Anyone involved in the export of spices and spice-related products from India must have the Spices Board Registration, also referred to as the Certificate of Registration as Exporter of Spices (CRES). Under the Ministry of Commerce and Industry's management, the Spices Board of India, this registration guarantees that exporters promote Indian spices in international markets while adhering to legal requirements and quality standards.

Getting registered with the Spices Board is crucial for manufacturers and exporters because it not only confirms the legitimacy of the company but also fosters confidence with foreign customers. Manufacturers can increase their global business prospects by registering and exporting directly, bypassing middlemen.

Access to export promotion programs, involvement in international trade shows, support for quality testing, and market development assistance from the Spices Board are just a few advantages of this registration. By guaranteeing uniformity in quality, hygienic practices, and packaging standards, it also contributes to the preservation of India's standing as a major exporter of spices.

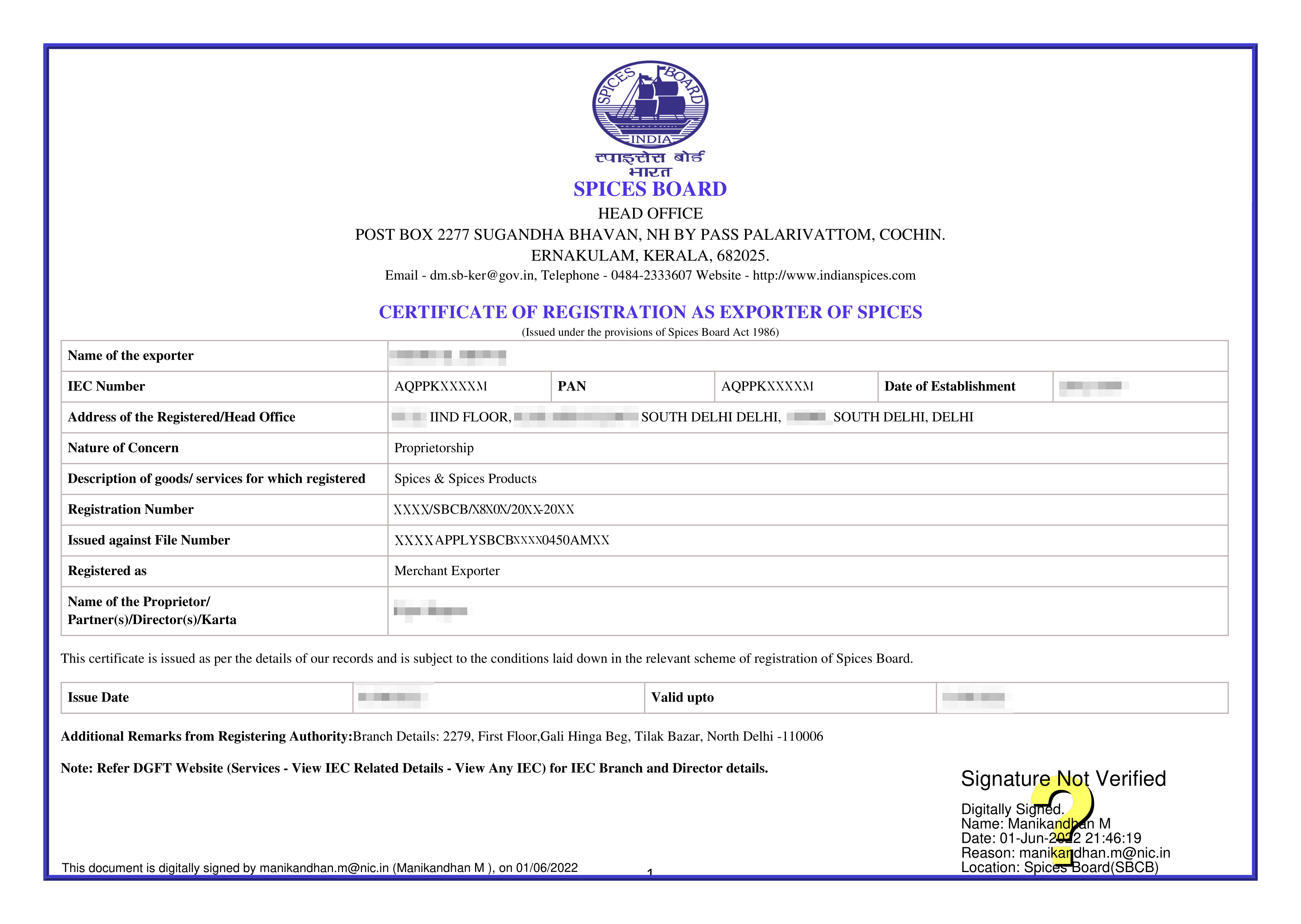

Spice Board Certificate Sample

The Spices Board of India requires companies involved in the production and export of spices to obtain the Spices Board Registration for Manufacturer Exporters certification. The Spices Board Act mandates that anyone wishing to export spices or products based on spices from India obtain the Certificate of Registration as Exporter of Spices (CRES).

This registration guarantees adherence to national laws and global quality standards and acts as verification of authenticity for manufacturer exporters. It enables producers of spices to sell their goods directly to customers abroad without the need for middlemen.

Manufacturer exporters can access a number of advantages by registering with the Spices Board, including financial assistance programs, market development plans, support for quality testing, and participation in international trade shows. Most significantly, it increases confidence among foreign buyers by reassuring them of the exporter's caliber and reliability.

In addition to being required by law, the Spices Board Registration Certificate of Registration as Exporter of Spices (CRES) gives manufacturers who export spices a competitive edge. It grants access to a number of government-supported advantages as well as recognition and credibility.

Principal Advantages:

To obtain the Spices Board Registration Certificate of Registration as Exporter of Spices (CRES), manufacturer exporters must submit certain documents to verify their business identity, production capacity, and compliance with export regulations. Below is the list of required documents:

The Spices Board Registration process for manufacturer exporters is carried out online through the official Spices Board portal. Below are the simple steps to complete the registration:

To apply for a CRES certificate, an applicant must register through their mobile no. and valid Email address. Once the verification is done through OTP on mobile, it will redirect you to the main application form.

The applicants are required to fill out the concerned application form and provide all the concerned details, such as ICE details issued by DGFT for export; after filling in all the details, it will immediately generate an application reference number which can be used to upload all the required documents on the portal.

The fee for spices board registration for manufacturer exporters can be Submitted online as per the guidelines of spice board regulation 2011. In the case of the manufacturer exporter of spices, the government fee is Rs. 15,000 + 18% GST, the sum of a total of Rs. 17,700 should pay respectively.

After completing the application form, applicants will have a login ID and password for their CRES certificate, which they can use to download from the portal.

The Spices Board of India charges a prescribed fee for granting the Certificate of Registration as Exporter of Spices (CRES) to manufacturer exporters. The fee is payable online during the application process and is non-refundable.

| Particulars | Manufacturers |

|---|---|

| Registration | Rs 15,000 |

| Renewal | Rs 10,000 |

| Modification | Rs 5,000 |

Note: The aforementioned Fees is exclusive of GST. Professional Fee for Spice Board Registration: ₹25,000 for Manufacturers and ₹7,500 for Merchants.

Manufacturer exporters are granted a Spices Board Registration Certificate of Registration as Exporter of Spices (CRES), which has a set expiration date and needs to be renewed in order to continue exporting lawfully.

The Spices Board Registration is a mandatory requirement for all spice exporters in India. Failure to comply with the rules and regulations set by the Spices Board of India can lead to strict penalties and legal action under the Spices Board Act:

List of SPICES In Schedule 2

All-Spice

Aniseed

Asafoetida

Basil

Bay Leaf

Bishop's Weed

Cambodge

Bishop's Weed

Caper

Caraway Seeds

Cardamom Large

Cardamom Small

Cassia

Celery

Chilli

Cinnamon

Clove

Coriander

Cumin

Curry Leaf

Dill

Fennel

Fenugreek

Garlic

Ginger

Greater Galanga

Horseradish

Hyssop

Juniper Berry

Kokam

Lovage

Marjoram

Mint

Mustard

Nutmeg & Mace

Oregano

Parsley

Pepper Long.

Pepper

Pomegranate

Poppy Seed

Rosemary

Saffron

Sage

Star Anise

Sweet Flag

Savory

Tamarind

Tarragon

Tejpat

Thyme

Vanilla

Conclusion

The Spices Board Registration is a vital requirement for anyone engaged in the export of spices and spice products from India. For manufacturer exporters, it not only ensures legal compliance but also opens doors to international markets with enhanced credibility. With this registration, exporters gain access to global trade opportunities, quality certification support, participation in international fairs, and government-backed export promotion schemes.

By obtaining and maintaining a valid registration, exporters can strengthen their brand reputation, meet international quality standards, and build long-term trust with overseas buyers. Timely compliance with renewal and documentation further helps avoid penalties and ensures uninterrupted export operations.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

Spice Board Registration, also known as the Certificate of Registration as Exporter of Spices (CRES), is a mandatory certification issued by the Spices Board of India. It is required for manufacturers engaged in the production and export of spices listed under the Spices Board Act of 1986. This registration ensures compliance with export regulations and quality standards.

The registration fee for Spice Board Registration for Manufacturer Exporters varies depending on the type of application:

The Spice Board Registration for Manufacturer Exporters is valid for 3 years from the date of issuance. It must be renewed before expiration to ensure continued legal compliance and uninterrupted export activities.

For a spice business, you need a Spice Board Registration (CRES) for exporting spices and a FSSAI license for food safety compliance. Additionally, manufacturers may require a Pollution NOC and other local trade or industrial registrations depending on the business setup.

Spice Board Registration ensures legal compliance for exporting spices and enhances credibility in international markets. It also provides access to government schemes, trade fairs, and market support from the Spices Board of India.

You can apply online through the Spices Board portal by filling out the application form, uploading the required documents, and paying the registration fee. After verification, the CRES certificate will be issued, allowing you to legally export spices.

The key documents required include Import Export Code (IEC), PAN Card, GST Registration, Bank Certificate, FSSAI License, Industrial Registration Certificate, Partnership Deed or Memorandum of Association (MoA), and a passport-size photograph of the authorized signatory.