Updated on August 14, 2025 01:45:20 PM

Businesses that export electronics, IT hardware, and computer software from India must have the Registration Cum Membership Certificate (RCMC). The Ministry of Commerce & Industry oversees the Electronics and Computer Software Export Promotion Council (ESC), which is responsible for issuing this certificate.

For exporters to be accepted as authorized exporters under the Foreign Trade Policy (FTP) and to be eligible for a variety of export incentives and programs supported by the DGFT, they must be registered as RCMCs. To take advantage of these advantages, businesses that sell laptops, servers, networking equipment, embedded systems, custom software, and mobile applications must first obtain an RCMC from ESC.

By offering market intelligence, global exposure through trade shows, and assistance with regulatory compliance and certifications, the ESC plays a critical role in supporting the expansion of electronics and IT exporters. RCMC registration through ESC provides access to global markets and government assistance, regardless of whether you are a large electronics manufacturer or a startup creating SaaS products.

Businesses of all sizes can easily apply because the process is entirely online, straightforward, and reasonably priced. The RCMC must be renewed before its five-year expiration date.

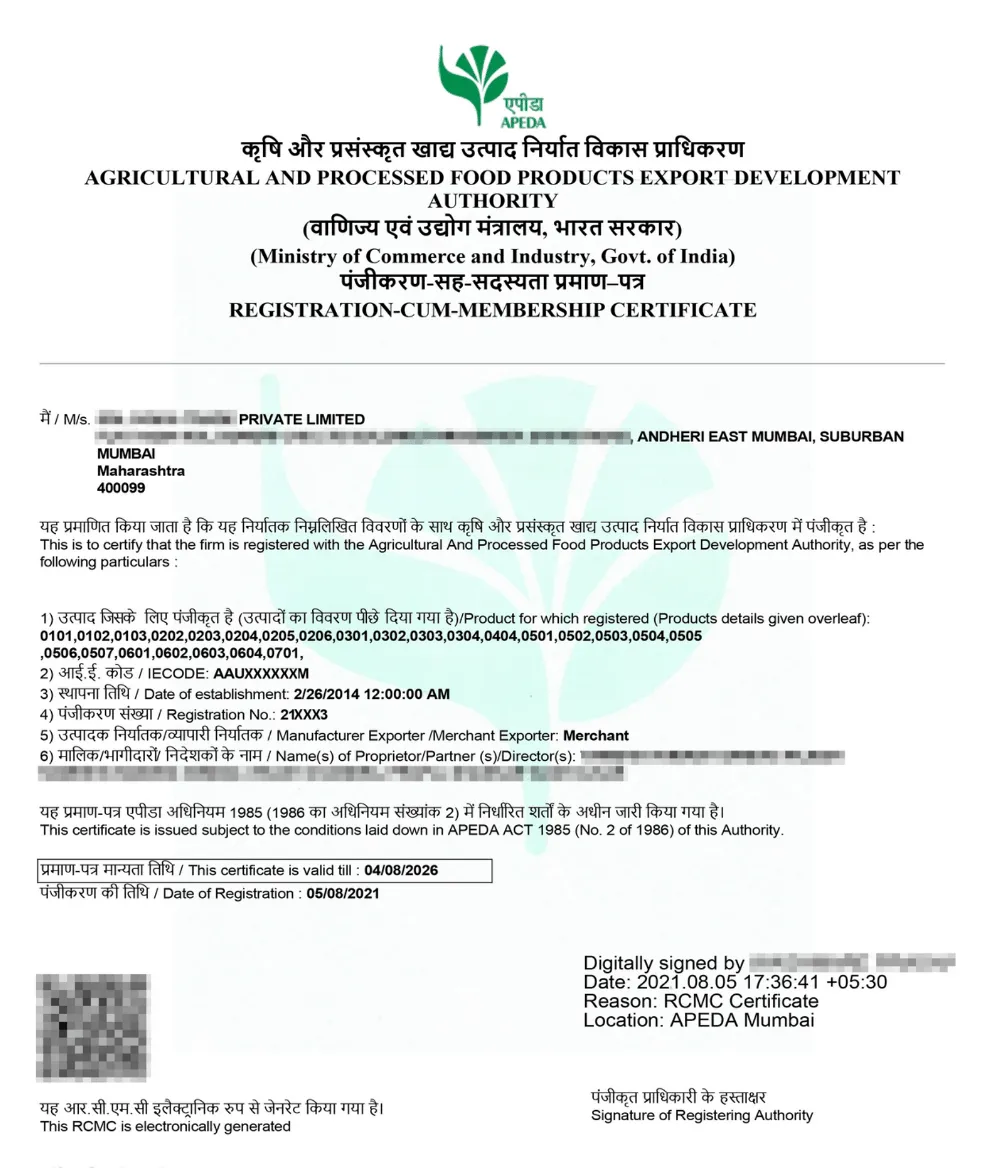

RCMC Sample Certificate

The official certificate granted by the Electronics and Computer Software Export Promotion Council (ESC) is known as the Registration Cum Membership Certificate (RCMC) for Electronics & Computer Software. Under India's Foreign Trade Policy (FTP), companies that export electronic goods, IT hardware, software, and related services must register.

Getting an RCMC from ESC guarantees that your company is accepted by the government as a valid exporter, regardless of whether you export computer hardware, embedded systems, custom software, SaaS solutions, mobile applications, or consumer electronics.

In addition to meeting compliance requirements, RCMC registration entitles exporters to a number of export incentives, DGFT programs, and the ability to participate in buyer-seller meetings and international trade shows. Additionally, it provides access to financial aid, technical support, and market intelligence through export promotion initiatives.

Obtaining an RCMC from the Electronics and Computer Software Export Promotion Council (ESC) is essential for exporters to gain official recognition and unlock various government-backed advantages. Below are the key benefits:

The following documents must be submitted to register with the Electronics and Computer Software Export Promotion Council (ESC) and receive your RCMC:

Businesses must obtain an RCMC (Registration Cum Membership Certificate) from the Electronics and Computer Software Export Promotion Council (ESC) to export electronics and IT/software products from India lawfully and to be eligible for export benefits.

Go to the RCMC Registration section at www.escindia.in.

Enter your company information, IEC, email address, and phone number to create an account.

Give your company's name, address, IEC number, GSTIN, type of business, and product information (software or electronics).

Upload all required files, such as:

Depending on your exporter category (manufacturer or merchant), pay online with a card, UPI, or Net Banking.

Your application and supporting documentation will be checked by ESC officials.

The RCMC certificate will be issued and sent by email or made available for download from the portal upon approval. The certificate has a five-year validity period.

The Electronics and Computer Software Export Promotion Council (ESC) levies a membership fee to issue the RCMC. The Ministry of Commerce & Industry has authorized this fee, which consists of an admission fee, a membership fee, and any applicable GST.

| Type of Exporter | Admission Fee | Membership Fee | GST (18%) | Total Payable |

|---|---|---|---|---|

| Merchant Exporter | ₹2,500 | ₹5,000 | ₹1,260 | ₹8,260 |

Note: Professional Fee for RCMC Registration for Electronic & Computer Software starts from @5,000

Businesses in India that export electronics, IT hardware, and software services must first register as RCMCs with the Electronics and Computer Software Export Promotion Council (ESC). In addition to guaranteeing adherence to the Foreign Trade Policy, it gives exporters access to a variety of government programs, DGFT incentives, and global trade opportunities.

Getting an RCMC helps establish credibility in the global market, regardless of whether you're a software development company providing SaaS or IT services or an electronics manufacturer. This registration is economical and strategically valuable for long-term export growth, with a 5-year validity period and a simplified online process.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Yes, by the Foreign Trade Policy, all exporters of software and electronics must register with ESC.

The ESC-issued RCMC is good for five years after it is issued.

Yes, using the official website www.escindia.in, the entire application process is done online.

The admission fee, membership fee, and 18% GST are all included in the total cost of ₹8,260.

IT hardware, embedded systems, computer peripherals, software, consumer electronics, and IT-enabled services are all covered.

Yes, RCMC is open to new exporters and startups alike. Businesses that intend to export soon are urged to register as soon as possible.

No. The ESC-issued RCMC is good for a full five years. However, depending on ESC's most recent policy changes, an annual membership fee might be required.

If you export without a valid RCMC, you risk breaking the Foreign Trade Policy and losing your eligibility for export incentives and DGFT benefits.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions