GSTR 9C is a reconciliation statement between GSTR 9 for a financial year and the audited financial statement of the taxpayer. In this guide, you will find the following information.

What is the GSTR 9C?

The GSTR9C is an audit form that was introduced on September 13, 2018. It must be filed annually by taxpayers with a turnover above 2 crores, and it must be certified by a CA. It is basically a reconciliation statement between the annual returns filed in GSTR-9 and the taxpayer’s audited annual financial statements. The form will contain the taxpayer’s gross and taxable turnover according to their accounting books, reconciled with the corresponding figures after consolidating all of their GST returns for the financial year, and any difference revealed by the reconciliation. The difference, and the reason for it, should be mentioned explicitly. A GSTR-9C must be issued for every GSTIN.

Who should file GSTR 9C?

Every taxpayer who is liable to get their annual reports audited is required to file GSTR9C. (A taxpayer must get their annual reports audited under GST law if their annual aggregate turnover exceeds Rs. 2 crores within a financial year.)

To file a GSTR9C, a chartered accountant or cost accountant must first prepare and certify the form, after which the taxpayer must file it either on the GST portal or through a facilitation center. The taxpayer may also be required to submit other documents along with the GSTR9C form, such as a copy of their audited accounts and their annual returns in a GSTR-9 form.

When to file GSTR 9C?

The last date to file GSTR9C for the financial year 2018-2019 is November 30, 2019. Typically, the GSTR9C must be filed on or before the 31st of December following the financial year which is under audit. (For example, for the financial year of 2018-2019, the GSTR9C must be filed on or by the 31st of December, 2020.)

How to file GSTR 9C?

The GSTR9C is split into two sections. Part A collects tax information; Part B is a certification that must be completed by a chartered accountant.

Part A, the reconciliation statement, contains sections for basic details, reconciliation of Annual Financial Statement turnover with GSTR-9 turnover, reconciliation of tax paid, reconciliation of Input Tax Credit (ITC), and auditor’s recommendation on additional liability due to non-reconciliation.

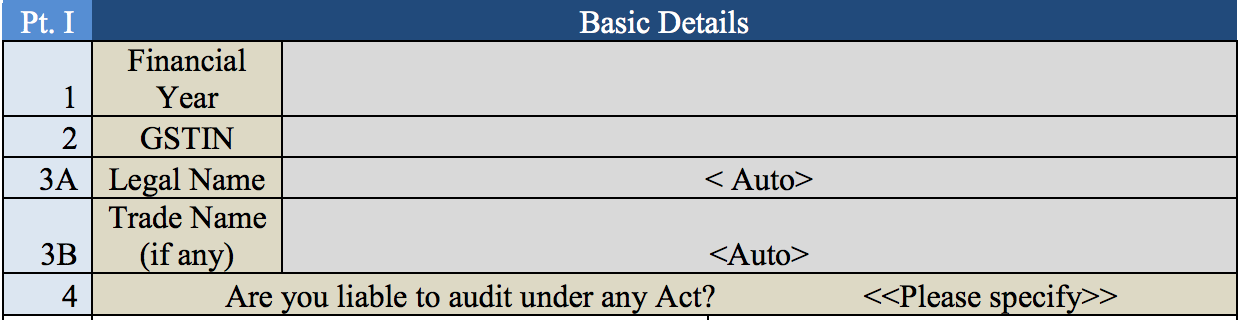

Part 1: Basic Details

In the first part of the GSTR 9C form, you can enter the financial year, GSTIN, legal name, and trade name (if any). You are also asked to specify whether you are liable to audit under any Act or not.

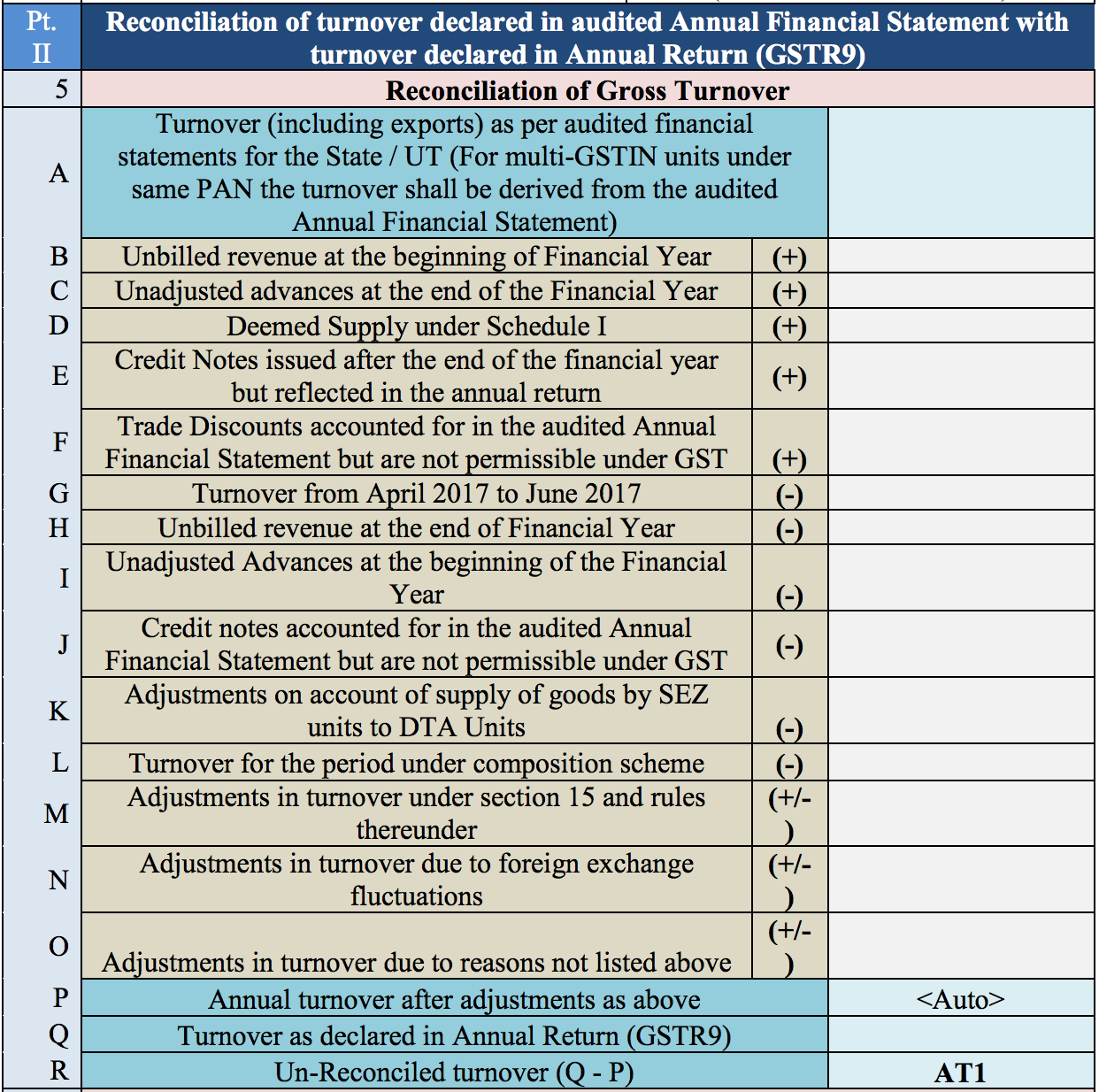

Part 2: Reconciliation of turnover declared in audited Annual Financial Statement

In Part 2, you’ll enter information about your turnover based on your audited Annual Financial Statement. Section 5 is for details regarding the reconciliation of your gross turnover. This involves reporting the gross and taxable turnover for the following:

- The turnover, inclusive of exports, as declared in the audited financial reports for the State.

- The unbilled revenue noted at the beginning of the financial year.

- Any unadjusted advances at the end of the financial year.

- The deemed supply as listed under Schedule I.

- All credit notes that were issued after the end of the financial year but reflected in the annual return.

- Trade discounts that have been accounted for in the audited annual financial statement, but are not allowed under GST.

- The turnover for the period between April and June, 2017.

- The unbilled revenue calculated for the end of the financial year.

- The unadjusted advances at the beginning of the financial year.

- Credit notes that have been accounted for in the audited annual financial statements, but are not allowed under GST.

- Any adjustments on account of supply of goods by SEZ units to DTA units.

- The turnover for the period under the composition scheme.

- Any adjustments in turnover under Section 15.

- Any adjustments in turnover due to foreign exchange fluctuations.

- Any adjustments in turnover due to reasons that have been not listed above.

- The annual turnover after all the above adjustments have been made. This field is auto-populated.

- The turnover declared in the annual return, GSTR-9.

- The un-reconciled turnover, which is calculated as the difference between lines P and Q above. (Q - P)

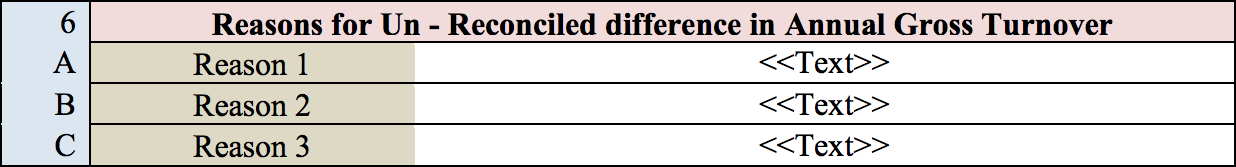

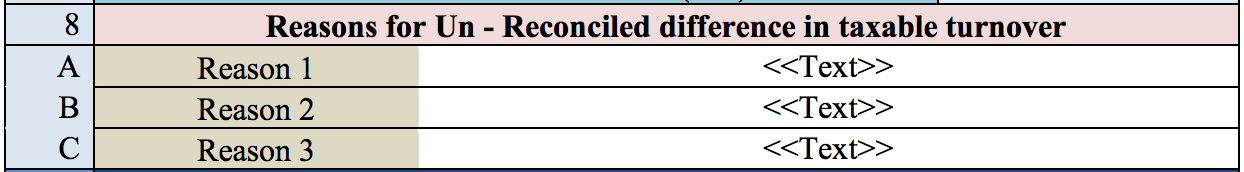

Under Section 6, you can list any possible reasons for un-reconciled differences in the annual gross turnover that may have occurred.

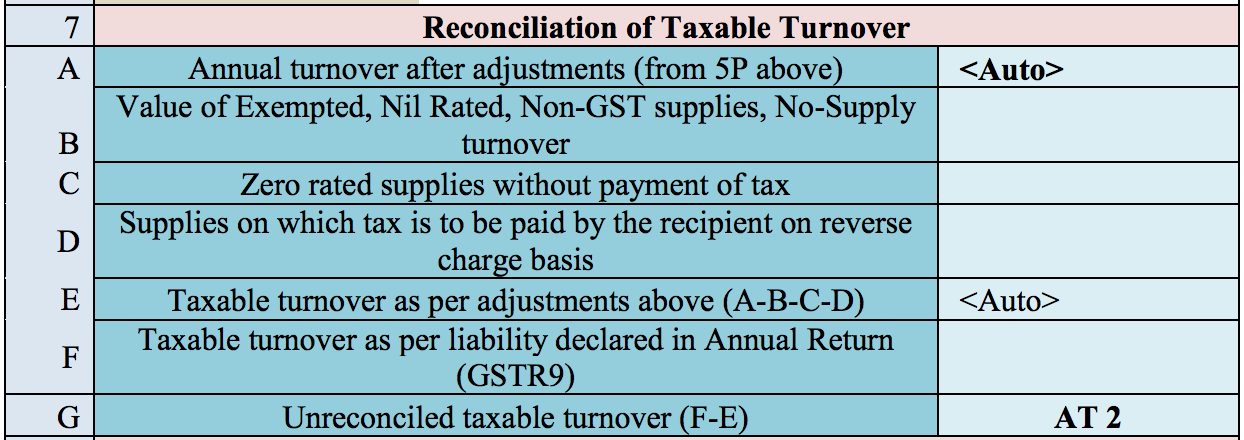

In this section, you are required to fill in the following values related to the reconciliation of taxable turnover:

- The annual turnover after adjustments. This value is auto-populated.

- The value of the exempted, nil rated, non-GST supplies, and no-supply turnover.

- The value of supplies which are zero-rated and for which no tax was paid.

- Value of supplies for which tax is to be paid by the recipient under reverse charge.

- The taxable turnover as per the adjustments listed in the above lines. (A - B - C - D)

- The taxable turnover with regard to the liability listed in the annual return (GSTR-9).

- Value of the unreconciled taxable turnover. (F - E)

Similar to Section 6, Section 8 allows you to list reasons for the difference between the taxable turnover declared in the annual return and the taxable turnover derived from line E of Section 7.

Part 3: Reconciliation of tax paid

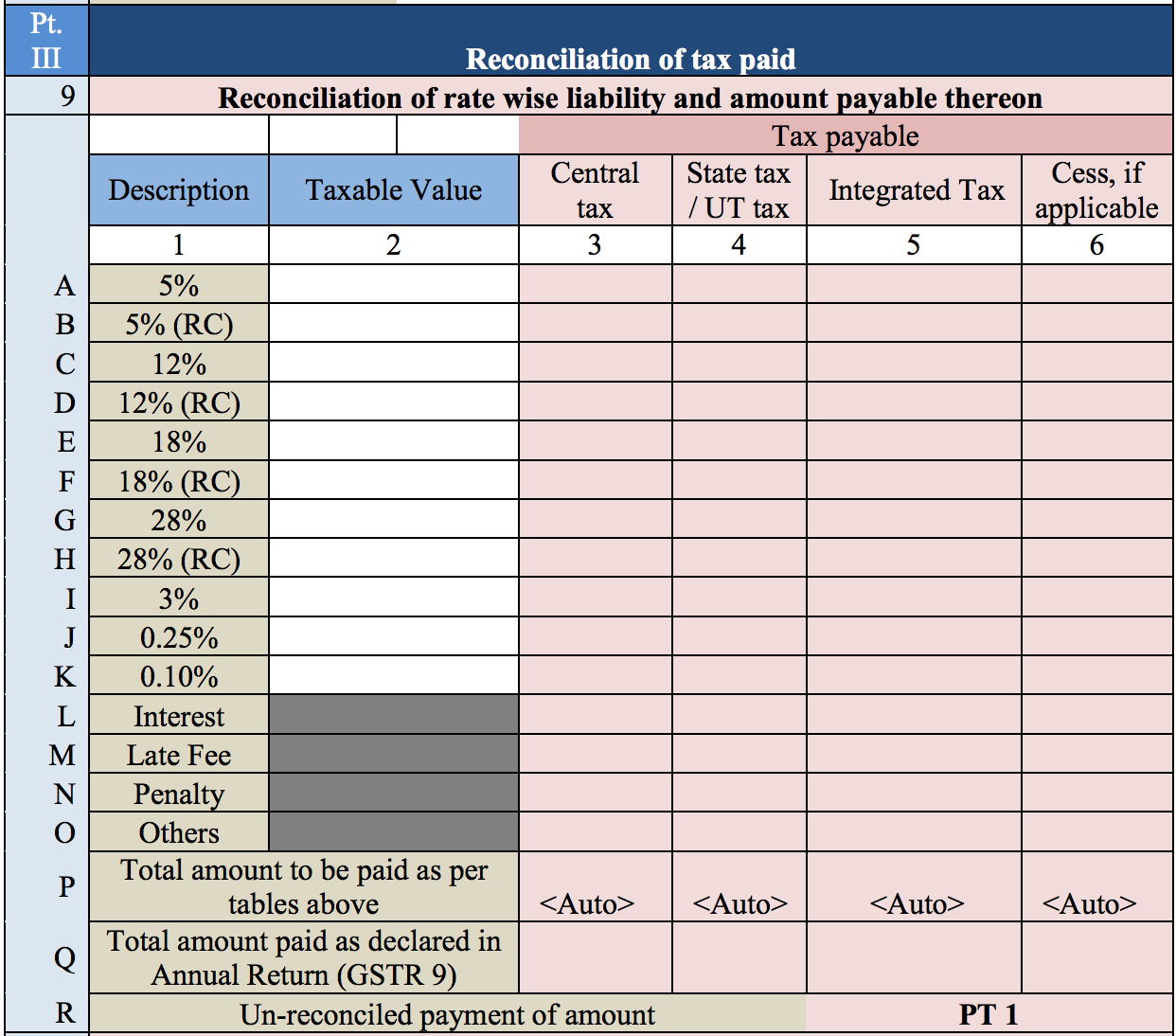

Part 3 collects information about the tax you have paid. In Section 9, you are to fill in the taxable value, central and state tax, integrated tax, and cess value for each tax rate: 5%, 12%, 18%, 28%, 3%, 0.25%, and 0.10%. For each rate, tax paid by reverse charge is listed in a separate line from tax collected normally.

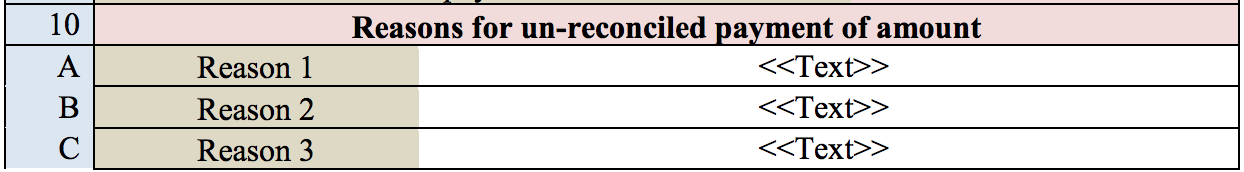

Under Section 10, you can enter the reasons for the difference between the total amount of tax paid as per the reconciliation statement, and the total amount of tax paid as given in the annual return (GSTR-9).

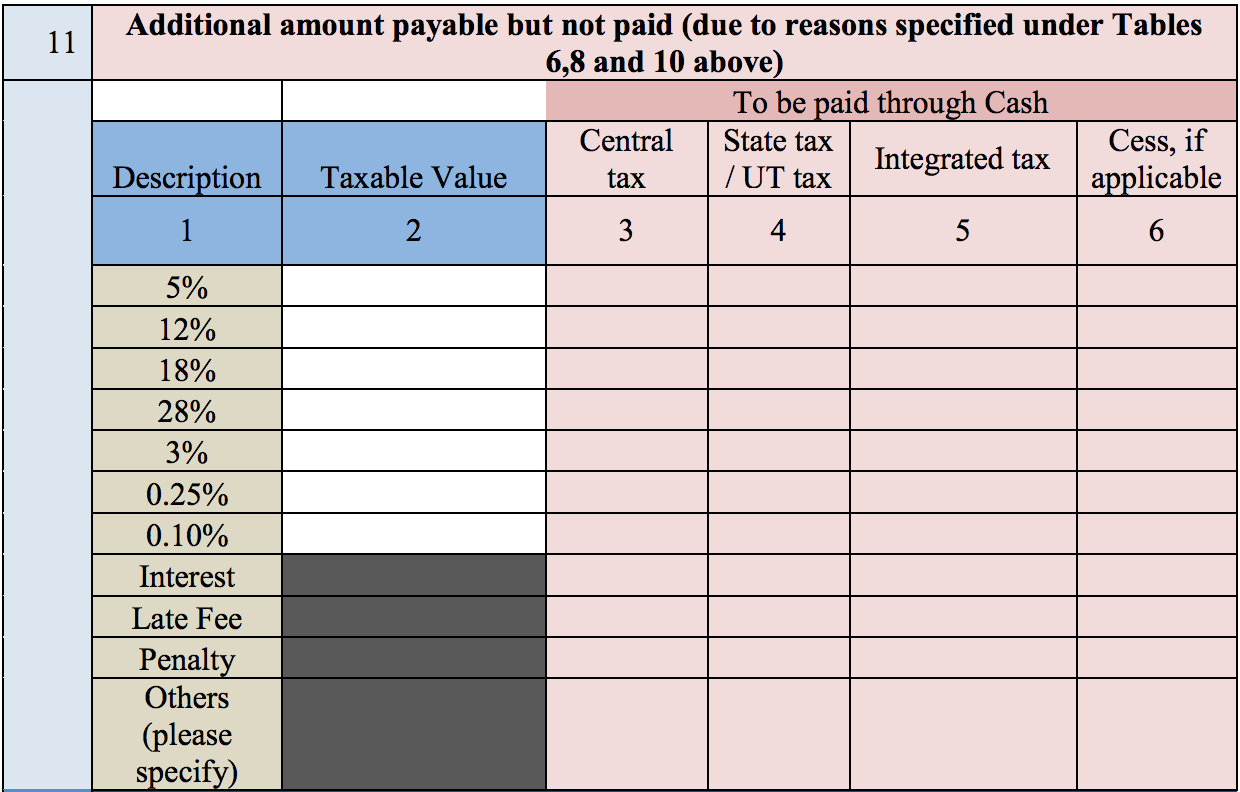

Section 11 is for details of any tax payable, but not yet paid, because of the reasons specified in Sections 6, 8, and 10.

Part 4: Reconciliation of ITC

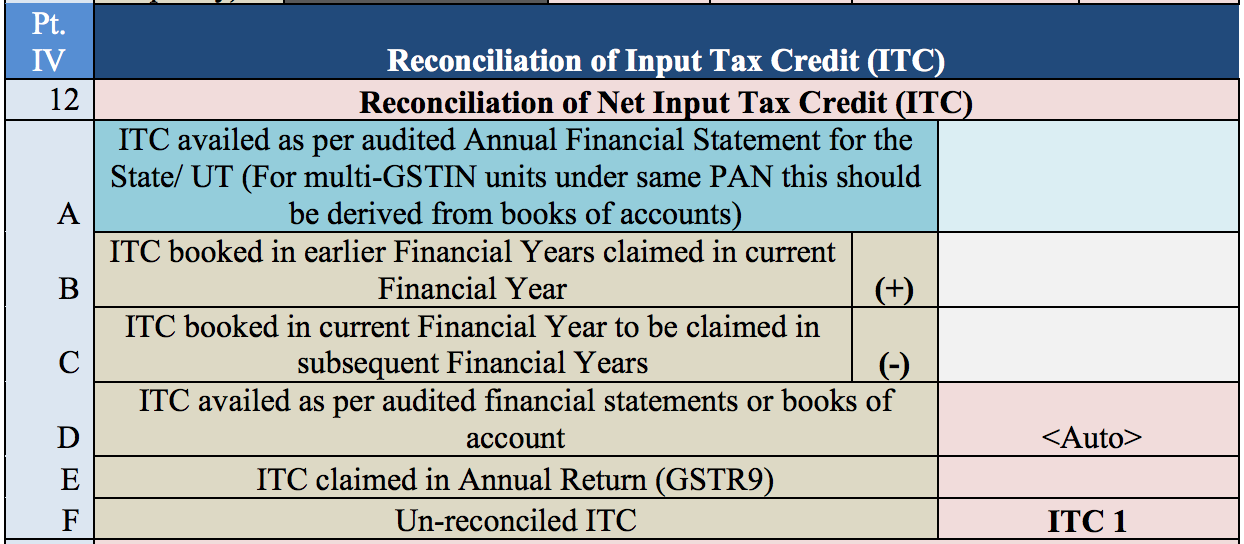

Part 4 contains information for reconciling your ITC. Under Section 12, mention the value of the ITC availed in the following categories:

- The ITC availed as per the audited annual financial statement for the state or UT. In the event of multiple GSTINs under the same PAN, this value should be derived from the audited accounts.

- The ITC that has been mentioned in the accounts for earlier financial years, but availed in the current financial year.

- The ITC that has been mentioned in the accounts of the current financial year, but kept to be availed in the next financial year.

- The ITC that has been availed as per the audited financial statements or accounts. This field will be auto-populated.

- The ITC that has been claimed in your annual return (GSTR-9).

- The un-reconciled ITC.

Under Section 13, you can list any reasons for a difference between the ITC claimed according to the annual return filed (GSTR-9) and the ITC claimed as per the audited financial statement.

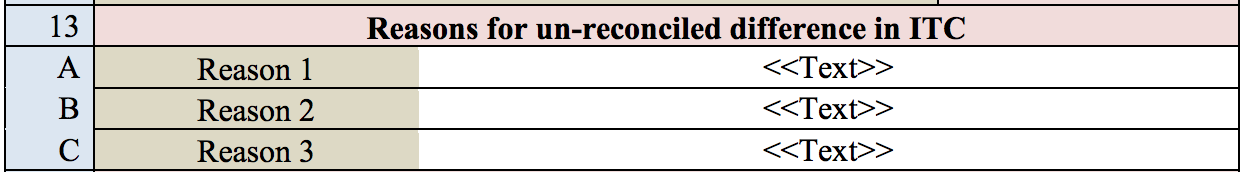

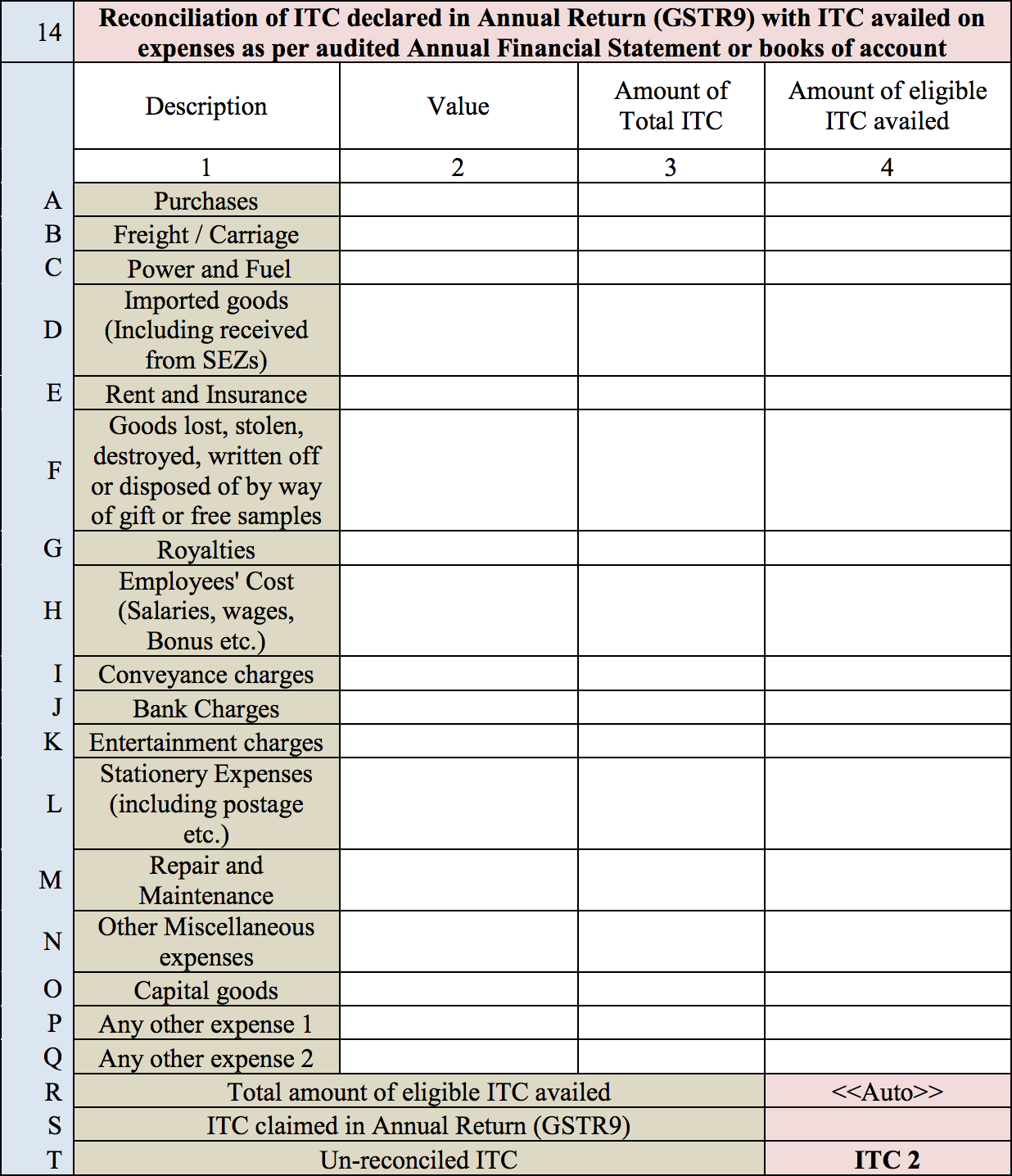

Under Section 14, specify the value, amount of total ITC, and amount of eligible ITC availed with regard to each category of expenses.

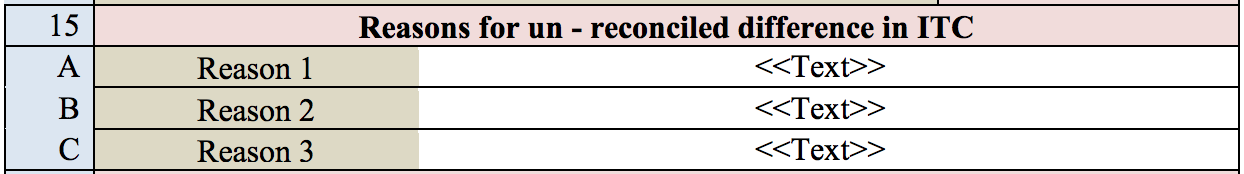

In Section 15, fill in the reasons for any difference between the amount of ITC availed for the different expenses (mentioned in line R of Section 14) and the availed ITC as per the annual return (mentioned in line S).

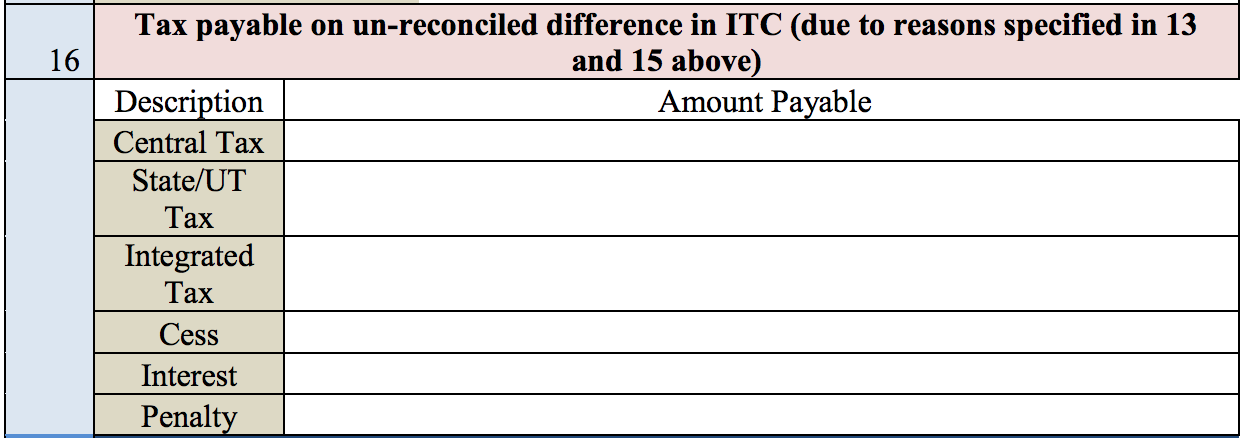

In Section 16, fill in the central and state tax, integrated tax, cess value, interest, and penalty payable with regard to the un-reconciled differences described in Sections 13 and 15.

Part 5: Auditor’s recommendation on additional liability due to non-reconciliation

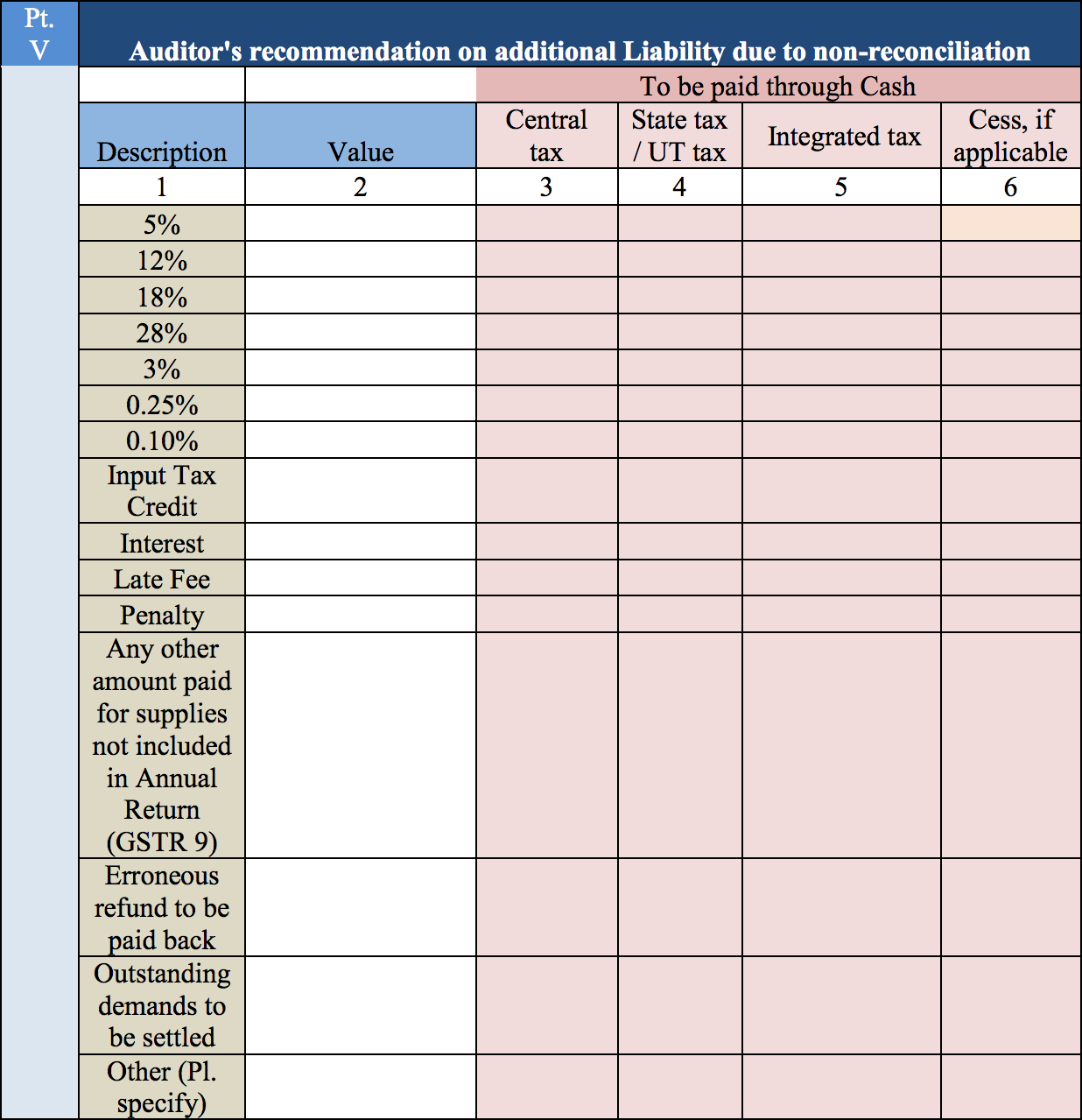

Part 5 contains your auditor’s recommendations on your additional tax liability due to non-reconciliation. Here, your auditor is to enter the taxable value, central and state tax, integrated tax, and cess value (if applicable) for several categories: the individual tax rates of 5%, 12%, 18%, 28%, 3%, 0.25% and 0.10%; the applicable ITC, interest, late fees, penalties, any other amounts paid but not included in GSTR-9; erroneous refunds to be paid back; and outstanding demands to be settled.

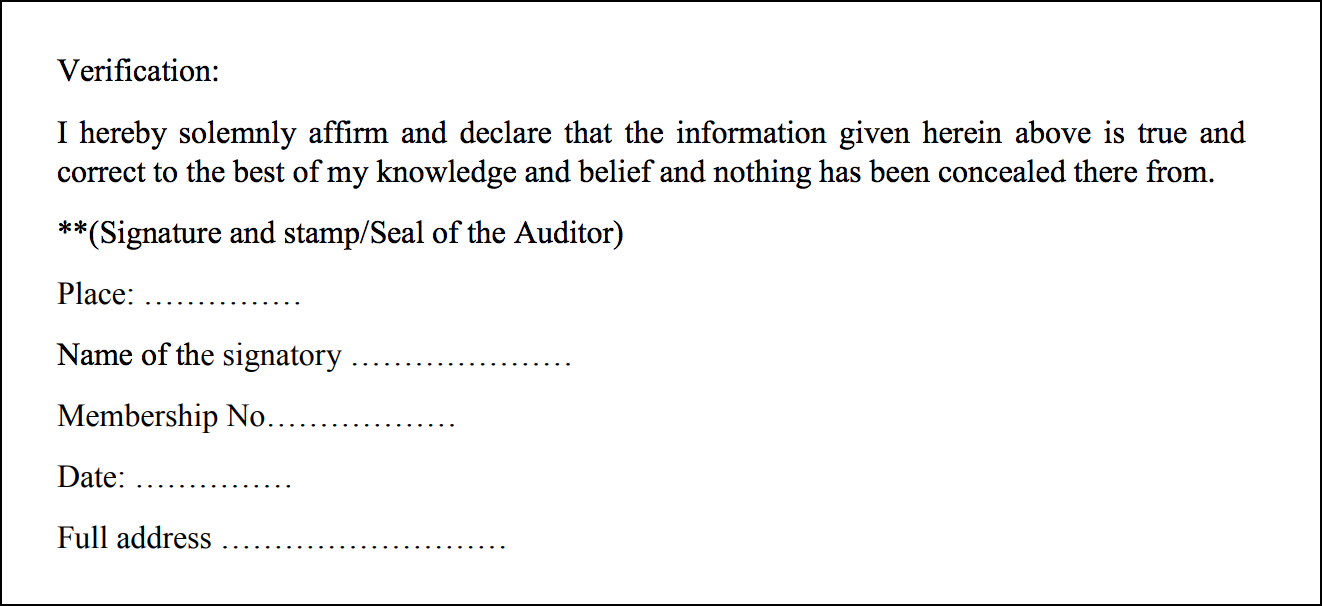

Before filing the GSTR-9C form, you must sign and authenticate the return either through a digital signature certificate (DSC) or by using an Aadhar-based signature verification mechanism.

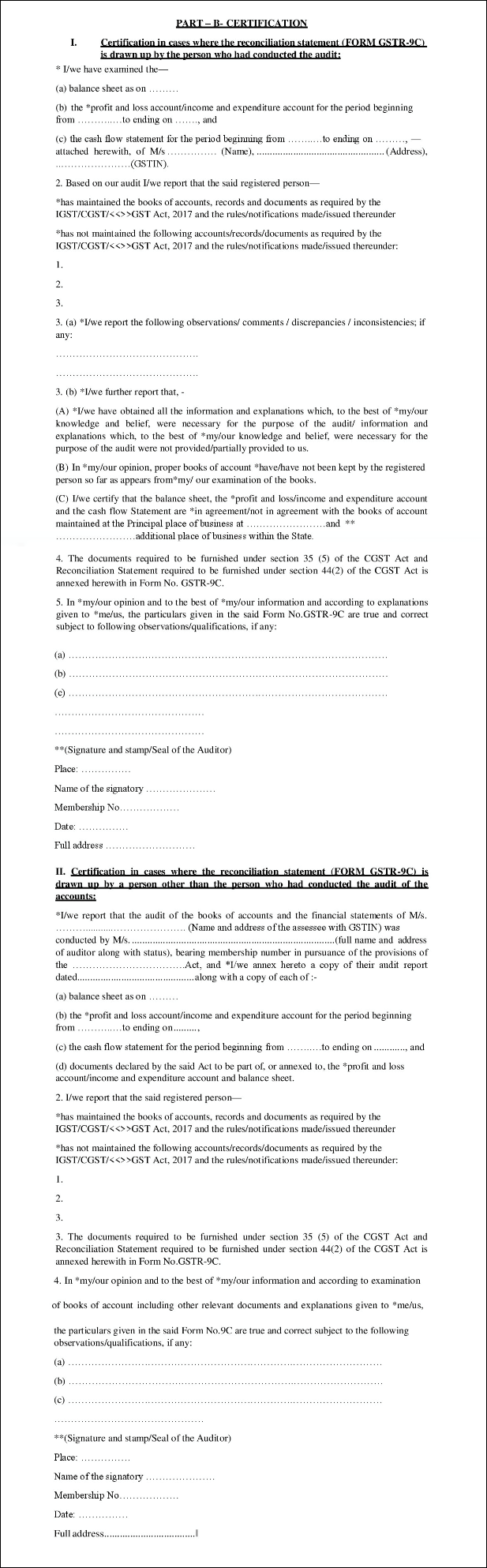

Part B: Certification

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

.svg)