, religion, charity, protection of the environment, and other charitable purposes.

Visit our dedicated page of non-governmental organization (NGO) registration for more details on documents required, process, fees and benefits of NGO incorporation.Choosing business structure carefully is important because each type of company or business entity requires different levels of compliances and income tax returns. The books of accounts need to be audited every year. All these legal compliances require money to be spent on professionals like auditors, accountants, and tax filing experts. Therefore, it is very important to select the right kind of company when registering your business.

To select the best company structure for your business, you need to look at some of the most important questions:

If all these questions seem overwhelming to you, then it is highly recommended that you seek help from an expert. We, at Professional Utilities, offer a free consultation so that you register your business under proper guidance. So take this opportunity and contact us for a free consultation for company registration in India.

Registering a company in India is a completely digital and hassle-free process. You are required to provide proper identity proof of members or partners and address proof of business premise. It is important to note that you don’t need to own a commercial place for business; you can incorporate your company with your residential property as address proof of a business office.

We have covered each type of online company registration in detail and if you’d like to check out any of the specific types of entity incorporation, you can refer to those pages. Here are the links to each of those entity incorporation pages:

Conclusion

Online company registration in India has made it easier for entrepreneurs to form legal and responsible businesses from any location. Choosing the right business structure, such as a private limited company, LLP, OPC, public limited company, or Section 8 company, facilitates legal compliance, trust building, and a long-term success plan.

Professional Utilities simplifies the company registration process by handling all legal documentation, name approval, and filing requirements. With our expert help at each stage, you can easily register your company online.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam