Updated on January 30, 2026 07:28:40 AM

Businesses or individuals engaged in the export of spices and products derived from spices from India are required to hold an RCMC (Registration Cum Membership Certificate). The Ministry of Commerce & Industry's Spices Board of India is the designated body responsible for issuing the RCMC for this category.

To lawfully export their goods and receive benefits under the Foreign Trade Policy (FTP), exporters who deal in items like curry powder, turmeric, cardamom, black pepper, cumin, chili, ginger, and value-added spice products must obtain RCMC from the Spices Board.

In addition to giving the exporter legal recognition, the RCMC makes it possible for them to take advantage of a number of government incentives, such as duty drawback, MEIS benefits, export subsidies, and entry to international trade shows. Additionally, it provides access to market development programs, technical assistance, and quality certifications that are supported by the Spices Board.

Exporters need a valid Import Export Code (IEC) and supporting documentation, including a PAN, GST certificate, proof of business registration, and product details, in order to apply for the RCMC. The RCMC is valid for five years after it is approved, and the application process is done online.

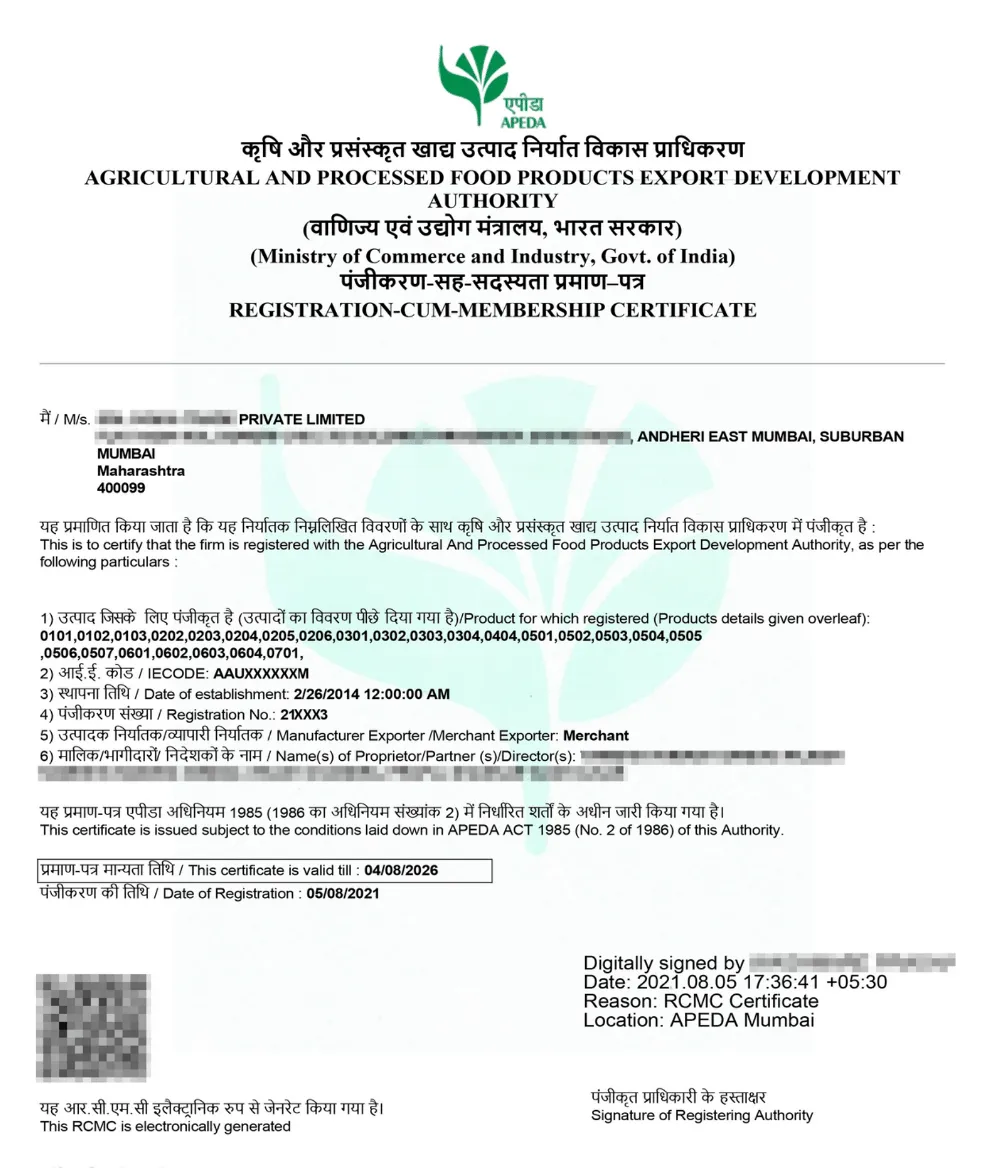

RCMC Sample Certificate

The Spices Board of India requires exporters of spices and products derived from spices to obtain the Registration Cum Membership Certificate (RCMC). It is evidence of the exporter's registration with the approved Commodity Board under India's Foreign Trade Policy (FTP).

To lawfully export their goods and take advantage of various government incentives, companies that deal in the export of spices such as pepper, cardamom, turmeric, ginger, cumin, chili, and spice powders must obtain RCMC from the Spices Board.

Exporters can access DGFT schemes, export subsidies, quality support, and international trade shows hosted by the Spices Board with the aid of RCMC registration. A list of export products, IEC, PAN, and GST registration are among the documents needed for the certificate, which typically has a five-year validity period..

RCMC is required by law from the Spices Board of India required by law, but it also provides access to a number of trade opportunities and government assistance. These are the main advantages:

Spice exporters need to provide the following documentation to register with the Spices Board of India and receive an RCMC:

Getting RCMC registration from the Spices Board of India is a must if you export spices or products made from spices from India. The online application process is easy to complete.

Visit www.indianspices.com, the Spices Board of India's official website.

