Updated on December 20, 2025 10:24:51 AM

Limited Liability Partnership is the most preferred type of business registration for small and medium enterprises. LLP registration in Delhi is the best choice for the small scale business owners and service providers planning to start a company in partnership. Go through the page to read about Online LLP Registration in Delhi, Process, Documents required, Govt and Professional Fees, Time required, features.

LLP offers the benefits of both a partnership and a limited liability company, making it an attractive option for those seeking a flexible yet protected business structure. If you're interested in understanding the process of LLP registration in Delhi, you've come to the right place.

Consult with Professional Utilities to get your LLP Registration online in Delhi at just ₹8,499 in 7-10 working days.

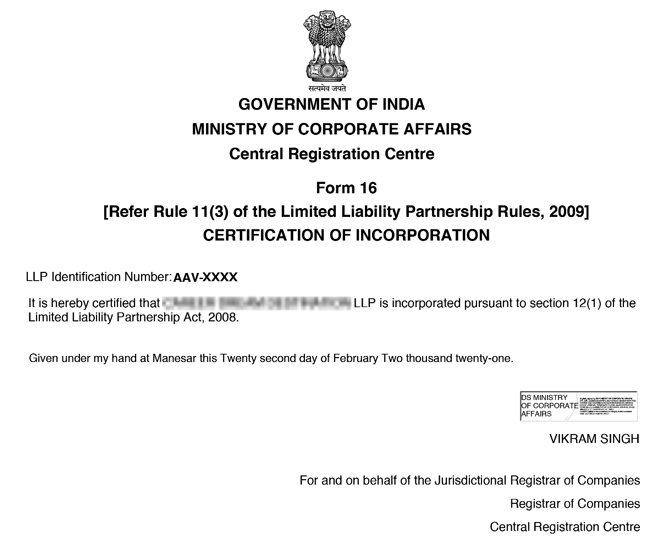

LLP Registration Certificate[Sample]

The full form of LLP is Limited Liability Partnership. LLP is a business structure that combines elements of both a partnership and a limited liability company. An LLP provides its partners with limited liability protection, meaning their personal assets are safeguarded in the event of business debts.

In an LLP, the partners have flexibility in managing the business while enjoying the benefit of limited liability. This means that each partner is not personally liable for the debts or misconduct of other partners in the LLP. The liability of each partner is limited to their agreed contribution to the LLP, and their personal assets are generally protected.

| LLP Registration Online in Delhi | Details |

|---|---|

| Cost of LLP Registration Online in Delhi | ₹8,499 |

| Time Required to Register LLP in Delhi | 7-10 days |

| Documents Required For LLP Registration Online in Delhi |

|

| Steps To Register LLP in Delhi |

|

| Steps after Company is Registered |

|

| Mode of Application for LLP Registration | Online Application |

Following are the requirements for incorporating an LLP in India:

Follow the step-by-step process below to register your LLP in Delhi smoothly and efficiently.

The first step in LLP registration is to obtain DSC for all the designated partners as the registration process of LLP is completely online. A DSC or Digital Signature certificate is required to sign the documents electronically for the registration of LLP in Delhi.

Application process of DSC is completely online and it can be availed from the concerned authorities as soon as within 24 hours of application. Once the DSC is received, Form DIR-3 is to be filed with ROC for getting a DIN( Directors Information Number).

The next step is to apply for DPIN(Designated Partner Identification Number) for all the designated partners of the proposed LLP. The application of DPIN is made through filing Form DIR-3.

To register an LLP, a unique name has to be approved through the RUN(Reserve Unique Name) facility provided by MCA. The proposed name for the LLP can be entered in the Name Search tool to check if there is any already registered LLP with the same or identical name.

You can also use our LLP Name Search tool to check for the name availability of the proposed LLP.

In this step the application form for LLP which is called FiLLiP(Form for Incorporation of Limited Liability Partnership) is filled with the Registrar of Companies who has jurisdiction in the state where the LLP is registered.

This form also provides for the application of DPIN for all the designated partners. If the name is approved then the same name can be used to apply for the application of LLP.

An LLP agreement is an important document as it governs the rights and duties of all the designated partners in the LLP. LLP agreement must be filed within 60 days of the LLP incorporation with the MCA.

The LLP agreement must be duly signed on a Stamp paper and the value of the stamp paper will vary from state to state.

By following the above mentioned steps you can easily register your LLP in Delhi.

LLP registration fees in Delhi include government charges and professional service costs, which may differ based on your business requirements.

| LLP Registration in Delhi | Registration Fees |

|---|---|

| Digital Signature Certificate Fee | ₹3,000 |

| Government Fee(Stamp Duty) | ₹1,500 |

| Professional fee | ₹3,999 |

| Total Cost | ₹8,499 |

Note - The LLP registration fees will include creation of DSC(for 2 partners), Drafting LLP agreement, DPIN for 2 Partners, Incorporation Certificate, and professional attorney fees.The Registration cost may vary if the number of members or the value of Authorised Capital is changed.

Given below is the list of documents required for LLP registration in Delhi.

The total time required for LLP registration in Delhi is around 7-10 working days which is subject to documents verification by MCA.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

LLP registration in Delhi is a crucial step for entrepreneurs and professionals looking to establish a business entity that combines the benefits of a partnership with limited liability protection. Throughout this comprehensive guide, we have explored the intricacies of LLP registration , from its definition and advantages to the eligibility criteria and the step-by-step registration process.

By choosing to register your business as an LLP, you can enjoy the flexibility of a partnership while safeguarding your personal assets. The limited liability protection offered by an LLP ensures that each partner's liability is limited to their agreed contribution, shielding them from the financial risks associated with the business.

Looking for LLP registration in Delhi, contact our team at Professional Utilities and get LLP incorporated at Rs 8,499 within 7-10 days.

The registration fee for LLP companies in Delhi is Rs 8,499 which includes DSC for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

Removal or resignation of partners means when a partner leaves a partnership firm either by choice (resignation) or by decision of the other partners (removal). This can happen due to personal reasons, mutual agreement, or breach of partnership terms. After the partner’s removal or resignation, the firm must update its legal documents and inform the Registrar of Firms to keep records accurate and compliant.

To register a LLP Company in Delhi you need to provide with some of the basic documents such as Aadhar card, PAN Card, registered office address, DPIN, DSC etc.

To be eligible for registering an LLP. in India, there must be at least two partners, with one of them being a resident of India. Both individuals and body corporates, such as companies or existing LLPs, are permitted to become partners. Every partner must be at least 18 years of age, of sound mind, and legally competent to enter into a contract. Foreign nationals and NRIs can also participate as partners in an LLP, as long as one designated partner is an Indian resident. This business structure provides limited liability protection along with the benefit of flexible management.

Speak Directly to our Expert Today

Expert Consultation

Affordable

Client Support