Enter your contact information and basic business details to create a user account on the portal.

Enter your company name, IEC, PAN, GST, and product list in the online RCMC application form.

Include scanned copies of all required paperwork, such as the GST, PAN, business registration proof, and IEC.

Use one of the available online payment methods to complete the RCMC registration fee.

After reviewing the information, submit the form. An acknowledgment or reference number will be given to you.

The Spices Board will check your information and supporting Pay the relevant fees.documentation. Your RCMC certificate, which is normally valid for five years, will be issued after approval.

The Registration Cum Membership Certificate (RCMC) is issued by the Spices Board of India for a small fee. The cost is subject to GST and may differ depending on the exporter type (manufacturer or merchant).

| Exporter Type | Government Fees ( ₹) |

|---|---|

| Merchant Exporter | ₹5,000 + 18% GST |

| Manufacturer Exporter | ₹15,000 + 18% GST |

Note: Professional Fee for RCMC Registration for Spices starts from @5,000

Any company engaged in the export of spices and products derived from them must take the strategic and necessary step of obtaining an RCMC from the Spices Board of India. In addition to guaranteeing adherence to the Foreign Trade Policy, it grants access to a variety of government advantages, such as export subsidies, participation in international trade shows, and technical advice from the Board.

This registration enhances your reputation in international markets and keeps you up to date on market opportunities and regulations, regardless of whether you are a manufacturer or a merchant exporter. A five-year validity period and an easy online application process make RCMC registration a wise investment for your export success.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Yes, to export spices lawfully and receive DGFT and other government benefits, one must obtain an RCMC from the Spices Board.

Typically, the RCMC is good for five years after it is issued.

Any person, business, or organization that exports spices or spice-related products is eligible to apply as a manufacturer, exporter, or merchant.

₹5,900 (GST included) for merchant exporters and ₹17,700 (GST included) for manufacturer exporters.

Documents such as the Import Export Code (IEC), PAN, GST certificate, proof of business registration, product list, and a bank certificate or cancelled check must be submitted.

Products include oleoresins, powdered spices, whole spices (such as cumin, turmeric, cardamom, and black pepper), and other spice-based goods with added value.

After the five-year period has passed, you can renew your RCMC by sending the Spices Board the necessary paperwork and paying the renewal fee.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions